Investments

2280Portfolio Exits

486Funds

154Partners & Customers

10Service Providers

2About Sequoia Capital

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Expert Collections containing Sequoia Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Sequoia Capital in 14 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Synthetic Biology

382 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

Game Changers 2018

20 items

Research containing Sequoia Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sequoia Capital in 14 CB Insights research briefs, most recently on May 7, 2025.

Apr 10, 2025 report

State of Fintech Q1’25 Report

Apr 3, 2025

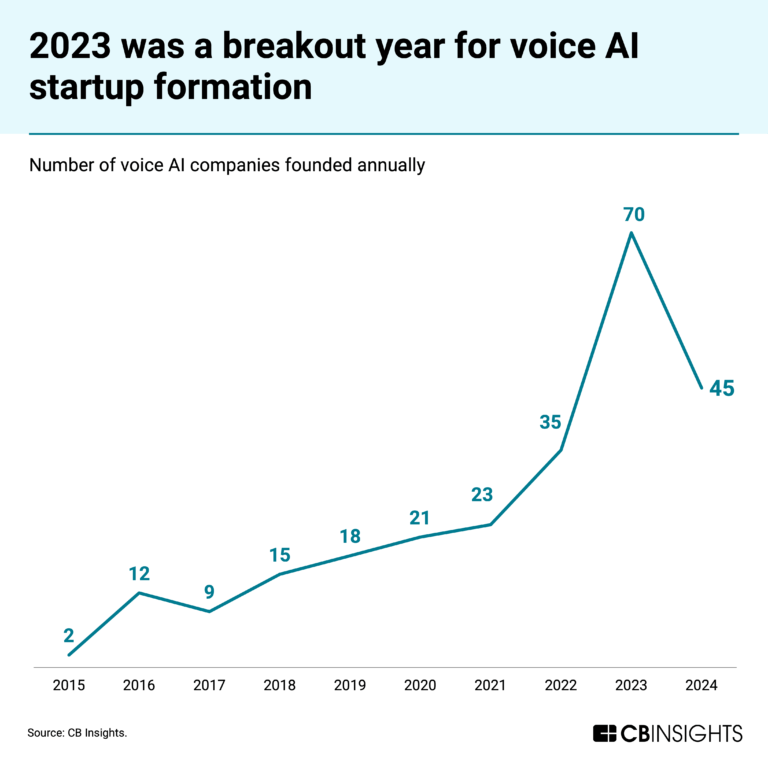

Voice AI’s sweet spot: ordering fries with that

Apr 3, 2025 report

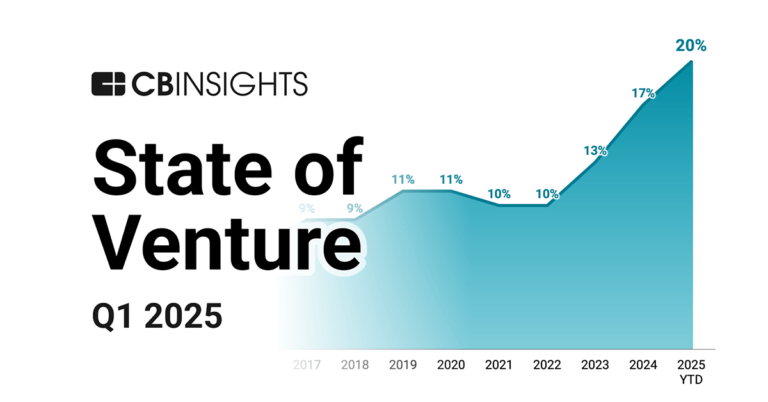

State of Venture Q1’25 Report

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024

Oct 3, 2024 report

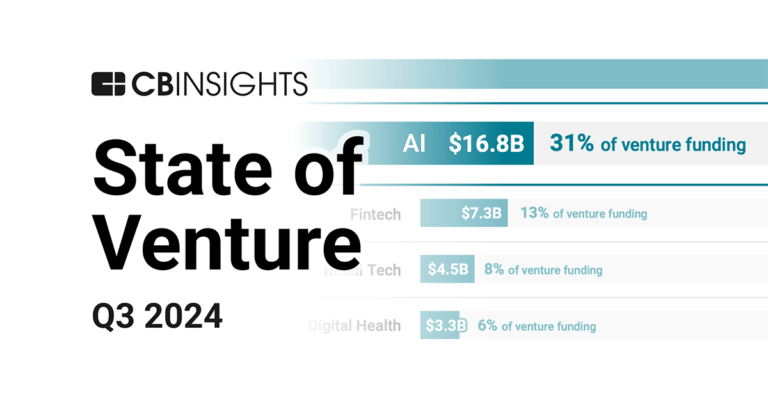

State of Venture Q3’24 ReportLatest Sequoia Capital News

Jul 20, 2025

השותף הפרו־ישראלי של קרן סקויה נגד ניו יורק טיימס: עושים לי רצח אופי שון מגווייר העלה סרטון בן 45 דקות, שבו מתח ביקורת על כתבה שסיקרה התבטאויות שלו נגד המועמד הדמוקרטי לראשות העיר ניו יורק, זוהרן ממדאני ■ מול הטענה כי האמירות שלו נגד ממדאני מסבכות את סקויה, ביקש מגווייר להסביר מדוע הוא מכנה אותו "איסלאמיסט" שלחו את הכתבה במתנה ללא פרסומות ותמונות, ובהגשה נוחה להדפסה ללא פרסומות ובהגשה נוחה לקריאה 12:30 • 20 ביולי 2025 שון מגווייר, משקיע שותף בקרן ההון סיכון סקויה קפיטל, יצא אתמול (שבת) למתקפה נגד ניו יורק טיימס בעקבות כתבה שעסקה באמירותיו נגד המועמד הדמוקרטי לראשות העיר ניו יורק, זוהרן ממדאני. סקויה תוארה בכתבה כגוף שבמשך שנים הצליח להישאר מחוץ לסערות פוליטיות, ונגרר בעל כורחו למוקד של אחת בעקבות פוסט שפירסם מגווייר ברשת X (לשעבר טוויטר) לפני שבועיים. טוען...

Sequoia Capital Investments

2,280 Investments

Sequoia Capital has made 2,280 investments. Their latest investment was in OpenEvidence as part of their Series D on July 15, 2025.

Sequoia Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/15/2025 | Series D | OpenEvidence | $210M | No | 3 | |

7/11/2025 | Series B | Two | $15.2M | No | Alliance Ventures, Antler, Arkwright X, Idekapital, Investinor, Local Globe, Phoenix Court, and Shine Capital | 5 |

7/10/2025 | Series B | Harmonic | $100M | No | 3 | |

6/24/2025 | Series B | |||||

6/24/2025 | Series A |

Date | 7/15/2025 | 7/11/2025 | 7/10/2025 | 6/24/2025 | 6/24/2025 |

|---|---|---|---|---|---|

Round | Series D | Series B | Series B | Series B | Series A |

Company | OpenEvidence | Two | Harmonic | ||

Amount | $210M | $15.2M | $100M | ||

New? | No | No | No | ||

Co-Investors | Alliance Ventures, Antler, Arkwright X, Idekapital, Investinor, Local Globe, Phoenix Court, and Shine Capital | ||||

Sources | 3 | 5 | 3 |

Sequoia Capital Portfolio Exits

486 Portfolio Exits

Sequoia Capital has 486 portfolio exits. Their latest portfolio exit was Chime on June 12, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

6/12/2025 | IPO | Public | 4 | ||

6/11/2025 | Acquired | 7 | |||

5/28/2025 | Acquired | 3 | |||

Sequoia Capital Acquisitions

5 Acquisitions

Sequoia Capital acquired 5 companies. Their latest acquisition was Faces Canada on August 24, 2017.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

8/24/2017 | Acq - Fin | 2 | ||||

7/1/2010 | ||||||

9/12/2006 | Private Equity | |||||

10/1/1988 | ||||||

3/6/1986 | Series B |

Date | 8/24/2017 | 7/1/2010 | 9/12/2006 | 10/1/1988 | 3/6/1986 |

|---|---|---|---|---|---|

Investment Stage | Private Equity | Series B | |||

Companies | |||||

Valuation | |||||

Total Funding | |||||

Note | Acq - Fin | ||||

Sources | 2 |

Sequoia Capital Fund History

154 Fund Histories

Sequoia Capital has 154 funds, including Sequoia Crypto Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/28/2023 | Sequoia Crypto Fund | $500M | 3 | ||

6/14/2022 | Sequoia SEA Fund I | $850M | 2 | ||

2/27/2021 | Sequoia Capital Seed Fund IV | $195M | 1 | ||

12/24/2020 | Sequoia Capital China GGF Affiliate I | ||||

2/18/2020 | Sequoia Capital U.S. Growth VIII Principals Fund |

Closing Date | 7/28/2023 | 6/14/2022 | 2/27/2021 | 12/24/2020 | 2/18/2020 |

|---|---|---|---|---|---|

Fund | Sequoia Crypto Fund | Sequoia SEA Fund I | Sequoia Capital Seed Fund IV | Sequoia Capital China GGF Affiliate I | Sequoia Capital U.S. Growth VIII Principals Fund |

Fund Type | |||||

Status | |||||

Amount | $500M | $850M | $195M | ||

Sources | 3 | 2 | 1 |

Sequoia Capital Partners & Customers

10 Partners and customers

Sequoia Capital has 10 strategic partners and customers. Sequoia Capital recently partnered with Kela on March 3, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/17/2025 | Partner | Kela | Israel | 2 | |

10/9/2024 | Partner | United States | Google enters cloud partnership with Sequoia Capital: report Google has entered into a non-exclusive cloud computing agreement with the venture firm Sequoia Capital , according to a report Wednesday by Axios . | 1 | |

8/29/2024 | Partner | United States | 1 | ||

7/30/2024 | Partner | ||||

5/2/2024 | Partner |

Date | 3/17/2025 | 10/9/2024 | 8/29/2024 | 7/30/2024 | 5/2/2024 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | Kela | ||||

Country | Israel | United States | United States | ||

News Snippet | Google enters cloud partnership with Sequoia Capital: report Google has entered into a non-exclusive cloud computing agreement with the venture firm Sequoia Capital , according to a report Wednesday by Axios . | ||||

Sources | 2 | 1 | 1 |

Sequoia Capital Team

81 Team Members

Sequoia Capital has 81 team members, including current Chief Financial Officer, Harshal Kamdar.

Name | Work History | Title | Status |

|---|---|---|---|

Harshal Kamdar | PwC, EY, and Colgate-Palmolive | Chief Financial Officer | Current |

Name | Harshal Kamdar | ||||

|---|---|---|---|---|---|

Work History | PwC, EY, and Colgate-Palmolive | ||||

Title | Chief Financial Officer | ||||

Status | Current |

Compare Sequoia Capital to Competitors

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

New Enterprise Associates is a global venture capital firm focused on technology and healthcare sectors. The company offers funding to entrepreneurs at various stages of company development, from seed stage to IPO. NEA primarily serves the technology and healthcare industries, investing in companies. It was founded in 1977 and is based in Menlo Park, California.

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Loading...