Investments

1264Portfolio Exits

267Funds

32Partners & Customers

10Service Providers

1About Index Ventures

Index Ventures operates as a global venture capital firm. It invests in the commercial services, media, retail, and information technology sectors. It was founded in 1996 and is based in London, United Kingdom.

Expert Collections containing Index Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Index Ventures in 8 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Food & Beverage

123 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

CB Insights Smart Money Investors

25 items

Research containing Index Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Index Ventures in 9 CB Insights research briefs, most recently on May 6, 2025.

May 6, 2025

The top 50 venture investors in the UK

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Feb 27, 2024

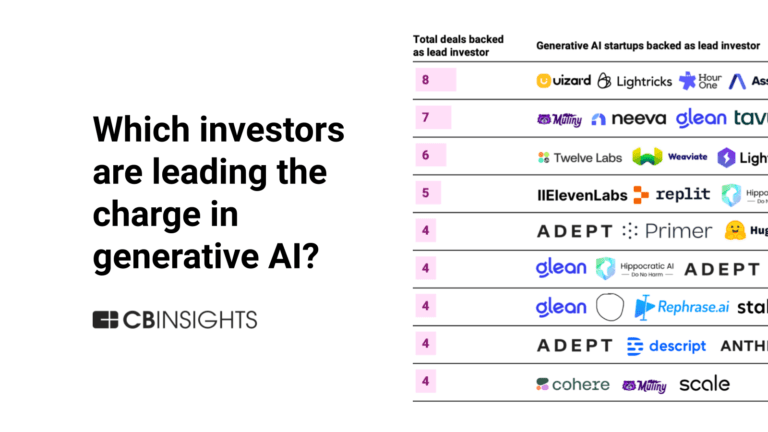

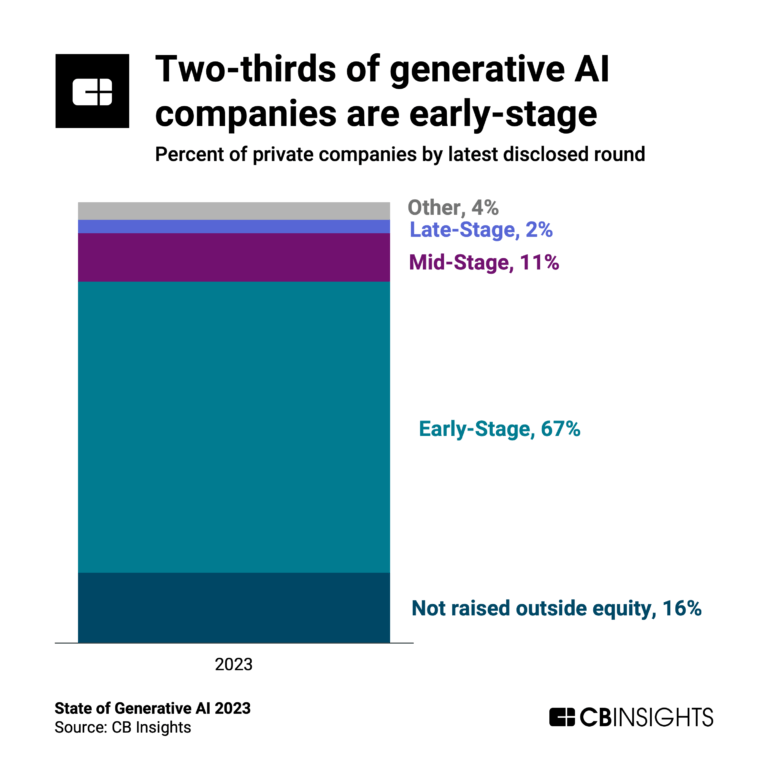

The generative AI boom in 6 charts

Jul 14, 2023

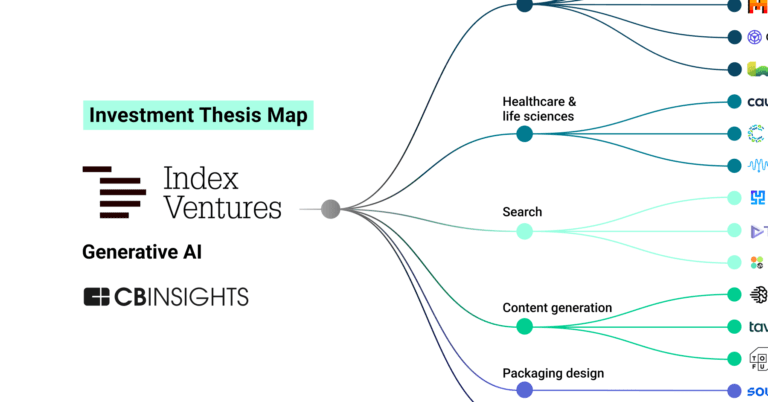

The state of LLM developers in 6 chartsLatest Index Ventures News

Aug 27, 2025

As investor focus shifts from speculative valuations to proven performance, this new measure of success reflects a wider shift across fast-growth tech companies towards sustainable growth and financial discipline. As more companies stay private for longer, the focus is on driving economic prosperity through improved productivity, job creation, and tax contributions. Thoroughbreds 100 EMEA by numbers: The Thoroughbreds 100 EMEA represent the companies with the most momentum in 2025, out of over 700 Thoroughbreds across EMEA, with 38 created in the last two years alone. Thoroughbreds now account for 27% of EMEA’s $5.6 trillion tech ecosystem. As companies reaching $100 million in annual revenue become the benchmark of progress, Dealroom has published its annual Power Law Investor Ranking for EMEA, with Phoenix Court, home of LocalGlobe, Latitude and Solar, topping the list. The ranking now includes Thoroughbreds ($100m+ revenues) and Colts ($25-100m revenues) alongside Unicorns. Investors are ranked by the number of high-growth companies in their portfolios, with additional weight for those backing them earliest at Seed and Series A, when data is scarce and risk is highest. Phoenix Court is recognised as the region’s #1 investor in Thoroughbreds, Colts, and Unicorns for consistently backing high-revenue tech companies from Seed stage and in the top 0.01% of funds globally. Index Ventures secured second overall, while Point Nine, the Germany-based Seed investor, achieved third position. Phoenix Court and Index Ventures are the only European funds in the global top 20, led by Y Combinator and Sequoia. Yoram Wijngaarde, Founder and CEO of Dealroom, said: “Venture has long been measured by promise, but performance comes from proof. That’s why our 2025 ranking includes a focus on Thoroughbreds: companies generating $100m+ in ARR, rooted in strong customer demand and lasting value. These aren’t speculative bets; they’re regional assets. By prioritising tangible impact and sustainable growth, we offer unprecedented clarity for founders, LPs, and policymakers on where resilience lies and the investors that are truly bending the curve. Europe is no longer merely emerging; it is a demonstrable engine room for national, regional, and global champions." Saul Klein, Co-Founder and Executive Chair at Phoenix Court, said: "For over a decade, venture capital has been gripped by unicorns. But the real test of a company is not valuation, but fundamentals. The definition of success has changed. Europe has the raw ingredients to create the companies that matter, and it's encouraging to see 38 new Thoroughbreds created in the past two years. The challenge is not building them, but scaling them. As we mark ten years since founding Phoenix Court, we’ve seen what it takes to back long-term winners from the earliest stages via LocalGlobe through to our later stage funds Latitude and Solar. What’s needed now in Europe is the long-term conviction at growth – so that the value created here stays here and compounds for the next generation.” Within EMEA, the ‘New Palo Alto region – an interconnected network of innovation ecosystems within a five-hour train ride of London (including London, Paris, Amsterdam and Brussels) is the most productive region for Thoroughbreds in EMEA, home to over 250 Thoroughbreds and nearly 800 Colts, underlining its position as the world's second most productive innovation cluster, surpassed only by the Bay Area. Seven of Europe's 10 most valuable tech companies founded after 1990 originated from this ecosystem, including Booking.com, ASML, Adyen, Arm, Revolut, Tide, Wise, and Monzo. Despite this robust growth, the EMEA region faces an estimated $57 billion scaleup funding gap according to Dealroom, compared to the Bay Area. While Europe consistently nurtures innovative companies, long-term value creation could be significantly accelerated with a more plentiful supply of local capital at later growth stages. This represents a substantial, largely unaddressed investment opportunity for asset allocators and institutional investors, with nearly 2,000 venture-backed companies in EMEA now generating revenues of $25 million or more. For more startup news, check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem.

Index Ventures Investments

1,264 Investments

Index Ventures has made 1,264 investments. Their latest investment was in Spiko as part of their Series A on July 17, 2025.

Index Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/17/2025 | Series A | Spiko | $22M | Yes | 199 Ventures, Antoine Le Nel, Arthur Waller, Athletico Ventures, Blockwall Capital, Bpifrance, Felix Blossier, FRST, Harsh Sinha, Jean-Luc Robert, Lionel Assant, Nik Storonsky, Quentin de Metz, Rerail, Stephane Kurgan, Tancrede Besnard, Undisclosed Angel Investors, White Star Capital, and Zach Abrams | 5 |

7/17/2025 | Series D | Boulevard | $80M | No | JMI Equity, and VMG Partners | 3 |

7/10/2025 | Series B | Harmonic | $100M | No | 3 | |

7/9/2025 | Series B | |||||

7/9/2025 | Seed VC |

Date | 7/17/2025 | 7/17/2025 | 7/10/2025 | 7/9/2025 | 7/9/2025 |

|---|---|---|---|---|---|

Round | Series A | Series D | Series B | Series B | Seed VC |

Company | Spiko | Boulevard | Harmonic | ||

Amount | $22M | $80M | $100M | ||

New? | Yes | No | No | ||

Co-Investors | 199 Ventures, Antoine Le Nel, Arthur Waller, Athletico Ventures, Blockwall Capital, Bpifrance, Felix Blossier, FRST, Harsh Sinha, Jean-Luc Robert, Lionel Assant, Nik Storonsky, Quentin de Metz, Rerail, Stephane Kurgan, Tancrede Besnard, Undisclosed Angel Investors, White Star Capital, and Zach Abrams | JMI Equity, and VMG Partners | |||

Sources | 5 | 3 | 3 |

Index Ventures Portfolio Exits

267 Portfolio Exits

Index Ventures has 267 portfolio exits. Their latest portfolio exit was topi on August 27, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/27/2025 | Acquired | 4 | |||

8/13/2025 | Acq - Talent | 3 | |||

7/31/2025 | IPO | Public | 6 | ||

Date | 8/27/2025 | 8/13/2025 | 7/31/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acq - Talent | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 4 | 3 | 6 |

Index Ventures Acquisitions

1 Acquisition

Index Ventures acquired 1 company. Their latest acquisition was Dubsmash on April 15, 2019.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

4/15/2019 | Seed / Angel | $22.25M | Acq - Fin | 2 |

Date | 4/15/2019 |

|---|---|

Investment Stage | Seed / Angel |

Companies | |

Valuation | |

Total Funding | $22.25M |

Note | Acq - Fin |

Sources | 2 |

Index Ventures Fund History

32 Fund Histories

Index Ventures has 32 funds, including Index Ventures Growth VI.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/26/2021 | Index Ventures Growth VI | $2,000M | 1 | ||

7/26/2021 | Index Ventures XI | $900M | 1 | ||

7/26/2021 | Index Origin | $200M | 3 | ||

5/19/2020 | Index Ventures Growth V (Jersey) | ||||

5/19/2020 | Index Ventures X (Jersey) |

Closing Date | 7/26/2021 | 7/26/2021 | 7/26/2021 | 5/19/2020 | 5/19/2020 |

|---|---|---|---|---|---|

Fund | Index Ventures Growth VI | Index Ventures XI | Index Origin | Index Ventures Growth V (Jersey) | Index Ventures X (Jersey) |

Fund Type | |||||

Status | |||||

Amount | $2,000M | $900M | $200M | ||

Sources | 1 | 1 | 3 |

Index Ventures Partners & Customers

10 Partners and customers

Index Ventures has 10 strategic partners and customers. Index Ventures recently partnered with Fenwick on May 5, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/14/2025 | Vendor | United States | 1 | ||

9/26/2022 | Vendor | United States | 1 | ||

6/9/2022 | Vendor | United Kingdom | 1 | ||

4/26/2017 | Partner | ||||

1/9/2014 | Partner |

Date | 5/14/2025 | 9/26/2022 | 6/9/2022 | 4/26/2017 | 1/9/2014 |

|---|---|---|---|---|---|

Type | Vendor | Vendor | Vendor | Partner | Partner |

Business Partner | |||||

Country | United States | United States | United Kingdom | ||

News Snippet | |||||

Sources | 1 | 1 | 1 |

Index Ventures Service Providers

1 Service Provider

Index Ventures has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Index Ventures Team

17 Team Members

Index Ventures has 17 team members, including current Founder, General Partner, Neil Rimer.

Name | Work History | Title | Status |

|---|---|---|---|

Neil Rimer | Founder, General Partner | Current | |

Name | Neil Rimer | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, General Partner | ||||

Status | Current |

Compare Index Ventures to Competitors

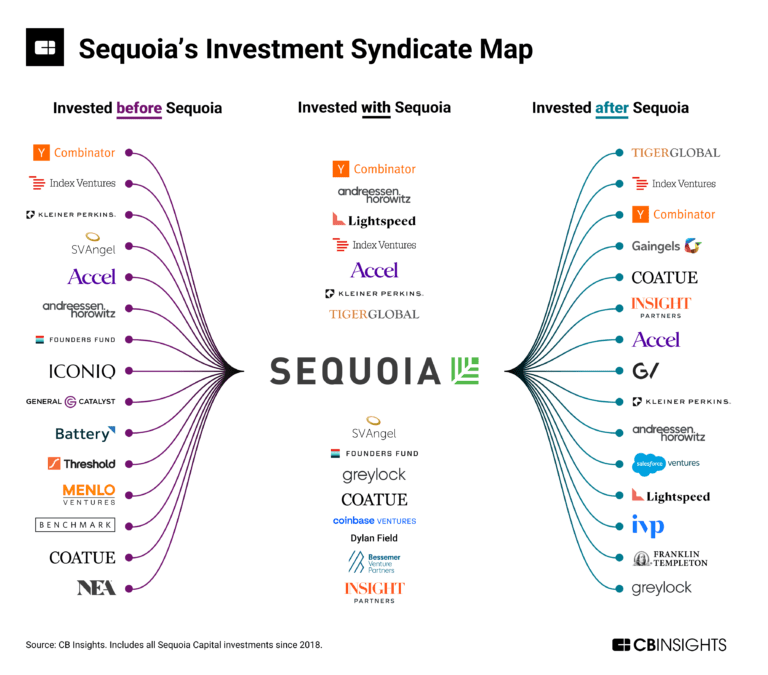

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Lightspeed Venture Partners is a venture capital firm that focuses on various sectors including Enterprise, Consumer, Health, and Fintech. The firm provides financial support to startups and emerging companies, with a portfolio that includes companies such as Affirm, Epic Games, and Snap. Lightspeed Venture Partners manages assets and has a presence with investment professionals and advisors across multiple regions. It was founded in 2000 and is based in Menlo Park, California.

Battery Ventures operates as a technology-focused investment firm operating across sectors, including application software, infrastructure software, consumer internet, and industrial technologies. The firm provides capital and support services, including business development and talent recruitment, to its portfolio companies. Battery Ventures invests in businesses at stages, from seed to growth and private equity, with a global investment strategy. It was founded in 1983 and is based in Boston, Massachusetts.

Loading...