Stripe

Founded Year

2010Stage

Valuation Change - III | AliveTotal Raised

$10.095BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-17 points in the past 30 days

About Stripe

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Loading...

ESPs containing Stripe

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The in‑person point‑of‑sale (POS) systems market provides hardware and software that enable merchants to accept card‑present and contactless payments in physical locations. Solutions include countertop terminals, smartPOS and mobile POS devices, and softPOS/Tap‑to‑Pay apps, together with POS software for checkout, receipts, tipping, taxes, inventory, analytics, and device/estate management. Provid…

Stripe named as Outperformer among 15 other companies, including Ingenico, Shopify, and Fiserv.

Loading...

Research containing Stripe

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stripe in 49 CB Insights research briefs, most recently on Sep 5, 2025.

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

Aug 4, 2025

3 markets fueling the shift to agentic commerce

Jul 17, 2025 report

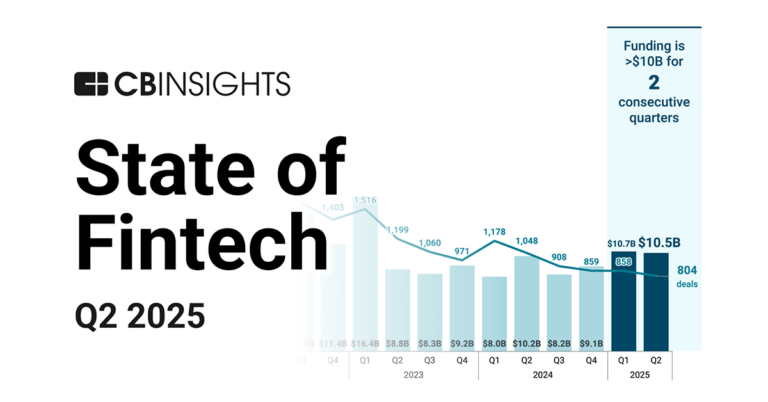

State of Fintech Q2’25 Report

Jun 6, 2025

The SMB fintech market map

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025Expert Collections containing Stripe

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stripe is included in 17 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Blockchain

9,656 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

2,003 items

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Payments

3,255 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Stripe Patents

Stripe has filed 318 patents.

The 3 most popular patent topics include:

- payment systems

- payment service providers

- mobile payments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/29/2023 | 4/1/2025 | Data management, Payment systems, Parallel computing, Machine learning, Systems engineering | Grant |

Application Date | 11/29/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Data management, Payment systems, Parallel computing, Machine learning, Systems engineering |

Status | Grant |

Latest Stripe News

Sep 14, 2025

So what makes Tempo special? Think of high-throughput, low-latency crypto transactions, tuned for business payments rather than crypto trading. Tempo’s network promises to process over 100,000 transactions per second with sub-second finality – a huge leap above Ethereum’s ~20 TPS or even Solana’s few thousand TPS in practice. It’s EVM-compatible (so developers can use Ethereum-style smart contracts) but with a twist: you can pay transaction fees in any stablecoin, not a volatile gas token. Tempo achieves this via an “enshrined AMM” – essentially a built-in exchange that seamlessly converts whatever stablecoin you’re using to the fee currency on the backend. In plain English, businesses could pay fees in dollars (tokenized dollars) instead of juggling ETH or SOL, making costs predictable and dollar-denominated. Speaking of stablecoins, Tempo is stablecoin-agnostic. It supports all major stablecoins (USD Coin, Tether, etc.) natively. Stripe’s stance is “bring your own dollar token” – a neutral platform for moving value. They even built in a native stablecoin swap feature for low-cost conversion between stablecoins. This could smooth out the on-chain FX issues (imagine swapping a USD stablecoin for a Euro stablecoin on the fly – that kind of thing). To further court the fintech crowd, Tempo includes features like payment memos and batch transfers (for including details with payments or bundling many payments into one transaction). Those memos are even designed to align with the banking standard ISO 20022 – basically, Stripe is ensuring blockchain payments speak the language of traditional finance. There are also opt-in privacy features to keep sensitive details private while “maintaining compliance”. And indeed, compliance is a theme: Tempo supports blocklists/allowlists at the protocol level, so regulated businesses can prevent funds going to blacklisted addresses or require KYC on certain accounts. (It’s like if Ethereum had a built-in sanctions filter you could choose to use – a very corporate-friendly touch, for better or worse.) If your head is spinning – same here. Essentially, Stripe built a blockchain that tries to feel like a high-speed payments network. It’s open and permissionless (anyone can build on it eventually), but at launch it’s in a private testnet with select partners. A “diverse group of independent entities” (including those big partners) will run validator nodes at first, before they “transition to a permissionless model” over time. In other words, it’s starting a bit like a VIP club, but they promise to open the doors wider later. To put Tempo in context, stablecoins (crypto tokens pegged 1:1 to fiat currencies like USD) have exploded in real-world usage. They’ve become the grease for global money movement because they’re fast, always-on, and don’t swing wildly in value. Stripe itself turned pro-stablecoin after seeing businesses actually use them: SpaceX uses stablecoins to pay vendors in hard-to-reach markets, a Latin American fintech uses them for banking services, even an Argentinian importer uses Stripe’s crypto payout features to pay suppliers. These aren’t crypto bros speculating – these are companies moving real money. As Collison noted, they’re using crypto “because it’s easier, faster, better than the status quo,” not for shenanigans. Stripe has already been dabbling in crypto rails – it acquired a startup called Bridge in 2024, which helps businesses integrate stablecoin payments across multiple blockchains. (Bridge has been Stripe’s way to let users hold USDC balances, do payouts on chains like Ethereum, Solana, etc.) But relying on external blockchains meant dealing with their limitations and fees. At peak times Stripe needs to handle 10,000+ TPS (think of all the transactions flowing through Stripe’s systems). On public chains, that either isn’t possible or gets really expensive. So, Stripe likely figured: why not build our own optimized chain and “own the whole stack”?

Stripe Frequently Asked Questions (FAQ)

When was Stripe founded?

Stripe was founded in 2010.

Where is Stripe's headquarters?

Stripe's headquarters is located at 354 Oyster Point Boulevard, South San Francisco.

What is Stripe's latest funding round?

Stripe's latest funding round is Valuation Change - III.

How much did Stripe raise?

Stripe raised a total of $10.095B.

Who are the investors of Stripe?

Investors of Stripe include Sequoia Capital, General Catalyst, Andreessen Horowitz, Thrive Capital, Founders Fund and 105 more.

Who are Stripe's competitors?

Competitors of Stripe include Klarna, Payment Labs, Keo, Paddle, PayToMe and 7 more.

Loading...

Compare Stripe to Competitors

BePay provides crypto payment solutions within the financial technology sector. The company offers a platform for users to monitor payments, manage settlements, and track transactions. It was founded in 2023 and is based in Dubai, United Arab Emirates.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Planet Payment specializes in VAT refund services and tax free shopping for international travelers, operating within the financial services sector. The company provides VAT refund services for shoppers and offers businesses payment solutions and tax free refund processes. Planet Payment caters primarily to the retail, hospitality, and payments industries. Planet Payment was formerly known as Fintrax. It was founded in 1985 and is based in Galway, Ireland.

DemandPay provides omnichannel payment solutions in the fintech sector. Its offerings include automating recurring payments, enabling real-time payment tracking, and facilitating direct bank transfers for businesses. DemandPay serves sectors that rely on collections and require payment processing, such as broadband, cable TV, and jewelry brands. It was founded in 2017 and is based in Bengaluru, India.

Moneris Solutions specializes in payment processing and point-of-sale systems for various industries. Its offerings include POS systems, online payment gateways, and e-commerce solutions to facilitate transactions for businesses. Moneris Solutions provides merchant cash advances, gift card programs, and data analytics services. It was founded in 2000 and is based in Toronto, Canada.

InComm Payments is a provider of payment technology solutions across various industries. The company specializes in cash digitization, card solutions, account funding, and payment services, including healthcare benefits, gifting, and incentives. InComm Payments serves sectors such as retail, healthcare, and transit with its suite of payment products and services. It was founded in 1992 and is based in Atlanta, Georgia.

Loading...