Chime

Founded Year

2012Stage

IPO | IPOTotal Raised

$2.599BDate of IPO

6/12/2025Market Cap

11.53BStock Price

24.34Revenue

$0000About Chime

Chime is a financial technology company that provides banking services. The company offers a banking app that includes features such as direct deposit, no overdraft fees, and resources for financial literacy. It was founded in 2012 and is based in San Francisco, California.

Loading...

Chime's Products & Differentiators

SpotMe

Fee free overdraft alternative

Loading...

Research containing Chime

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Chime in 4 CB Insights research briefs, most recently on Jul 17, 2025.

Jul 17, 2025 report

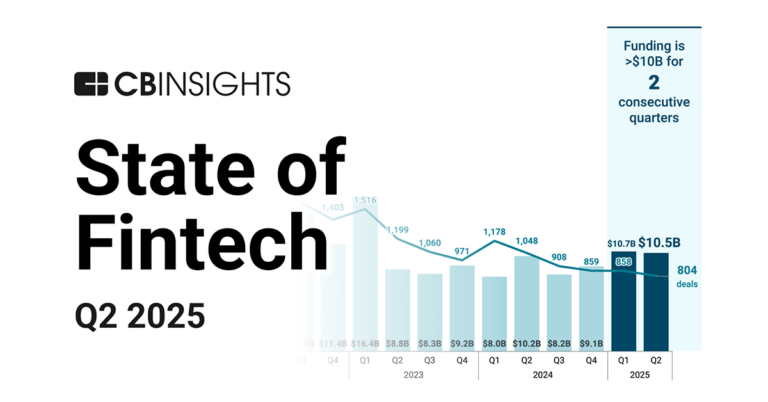

State of Fintech Q2’25 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Chime

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chime is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,153 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Chime Patents

Chime has filed 8 patents.

The 3 most popular patent topics include:

- computer security

- machine learning

- remote desktop

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/18/2024 | 4/1/2025 | Machine learning, Units of information, Wireless networking, Artificial intelligence, Remote desktop | Grant |

Application Date | 3/18/2024 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Machine learning, Units of information, Wireless networking, Artificial intelligence, Remote desktop |

Status | Grant |

Latest Chime News

Sep 5, 2025

The servicing paradox: Why banks are building platforms through customer problems, not tech strategies Major banks are transforming into API-first platforms. But unlike the fintech noise of previous years, this shift is happening through deliberate infrastructure plays rather than flashy product launches. Summer Dellacqua | September 05, 2025 This iframe contains the logic required to handle Ajax powered Gravity Forms. While banks announce AI deployments and digital transformations, the real platform shift is happening through something more mundane: solving customer servicing headaches one API call at a time. Banks have a servicing problem masquerading as a platform opportunity. You won’t read the evidence in their press releases, but you can see it in how they’re actually solving operational friction for business customers who want banking to work well. American Express exemplifies this quiet evolution . The company’s “One Amex” servicing model isn’t pitched as a platform play, yet it functions exactly like one. Clients access corporate cards, working capital solutions, payment automation, and merchant services through unified touchpoints that span their entire business relationship. The platform emerged from customer need, not strategic planning. The AI deployment reality check The gap between platform marketing and platform delivery becomes obvious when examining banks’ AI initiatives. Major institutions like Bank of America, Citizens, and J.P. Morgan actively deploy generative AI tools for employee productivity, yet nearly 70% of AI use cases lack reported outcomes or measurable ROI. The disconnect stems from familiar challenges: difficulty separating AI impact from overall growth, problems mapping cost benefits from internal efficiency gains, and an inability to translate technological capabilities into customer value. Banks deploy AI tools but struggle to demonstrate platform-level transformation. Learning from digital banking’s platform evolution Chime built a platform around interchange fees and basic banking services, achieving profitability but facing questions about sustainable differentiation. SoFi expanded from student loans into full banking, recently experimenting with the Bitcoin Lightning Network for remittances. Nubank scaled to over 100 million customers across Latin America with a platform that prioritizes relationship depth over breadth. Each approach reflects different theories about platform value creation, but all succeed by solving real customer problems rather than building technology for its own sake. The most successful platform transformations happen quietly, through improved servicing rather than announced strategies. Banks with long-term ambitions are prioritizing pain points in the customer journey over technology theatrics. 0 comments on “The servicing paradox: Why banks are building platforms through customer problems, not tech strategies” You must be logged in the post a comment.

Chime Frequently Asked Questions (FAQ)

When was Chime founded?

Chime was founded in 2012.

Where is Chime's headquarters?

Chime's headquarters is located at 101 California Street, San Francisco.

What is Chime's latest funding round?

Chime's latest funding round is IPO.

How much did Chime raise?

Chime raised a total of $2.599B.

Who are the investors of Chime?

Investors of Chime include Crosslink Capital, Menlo Ventures, General Atlantic, Dragoneer Investment Group, Tiger Global Management and 29 more.

Who are Chime's competitors?

Competitors of Chime include Branch, Deserve, MoneyLion, Revolut, Current and 7 more.

What products does Chime offer?

Chime's products include SpotMe and 2 more.

Loading...

Compare Chime to Competitors

KikOff is a personal finance platform that offers a revolving line of credit and a secured credit card. These financial products aim to assist individuals in establishing a payment history and improving their credit scores. KikOff serves individuals interested in building or enhancing their credit profiles. It was founded in 2019 and is based in San Francisco, California.

Varo offers personal banking services. The company provides savings accounts, tools for credit building, and personal finance management features. Varo primarily serves individuals seeking accessible banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

EarnIn provides earned wage access and financial management tools. The company offers services including real-time pay access, early paycheck deposits, and financial tools like overdraft alerts and credit score monitoring. EarnIn serves individuals seeking access to their earnings and businesses looking to offer these services to their employees. EarnIn was formerly known as ActiveHours. It was founded in 2012 and is based in Mountain View, California.

Tala provides digital financial services. The company offers a money app that facilitates access to credit, payments, savings, and transfers, utilizing artificial intelligence (AI) and machine learning to create financial experiences. Tala primarily serves individuals seeking services beyond traditional banking. It was founded in 2011 and is based in Santa Monica, California.

Atom bank is a digital bank that provides financial services such as savings accounts, mortgages, and business loans. The company offers savings products with various interest rates, mortgage solutions, and business financing options, all managed through a mobile app. Atom bank serves individuals and small to medium-sized enterprises seeking banking solutions. It was founded in 2014 and is based in Durham, England.

Empower Finance is a financial technology company that provides credit solutions and financial security tools. The company offers cash advances, a line of credit service called Thrive, and savings features. Empower Finance primarily serves individuals seeking financial products and services. It was founded in 2016 and is based in San Francisco, California.

Loading...