Investments

2891Portfolio Exits

681Funds

33Partners & Customers

3Service Providers

3About New Enterprise Associates

New Enterprise Associates is a global venture capital firm focused on technology and healthcare sectors. The company offers funding to entrepreneurs at various stages of company development, from seed stage to IPO. NEA primarily serves the technology and healthcare industries, investing in companies. It was founded in 1977 and is based in Menlo Park, California.

Expert Collections containing New Enterprise Associates

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find New Enterprise Associates in 12 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

Synthetic Biology

382 items

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

Research containing New Enterprise Associates

Get data-driven expert analysis from the CB Insights Intelligence Unit.

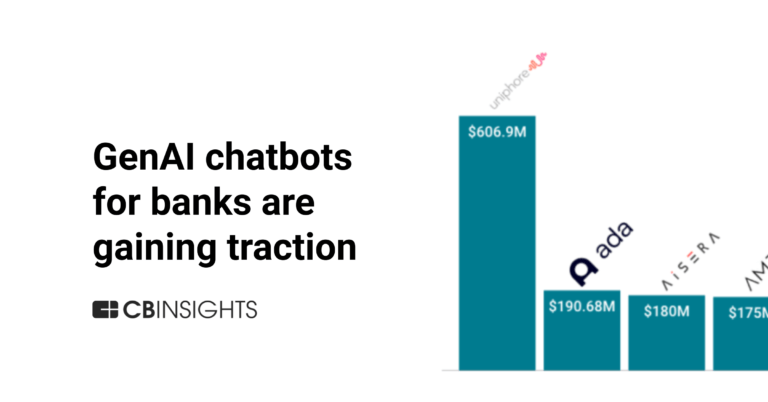

CB Insights Intelligence Analysts have mentioned New Enterprise Associates in 3 CB Insights research briefs, most recently on Jul 17, 2025.

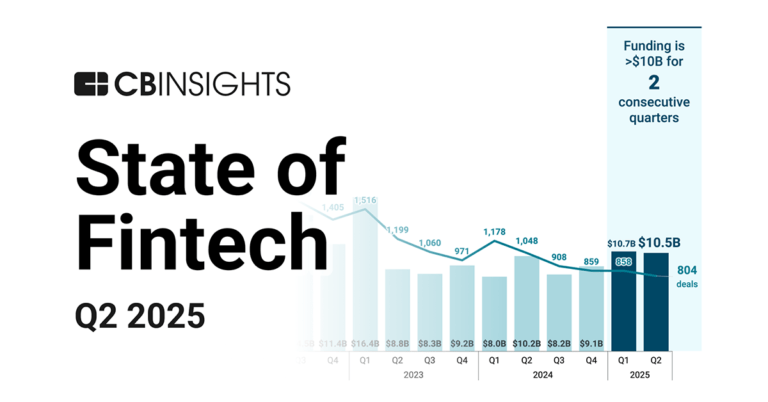

Jul 17, 2025 report

State of Fintech Q2’25 Report

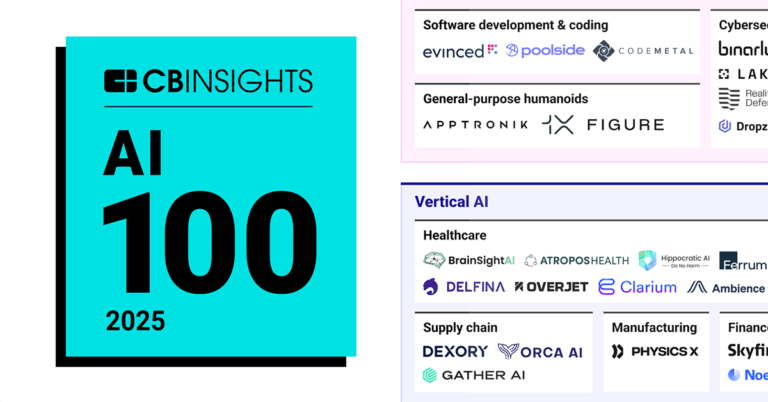

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025Latest New Enterprise Associates News

Jul 16, 2025

Reading Time: 2 minutes NG.Cash funding round has raised US$26.5 million in new capital, with New Enterprise Associates (NEA) leading the Series B investment. The Brazilian fintech, which targets Gen Z users, will use the funds to expand its offering of credit products and personalized financial services for young adults. Founded in 2021, NG.Cash has quickly grown to more than 7 million users by offering a digital financial platform tailored to teenagers and young adults. Now, as its customer base matures, the company is expanding into credit cards, consórcios (installment plans), insurance, and fixed-income investments, aiming to support its users as they transition into full financial independence. This NG.Cash funding round attracted a global roster of investors. In addition to NEA, participants included Quantum Light (created by Revolut’s founder), Andreessen Horowitz (a16z), Monashees , Endeavor Catalyst , 17Sigma, and Daphni . NEA venture capital leadership in this round signals a growing international interest in Brazil’s fintech ecosystem and NG.Cash’s model specifically. CEO Mario Augusto Sá emphasized that the company’s mission is to offer “responsible and accessible credit” to a generation underserved by traditional banks. A key component of this next phase is the integration of AI in financial services and tools, such as virtual assistants and smart money management interfaces that adapt to user behavior and goals. This funding follows NG.Cash’s acquisition of Z1’s client base, another Gen Z–focused fintech, which added more than 1 million new customers to its base. With the Series B, the company’s total capital raised now exceeds R$300 million (~US$55 million), positioning it among the most well-funded youth-oriented financial startups in Latin America. With the NG.Cash funding round, NEA — with over $25 billion in assets under management — deepens its exposure to the Brazilian fintech landscape while NG.Cash enters a new chapter of scaling credit products and financial infrastructure for a generation coming of age in a digital economy. New Enterprise Associates (NEA) brings not only capital but also deep expertise from having backed major players like Robinhood, Coursera, and Duolingo. The Firms Behind the Deal Legal Advisors on the NG.Cash Funding Round The NG.Cash funding round was supported by a cross-border legal team representing both investors and the company. On NEA’s side, legal counsel was provided by Foley & Lardner LLP in the United States and Demarest Advogados in Brazil. Representing NG.Cash, Gunderson Dettmer and Veirano Advogados advised on U.S. and Brazilian aspects, respectively. Representing NEA:

New Enterprise Associates Investments

2,891 Investments

New Enterprise Associates has made 2,891 investments. Their latest investment was in NG.CASH as part of their Series B on July 14, 2025.

New Enterprise Associates Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/14/2025 | Series B | NG.CASH | $26.5M | Yes | 17Sigma, a16z Bio Health, Daphni, Endeavor Catalyst, Monashees+, and QuantumLight | 3 |

6/26/2025 | Seed | Foresight | $5.5M | Yes | 2 | |

6/18/2025 | Series A - II | Firestorm | $15M | No | Booz Allen Ventures, Decisive Point, Lockheed Martin Ventures, Undisclosed Investors, and Washington Harbour Partners | 3 |

6/11/2025 | Series B | |||||

6/2/2025 | Series H |

Date | 7/14/2025 | 6/26/2025 | 6/18/2025 | 6/11/2025 | 6/2/2025 |

|---|---|---|---|---|---|

Round | Series B | Seed | Series A - II | Series B | Series H |

Company | NG.CASH | Foresight | Firestorm | ||

Amount | $26.5M | $5.5M | $15M | ||

New? | Yes | Yes | No | ||

Co-Investors | 17Sigma, a16z Bio Health, Daphni, Endeavor Catalyst, Monashees+, and QuantumLight | Booz Allen Ventures, Decisive Point, Lockheed Martin Ventures, Undisclosed Investors, and Washington Harbour Partners | |||

Sources | 3 | 2 | 3 |

New Enterprise Associates Portfolio Exits

681 Portfolio Exits

New Enterprise Associates has 681 portfolio exits. Their latest portfolio exit was Verona Pharma on July 09, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/9/2025 | Acq - Pending | 11 | |||

7/1/2025 | Acquired | 6 | |||

6/25/2025 | Acq - Fin | 2 | |||

Date | 7/9/2025 | 7/1/2025 | 6/25/2025 | ||

|---|---|---|---|---|---|

Exit | Acq - Pending | Acquired | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 11 | 6 | 2 |

New Enterprise Associates Acquisitions

9 Acquisitions

New Enterprise Associates acquired 9 companies. Their latest acquisition was NeueHealth on December 24, 2024.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

12/24/2024 | Series E+ | $1,575M | Acq - Pending | 3 | ||

6/6/2018 | Other Venture Capital | |||||

11/26/2014 | Series A | |||||

11/10/2011 | Seed / Angel | |||||

10/17/2011 |

Date | 12/24/2024 | 6/6/2018 | 11/26/2014 | 11/10/2011 | 10/17/2011 |

|---|---|---|---|---|---|

Investment Stage | Series E+ | Other Venture Capital | Series A | Seed / Angel | |

Companies | |||||

Valuation | |||||

Total Funding | $1,575M | ||||

Note | Acq - Pending | ||||

Sources | 3 |

New Enterprise Associates Fund History

33 Fund Histories

New Enterprise Associates has 33 funds, including New Enterprise Associates III LP.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/1/2025 | New Enterprise Associates III LP | $300M | 2 | ||

1/27/2023 | New Enterprise Associates XVIII | $3,050M | 1 | ||

1/27/2023 | New Enterprise Associates Growth Equity Fund I | $3,180M | 1 | ||

9/4/2020 | NEA BH SPV II | ||||

3/11/2020 | New Enterprise Associates XVII |

Closing Date | 4/1/2025 | 1/27/2023 | 1/27/2023 | 9/4/2020 | 3/11/2020 |

|---|---|---|---|---|---|

Fund | New Enterprise Associates III LP | New Enterprise Associates XVIII | New Enterprise Associates Growth Equity Fund I | NEA BH SPV II | New Enterprise Associates XVII |

Fund Type | |||||

Status | |||||

Amount | $300M | $3,050M | $3,180M | ||

Sources | 2 | 1 | 1 |

New Enterprise Associates Partners & Customers

3 Partners and customers

New Enterprise Associates has 3 strategic partners and customers. New Enterprise Associates recently partnered with Speedinvest on May 5, 2015.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/28/2015 | Partner | Austria | New Enterprise, Speedinvest unveil collaboration to target ‘Best’ European start-ups New Enterprise Associates , Speedinvest unveil collaboration to target ` Best ' European start-ups | 2 | |

Partner | |||||

Vendor |

Date | 5/28/2015 | ||

|---|---|---|---|

Type | Partner | Partner | Vendor |

Business Partner | |||

Country | Austria | ||

News Snippet | New Enterprise, Speedinvest unveil collaboration to target ‘Best’ European start-ups New Enterprise Associates , Speedinvest unveil collaboration to target ` Best ' European start-ups | ||

Sources | 2 |

New Enterprise Associates Service Providers

7 Service Providers

New Enterprise Associates has 7 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | |||

|---|---|---|---|

Associated Rounds | |||

Provider Type | Counsel | ||

Service Type | General Counsel |

Partnership data by VentureSource

New Enterprise Associates Team

36 Team Members

New Enterprise Associates has 36 team members, including current Founder, General Partner, Charles Ashton Newhall.

Name | Work History | Title | Status |

|---|---|---|---|

Charles Ashton Newhall | Greenspring Associates, and T. Rowe Price | Founder, General Partner | Current |

Name | Charles Ashton Newhall | ||||

|---|---|---|---|---|---|

Work History | Greenspring Associates, and T. Rowe Price | ||||

Title | Founder, General Partner | ||||

Status | Current |

Compare New Enterprise Associates to Competitors

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Battery Ventures operates as a technology-focused investment firm operating across sectors, including application software, infrastructure software, consumer internet, and industrial technologies. The firm provides capital and support services, including business development and talent recruitment, to its portfolio companies. Battery Ventures invests in businesses at stages, from seed to growth and private equity, with a global investment strategy. It was founded in 1983 and is based in Boston, Massachusetts.

Loading...