Colgate-Palmolive

Founded Year

1806Stage

PIPE | IPOMarket Cap

68.04BStock Price

84.19Revenue

$0000About Colgate-Palmolive

Colgate-Palmolive engages as a global consumer products company that operates in various sectors, including oral care, personal care, home care, and pet nutrition. The company has initiatives related to water conservation, waste reduction, and oral health. Colgate-Palmolive was formerly known as Colgate-Palmolive-Peet Company. It was founded in 1806 and is based in New York, New York.

Loading...

Loading...

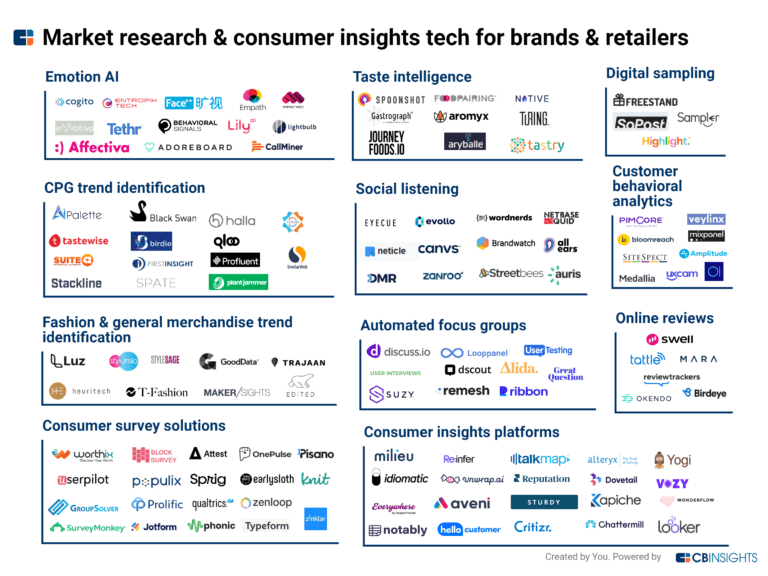

Research containing Colgate-Palmolive

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Colgate-Palmolive in 2 CB Insights research briefs, most recently on Nov 3, 2022.

Colgate-Palmolive Patents

Colgate-Palmolive has filed 2662 patents.

The 3 most popular patent topics include:

- oral hygiene

- dentistry

- brands of toothpaste

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/2/2019 | 4/8/2025 | Conditions of the mucous membranes, Oral mucosal pathology, Periodontology, Salivary gland pathology, Oral hygiene | Grant |

Application Date | 12/2/2019 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Conditions of the mucous membranes, Oral mucosal pathology, Periodontology, Salivary gland pathology, Oral hygiene |

Status | Grant |

Latest Colgate-Palmolive News

Sep 9, 2025

The has turned the spotlight back on India's consumption story. The brokerage house believes this could be the much-needed trigger for India's consumption revival, with several large categories now shifting from 18% GST to 5%. According to the brokerage house, the new tax slabs could unlock a sharp rise in demand just ahead of the festive season, making staples and the biggest beneficiaries. As per the brokerage report, “In continuation of PM Modi's announcement on on Independence Day, the 56th GST meet concluded with most consumer categories receiving a GST rate cut.” The new structure will be effective from September 22, 2025, just ahead of the festive season. Motilal Oswal's top pick: Colgate-Palmolive upgraded The brokerage house has made a decisive call on , upgrading it to “Buy” from Neutral. The stock has corrected nearly 35% over the past year. This make the valuations more attractive at 46x and 41x P/E for FY26 and FY27, respectively. The report added, “Domestic sales mix falling under the impacted categories results in ~12% effective GST cut at the company level.” With GST-driven tailwinds and a focus on oral care expansion, Motilal Oswal expects Colgate to see a sharp recovery in both volume and revenue growth. HUL, GCPL, Marico also in focus While takes the spotlight, Motilal Oswal continues to prefer large FMCG names like and . These companies, with strong penetration in essential categories, are expected to pass on benefits through lower prices or increased grammage in packs. “We expect most companies to pass on the benefits of the GST rate reduction to consumers,” the brokerage noted. This, in turn, could fuel higher demand across both urban and rural markets. Consumption revival on the horizon The brokerage highlighted that weak trends over the past 2–3 years driven by commodity inflation, higher interest rates, and post-Covid disruptions are now easing. “While the government initially focused on infrastructure and manufacturing set-up, consumption revival has now become among the top priorities,” Motilal Oswal report adedd. With inflation cooling, a favourable monsoon forecast, and supportive policy measures, the report expects household spending to bounce back over the next year GST 2.0: Why consumption revival is back in play The brokerage drew parallels with the first GST rollout in 2017, when demand picked up strongly post-implementation. “Following the implementation (July 2017), there was a significant pickup in volume and revenue growth in the subsequent quarters. FY18 and FY19 witnessed growth acceleration of 500–1,000bp compared to FY17 across companies,” the report highlighted. This time too, while some near-term disruption in trade is possible in the September quarter, believes the structural changes are long-term positives. “With improving macros, easing inflation, and a favorable monsoon outlook, the consumption sector is well poised for recovery over the next 12-15 months,” added the brokerage report. Other notable beneficiaries: Emami, Nestle, Dabur Apart from the big names, mid-sized FMCG companies will also benefit from GST rationalisation. , with 90% domestic sales, is expected to see approx. 9% effective GST cut, while Nestle India stands to gain from around 8% reduction at the company level. , and are also well-placed, though their overall exposure is slightly lower. The brokerage added, “While the immediate stock reaction was muted due to this run-up, we believe the structural benefits of lower taxation particularly in essential food and personal care categories will support healthy volume-led growth over the medium term.”

Colgate-Palmolive Frequently Asked Questions (FAQ)

When was Colgate-Palmolive founded?

Colgate-Palmolive was founded in 1806.

Where is Colgate-Palmolive's headquarters?

Colgate-Palmolive's headquarters is located at 300 Park Avenue, New York.

What is Colgate-Palmolive's latest funding round?

Colgate-Palmolive's latest funding round is PIPE.

Who are the investors of Colgate-Palmolive?

Investors of Colgate-Palmolive include Third Point.

Who are Colgate-Palmolive's competitors?

Competitors of Colgate-Palmolive include George Weston Foods, Kenvue, SoapBox Soaps, Haleon, Coty and 7 more.

Loading...

Compare Colgate-Palmolive to Competitors

Amway operates in the direct selling industry and provides health and beauty products. The company has products, including nutrition supplements, skincare, makeup, and personal care items, as well as home care solutions. Amway's offerings serve sectors of the economy with an emphasis on individual wellness and beauty. It was founded in 1959 and is based in Ada, Michigan.

Oriflame is a social selling beauty company operating in the beauty and personal care industry. The company offers a range of beauty products, including skincare, makeup, personal and hair care, fragrance, accessories, and nutritional products. Oriflame primarily sells to individuals who become Independent Oriflame Brand Partners. It was founded in 1967 and is based in Schaffhausen, Switzerland.

Beiersdorf operates in the personal care industry and offers products such as epigenetic serums, moisturizers, and wound healing solutions. The company also mentions its efforts in sustainability and digital transformation in its operations. It was founded in 1882 and is based in Hamburg, Germany.

MAM focuses on the development of baby care products within the healthcare sector. The company offers a range of products, including pacifiers, baby bottles, and breastfeeding accessories. MAM's products are developed with input from professionals in medicine, research, and technology to address the needs of babies and parents. It was founded in 1976 and is based in Vienna, Austria.

Belcorp is a global manufacturer of beauty and personal care products operating under a direct sales model. The company aims to promote beauty through its brands L’Bel, Ésika and Cyzone.

Mars operates in the petcare, food & nutrition, and snacking industries. The company provides products including pet nutrition, health, veterinary services, snacks, and confections. Mars has initiatives aimed at reducing greenhouse gas emissions and promoting climate-smart agriculture. Mars was formerly known as Mar-O-Bar. It was founded in 1911 and is based in McLean, Virginia.

Loading...