Investments

1331Portfolio Exits

291Funds

6Partners & Customers

4Service Providers

2About Google Ventures

Google Ventures is a venture capital firm that invests in various sectors, including life sciences, consumer, enterprise, cryptocurrency, climate, and frontier technology. The firm provides financial backing and resources to startups and connects them with Google. It was founded in 2009 and is based in Mountain View, California.

Expert Collections containing Google Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Google Ventures in 13 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Agriculture Technology (Agtech)

29 items

Companies that are using technology to make farms more efficient

Synthetic Biology

382 items

Research containing Google Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Google Ventures in 17 CB Insights research briefs, most recently on Apr 29, 2025.

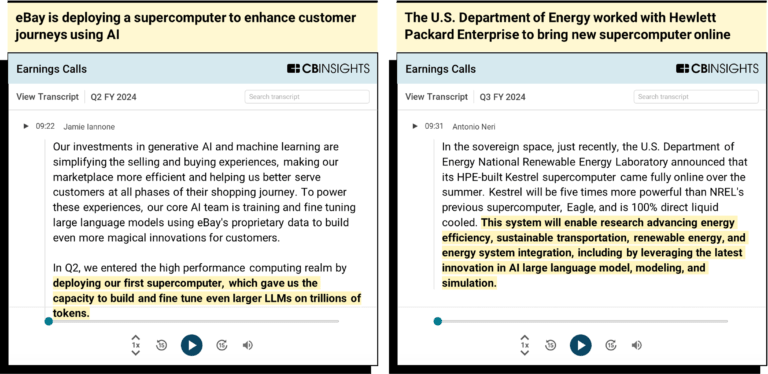

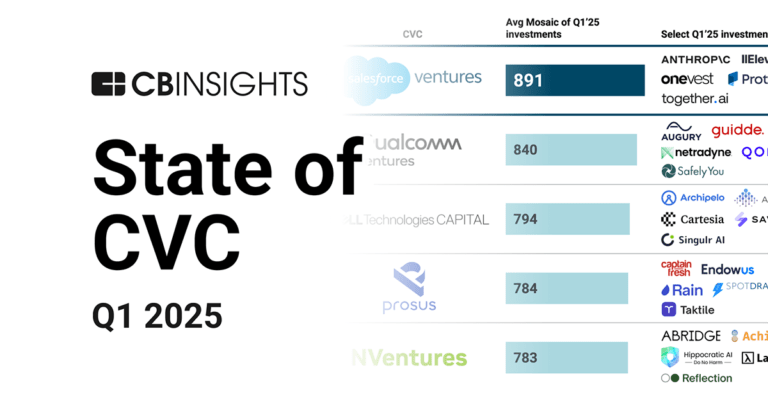

Apr 29, 2025 report

State of CVC Q1’25 Report

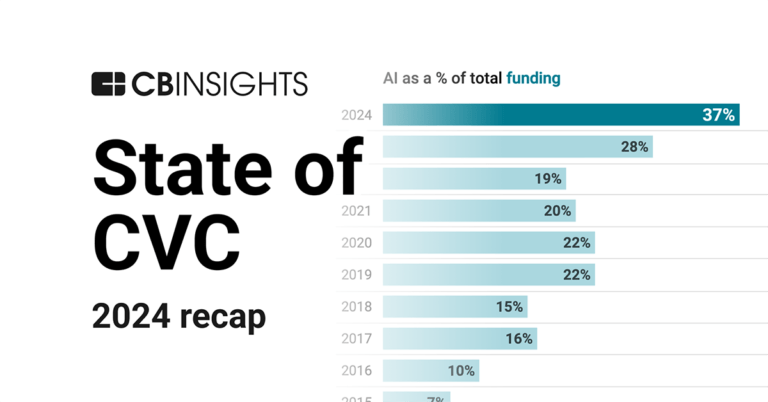

Feb 4, 2025 report

State of CVC 2024 Report

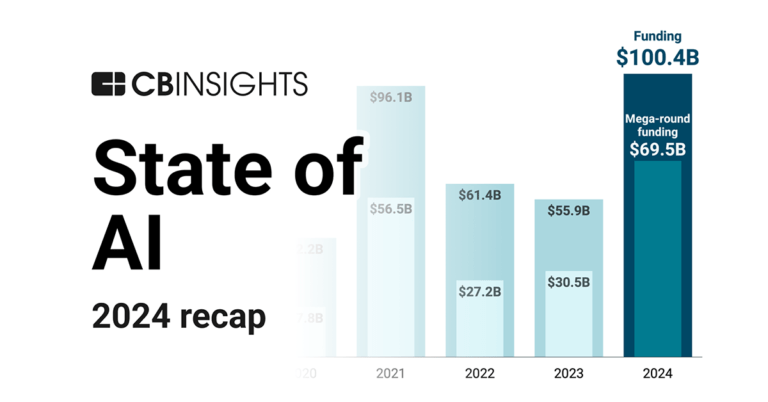

Jan 30, 2025 report

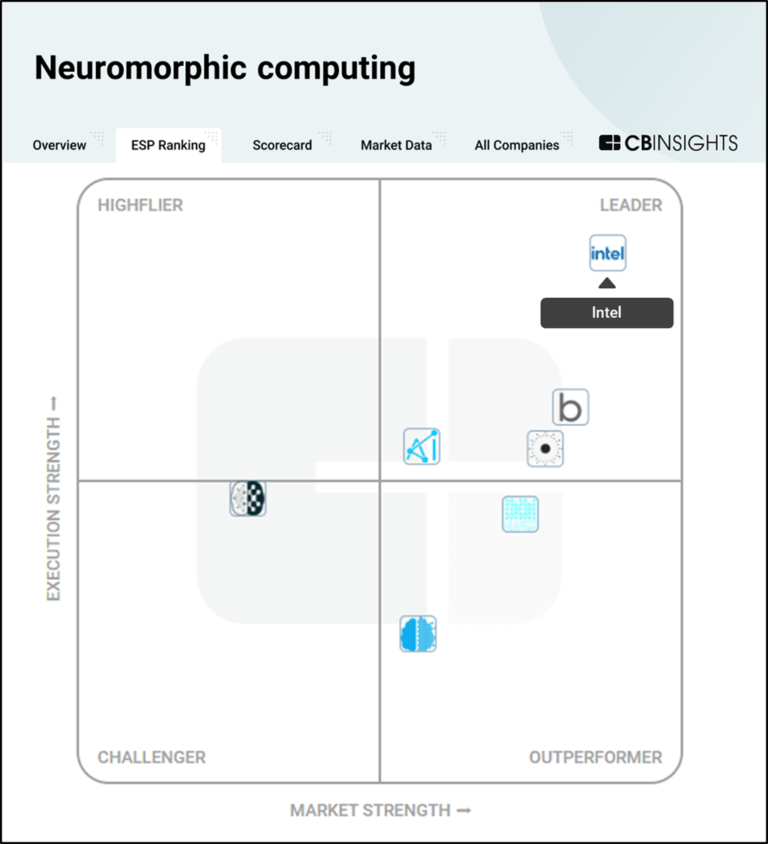

State of AI Report: 6 trends shaping the landscape in 2025

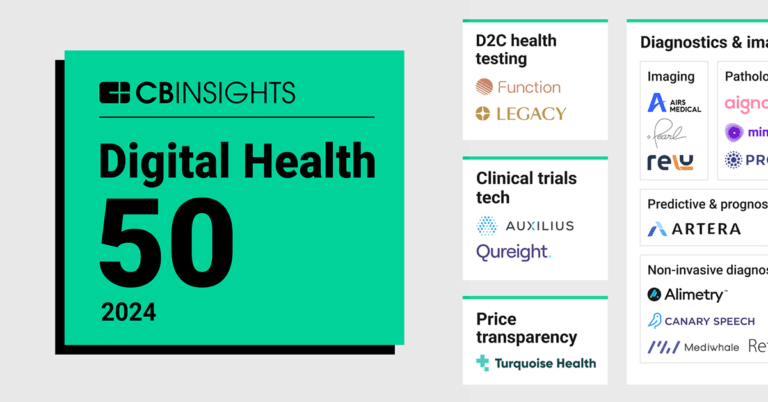

Dec 3, 2024 report

Digital Health 50: The most promising digital health startups of 2024

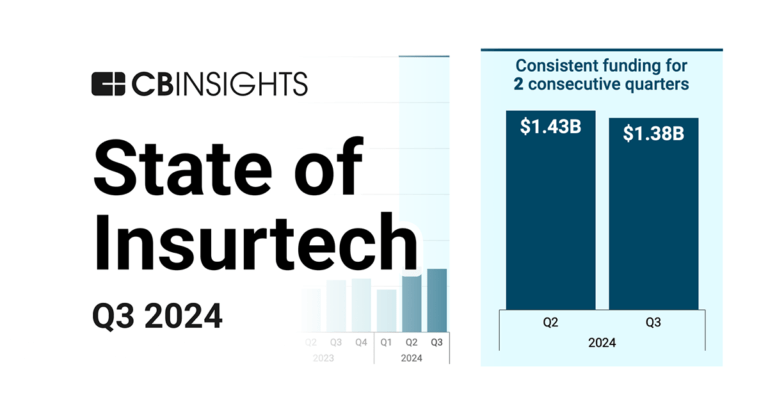

Nov 14, 2024 report

State of Insurtech Q3’24 Report

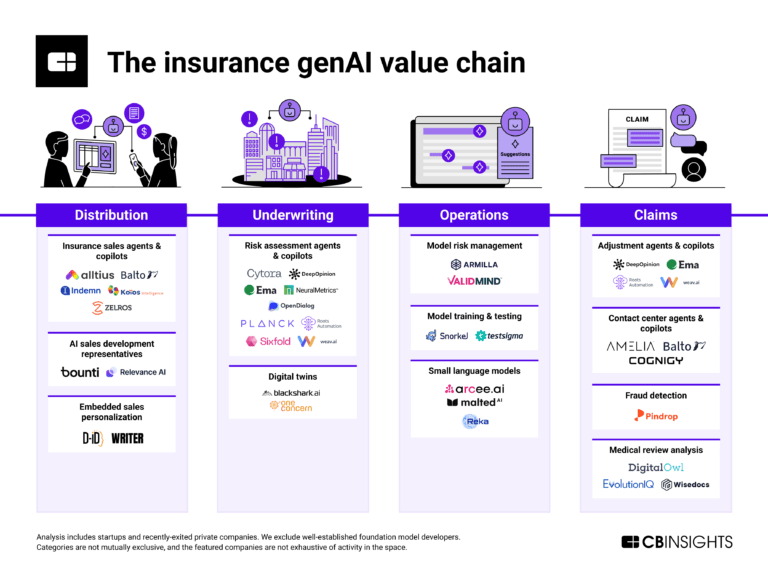

Oct 11, 2024

How genAI is reshaping the insurance value chainLatest Google Ventures News

Aug 20, 2025

Google Ventures co-leads £12.6m investment in Phoebe The startup has developed an 'AI immune system' for software AI Wed 20 Aug 2025 Bookmark Share this Share link Phoebe, an agentic AI startup that acts as an ‘immune system’ for software, has secured a $17m (£12.6m) investment co-led by Google Ventures. Based in London, Phoebe was founded by former executives of Stripe and Google to develop AI agents to remove software downtime. According to the company, its agents continuously monitor and react to live system data, diagnosing issues as they appear and generating code and infrastructure changes to resolve them. Software downtime can be quite costly, with research published last year by Splunk and Oxford Economics putting the cost at $400bn annually. Co-founders Matt Henderson and James Summerfield, the former chief executive officer and chief innovation officer of Strip Europe, sold their first startup, Rangespan, to Google in 2014. The pair was inspired to create their latest venture by, as Henderson explains, experiencing the frustration of software failures in past roles. “High-severity incidents can make or break big customer relationships, and numerous smaller problems drain engineering productivity,” he said. “Software monitoring tools exist, but they aren’t very intelligent and require people to spend a lot of time working out what’s wrong and what to do about it.” Cherry Ventures co-led the investment round alongside Google Ventures. “AI has transformed how code is written, but software reliability has not kept pace,” said Roni Hiranand of Google Ventures. “Phoebe is building a missing layer of contextual intelligence that can help both human and AI engineers avoid software failures. We love the boldness of the team’s vision for a software immune system that preemptively fixes problems.” The funding round, announced on Wednesday, coincides with the public launch of its platform, currently live with engineering times from a handful of early access customers including Trainline. “Phoebe has already had a real impact on how we investigate and remediate incidents at Trainline,” said Trainline’s head of engineering for reliability and operations Jay Davies. “Work that used to take us hours to piece together can now take minutes and that matters when you’re running critical services at our scale. We’re excited to see Phoebe progress and help us operate efficiently.” Topics

Google Ventures Investments

1,331 Investments

Google Ventures has made 1,331 investments. Their latest investment was in Blue Water Autonomy as part of their Series A on August 26, 2025.

Google Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

8/26/2025 | Series A | Blue Water Autonomy | $50M | Yes | Eclipse, Impatient Ventures, Riot Ventures, and Undisclosed Investors | 3 |

8/26/2025 | Series B - II | Attio | $19M | Yes | 3 | |

8/20/2025 | Seed VC | Phoebe | $17M | Yes | 4 | |

8/18/2025 | Series D | |||||

8/12/2025 | Series C - II |

Date | 8/26/2025 | 8/26/2025 | 8/20/2025 | 8/18/2025 | 8/12/2025 |

|---|---|---|---|---|---|

Round | Series A | Series B - II | Seed VC | Series D | Series C - II |

Company | Blue Water Autonomy | Attio | Phoebe | ||

Amount | $50M | $19M | $17M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Eclipse, Impatient Ventures, Riot Ventures, and Undisclosed Investors | ||||

Sources | 3 | 3 | 4 |

Google Ventures Portfolio Exits

291 Portfolio Exits

Google Ventures has 291 portfolio exits. Their latest portfolio exit was Waltz Health on August 26, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/26/2025 | Merger | 7 | |||

8/22/2025 | Acquired | 7 | |||

8/14/2025 | Acq - Pending | Bleichroeder Acquisition | 4 | ||

Date | 8/26/2025 | 8/22/2025 | 8/14/2025 | ||

|---|---|---|---|---|---|

Exit | Merger | Acquired | Acq - Pending | ||

Companies | |||||

Valuation | |||||

Acquirer | Bleichroeder Acquisition | ||||

Sources | 7 | 7 | 4 |

Google Ventures Fund History

6 Fund Histories

Google Ventures has 6 funds, including Google Digital News Initiative Innovation Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

10/22/2015 | Google Digital News Initiative Innovation Fund | UNKNOWN | Closed | $170M | 1 |

9/12/2014 | Google Cloud Platform for Startups | ||||

7/9/2014 | Google Ventures Europe | ||||

Google Ventures Fund LP | |||||

Google Ventures London Fund |

Closing Date | 10/22/2015 | 9/12/2014 | 7/9/2014 | ||

|---|---|---|---|---|---|

Fund | Google Digital News Initiative Innovation Fund | Google Cloud Platform for Startups | Google Ventures Europe | Google Ventures Fund LP | Google Ventures London Fund |

Fund Type | UNKNOWN | ||||

Status | Closed | ||||

Amount | $170M | ||||

Sources | 1 |

Google Ventures Partners & Customers

4 Partners and customers

Google Ventures has 4 strategic partners and customers. Google Ventures recently partnered with Metabiota on September 9, 2015.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

9/24/2015 | Client | United States | Google Ventures Backs Metabiota to Forecast Disease Outbreaks Google Ventures will also partner with Metabiota Inc , offering its big-data expertise to help the company serve its customers -- insurers , government agencies and other organizations -- by offering them forecasting and risk-management tools , Metabiota Inc founder Dr. Nathan Wolfe said ... Document DJFVW00120150924eb9oallz9 | 3 | |

6/14/2011 | Partner | ||||

Vendor | |||||

Partner |

Date | 9/24/2015 | 6/14/2011 | ||

|---|---|---|---|---|

Type | Client | Partner | Vendor | Partner |

Business Partner | ||||

Country | United States | |||

News Snippet | Google Ventures Backs Metabiota to Forecast Disease Outbreaks Google Ventures will also partner with Metabiota Inc , offering its big-data expertise to help the company serve its customers -- insurers , government agencies and other organizations -- by offering them forecasting and risk-management tools , Metabiota Inc founder Dr. Nathan Wolfe said ... Document DJFVW00120150924eb9oallz9 | |||

Sources | 3 |

Google Ventures Service Providers

2 Service Providers

Google Ventures has 2 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | ||

|---|---|---|

Associated Rounds | ||

Provider Type | Counsel | |

Service Type | General Counsel |

Partnership data by VentureSource

Google Ventures Team

28 Team Members

Google Ventures has 28 team members, including current Chief Executive Officer, Managing Partner, David Krane.

Compare Google Ventures to Competitors

Lightspeed Venture Partners is a venture capital firm that focuses on various sectors including Enterprise, Consumer, Health, and Fintech. The firm provides financial support to startups and emerging companies, with a portfolio that includes companies such as Affirm, Epic Games, and Snap. Lightspeed Venture Partners manages assets and has a presence with investment professionals and advisors across multiple regions. It was founded in 2000 and is based in Menlo Park, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Loading...