Bridge

Founded Year

2022Stage

Acquired | AcquiredTotal Raised

$58MValuation

$0000Revenue

$0000About Bridge

Bridge specializes in stablecoin orchestration and issuance within the financial technology sector. The company provides APIs that enable developers to convert various forms of currency into stablecoins and to facilitate instant, global transactions with built-in compliance and programmability features. It was founded in 2022 and is based in San Antonio, Texas. In October 2024, Bridge was acquired by Stripe.1B.

Loading...

ESPs containing Bridge

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The yield-bearing stablecoin issuers market includes companies that create and issue stablecoins with built-in yield mechanisms that automatically generate returns for holders without requiring external staking or farming. These issuers embed yield-generation directly into their stablecoin architecture through treasury-backed yields, algorithmic distribution systems, automated DeFi strategy deploy…

Bridge named as Leader among 15 other companies, including Paxos, Ethena, and Maple Finance.

Loading...

Research containing Bridge

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bridge in 4 CB Insights research briefs, most recently on Jul 17, 2025.

Jul 17, 2025 report

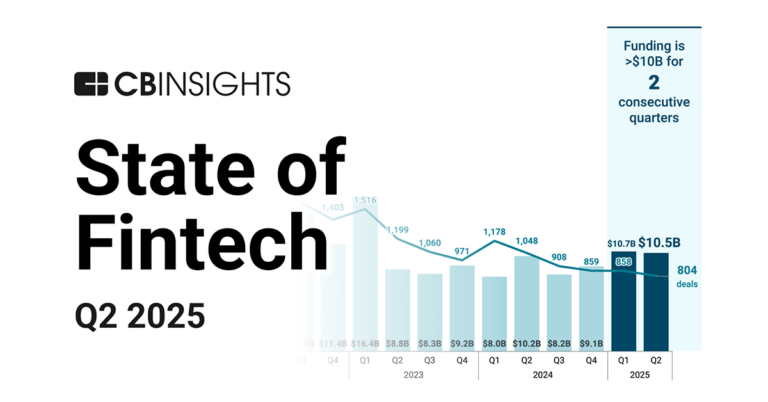

State of Fintech Q2’25 Report

May 29, 2025

The stablecoin market map

Apr 10, 2025 report

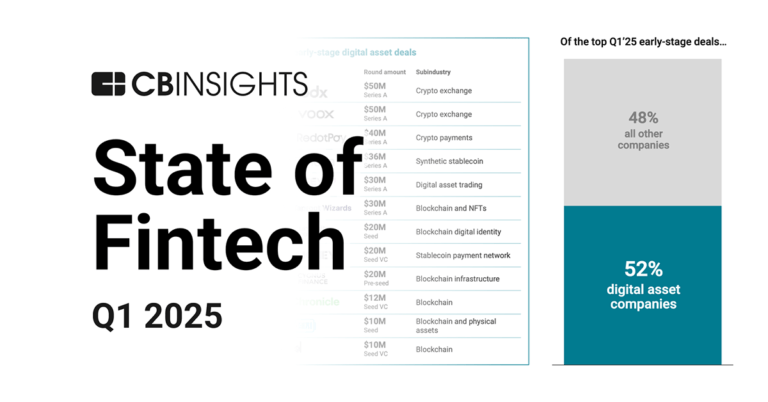

State of Fintech Q1’25 Report

Jan 14, 2025 report

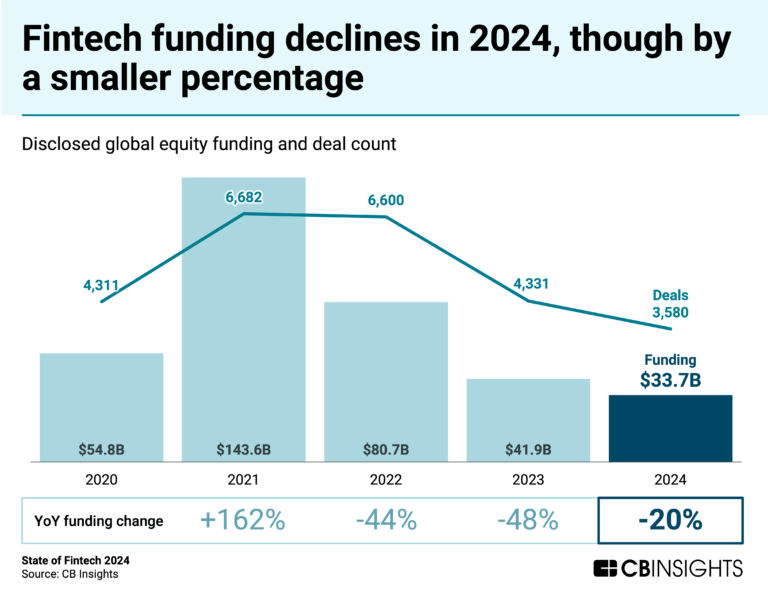

State of Fintech 2024 ReportExpert Collections containing Bridge

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bridge is included in 3 Expert Collections, including Blockchain.

Blockchain

9,296 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,777 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Stablecoin

458 items

Latest Bridge News

Sep 15, 2025

Share Crypto wallet MetaMask has launched its own dollar-pegged stablecoin, mUSD, becoming the first self-custodial wallet to issue a native digital dollar unit. The stablecoin, which went live Monday, is being issued by Bridge, a Stripe-owned stablecoin platform, and minted through decentralized infrastructure developed by M0. MetaMask said mUSD will be fully backed 1:1 by “high-quality, highly liquid dollar-equivalent assets,” with real-time transparency and cross-chain interoperability through M0’s liquidity network. As of Monday, mUSD’s circulating supply stood at about $18 million, according to the project’s website. MetaMask said the stablecoin is aimed at expanding activity on Linea’s DeFi ecosystem and will later connect to a planned MetaMask Card, developed with Mastercard, enabling cardholders to spend mUSD in everyday transactions. The move follows MetaMask’s broader push into payments. In April, the company announced a waitlist for its crypto card, also in partnership with Mastercard. The launch comes as competition heats up in the stablecoin sector. Earlier this month, Tether unveiled plans for a U.S.-compliant token dubbed USAT, while trading platform Hyperliquid announced its own native stablecoin. Traditional banks have also begun exploring tokenized dollars, buoyed by regulatory clarity in the United States. MetaMask, incubated by Ethereum developer Consensys, said the move positions mUSD as the “default digital dollar unit” across its ecosystem. Users will be able to on-ramp, hold, swap, transfer, and bridge the stablecoin directly inside the wallet, with plans to enable payments via the MetaMask Card at Mastercard-accepting merchants by year-end. MetaMask has steadily broadened its offerings. In May, it enabled support for Solana SPL tokens, while also working with BNB Smart Chain and Sei, alongside Ethereum layer-2 networks . The addition of Tron comes as the network pursues greater visibility in global markets. In June, toy maker SRM Entertainment announced plans to rebrand as Tron Inc. and adopt TRX as part of its treasury, with Tron founder Justin Sun acting as adviser. This integration could also serve as a test case for how MetaMask approaches other high-volume but controversial networks. Tron, despite its growth, has faced regulatory scrutiny in the U.S., with founder Justin Sun previously charged by the SEC over alleged securities violations.

Bridge Frequently Asked Questions (FAQ)

When was Bridge founded?

Bridge was founded in 2022.

Where is Bridge's headquarters?

Bridge's headquarters is located at 21750 Hardy Oak Boulevard, San Antonio.

What is Bridge's latest funding round?

Bridge's latest funding round is Acquired.

How much did Bridge raise?

Bridge raised a total of $58M.

Who are the investors of Bridge?

Investors of Bridge include Stripe, SpaceX, Sequoia Capital, Ribbit Capital, Coinbase and 5 more.

Who are Bridge's competitors?

Competitors of Bridge include Zero Hash and 4 more.

Loading...

Compare Bridge to Competitors

BVNK is a company that provides stablecoin payments infrastructure within the fintech sector. The company offers a platform for businesses to send, receive, store, and convert fiat and stablecoins, connecting traditional banking and blockchain technology. BVNK serves sectors including fintech, payment service providers, CFD and forex trading, iGaming, and digital asset businesses. It was founded in 2020 and is based in London, United Kingdom.

Conduit specializes in facilitating international business payments within the financial technology sector. The company offers a platform for cross-border transactions, enabling businesses to manage global cash flows and accounts payable without the need for a US bank account or credit card. Conduit primarily serves businesses engaged in international trade and financial transactions. It was founded in 2021 and is based in Kalispell, Montana.

MoonPay provides a platform for buying, selling, and swapping cryptocurrencies. Its services include an interface for digital asset transactions, a wallet service, and support for viewing digital collectibles and NFTs. MoonPay serves individuals and businesses looking to engage with cryptocurrencies and Web3 technologies. It was founded in 2018 and is based in Dover, Delaware.

Ramp focuses on providing Web3 financial infrastructure within the cryptocurrency sector. It offers non-custodial services that enable users to buy and sell cryptocurrencies, facilitating the exchange between fiat currency and digital assets. Ramp's infrastructure supports businesses by integrating crypto onboarding tools, ensuring compliance, and providing a seamless user experience for transactions. It was founded in 2018 and is based in London, United Kingdom.

Nilos provides international payments and financial infrastructure for businesses across various sectors. It offers multi-currency accounts, payment solutions, and foreign exchange services for cross-border transactions. It serves import and export merchants, global corporations, and financial technology companies with its financial products. It was founded in 2021 and is based in Tel Aviv, Israel.

Cobre provides a financial management platform. It allows businesses to centralize their treasury operations, optimizing processes such as reconciliation, collections, and payments. The company serves large and medium-sized businesses across various sectors, including e-commerce platforms, technology companies, and real estate administrators. The company was founded in 2019 and is based in Bogota, Colombia.

Loading...