Investments

311Portfolio Exits

31Funds

31Partners & Customers

1Service Providers

1Expert Collections containing Ribbit Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Ribbit Capital in 1 Expert Collection, including CB Insights Fintech Smart Money Investors - 2020.

CB Insights Fintech Smart Money Investors - 2020

25 items

Research containing Ribbit Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

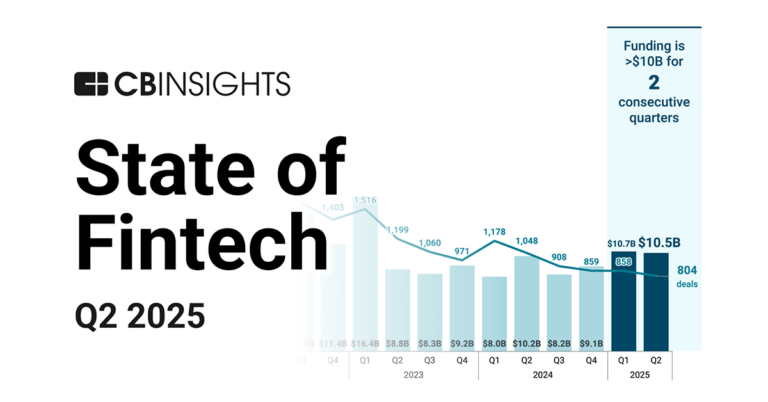

CB Insights Intelligence Analysts have mentioned Ribbit Capital in 4 CB Insights research briefs, most recently on Jul 17, 2025.

Jul 17, 2025 report

State of Fintech Q2’25 ReportLatest Ribbit Capital News

Sep 8, 2025

The round was led by Ribbit Capital , with participation from existing investors Los Angeles-based Ares Credit and Moonshots Capital , which is headquartered in Austin, Texas, with offices in Los Angeles. Greenwich, Conn.-based Positive Sum joined as a new investor. The startup, founded in 2010, has developed a digital identity wallet that helps individuals securely prove their identity online once and then seamlessly sign-in across websites using the same identity. It is used by several U.S. agencies including the Internal Revenue Service (IRS). ID.me plans to use the new funding to build technology that can ward off AI-driven identity attacks. “Fraud is evolving at the speed of AI — and so are we,” said ID.me founder and CEO Blake Hall , who served the U.S. Army for four years. “Secure identity is foundational to AI ecosystems that will depend on memory, context, and authentication, and ID.me is leading the charge. This funding strengthens our ability to expand secure digital access, protect privacy, and innovate faster to stay ahead of criminal networks.” ID.me claims a user base of 152 million, representing nearly 60% of U.S. adults. Its technology meets the standards of federal and state agencies. Seven states credited the company with preventing more than $270 billion in unemployment fraud during the Covid-19 pandemic. Still, identity fraud is seen as a financial and national security crisis, further threatened by AI-based attacks. Between 2018 and 2022, the U.S. government lost up to $521 billion annually to fraud, ID.me said, citing the Government Accountability Office. “As AI reshapes the economy and new fraud risks emerge, we believe ID.me's digital identity wallet will become even more essential in enabling secure connections between large organizations and their users, while also minimizing friction and improving the end-user experience,” said John Clark of Ares Management. Ribbit Capital's Justin Saslaw called ID.me's platform “one of the most advanced and widely adopted digital identity wallets in the world, giving it a durable advantage in creating and scaling the identity tokens that will power this new era.”

Ribbit Capital Investments

311 Investments

Ribbit Capital has made 311 investments. Their latest investment was in PsiQuantum as part of their Series E on September 10, 2025.

Ribbit Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/10/2025 | Series E | PsiQuantum | $1,000M | Yes | 1789 Capital, Adage Capital Management, Baillie Gifford, Blackbird Ventures, BlackRock, Macquarie Capital, Morgan Stanley, NVentures, Qatar Investment Authority, S Ventures, T. Rowe Price, Temasek, Third Point Ventures, Type One Ventures, and Undisclosed Investors | 15 |

9/4/2025 | Series B | Lead Bank | $70M | Yes | 6 | |

9/3/2025 | Series E | ID.me | $65M | No | 3 | |

8/28/2025 | Series B | |||||

8/27/2025 | Series A |

Date | 9/10/2025 | 9/4/2025 | 9/3/2025 | 8/28/2025 | 8/27/2025 |

|---|---|---|---|---|---|

Round | Series E | Series B | Series E | Series B | Series A |

Company | PsiQuantum | Lead Bank | ID.me | ||

Amount | $1,000M | $70M | $65M | ||

New? | Yes | Yes | No | ||

Co-Investors | 1789 Capital, Adage Capital Management, Baillie Gifford, Blackbird Ventures, BlackRock, Macquarie Capital, Morgan Stanley, NVentures, Qatar Investment Authority, S Ventures, T. Rowe Price, Temasek, Third Point Ventures, Type One Ventures, and Undisclosed Investors | ||||

Sources | 15 | 6 | 3 |

Ribbit Capital Portfolio Exits

31 Portfolio Exits

Ribbit Capital has 31 portfolio exits. Their latest portfolio exit was Figure on September 11, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/11/2025 | IPO | Public | 7 | ||

8/1/2025 | Acquired | 1 | |||

7/17/2025 | Merger | 2 | |||

Date | 9/11/2025 | 8/1/2025 | 7/17/2025 | ||

|---|---|---|---|---|---|

Exit | IPO | Acquired | Merger | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 7 | 1 | 2 |

Ribbit Capital Fund History

31 Fund Histories

Ribbit Capital has 31 funds, including Ribbit Capital Fund X.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

8/7/2023 | Ribbit Capital Fund X | $800M | 2 | ||

1/4/2022 | Ribbit Capital VII | $1,150M | 1 | ||

10/5/2020 | AL-W Ribbit Opportunity V | $14.52M | 1 | ||

9/24/2020 | LEAP Ribbit Opportunity VI | ||||

4/8/2020 | RV-E Ribbit Opportunity III |

Closing Date | 8/7/2023 | 1/4/2022 | 10/5/2020 | 9/24/2020 | 4/8/2020 |

|---|---|---|---|---|---|

Fund | Ribbit Capital Fund X | Ribbit Capital VII | AL-W Ribbit Opportunity V | LEAP Ribbit Opportunity VI | RV-E Ribbit Opportunity III |

Fund Type | |||||

Status | |||||

Amount | $800M | $1,150M | $14.52M | ||

Sources | 2 | 1 | 1 |

Ribbit Capital Partners & Customers

1 Partners and customers

Ribbit Capital has 1 strategic partners and customers. Ribbit Capital recently partnered with Walmart on January 1, 2021.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

1/11/2021 | Partner | United States | Walmart notes that the company will have a board of directors that includes Walmart 's CEO , John Furner , and also the company 's CFO , and Meyer Malka , managing partner at Ribbit Capital . | 16 |

Date | 1/11/2021 |

|---|---|

Type | Partner |

Business Partner | |

Country | United States |

News Snippet | Walmart notes that the company will have a board of directors that includes Walmart 's CEO , John Furner , and also the company 's CFO , and Meyer Malka , managing partner at Ribbit Capital . |

Sources | 16 |

Ribbit Capital Service Providers

1 Service Provider

Ribbit Capital has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Gunderson Dettmer | Counsel |

Service Provider | Gunderson Dettmer |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type |

Partnership data by VentureSource

Ribbit Capital Team

8 Team Members

Ribbit Capital has 8 team members, including current Founder, Managing Partner, Meyer Malka.

Name | Work History | Title | Status |

|---|---|---|---|

Meyer Malka | Founder, Managing Partner | Current | |

Name | Meyer Malka | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, Managing Partner | ||||

Status | Current |

Compare Ribbit Capital to Competitors

QED Investors is a boutique venture capital firm. It invests in early-stage startups. It primarily invests in financial services firms in the US, UK, and Latin America. The company was founded in 2008 and is based in Alexandria, Virginia.

Greylock Partners is a venture capital firm that focuses on early-stage investments in the technology sector. The company provides funding to AI-focused companies at the pre-seed, seed, and Series A stages. Greylock Partners offers a company-building program to support pre-idea and pre-seed founders in developing their startups. It was founded in 1965 and is based in Menlo Park, California.

Founders Fund is a venture capital firm that invests in technologies across various sectors. The firm provides capital to companies at different stages of development, focusing on those that address complex problems. Founders Fund's portfolio includes a range of companies, reflecting its investment strategy. It was founded in 2005 and is based in San Francisco, California.

Mayfield operates as a venture capital firm that focuses on enterprise technology, AI-first, deep tech, and human and planetary health sectors. The firm provides financial backing and strategic support to founders starting from the inception stage to develop and grow their companies. Mayfield invests in sectors such as enterprise technology and health-related technologies. It was founded in 1969 and is based in Menlo Park, California.

Polaris Partners focuses on technology and healthcare sectors. The company invests in entrepreneurs and supports them in building companies. Polaris Partners primarily serves startups in these industries. Polaris Partners was formerly known as Polaris Venture Partners. It was founded in 1996 and is based in Boston, Massachusetts.

Bain Capital Ventures operates as a venture capital firm. It prefers to invest in the software, fintech, commercial services, software-as-a-service, finance technology, e-commerce, health technology, and mobile commerce sectors. The company was founded in 1984 and is based in Boston, Massachusetts.

Loading...