Investments

1694Portfolio Exits

290Funds

43Partners & Customers

5Service Providers

3About Lightspeed Venture Partners

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Expert Collections containing Lightspeed Venture Partners

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Lightspeed Venture Partners in 9 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Synthetic Biology

382 items

Food & Beverage

123 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

Research containing Lightspeed Venture Partners

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Lightspeed Venture Partners in 6 CB Insights research briefs, most recently on May 7, 2025.

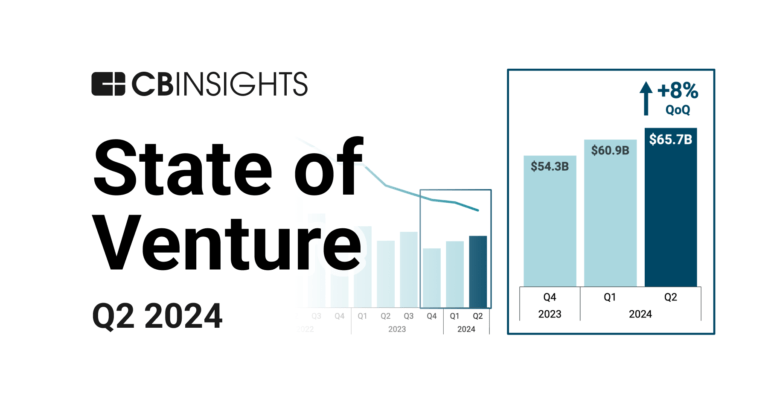

Jul 3, 2024 report

State of Venture Q2’24 Report

May 29, 2024

483 startup failure post-mortems

Feb 1, 2024 report

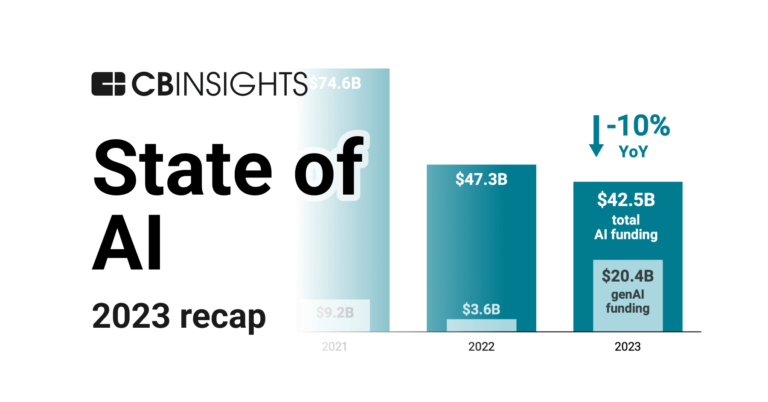

State of AI 2023 ReportLatest Lightspeed Venture Partners News

Jul 17, 2025

スタートアップHRフォーラム2025 豪華登壇者決定!海外からシリコンバレー著名VCの投資先HR支援担当・シリコンバレーで注目のAI HRプロダクト開発企業のCEOが登壇! 株式会社ノックラーン(東京都大田区、代表取締役:福本 英)は、2025年7月24日(木)に開催する「スタートアップHRフォーラム2025」において、海外セッションの追加登壇者が決定したことをお知らせいたします。 海外セッションの登壇者として、シリコンバレー著名VC「Lightspeed Venture Partners」の投資先HR支援を担当しているVice President of Executive Talent Amy Lewis氏・シリコンバレーで注目のAI HRプロダクト開発企業「Torre.ai」のCEOであるAlexander Torrenegra氏の登壇が決定したことをご報告いたします。 本イベントは、スタートアップの「社会的な認知度向上」「採用力強化」、そして「採用支援ネットワークの構築」という3つの主要な目的を掲げ、スタートアップ企業のさらなる成長と発展に貢献することを目指しております 。 このたび、これらの目的にご賛同いただき、スタートアップ企業の採用力強化を共に推進してくださる登壇者様をお迎えする運びとなりました。 今回のAlexander Torrenegra氏とAmy Lewis氏の登壇により、グローバルな視点からの議論がさらに活発化し、国際的なHRトレンドや、AIを活用した最先端の採用戦略、そしてVCによるHR支援のあり方についての発信をより一層強化してまいります。 登壇者様のご紹介 求人マーケットプレイスに関する複数の特許を保有し、MITの「35歳未満の革新者」に挙げられ、世界経済フォーラムの「ヤング・グローバル・リーダー」にも選出されています。 本イベントでは、AIが採用プロセスにもたらす未来について、その最先端の知見を語っていただきます。 (Short biography) I’m the CEO of Torre.ai, where we’re building an AI-driven recruitment ecosystem powered by Emma, a personal AI recruiter. Prior to Torre, I co-founded Voice123 and Bunny Inc., and launched the nonprofit Discrimination Watch. I hold multiple patents in job marketplace technologies, have been recognized as an MIT Innovator Under 35 and a World Economic Forum Young Global Leader, and have invested in over 50 tech startups, including as a Shark on Sony’s Shark Tank in Colombia and Mexico. Vice President of Executive Talent at Lightspeed Venture Partners Amy Lewis氏 成長中のテック企業の経営幹部採用支援の豊富な経験を持ち、今回のセッションでは、グローバルな視点から見たスタートアップの採用戦略や、トップタレントの獲得・育成におけるVCの役割について、貴重な視点を提供していただきます。 (Short biography) I’m the Vice President of Executive Talent at Lightspeed Venture Partners, where I focus on identifying and supporting exceptional leaders across our portfolio. Previously, I was a Partner at Parker Remick, advising high-growth tech companies on executive hiring. I’m also pursuing a Psy.D. at Northwest University to deepen my understanding of leadership and organizational psychology.

Lightspeed Venture Partners Investments

1,694 Investments

Lightspeed Venture Partners has made 1,694 investments. Their latest investment was in Harmony as part of their Unattributed VC on July 15, 2025.

Lightspeed Venture Partners Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/15/2025 | Unattributed VC | Harmony | $3.88M | Yes | 1 | |

7/9/2025 | Series B | Moment | $36M | Yes | 2 | |

7/4/2025 | Series B | Castelion | $350M | No | 4 | |

6/30/2025 | Series G | |||||

6/30/2025 | Seed VC |

Date | 7/15/2025 | 7/9/2025 | 7/4/2025 | 6/30/2025 | 6/30/2025 |

|---|---|---|---|---|---|

Round | Unattributed VC | Series B | Series B | Series G | Seed VC |

Company | Harmony | Moment | Castelion | ||

Amount | $3.88M | $36M | $350M | ||

New? | Yes | Yes | No | ||

Co-Investors | |||||

Sources | 1 | 2 | 4 |

Lightspeed Venture Partners Portfolio Exits

290 Portfolio Exits

Lightspeed Venture Partners has 290 portfolio exits. Their latest portfolio exit was DataStax on May 28, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

5/28/2025 | Acquired | 3 | |||

5/23/2025 | Acquired | 1 | |||

5/16/2025 | Acquired | 3 | |||

Date | 5/28/2025 | 5/23/2025 | 5/16/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 3 | 1 | 3 |

Lightspeed Venture Partners Fund History

43 Fund Histories

Lightspeed Venture Partners has 43 funds, including Audacious Ventures II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/2/2024 | Audacious Ventures II | $150M | 1 | ||

7/12/2022 | Lightspeed Opportunity Fund II | $2,410M | 2 | ||

7/12/2022 | Lightspeed Venture Partners Select V | $2,260M | 1 | ||

7/12/2022 | Lightspeed Venture Partners XIV-A/B | ||||

7/12/2022 | Lightspeed India Partners IV |

Closing Date | 4/2/2024 | 7/12/2022 | 7/12/2022 | 7/12/2022 | 7/12/2022 |

|---|---|---|---|---|---|

Fund | Audacious Ventures II | Lightspeed Opportunity Fund II | Lightspeed Venture Partners Select V | Lightspeed Venture Partners XIV-A/B | Lightspeed India Partners IV |

Fund Type | |||||

Status | |||||

Amount | $150M | $2,410M | $2,260M | ||

Sources | 1 | 2 | 1 |

Lightspeed Venture Partners Partners & Customers

5 Partners and customers

Lightspeed Venture Partners has 5 strategic partners and customers. Lightspeed Venture Partners recently partnered with Google Cloud on April 4, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

4/9/2025 | Partner | United States | 2 | ||

2/26/2024 | Vendor | ||||

Vendor | |||||

Partner | |||||

Partner |

Date | 4/9/2025 | 2/26/2024 | |||

|---|---|---|---|---|---|

Type | Partner | Vendor | Vendor | Partner | Partner |

Business Partner | |||||

Country | United States | ||||

News Snippet | |||||

Sources | 2 |

Lightspeed Venture Partners Service Providers

5 Service Providers

Lightspeed Venture Partners has 5 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Series A | Management Consultants | General Counsel | |

Service Provider | |||

|---|---|---|---|

Associated Rounds | Series A | ||

Provider Type | Management Consultants | ||

Service Type | General Counsel |

Partnership data by VentureSource

Lightspeed Venture Partners Team

34 Team Members

Lightspeed Venture Partners has 34 team members, including current Founder, Managing Director, Ravi Mhatre.

Name | Work History | Title | Status |

|---|---|---|---|

Ravi Mhatre | SGI, and Booz Allen Hamilton | Founder, Managing Director | Current |

Name | Ravi Mhatre | ||||

|---|---|---|---|---|---|

Work History | SGI, and Booz Allen Hamilton | ||||

Title | Founder, Managing Director | ||||

Status | Current |

Compare Lightspeed Venture Partners to Competitors

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

New Enterprise Associates is a global venture capital firm focused on technology and healthcare sectors. The company offers funding to entrepreneurs at various stages of company development, from seed stage to IPO. NEA primarily serves the technology and healthcare industries, investing in companies. It was founded in 1977 and is based in Menlo Park, California.

Loading...