Investments

78Portfolio Exits

10Funds

2Research containing SE Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SE Ventures in 1 CB Insights research brief, most recently on Apr 29, 2025.

Apr 29, 2025 report

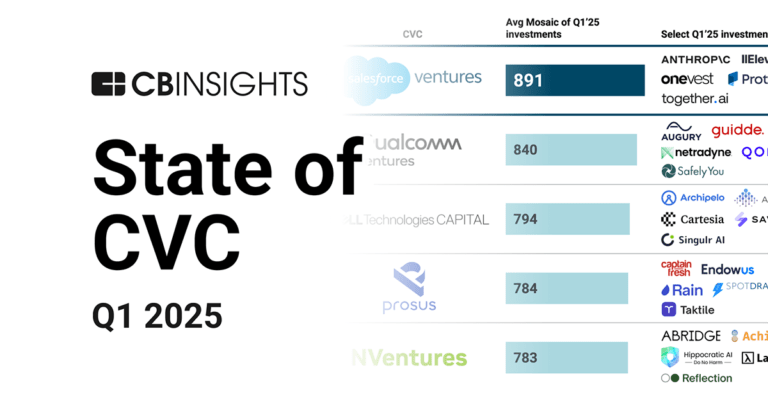

State of CVC Q1’25 ReportLatest SE Ventures News

Aug 15, 2025

AUSTIN, Texas, July 31, 2025 /PRNewswire/ — Command Zero, the industry's first autonomous and AI-assisted cyber investigation platform, today announced a $10 million strategic investment from leading cybersecurity and technology investors Okta Ventures, SE Ventures, and Crosspoint Capital. The company also achieved SOC 2 Type 2 compliance, demonstrating its unwavering commitment to the highest standards of security, availability, and confidentiality for enterprise customers. Strengthening the Cyber Investigation Revolution Command Zero's platform combines encoded expert knowledge, advanced Large Language Models (LLMs), and intuitive interfaces to empower security analysts with unprecedented investigative capabilities. The solution addresses the critical shortage of skilled cybersecurity professionals by enabling tier-2 and tier-3 analysts to conduct faster, more accurate investigations across even the most complex enterprise environments. Command Zero customers also use the platform to standardize, document and accelerate tier-1 analysis. “As an industry, we're not facing a shortage of detections or data. We are facing restrictions in complex analysis in security operations,” said Dov Yoran, co-founder and CEO of Command Zero. “While automation has transformed detection and triaging, escalated cases still demand expert human analysis. This strategic investment validates our approach to bridging the expertise gap while maintaining the human intelligence essential for nuanced threat analysis. Combined with our SOC 2 Type 2 compliance, we're positioned to serve the most demanding enterprise security requirements.” Command Zero's technology-agnostic approach enables analysts to conduct investigations across data sources in modern enterprises, dramatically reducing mean time to understand and respond to sophisticated threats. This capability is particularly crucial as organizations face increasingly complex attack vectors and regulatory compliance requirements. Strategic Partnerships with Industry Leaders The strategic investment brings together three complementary partners, each adding unique value to Command Zero's growth trajectory: Okta Ventures joined the investment, contributing their identity and access management expertise to support Command Zero's enterprise security mission. “Identity security requires sophisticated investigation capabilities to understand and respond to complex attack patterns,” said Austin Arensberg, Vice President of Okta Ventures. “Command Zero's platform enables security teams to conduct thorough investigations while maintaining the speed and precision required in today's threat landscape, making it an ideal complement to comprehensive identity security strategies.” SE Ventures, the venture fund backed by Schneider Electric invested, bringing their extensive industrial cybersecurity expertise and global enterprise customer base of Schneider Electric. “We recognize the transformative potential of technologies that enhance security operations across complex industrial environments,” said Amit Chaturvedy, Global Head & Managing Partner at SE Ventures. “Command Zero's approach to democratizing expert-level investigation capabilities aligns perfectly with our vision of empowering organizations to defend against increasingly sophisticated cyber threats while maintaining operational excellence.” Crosspoint Capital participated in the investment in connection with Command Zero's selection as a top 10 finalist of the RSA Conference 2025 Innovation Sandbox. “Command Zero is addressing one of the most persistent challenges in cybersecurity operations – the investigation bottleneck that limits even the most well-funded security teams,” said Zach Sivertson with Crosspoint Capital. “Their unique combination of expert knowledge encoding, advanced AI, and human-centered design represents a fundamental breakthrough in how organizations can scale their security operations while maintaining investigative rigor.” Achieving SOC 2 Type 2 Compliance In addition to securing strategic investment, Command Zero has successfully achieved SOC 2 Type 2 compliance, following a comprehensive audit. The data security certification validates the company's commitment to security, availability, and confidentiality. This milestone demonstrates Command Zero's adherence to the most stringent industry standards for protecting sensitive customer data and maintaining operational excellence. “Our customers' security has been a top priority since day one. “Achieving SOC 2 Type 2 compliance represents more than regulatory adherence – it demonstrates our foundational commitment to security excellence,” said Dean De Beer, co-founder and CTO of Command Zero. “Our customers trust us with their most critical security investigations, and this compliance validates our ability to protect their data while delivering the investigative capabilities they need to defend against sophisticated threats.” Transforming Security Operations at Scale Command Zero's platform addresses the fundamental challenge facing security operations teams: the inability to scale advanced investigative capabilities across all escalated security incidents. Traditional approaches rely on individual knowledge and manual processes, creating bottlenecks that limit organizational security effectiveness. The platform's innovative approach combines several breakthrough capabilities: Expert Knowledge Encoding: Decades of incident response and threat hunting expertise embedded directly into investigative workflows AI-Assisted Analysis: Advanced LLMs that augment human investigators while preserving critical analytical thinking Technology-Agnostic Querying: Unified investigation capabilities across enterprise data sources Automated Reporting: Comprehensive documentation and timeline generation for compliance and knowledge retention These capabilities enable security teams to conduct thorough investigations without requiring technology-specific expertise, dramatically reducing training requirements while improving investigation quality and consistency. About Command Zero Command Zero is the industry's first autonomous and AI-assisted cyber investigation platform, built to transform security operations in complex enterprise environments. The platform reduces the need for technology-specific expertise for tier-2, tier-3 analysts, incident responders, and threat hunters. Command Zero enables all users to perform at the highest level by ensuring consistent, repeatable, auditable investigations with automated reporting. Command Zero is a passionate group of accomplished cyber experts focused on revolutionizing cyber investigations. The co-founders have led seven successful cybersecurity acquisitions to date including exits to Symantec, McAfee, Sourcefire, Cisco, and IBM. Headquartered in Austin, TX with presence in Calgary, Alberta, Canada, the company has seasoned employees across the US and Canada. Learn more at https://www.cmdzero.io/ and follow the Command Zero LinkedIn page. About Okta Ventures Okta Ventures is the venture investment arm of Okta, investing in companies developing innovative identity and security solutions. Okta Ventures focuses on modern identity technologies that address identity, privacy, and security use cases across the enterprise ecosystem. For more information, please visit: www.okta.com/okta-ventures About SE Ventures SE Ventures is a $1B+ venture capital firm based in Menlo Park. A team of specialist investors and operators, SE Ventures backs bold entrepreneurs in Industrial & Climate Tech and drives commercial acceleration for portfolio startups by tapping into the deep domain expertise and global customer base of its LP, Schneider Electric. For more information, visit: www.seventures.com About Crosspoint Capital Crosspoint Capital is an investment firm focused on the cybersecurity, privacy, and infrastructure software markets. Crosspoint Capital has assembled a group of highly successful operators, investors, and sector experts to partner with foundational technology companies and drive differentiated returns. Crosspoint Capital has offices in Menlo Park, CA and Boston, MA. For more information, visit: www.crosspointcapital.com. Contact Erdem Menges VP of Product Marketing Command Zero press@cmdzero.io SOURCE Command Zero Copyright © 2025 Cision US Inc.

SE Ventures Investments

78 Investments

SE Ventures has made 78 investments. Their latest investment was in Makersite as part of their Series B on July 22, 2025.

SE Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/22/2025 | Series B | Makersite | $70.11M | Yes | 6 | |

6/24/2025 | Series B - II | Enter | $23.22M | Yes | Coatue, Foundamental, noa, Partech, and Target Global | 1 |

6/23/2025 | Seed VC - II | Command Zero | $10M | Yes | 4 | |

6/19/2025 | Series B | |||||

6/18/2025 | Series B |

Date | 7/22/2025 | 6/24/2025 | 6/23/2025 | 6/19/2025 | 6/18/2025 |

|---|---|---|---|---|---|

Round | Series B | Series B - II | Seed VC - II | Series B | Series B |

Company | Makersite | Enter | Command Zero | ||

Amount | $70.11M | $23.22M | $10M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Coatue, Foundamental, noa, Partech, and Target Global | ||||

Sources | 6 | 1 | 4 |

SE Ventures Portfolio Exits

10 Portfolio Exits

SE Ventures has 10 portfolio exits. Their latest portfolio exit was Wattbuy on August 21, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/21/2025 | Acquired | 4 | |||

1/20/2025 | Acquired | 4 | |||

10/1/2024 | Acquired | 2 | |||

Date | 8/21/2025 | 1/20/2025 | 10/1/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 4 | 4 | 2 |

SE Ventures Fund History

2 Fund Histories

SE Ventures has 2 funds, including SE Ventures Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

11/17/2022 | SE Ventures Fund II | $500M | 1 | ||

12/4/2018 | SE Ventures Fund I |

Closing Date | 11/17/2022 | 12/4/2018 |

|---|---|---|

Fund | SE Ventures Fund II | SE Ventures Fund I |

Fund Type | ||

Status | ||

Amount | $500M | |

Sources | 1 |

SE Ventures Team

5 Team Members

SE Ventures has 5 team members, including current Vice President, Grégoire Viasnoff.

Name | Work History | Title | Status |

|---|---|---|---|

Grégoire Viasnoff | Schneider Electric, and Airbus | Vice President | Current |

Name | Grégoire Viasnoff | ||||

|---|---|---|---|---|---|

Work History | Schneider Electric, and Airbus | ||||

Title | Vice President | ||||

Status | Current |

Loading...