Investments

668Portfolio Exits

124Funds

13Partners & Customers

8About Partech

Partech serves as an independent investment firm focused on the technology and digital sectors. Partech brings together capital, operational experience, and strategic support to back entrepreneurs from seed to growth stage. Its primary customer segments include the tech and digital industries. Partech manages €2.7B AUM and a current portfolio of 220 companies, spread across 40 countries and 4 continents. It was founded in 1982 and is based in Paris, France.

Research containing Partech

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Partech in 1 CB Insights research brief, most recently on Jun 13, 2025.

Jun 13, 2025

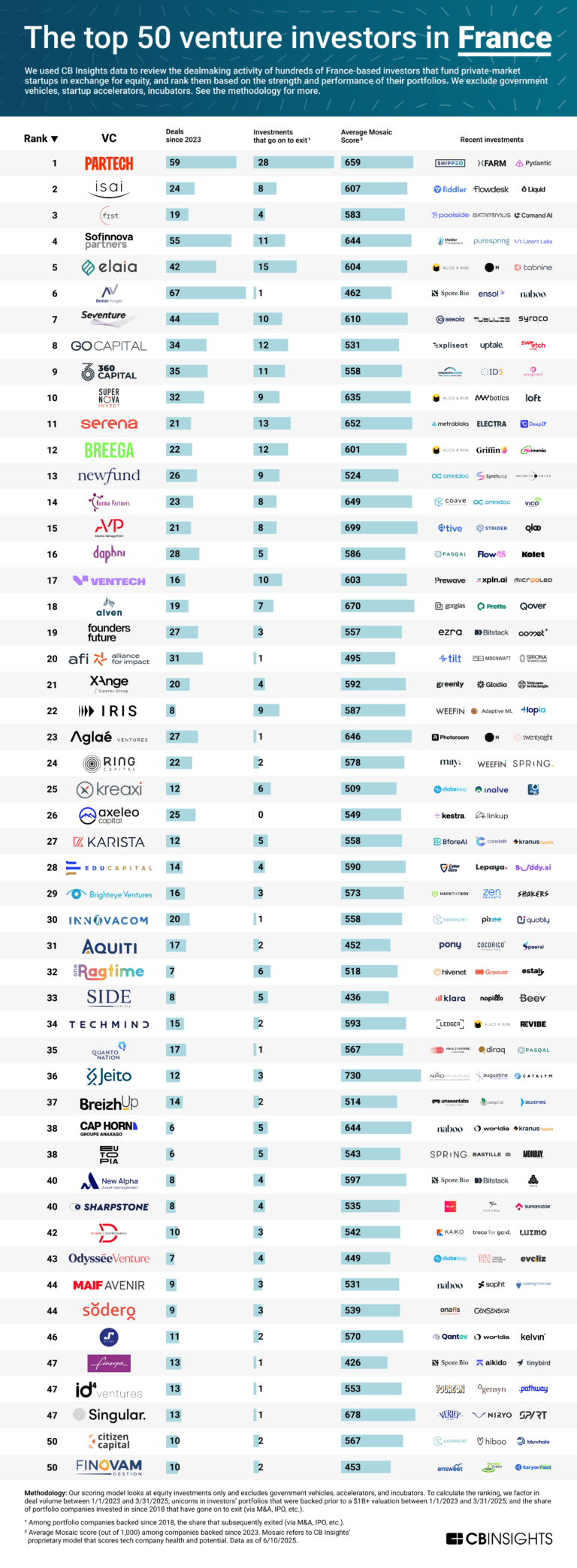

The top 50 venture investors in FranceLatest Partech News

Sep 16, 2025

funding round led by AfricInvest via their Cathay AfricInvest Innovation Fund (CAIF) and Financial Inclusion Vehicle (FIVE), alongside Partech, and with participation from Polymorphic Capital. This latest round, which brings Kredete's total funding to $24.75 million, will finance the company's expansion into Canada, the United Kingdom, and key European markets. Kredete was founded in 2023 by serial entrepreneur Adeola Adedewe. Since then, the firm has been on a mission to help African immigrants build credit and access better financial services through stablecoin payments and responsible remittance infrastructure. The company combines international money transfers with a proprietary credit-building engine, enabling users to send money to over 30 African countries while improving their credit history in the U.S. and beyond. Kredete has also built API-based infrastructure to help businesses make secure and affordable cross-border payments into Africa, leveraging modern payment rails and stablecoin technology. Kredete is doubling down on its mission to make credit universally accessible for Africans by expanding its credit-building infrastructure. The company is introducing new features like rent reporting, credit-linked savings plans, and responsible goal-based loans. These features are designed for thin-file or no-file immigrants who have historically been excluded from traditional credit systems. At the core of this expansion is Africa's first stablecoin-backed credit card, set to roll out across 41+ African countries, enabling users to spend seamlessly, build credit, and avoid costly foreign exchange fees. To complement this, Kredete is launching interest-bearing USD and EUR accounts, empowering Africans globally to preserve value, earn yield, and hedge against local currency volatility. On the infrastructure side, Kredete is building the continent's largest aggregation layer of banks and wallets — giving businesses a single API to enable secure, real-time, and affordable payouts into Africa. With this foundation, Kredete is redefining cross-border finance — helping Africans everywhere send, spend, save, and build credit on one powerful platform. “Our vision is simple: if you support your family financially, that should count toward your creditworthiness,” says Adeola Adedewe , Founder and CEO of Kredete. “We're building a system that rewards financial responsibility across borders. This raise is about scaling that infrastructure globally — and making sure that the millions of Africans abroad are finally seen, scored, and served.” “Kredete has been focusing on serving the African diaspora while addressing the key bottlenecks faced by payment operators when they move money in and out of Africa,” comments Khaled Ben Jilani , Senior Partner at AfricInvest. “It is one of those extremely rare start-ups that has managed to solve several problems at once—both for its African consumer clients, as well as for the large payments companies operating in Africa.” “Adeola and his team are driving transformative innovation in remittance and cross-border payment infrastructure,” comments Lewam Kefela , Principal at Partech. “We're excited about how their work is enabling better financial services for the African diaspora and unlocking broader opportunities across the ecosystem. We are thrilled to partner with Kredete on this journey.” Kredete's mission aligns with the United Nations Sustainable Development Goals (SDGs) related to Decent Work and Economic Growth (SDG 8) and Reduced Inequalities (SDG 10). Since its launch, Kredete has reached over 700,000 monthly users, facilitated $500 million in remittances, and helped raise users' U.S. credit scores by an average of 58 points. About Kredete Kredete is a financial technology platform that empowers African immigrants in the diaspora to build credit and send money instantly to over 30 African countries with low fees. Kredete offers an API-based infrastructure for businesses to make secure and affordable cross-border payments into Africa, leveraging modern payment rails and stablecoin technology. https www kredete io About Partech Partech is a global tech investment firm headquartered in Paris, with offices in Berlin, Dakar, Dubai, Nairobi, and San Francisco. Partech brings together capital, operational experience, and strategic support to back entrepreneurs from seed to growth stage. Born in San Francisco 40 years ago, today Partech manages €2.5B AUM and a current portfolio of 220 companies, spread across 40 countries and 4 continents. About Cathay AfricInvest Innovation Fund (CAIF) and Financial Inclusion Vehicle (FIVE) CAIF is a joint venture between pan-African investment firm AfricInvest and global venture firm Cathay Innovation to invest in highly scalable and ambitious technology companies operating in Africa. The first fund is a €110m vehicle launched in 2019 that invests primarily in Series A and B stage startups. The fund is backed by a diverse pool of globally renowned investors, development finance institutions, leading multinational corporations, and high-net-worth individuals. FIVE is AfricInvest's first pan-African evergreen fund and its second-generation vehicle dedicated to the financial inclusion in Africa. With a flexible mandate, FIVE invests across the spectrum of traditional financial institutions and high-growth FinTechs. Backed by a diverse base of private investors and development finance institutions, FIVE has surpassed €200 million in assets under management. The fund's perpetual structure enables a patient capital and long-term value creation, empowering portfolio companies to drive transformational growth. Through digital innovation and inclusive finance, FIVE is committed to the universal access to financial services and fostering sustainable economic development across the African continent. AfricInvest is a leading pan-African investment platform active in multiple alternative asset classes including private equity, venture capital, private credit, blended finance, and listed equities. Over the past quarter century, we have raised more than $2bn to finance more than 200 companies at various development stages, delivering value and impact for our investors, portfolio companies, and the communities we serve. Our 100-strong team of investment experts in more than ten offices across three continents has a proven track record of providing attractive risk-adjusted returns while spurring productivity growth, creating jobs, and ultimately improving African lives through inclusive and sustainable development. Cathay Innovation is a multi-stage venture capital firm, affiliated to Cathay Capital, that goes beyond the traditional VC playbook by providing entrepreneurs the support of a global ecosystem. Its global venture capital platform – bridging entrepreneurs with innovation centers, investors and Fortune 500 companies across five continents – helps startups grow and lead on the local or global stage with access to new markets, invaluable industry knowledge and introductions to potential partners with the world's leading corporations. For further information on AfricInvest, contact: ann.wyman@africinvest.com

Partech Investments

668 Investments

Partech has made 668 investments. Their latest investment was in Plumerai as part of their Series A on September 16, 2025.

Partech Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/16/2025 | Series A | Plumerai | $8.7M | Yes | Acclimate Ventures, OTB Ventures, and Undisclosed Investors | 2 |

9/15/2025 | Series A | Kredete | $22M | Yes | 4 | |

9/4/2025 | Pre-Seed | Alpic | $6M | Yes | Drysdale Ventures, Galion.exe, Irregular Expressions, K5 Global Technology, Kima Ventures, Undisclosed Angel Investors, and Yellow | 4 |

7/22/2025 | Series B | |||||

7/15/2025 | Series C |

Date | 9/16/2025 | 9/15/2025 | 9/4/2025 | 7/22/2025 | 7/15/2025 |

|---|---|---|---|---|---|

Round | Series A | Series A | Pre-Seed | Series B | Series C |

Company | Plumerai | Kredete | Alpic | ||

Amount | $8.7M | $22M | $6M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Acclimate Ventures, OTB Ventures, and Undisclosed Investors | Drysdale Ventures, Galion.exe, Irregular Expressions, K5 Global Technology, Kima Ventures, Undisclosed Angel Investors, and Yellow | |||

Sources | 2 | 4 | 4 |

Partech Portfolio Exits

124 Portfolio Exits

Partech has 124 portfolio exits. Their latest portfolio exit was Zolar on August 13, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/13/2025 | Asset Sale | 2 | |||

8/11/2025 | Acquired | 5 | |||

6/27/2025 | Acq - Talent | 4 | |||

Date | 8/13/2025 | 8/11/2025 | 6/27/2025 | ||

|---|---|---|---|---|---|

Exit | Asset Sale | Acquired | Acq - Talent | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 5 | 4 |

Partech Acquisitions

1 Acquisition

Partech acquired 1 company. Their latest acquisition was TerraPay on March 03, 2020.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

3/3/2020 | Other | $258.43M | Management Buyout | 5 |

Date | 3/3/2020 |

|---|---|

Investment Stage | Other |

Companies | |

Valuation | |

Total Funding | $258.43M |

Note | Management Buyout |

Sources | 5 |

Partech Fund History

13 Fund Histories

Partech has 13 funds, including Partech Africa Venture Capital Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

2/18/2024 | Partech Africa Venture Capital Fund II | $323M | 6 | ||

12/5/2022 | Partech Entrepreneur Fund IV | $124M | 1 | ||

11/30/2021 | Partech Growth Fund II | $750M | 3 | ||

4/28/2020 | Partech Entrepreneur Fund III | ||||

1/31/2019 | Partech Africa Fund |

Closing Date | 2/18/2024 | 12/5/2022 | 11/30/2021 | 4/28/2020 | 1/31/2019 |

|---|---|---|---|---|---|

Fund | Partech Africa Venture Capital Fund II | Partech Entrepreneur Fund IV | Partech Growth Fund II | Partech Entrepreneur Fund III | Partech Africa Fund |

Fund Type | |||||

Status | |||||

Amount | $323M | $124M | $750M | ||

Sources | 6 | 1 | 3 |

Partech Partners & Customers

8 Partners and customers

Partech has 8 strategic partners and customers. Partech recently partnered with ClimateCare on January 1, 2020.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

1/14/2020 | Partner | United Kingdom | Partech marks 3 years ' partnership with ClimateCare to offset carbon emissions with projects that improve lives and fight climate change , and announces a partnership with EcoVadis to rate ESG performance of its portfolio companies . | 2 | |

6/11/2018 | Partner | ||||

5/2/2018 | Partner | ||||

1/18/2018 | Partner | ||||

11/16/2016 | Partner |

Date | 1/14/2020 | 6/11/2018 | 5/2/2018 | 1/18/2018 | 11/16/2016 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United Kingdom | ||||

News Snippet | Partech marks 3 years ' partnership with ClimateCare to offset carbon emissions with projects that improve lives and fight climate change , and announces a partnership with EcoVadis to rate ESG performance of its portfolio companies . | ||||

Sources | 2 |

Partech Team

26 Team Members

Partech has 26 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Rémi Said | Founder | Current | |

Name | Rémi Said | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Compare Partech to Competitors

Next4 is a holding company that specializes in digital investments with a particular focus on digital health. The company serves as a reference point for Design Thinking, supporting startups and scaleups in innovating their Value Propositions. Next4Production primarily engages with the digital health sector, offering services such as market needs analysis, fostering a disruptive technology ecosystem, and facilitating access to funding sources for business growth. It was founded in 2018 and is based in Roma, Italy.

Blacktyde Capital Partners is a private equity firm that focuses on launching and managing investment vehicles in sectors such as EV infrastructure, specialty real estate, and structured private credit. The firm serves institutional investors seeking opportunities in distinct market segments. It was founded in 2013 and is based in Toronto, Canada.

BC Partners is a private equity firm that specializes in buyouts, principally investing in larger businesses through its established network of offices in London, Paris, Hamburg, and New York. BC Partners invests in the education, media and telecom, industrial, business, and healthcare sectors. The company was founded in 1986 and is based in London, United Kingdom.

Advent International is a global private equity firm. It seeks to invest in positioned companies with operational and strategic improvement potential and partner with management teams to create sustainable value through revenue and earnings growth. The company was founded in 1984 and is based in Boston, Massachusetts.

Ardian operates as a private equity investment company. It focuses on co-investment, buyout, expansion, growth, and other private equity investments. It also provides real estate, infrastructure, and credit-based capital to companies. It was formerly known as AXA Private Equity. It was founded in 1996 and is based in Paris, France.

Arle Capital Partners is a multinational investment firm that focuses on value creation in various sectors. The firm is involved in private equity investments, including buyouts, carve-outs, and platform creations, with a portfolio in technology, manufacturing, and consumer sectors. Arle Capital Partners serves mid-market companies in the energy sector and acts as an investment manager for the Candover Funds and special purpose vehicles. It was founded in 2011 and is based in London, England.

Loading...