Investments

62Portfolio Exits

1Funds

4About Hitachi Ventures

Hitachi Ventures operates as the global venture capital arm of Hitachi Group. It scouts for startups in industries of strategic relevance for Hitachi, such as Healthcare, Environment, and future Social Businesses. It invests invest in Europe, Israel, and North America. Hitachi Ventures was founded in 2019 and is based in Munich, Germany.

Research containing Hitachi Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hitachi Ventures in 1 CB Insights research brief, most recently on Aug 7, 2025.

Aug 7, 2025

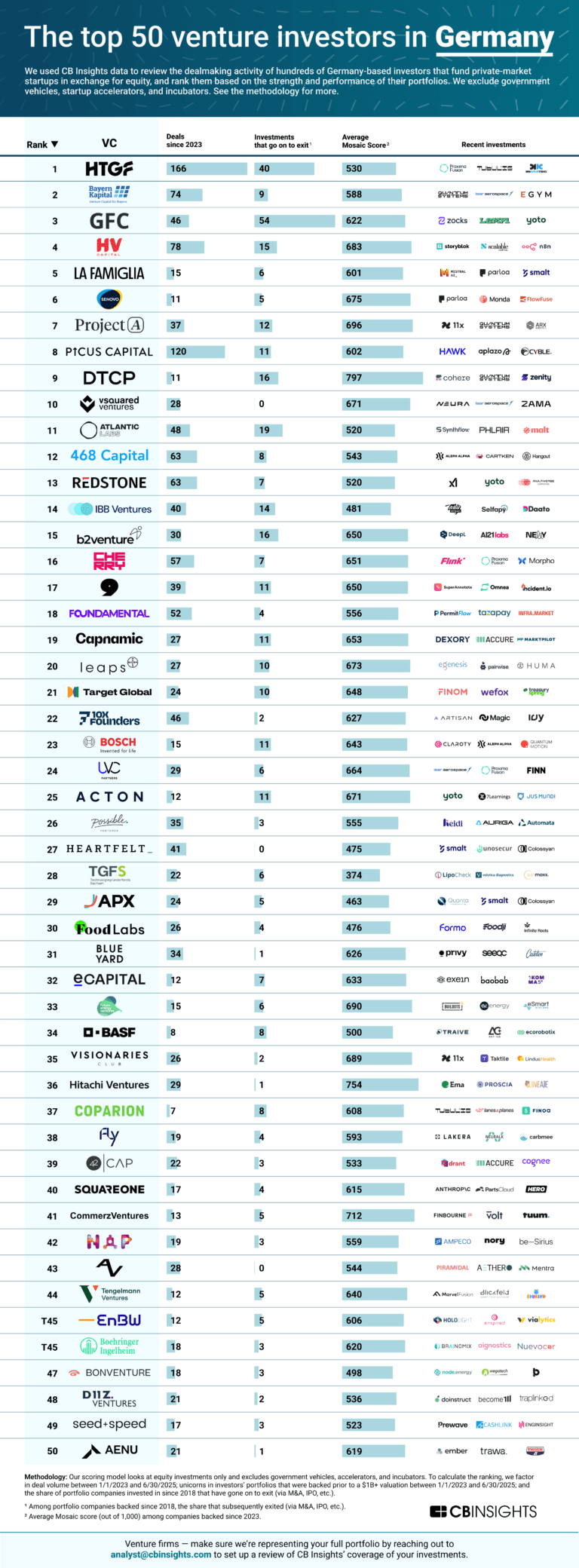

The top 50 venture investors in GermanyLatest Hitachi Ventures News

Sep 10, 2025

Hitachi hires Poh as head of operations for investment unit Sep 10, 2025 • Oishani Mitra Liling Poh brings more than 17 years of legal experience to her role at Hitachi Ventures. Liling Poh has joined Hitachi Ventures, the corporate VC arm of Japanese tech and industrial conglomerate Hitachi, as head of operations. She was previously a partner at US-based law firm Dentons where she did deal structuring and strategic advisory work. Poh will partner with Hitachi Ventures’ limited partners, investors, co-investors and portfolio companies to navigate legal and operational affairs across the unit’s global operations. Established in 2019 with a $150m fund, Hitachi Ventures has grown to manage over $1bn. The team focuses on early-stage and follow-on investments in the digital, energy and mobility sectors. Its latest fund (Fund IV), with a $400m allocation, was launched in February this year.

Hitachi Ventures Investments

62 Investments

Hitachi Ventures has made 62 investments. Their latest investment was in Aalo Atomics as part of their Series B on August 19, 2025.

Hitachi Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

8/19/2025 | Series B | Aalo Atomics | $100M | No | 2 | |

7/29/2025 | Series B | Teramount | $50M | Yes | AMD Ventures, Grove Ventures, Koch Disruptive Technologies, Samsung Catalyst, Undisclosed Investors, and Wistron | 4 |

7/22/2025 | Series B | Makersite | $70.11M | No | 6 | |

7/22/2025 | Series A | |||||

7/11/2025 | Series B |

Date | 8/19/2025 | 7/29/2025 | 7/22/2025 | 7/22/2025 | 7/11/2025 |

|---|---|---|---|---|---|

Round | Series B | Series B | Series B | Series A | Series B |

Company | Aalo Atomics | Teramount | Makersite | ||

Amount | $100M | $50M | $70.11M | ||

New? | No | Yes | No | ||

Co-Investors | AMD Ventures, Grove Ventures, Koch Disruptive Technologies, Samsung Catalyst, Undisclosed Investors, and Wistron | ||||

Sources | 2 | 4 | 6 |

Hitachi Ventures Portfolio Exits

1 Portfolio Exit

Hitachi Ventures has 1 portfolio exit. Their latest portfolio exit was SOPHiA Genetics on July 23, 2021.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/23/2021 | IPO | Public | 12 |

Date | 7/23/2021 |

|---|---|

Exit | IPO |

Companies | |

Valuation | |

Acquirer | Public |

Sources | 12 |

Hitachi Ventures Fund History

4 Fund Histories

Hitachi Ventures has 4 funds, including Hitachi Ventures Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

10/4/2021 | Hitachi Ventures Fund II | $150M | 1 | ||

Hitachi Ventures Fund III | |||||

Hitachi Ventures Fund I | |||||

Hitachi Ventures Fund IV |

Closing Date | 10/4/2021 | |||

|---|---|---|---|---|

Fund | Hitachi Ventures Fund II | Hitachi Ventures Fund III | Hitachi Ventures Fund I | Hitachi Ventures Fund IV |

Fund Type | ||||

Status | ||||

Amount | $150M | |||

Sources | 1 |

Hitachi Ventures Team

2 Team Members

Hitachi Ventures has 2 team members, including current Chief Executive Officer, Managing Director, Stefan Gabriel.

Loading...