Investments

12Portfolio Exits

10Partners & Customers

10About Airbus

Airbus designs, manufactures, and delivers commercial aircraft, helicopters, military transports, satellites, and launch vehicles. The company also provides data services, navigation, secure communications, urban mobility, and other solutions for customers on a global scale.

Expert Collections containing Airbus

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Airbus in 2 Expert Collections, including Aerospace & Space Tech.

Aerospace & Space Tech

1,899 items

These companies provide a variety of solutions, ranging from industrial drones to electrical vertical takeoff vehicles, space launch systems to satellites, and everything in between

Defense Tech

1,807 items

Research containing Airbus

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Airbus in 5 CB Insights research briefs, most recently on Mar 1, 2024.

Mar 1, 2024

The satellite & geospatial tech market map

Mar 22, 2023

6 applications of generative AI in industrials

Nov 3, 2021

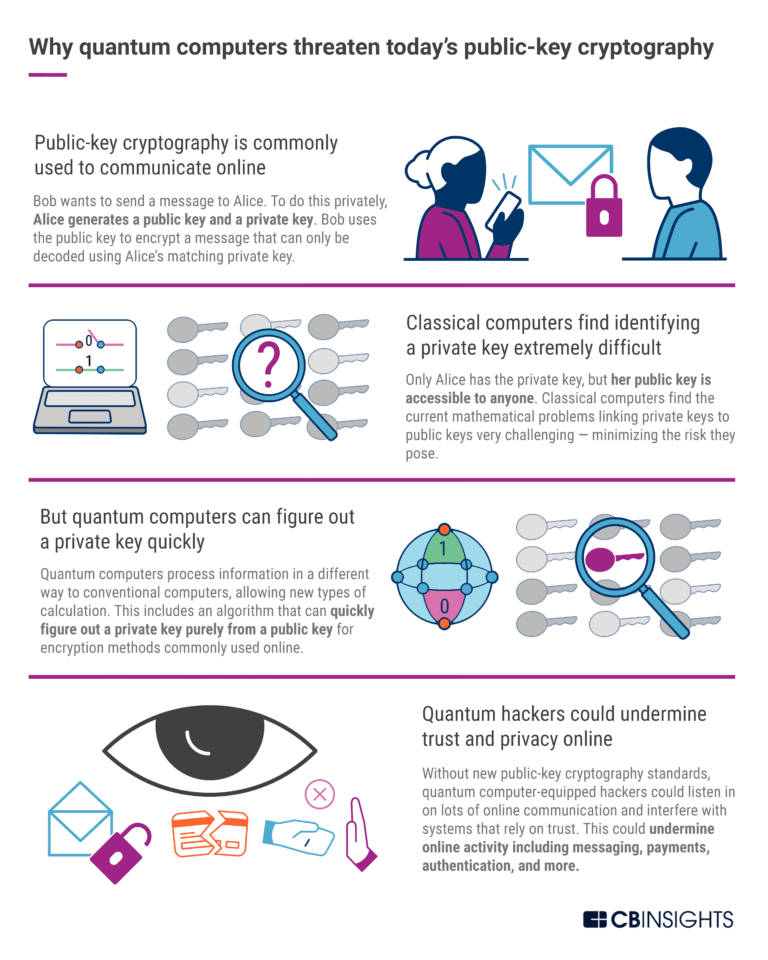

Is Quantum Computing The Next Banking Arms Race?Latest Airbus News

Mar 28, 2024

Advertisement The turmoil at the top of Boeing this week underscores the extent to which the aircraft manufacturer’s quality control issues have the potential to destabilise the entire commercial aviation industry. This week Boeing’s chairman said he wouldn’t stand for re-election at Boeing’s upcoming annual meeting, its chief executive said he would depart at the end of the year and the head of the division that makes its commercial jetliners retired with immediate effect. Airline CEOs are adamant that Boeing prioritise improving its quality control over any attempt to accelerate production. Credit: AP While the CEO, Dave Calhoun, a former chairman who took on the CEO role after the 2018 and 2019 crashes of Boeing Max 8 aircraft that claimed nearly 350 lives , said he would hang around until the end of the year, there’s already pressure from the company’s airline customers for more urgent change. With the US Federal Aviation Administration already capping its production, a massive and growing backlog of orders and continuing quality control issues and safety incidents that have further slowed its production, Boeing’s plight is not just threatening its own financial condition – it expects net cash outflows of $US4 billion ($6.1 billion) to $US4.5 billion in the first quarter of this year – but is disrupting the entire industry. Loading While Boeing lost its mantle as the world’s largest commercial aircraft manufacturer to Airbus some years ago and the gap continues to widen, the two companies dominate commercial aircraft production. The industry will – and is being – impaired by the problems within Boeing. Already airlines in the US and Europe are having to revise their schedules to reflect smaller-than-planned fleets because of Boeing’s inability to deliver as promised. That’s against a backdrop of a continuing strong increase in demand for travel and new industry capacity in the post-pandemic environment. That, in turn, will flow through, and is flowing through, to higher airfares as capacity is tightening relative to demand and, with the prospect of Boeing delivering the next generation of more fuel-efficient jets receding into the distance, more pressure on airlines’ costs in future. Airlines from Ryanair to United, Qantas to Virgin, are having to re-think plans for their fleets, with Boeing’s delivery schedules now being stretched out considerably and having a significant question mark over them. Advertisement There’s no quick fix to the industry’s over-reliance on the two major manufacturers. Airbus, which has a 62 per cent market share in the key narrow-bodied segment of the commercial market, is already struggling to keep up with demand despite ramping up its production. Boeing’s under-fire CEO Dave Calhoun announced he will depart at the end of the year. Credit: AP Last year Airbus delivered 735 aircraft, up from 663 in 2022, against Boeing’s 528. Airbus has a record backlog of 8598 jets and the highest gross orders (2319) in aviation history. Boeing’s backlog of 6216, which is swelling daily, is more than 6200 jets. It is likely that its order book will fall and its backlog of orders will grow further because of its current predicament. Even though Airbus plans to deliver about 800 aircraft to customers this year it doesn’t have the capacity to pick up anything meaningful of the slack created by Boeing’s reduced production. Boeing had planned to lift its own production to around 600 planes a year by 2025 but has suspended all forecasts after the January incident, when a fuselage panel blew off an Alaska Airlines 737 Max 9 full of passengers . Loading Airbus, which earned about $US6.2 billion last year, is already investing in a successor to its very successful A320neo. It has said the new plane will be 20 per cent more fuel-efficient. Boeing, having lost more than $US7 billion over the past two years, will likely fall further behind in terms of cutting-edge technologies because of the constraints on its ability invest and the authorities’ – and it’s own – restrictions on its production. Boeing has slowed manufacturing rates as it grapples with quality control issues that pre-date the crashes of the two Max 8s. A lot of Boeing watchers blame the 1997 acquisition of McDonnell Douglas for a shift in Boeing’s culture from one of engineering excellence and prioritisation of safety to the prioritisation of profits. Like many aircraft manufacturers, in recent decades Boeing has outsourced much of its production to focus on assembly. Airbus also relies on third-party suppliers – including Sprint Aerosystems, which was spun off from Boeing in 2005 and which makes Boeing’s fuselages – although perhaps to a lesser extent. Its quality control issues were compounded by the pandemic. Where Airbus kept control of most of its workforce, Boeing let much of its go and has had trouble rehiring experienced workers as demand for its planes has rebounded. Boeing has been in talks to buy back Sprint to regain direct control over the quality of production of a key source of some of its recent issues, which include the Alaskan Air incident, misdrilled holes on its 737 Max planes, loose bolts, tools found under cabin floors and, more recently, a “technical event” on a LATAM Airlines’ flight from Australia to New Zealand than injured 50 passengers. Boeing has to sort out its quality control issues, not just to ensure its own survival, but because they will restrict the growth of the aviation industry and will increase airfares for customers if they aren’t resolved quickly, with economies-wide effects. Beyond Airbus and Boeing there’s little relief in prospect for capacity-constrained airlines. The industry will – and is being – impaired by the problems within Boeing. Embraer could possibly expand into larger aircraft but that would be a big and risky step up for the Brazilian company. When, in the last decade, Canada’s Bombardier tried to enter the smaller end of the markets dominated by Airbus and Boeing it was a disaster than ended with Bombardier largely exiting the mainstream commercial aviation markets. China’s COMAC, whose C919 narrow-bodied jet flew commercially for the first time last year, might be a competitor , particularly in its home market, to Airbus and Boeing in the long term. Its engine, avionics, control systems, brakes, wheels, tyres, landing gear and cabin system are, however, all made by US and European suppliers and it doesn’t have the ubiquitous international network of parts and service centres that the two dominant manufacturers have developed over many decades and which would be very difficult and costly to replicate in anything other than the very long term. Loading Airline CEOs are adamant that Boeing prioritise improving its quality control over any attempt to accelerate production. They don’t want unsafe planes or, as is happening today, passengers choosing not to fly on their Boeing aircraft. They want the next CEO to have a strong engineering background for that reason. The candidates for that role will be few. There are few industries more complex or so reliant on such a complex ecosystem of suppliers and customers as aviation. The pressure, internal and external, on Boeing to make the right choice will be intense and the success, or failure, of the chosen one will influence the future shape of the entire industry.

Airbus Investments

12 Investments

Airbus has made 12 investments. Their latest investment was in Jet Zero Australia as part of their Series A on March 11, 2024.

Airbus Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/11/2024 | Series A | Jet Zero Australia | $19M | Yes | 1 | |

9/18/2023 | Series C | ZeroAvia | $116M | Yes | 4 | |

2/22/2021 | Seed VC | Luos | $1.46M | Yes | 1 | |

10/31/2019 | Corporate Minority | |||||

10/14/2019 | Corporate Minority |

Date | 3/11/2024 | 9/18/2023 | 2/22/2021 | 10/31/2019 | 10/14/2019 |

|---|---|---|---|---|---|

Round | Series A | Series C | Seed VC | Corporate Minority | Corporate Minority |

Company | Jet Zero Australia | ZeroAvia | Luos | ||

Amount | $19M | $116M | $1.46M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | |||||

Sources | 1 | 4 | 1 |

Airbus Portfolio Exits

10 Portfolio Exits

Airbus has 10 portfolio exits. Their latest portfolio exit was Amprius Technologies on September 14, 2022.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/14/2022 | Reverse Merger | 4 | |||

5/7/2021 | Reverse Merger | 2 | |||

8/27/2020 | Acquired | 1 | |||

Date | 9/14/2022 | 5/7/2021 | 8/27/2020 | ||

|---|---|---|---|---|---|

Exit | Reverse Merger | Reverse Merger | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 4 | 2 | 1 |

Airbus Acquisitions

18 Acquisitions

Airbus acquired 18 companies. Their latest acquisition was Infodas on March 25, 2024.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

3/25/2024 | Acquired | 2 | ||||

1/20/2023 | Acquired | 1 | ||||

7/26/2022 | Acquired Unit | 1 | ||||

4/8/2022 | ||||||

2/22/2022 |

Date | 3/25/2024 | 1/20/2023 | 7/26/2022 | 4/8/2022 | 2/22/2022 |

|---|---|---|---|---|---|

Investment Stage | |||||

Companies | |||||

Valuation | |||||

Total Funding | |||||

Note | Acquired | Acquired | Acquired Unit | ||

Sources | 2 | 1 | 1 |

Airbus Partners & Customers

10 Partners and customers

Airbus has 10 strategic partners and customers. Airbus recently partnered with NASA on March 3, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/19/2024 | Client | United States | Airbus : continues to collaborate with NASA to monitor climate change from Space Airbus Defence and Space : continues to collaborate with NASA to monitor climate change from Space | 1 | |

3/13/2024 | Vendor | India | Cyient Collaborates with Airbus for Cabin Engineering Services to Support Future Connected Cabins Cyient is committed to growing this partnership with Airbus to greater heights . | 5 | |

3/1/2024 | Vendor | United States | Airbus has explored buying Spirit A220 wings plant -sources A spokesperson for Spirit , which has said it is in ongoingcontractual price negotiations with Airbus , said `` We continuediscussions with Airbus . | 1 | |

2/29/2024 | Client | ||||

2/29/2024 | Client |

Date | 3/19/2024 | 3/13/2024 | 3/1/2024 | 2/29/2024 | 2/29/2024 |

|---|---|---|---|---|---|

Type | Client | Vendor | Vendor | Client | Client |

Business Partner | |||||

Country | United States | India | United States | ||

News Snippet | Airbus : continues to collaborate with NASA to monitor climate change from Space Airbus Defence and Space : continues to collaborate with NASA to monitor climate change from Space | Cyient Collaborates with Airbus for Cabin Engineering Services to Support Future Connected Cabins Cyient is committed to growing this partnership with Airbus to greater heights . | Airbus has explored buying Spirit A220 wings plant -sources A spokesperson for Spirit , which has said it is in ongoingcontractual price negotiations with Airbus , said `` We continuediscussions with Airbus . | ||

Sources | 1 | 5 | 1 |

Compare Airbus to Competitors

Safran is a company that focuses on aviation and operates in the aerospace and defense industries. The company provides a range of products and services including aircraft equipment such as landing gear, wheels, brakes, and avionics, as well as aircraft interiors and propulsion systems. Additionally, Safran offers defense systems and equipment, and has expertise in space technologies, particularly in rocket propulsion systems and high-performance space optics. It is based in Paris, France.

Dassault Aviation is a leading aerospace company that operates in the aviation industry. The company's main offerings include the design, manufacturing, and support of business jets. These jets are used for various purposes, including long-range travel. It was founded in 2000 and is based in Saint Cloud, France.

Cubic Corporation specializes in technology solutions within transportation and defense. The company offers systems for daily travel for individuals and mission success and safety for defense personnel. Cubic primarily serves the transportation industry and the defense sector with its solutions. It was founded in 1951 and is based in San Diego, California.

Peraton focuses on delivering national security solutions and acting as a mission capability integrator. The company offers a range of services including cyber-systems, systems engineering, and support for cyberspace operations. Peraton's primary customer segments include various sectors of national security such as defense, intelligence, and homeland security. Peraton was formerly known as Harris - Government IT Services. It was founded in 2017 and is based in Herndon, Virginia.

ManTech provides technologies and solutions for national security programs. It also provides communications, intelligence, surveillance, and reconnaissance systems and solutions, cyber security services, logistics support services, intelligence or counter-intelligence solutions and support, including secure information sharing and collaboration, operations and analysis support, secrecy management and program security architecture, and multi-level, secure, and network engineering solutions, and information technology modernization and sustainment services. The company was founded in 1968 and is based in Herndon, Virginia.

Rheinmetall is an integrated technology company operating in the defense industry. The company offers innovative products and services, with a focus on providing solutions for defense and civil markets. It primarily serves the defense industry. It was founded in 1889 and is based in Dusseldorf, Germany.

Loading...