Investments

155Portfolio Exits

6Funds

2Research containing Foundamental

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Foundamental in 1 CB Insights research brief, most recently on Aug 7, 2025.

Aug 7, 2025

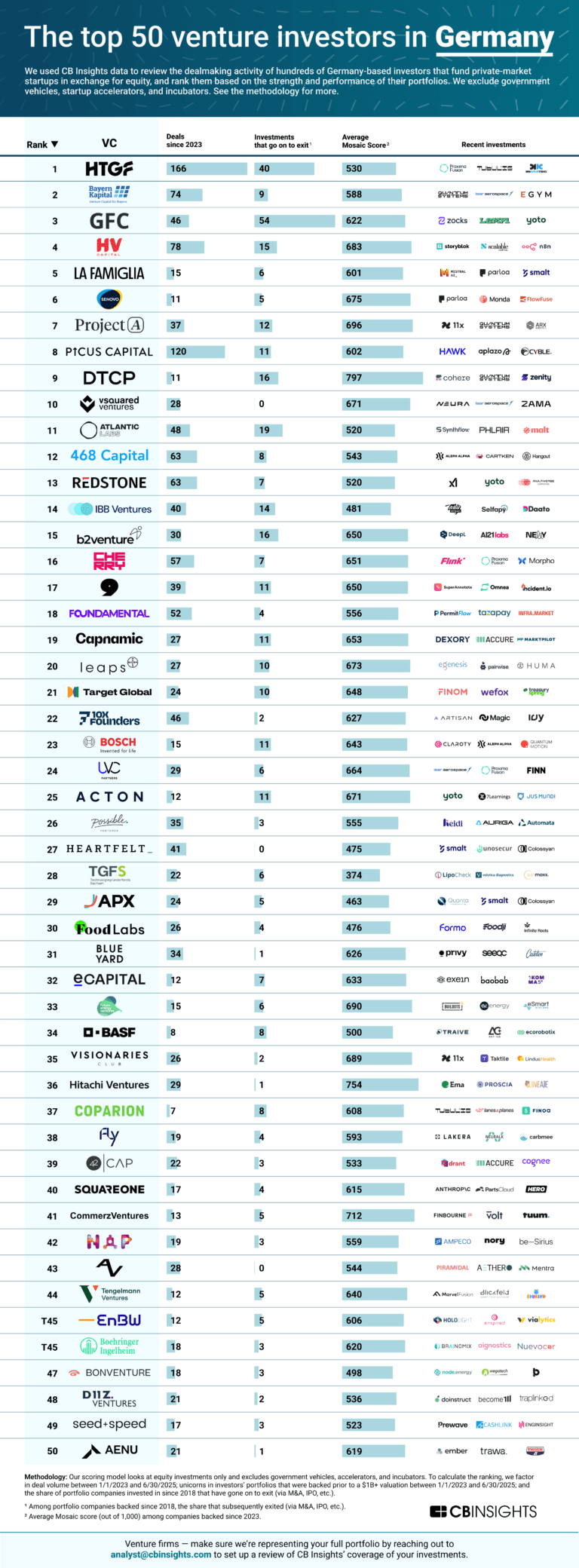

The top 50 venture investors in GermanyLatest Foundamental News

Sep 17, 2025

Berlin- and Mumbai-based venture capital firm Foundamental has launched its third fund to invest in construction technology and related project economy sectors, with India positioned as a key market. The firm, led by Berlin-based managing partners Shubhankar Bhattacharya and Patric Hellermann, aims to have the final close of Fund III by the end of calendar 2025. The fund will continue Foundamental 's strategy of backing early-stage companies in construction, infrastructure, and heavy industry supply chains across Asia-Pacific, Europe, the Americas, and MENA. “Backing winners and market leaders across continents has helped us compound our knowledge, enabling us to spot the founder traits that win and the business models that endure in the project economy. Being a global investor gives us this distinctive unfair advantage in partnering with Indian founders,” said Bhattacharya. The fund's investment sizes will range between $500,000 and $5 million (around Rs 4.3 crore to Rs 43 crore), from pre-seed to Series A rounds. Founded in 2019, Foundamental has invested in over 70 companies across 22 countries. Its India portfolio includes Infra.Market and Infraprime Logistics, both of which are preparing public listings. “As India undergoes a once-in-a-century transformation in infrastructure, the need for efficiency, transparency, and technology has never been greater. Fund III allows us to deepen our commitment to India while continuing to invest globally,” said Bhattacharya. Other global bets include Enter in Germany, Snaptrude in the US, Tazapay in Singapore, Monumental in the Netherlands, and Speckle in the UK. The new vehicle builds on Fund I (2019) and Fund II (2022), which the firm said rank among the better-performing venture funds globally in their cohorts. “Our capital platform bundles global blue-chip investors investing in the project economy. A remarkable feature of our platform is that all investors from Fund I and Fund II have returned as LPs in Fund III, with 40% doubling their commitments and 60% more than doubling their allocations,” said Bhattacharya. “These commitments were raised in record time, entirely from inbound demand and without the need for traditional fundraising roadshows; in fewer than 20 meetings,” Bhattacharya added. Foundamental manages sector-specific investments across seven verticals: construction and building materials, infrastructure, CAD and engineering, renovation, supply chain and logistics for heavy industry, lot-size-one manufacturing, and aerospace, defence and shipbuilding. It now has a presence in 22 countries and more than 75 markets. Share article on Get daily update with our newsletter Subscribe Now !

Foundamental Investments

155 Investments

Foundamental has made 155 investments. Their latest investment was in Enter as part of their Series B - II on June 24, 2025.

Foundamental Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/24/2025 | Series B - II | Enter | $23.22M | No | Coatue, noa, Partech, SE Ventures, and Target Global | 1 |

5/28/2025 | Pre-Seed | CalcTree | $2.45M | No | Antler, Kungari, Suffolk Technologies, and Undisclosed Angel Investors | 2 |

3/26/2025 | Seed VC - II | GreenFortune Windows and Doors | $4.5M | Yes | 2 | |

2/20/2025 | Series B | |||||

2/4/2025 | Seed VC - II |

Date | 6/24/2025 | 5/28/2025 | 3/26/2025 | 2/20/2025 | 2/4/2025 |

|---|---|---|---|---|---|

Round | Series B - II | Pre-Seed | Seed VC - II | Series B | Seed VC - II |

Company | Enter | CalcTree | GreenFortune Windows and Doors | ||

Amount | $23.22M | $2.45M | $4.5M | ||

New? | No | No | Yes | ||

Co-Investors | Coatue, noa, Partech, SE Ventures, and Target Global | Antler, Kungari, Suffolk Technologies, and Undisclosed Angel Investors | |||

Sources | 1 | 2 | 2 |

Foundamental Portfolio Exits

6 Portfolio Exits

Foundamental has 6 portfolio exits. Their latest portfolio exit was SafeAI on July 15, 2025.

Foundamental Fund History

2 Fund Histories

Foundamental has 2 funds, including Foundamental II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

12/13/2022 | Foundamental II | $85M | 2 | ||

Foundamental I |

Closing Date | 12/13/2022 | |

|---|---|---|

Fund | Foundamental II | Foundamental I |

Fund Type | ||

Status | ||

Amount | $85M | |

Sources | 2 |

Foundamental Team

4 Team Members

Foundamental has 4 team members, including current Chief Executive Officer, Patric Hellermann.

Name | Work History | Title | Status |

|---|---|---|---|

Patric Hellermann | Chief Executive Officer | Current | |

Name | Patric Hellermann | |||

|---|---|---|---|---|

Work History | ||||

Title | Chief Executive Officer | |||

Status | Current |

Loading...