Investments

739Portfolio Exits

169Funds

7Partners & Customers

7About Qualcomm Ventures

Qualcomm Ventures is the venture capital arm of Qualcomm, focusing on investments in the technology sector. The company provides funding and support to mobile technology companies, focusing on 5G, IoT, connected automotive, AI, consumer, enterprise, and cloud. Qualcomm Ventures connects entrepreneurs with resources and relationships. It was founded in 2000 and is based in San Diego, California.

Expert Collections containing Qualcomm Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Qualcomm Ventures in 5 Expert Collections, including AR/VR.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Qualcomm Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

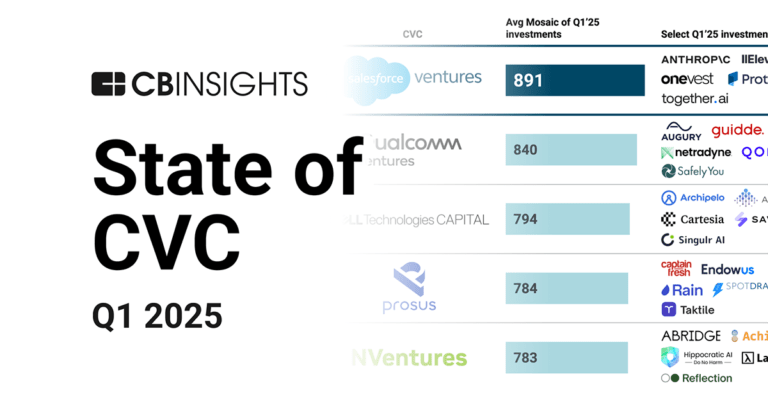

CB Insights Intelligence Analysts have mentioned Qualcomm Ventures in 4 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

State of CVC Q1’25 Report

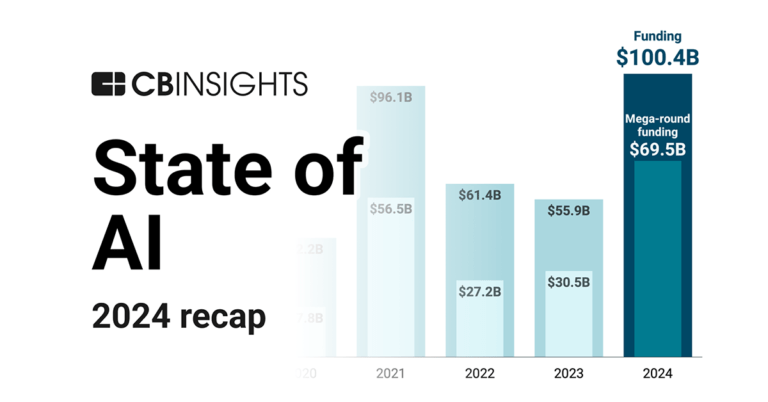

Jan 30, 2025 report

State of AI Report: 6 trends shaping the landscape in 2025

May 29, 2024

483 startup failure post-mortemsLatest Qualcomm Ventures News

Aug 7, 2025

Mayshar joins investment arm of chipmaker Qualcomm Aug 7, 2025 • Yoana Cholteeva Raz Mayshar is moving to Qualcomm Ventures from Tel Aviv-based smart mobility innovation hub Drive TLV. Raz Mayshar is joining Qualcomm Ventures, the venture capital investment arm of semiconductor and software firm Qualcomm, as a senior investment manager. He is leaving Israel-based smart mobility innovation hub Drive TLV, where he was head of research and scouting for six years. “In those six years, I met thousands of startups, worked closely with hundreds and invested in a few dozen. [And] spent countless hours with top corporates and visionary founders,” Mayshar said in a LinkedIn post announcing his move. He also worked at Next Gear Ventures, a tech fund focused on early-stage entrepreneurs in AI, digitisation and automation, where he was a principal. Qualcomm Ventures has over 150 active portfolio companies and has had more than 20 exits over a billion dollars, including Fitbit, 99 Taxis, Cruise Automation, Invensense, NQ Mobile and Waze. The unit also backs some of the leading generative AI companies including machine learning collaboration platform Hugging Face and AI model builder Anthropic.

Qualcomm Ventures Investments

739 Investments

Qualcomm Ventures has made 739 investments. Their latest investment was in Pokee AI as part of their Seed VC on June 10, 2025.

Qualcomm Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/10/2025 | Seed VC | Pokee AI | $12M | Yes | Abhay Parasnis, Lip-Bu Tan, Point72 Ventures, Salience Capital, Samsung NEXT, and SCB 10X | 3 |

5/28/2025 | Seed VC | Context | $11M | Yes | General Catalyst, Lux Capital, and Undisclosed Investors | 2 |

4/21/2025 | Unattributed VC | Pitch Deck | Yes | |||

4/16/2025 | Series C | |||||

4/8/2025 | Series A - II |

Date | 6/10/2025 | 5/28/2025 | 4/21/2025 | 4/16/2025 | 4/8/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Seed VC | Unattributed VC | Series C | Series A - II |

Company | Pokee AI | Context | Pitch Deck | ||

Amount | $12M | $11M | |||

New? | Yes | Yes | Yes | ||

Co-Investors | Abhay Parasnis, Lip-Bu Tan, Point72 Ventures, Salience Capital, Samsung NEXT, and SCB 10X | General Catalyst, Lux Capital, and Undisclosed Investors | |||

Sources | 3 | 2 |

Qualcomm Ventures Portfolio Exits

169 Portfolio Exits

Qualcomm Ventures has 169 portfolio exits. Their latest portfolio exit was COWIN on July 01, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/1/2025 | Acquired | 2 | |||

6/30/2025 | IPO | Public | 3 | ||

5/22/2025 | IPO | Public | 4 | ||

Qualcomm Ventures Fund History

7 Fund Histories

Qualcomm Ventures has 7 funds, including Qualcomm BNDES Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/13/2020 | Qualcomm BNDES Fund | $19.31M | 2 | ||

11/28/2018 | Qualcomm AI Fund | ||||

9/27/2015 | Qualcomm India Startup Fund | ||||

7/1/2015 | Qualcomm South Korea Startup Fund | ||||

1/11/2015 | Qualcomm Life |

Closing Date | 1/13/2020 | 11/28/2018 | 9/27/2015 | 7/1/2015 | 1/11/2015 |

|---|---|---|---|---|---|

Fund | Qualcomm BNDES Fund | Qualcomm AI Fund | Qualcomm India Startup Fund | Qualcomm South Korea Startup Fund | Qualcomm Life |

Fund Type | |||||

Status | |||||

Amount | $19.31M | ||||

Sources | 2 |

Qualcomm Ventures Partners & Customers

7 Partners and customers

Qualcomm Ventures has 7 strategic partners and customers. Qualcomm Ventures recently partnered with Arriver on January 1, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

1/5/2022 | Partner | United States | 1 | ||

1/4/2022 | Partner | ||||

3/23/2021 | Partner | ||||

2/4/2021 | Partner | ||||

1/9/2017 | Partner |

Date | 1/5/2022 | 1/4/2022 | 3/23/2021 | 2/4/2021 | 1/9/2017 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | ||||

News Snippet | |||||

Sources | 1 |

Qualcomm Ventures Team

13 Team Members

Qualcomm Ventures has 13 team members, including current Senior Vice President, Quinn Li.

Name | Work History | Title | Status |

|---|---|---|---|

Quinn Li | IBM, Broadcom, and Lucent Technologies | Senior Vice President | Current |

Name | Quinn Li | ||||

|---|---|---|---|---|---|

Work History | IBM, Broadcom, and Lucent Technologies | ||||

Title | Senior Vice President | ||||

Status | Current |

Compare Qualcomm Ventures to Competitors

Samsung Ventures is the venture investment arm of Samsung Group, focusing on technologies and industries through venture capital. The company invests in anticipatory technologies and industries to support the growth of a venture ecosystem. Samsung Ventures aims to contribute to society and the group. It was founded in 1999 and is based in Seoul, South Korea.

Intel Capital is a venture capital firm that invests in early-stage startups within the tech ecosystem, which includes Cloud, Devices, Frontier, and Silicon sectors. It was founded in 1991 and is based in Santa Clara, California.

Sony Innovation Fund operates as a venture capital initiative focused on investing in early-stage companies within the technology, content, and services sectors. The fund provides investment and access to Sony's global network, fostering business creation and innovation in various areas of interest to Sony, including entertainment, health, and emerging technologies. It primarily targets seed to Series B funding stages for consumer and enterprise-facing businesses. It was founded in 2016 and is based in Tokyo, Japan. Sony Innovation Fund operates as a subsidiary of Sony.

bp Ventures is the venturing arm of BP, focusing on technologies and founders within the energy sector. The company invests in startups to align with BP's strategy and sustainability goals. bp Ventures primarily invests in Series A and later stages of companies that propose ideas and technologies. It was founded in 2007 and is based in London, United Kingdom.

Google Ventures, also known as GV, operates as a venture capital firm investing in various sectors, including life sciences, consumer, enterprise, cryptocurrency, climate, and frontier technology. The firm provides financial backing and resources to startups and connects them with Google. It was founded in 2009 and is based in Mountain View, California. Google Ventures operates as a subsidiary of Google.

Dell Technologies Capital is focused on driving innovation and delivering results. The Ventures team invests in innovative early-stage companies, providing crucial business guidance and access to the power of the Dell Technologies brand and channel.

Loading...