Investments

518Portfolio Exits

110Funds

5Partners & Customers

10About Samsung Ventures

Samsung Ventures is the venture investment arm of Samsung Group, focusing on technologies and industries through venture capital. The company invests in anticipatory technologies and industries to support the growth of a venture ecosystem. Samsung Ventures aims to contribute to society and the group. It was founded in 1999 and is based in Seoul, South Korea.

Expert Collections containing Samsung Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Samsung Ventures in 2 Expert Collections, including AR/VR.

AR/VR

33 items

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Samsung Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

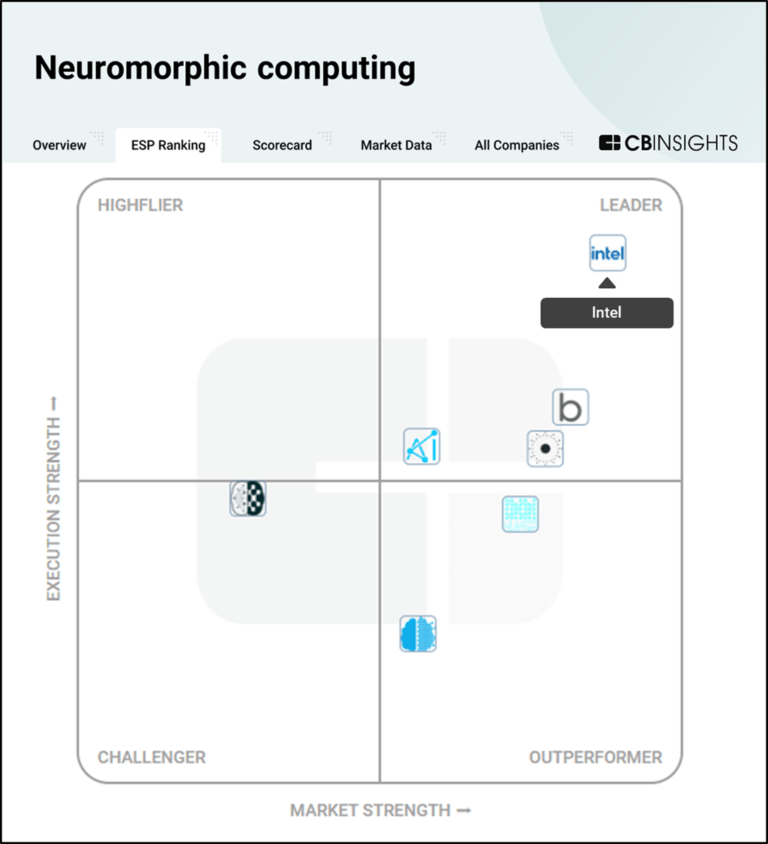

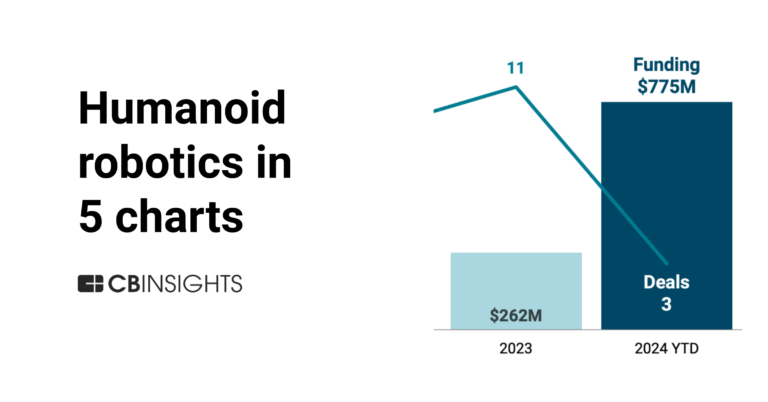

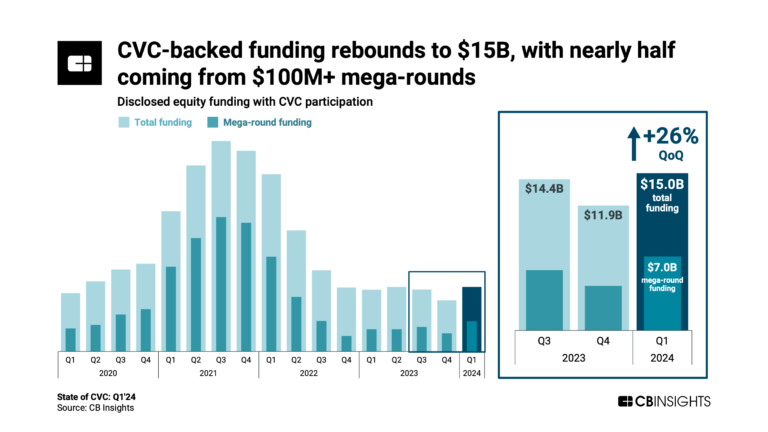

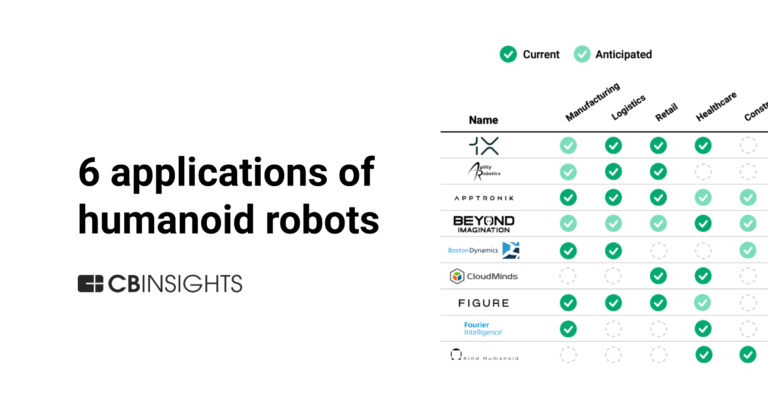

CB Insights Intelligence Analysts have mentioned Samsung Ventures in 4 CB Insights research briefs, most recently on Oct 9, 2024.

May 16, 2024 report

State of CVC Q1’24 Report

Mar 26, 2024

6 applications of humanoid robots across industriesLatest Samsung Ventures News

Aug 3, 2025

31일 투자은행(IB) 업계에 따르면, 진이어스는 최근 150억원 규모 시리즈B 라운드를 완료했다. 삼성벤처투자와 한국투자파트너스 PE본부, SV인베스트먼트-이스트벤처스, 인터레이스자산운용이 각각 구주와 신주를 섞어 총 150억원을 나눠 투자했다. 구주의 경우 진이어스가 보유하고 있는 자사주 일부를 사들이는 형태로 거래가 이뤄졌다. 투자금 150억원 전액 회사에 신규 유입된 셈이다. 시리즈B 라운드 이전 기준 진이어스가 보유한 자사주는 56만9995주로, 지분율만 28.61%에 달한다. 최대주주인 김민경 대표의 지분율도 37.05%로 높다. 이런 이유로 딜클로징 후에도 최대주주 변동은 없는 상황이다. 시리즈B 라운드의 주요 투자자는 한국투자파트너스 PE본부다. 100억원대 초반가량 베팅하며 가장 많은 자금을 책임졌다. 이밖에 삼성벤처투자와 SV인베스트먼트-이스트벤처스, 인터레이스자산운용이 각각 수십억원씩 베팅했다. 투자자들 모두 이번 주 초 자금 납입을 끝냈다. 투자금은 해외 진출에 쓰인다. 진이어스는 인도네시아와 싱가포르를 시작으로 유럽과 미국 진출을 동시 추진하고 있다. 첫 진출지는 인도네시아와 싱가포르다. 현재 해외 자회사 형태로 법인 설립을 마쳤다. 일찍이 현지 피부미용의원 개업을 위한 부지 확보와 착공을 완료했으며, 준공을 목전에 뒀다. 인도네시아와 싱가포르 의원 모두 9월 말 개업할 예정이다. 인도네시아와 싱가포르를 시험대로 삼아 노하우를 축적한 뒤 유럽과 미국으로 발을 넓히겠다는 청사진이다. 인도네시아의 경우 투자자인 SV인베스트먼트-이스트벤처스와의 협업을 통해 현지 시장에 빠르게 자리를 잡겠다는 전략이다. 이스트벤처스는 인도네시아 대형 벤처캐피탈(VC)로 현지 네트워크가 탄탄하고, SV인베스트먼트도 활발한 동남아시아 투자 경험을 보유했다. 이들을 파트너로 확보하면서 사업 안정성과 네트워크 역량을 끌어올렸다는 평가다. < 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

Samsung Ventures Investments

518 Investments

Samsung Ventures has made 518 investments. Their latest investment was in CuspAI as part of their Series A on September 10, 2025.

Samsung Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/10/2025 | Series A | CuspAI | $100M | Yes | Durk Kingma, Hyundai Motor Company, New Enterprise Associates, NVentures, Prosus Ventures, Temasek, Thomas Wolf, Undisclosed Angel Investors, Undisclosed Venture Investors, and Zoubin Ghahramani | 4 |

8/20/2025 | Series A | FieldAI | $314M | Yes | Bezos Expeditions, BHP Ventures, Canaan Partners, Emerson Collective, Gates Frontier, Intel Capital, Khosla Ventures, NVentures, Prysm Capital, Temasek, and Undisclosed Investors | 3 |

7/28/2025 | Series C | Rebellions | $10.11M | Yes | 2 | |

7/28/2025 | Series B | |||||

7/17/2025 | Series B - II |

Date | 9/10/2025 | 8/20/2025 | 7/28/2025 | 7/28/2025 | 7/17/2025 |

|---|---|---|---|---|---|

Round | Series A | Series A | Series C | Series B | Series B - II |

Company | CuspAI | FieldAI | Rebellions | ||

Amount | $100M | $314M | $10.11M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Durk Kingma, Hyundai Motor Company, New Enterprise Associates, NVentures, Prosus Ventures, Temasek, Thomas Wolf, Undisclosed Angel Investors, Undisclosed Venture Investors, and Zoubin Ghahramani | Bezos Expeditions, BHP Ventures, Canaan Partners, Emerson Collective, Gates Frontier, Intel Capital, Khosla Ventures, NVentures, Prysm Capital, Temasek, and Undisclosed Investors | |||

Sources | 4 | 3 | 2 |

Samsung Ventures Portfolio Exits

110 Portfolio Exits

Samsung Ventures has 110 portfolio exits. Their latest portfolio exit was Powin on August 06, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/6/2025 | Asset Sale | 4 | |||

6/5/2025 | Acquired | 3 | |||

3/17/2025 | Acquired | 2 | |||

Samsung Ventures Fund History

5 Fund Histories

Samsung Ventures has 5 funds, including Automotive Innovation Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

9/14/2017 | Automotive Innovation Fund | $300M | 1 | ||

5/29/2014 | Samsung Wearable Health Fund | ||||

2/4/2013 | Samsung Catalyst Fund | ||||

Samsung Life Science Fund | |||||

Samsung Life Science Fund II |

Closing Date | 9/14/2017 | 5/29/2014 | 2/4/2013 | ||

|---|---|---|---|---|---|

Fund | Automotive Innovation Fund | Samsung Wearable Health Fund | Samsung Catalyst Fund | Samsung Life Science Fund | Samsung Life Science Fund II |

Fund Type | |||||

Status | |||||

Amount | $300M | ||||

Sources | 1 |

Samsung Ventures Partners & Customers

10 Partners and customers

Samsung Ventures has 10 strategic partners and customers. Samsung Ventures recently partnered with Carbon Clean, and Saudi Aramco on December 12, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

12/5/2024 | Partner | Carbon Clean, and Saudi Aramco | United Kingdom, and Saudi Arabia | Aramco, Carbon Clean, Samsung partner on carbon capture tech Aramco has signed a collaboration agreement with Carbon Clean and Samsung E&A to demonstrate a new carbon capture technology . | 2 |

3/6/2019 | Partner | China | DeepMotion launches digital avatars for Samsung’s Galaxy S10 smartphones `` Body language is a key part of human social interaction , and our partnership with Samsung Ventures empowers Galaxy S10 owners to use their natural body movements to express themselves through emojis , '' said Kevin He , CEO of DeepMotion , in a statement . | 1 | |

1/6/2014 | Partner | United States | Bitcasa and Samsung Partner to Bring More Storage and Usability to Tablet Devices `` Our partnership gives Samsung and TabPRO users frustration-free storage and makes their digital belongings infinitely useful . | 2 | |

Partner | |||||

Partner |

Date | 12/5/2024 | 3/6/2019 | 1/6/2014 | ||

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | Carbon Clean, and Saudi Aramco | ||||

Country | United Kingdom, and Saudi Arabia | China | United States | ||

News Snippet | Aramco, Carbon Clean, Samsung partner on carbon capture tech Aramco has signed a collaboration agreement with Carbon Clean and Samsung E&A to demonstrate a new carbon capture technology . | DeepMotion launches digital avatars for Samsung’s Galaxy S10 smartphones `` Body language is a key part of human social interaction , and our partnership with Samsung Ventures empowers Galaxy S10 owners to use their natural body movements to express themselves through emojis , '' said Kevin He , CEO of DeepMotion , in a statement . | Bitcasa and Samsung Partner to Bring More Storage and Usability to Tablet Devices `` Our partnership gives Samsung and TabPRO users frustration-free storage and makes their digital belongings infinitely useful . | ||

Sources | 2 | 1 | 2 |

Samsung Ventures Team

14 Team Members

Samsung Ventures has 14 team members, including current Chief Executive Officer, President, Youngjoon Choi.

Name | Work History | Title | Status |

|---|---|---|---|

Youngjoon Choi | Chief Executive Officer, President | Current | |

Name | Youngjoon Choi | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Executive Officer, President | ||||

Status | Current |

Compare Samsung Ventures to Competitors

Intel Capital is a venture capital firm that invests in early-stage startups within the tech ecosystem, which includes Cloud, Devices, Frontier, and Silicon sectors. It was founded in 1991 and is based in Santa Clara, California.

AON Investment is a venture capital firm with a specialized focus on company building within various industry sectors. The company's main service is providing financial investment to startups and emerging companies. It was founded in 2021 and is based in Seoul, South Korea.

SBVA is a venture capital firm focused on empowering entrepreneurs and fostering innovation in the technology sector. It provides funding and support to early-stage startups, leveraging its partnership with The Edgeof to build a global startup ecosystem. It primarily sells to the technology and startup industries. It was formerly known as Softbank Ventures Asia and changed its name to SBVA in January 2024. It was founded in 2000 and is based in Seoul, South Korea.

Korea Investment Partners focuses on venture capital and private equity within the financial services industry. The company manages investment funds, providing capital to startups and managing the lifecycle of these funds, including liquidation. It primarily serves the startup ecosystem and financial market sectors. It was founded in 1986 and is based in Seoul, South Korea. Korea Investment Partners operates as a subsidiary of Korea Investment Holdings.

BMW i Ventures operates as a venture capital firm focused on investing in high-performance companies within the hardware, software, and sustainability sectors. The firm provides capital, strategic partnerships, and access to an ecosystem of specialists to support startups in the manufacturing, transportation, and service industries. BMW i Ventures primarily invests in companies that offer solutions such as automated forklift technology, electric vehicle charging management software, cloud manufacturing platforms, and advanced electric motor technology. It was founded in 2011 and is based in Mountain View, California.

Sierra Ventures is a venture capital firm. It invests in artificial intelligence, machine learning, big data, cloud, financial technology, education technology, health technology, commerce, Internet of Things sector. Sierra Ventures was founded in 1982 and is based in San Mateo, California.

Loading...