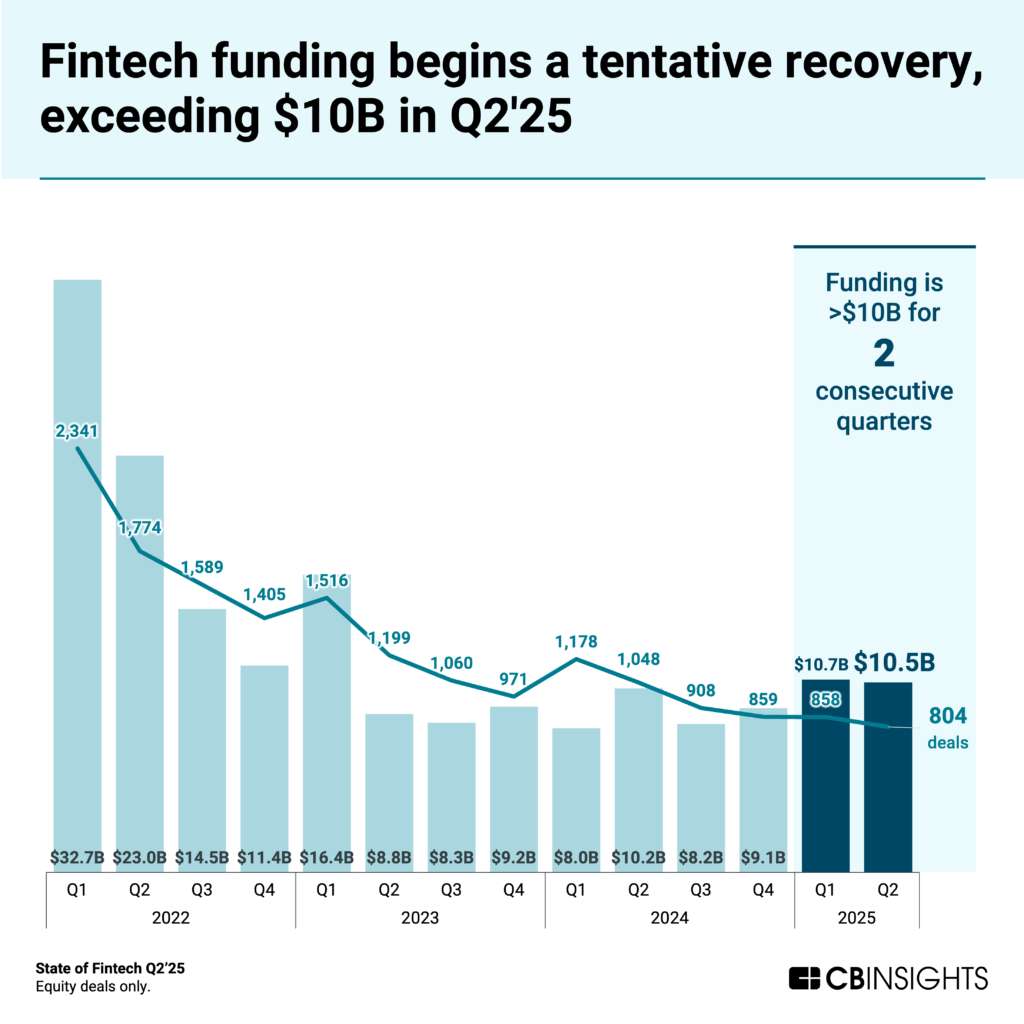

Fintech funding remained steady in Q2’25 at $10.5B, marking 2 consecutive quarters above $10B for the first time since early 2023. While the sector is recovering, funding remains below 2022 levels.

Dealmaking fell this quarter by 7% to 804, as mega-rounds drove a substantial share (40%) of funding, and median deal size increased from $4M to $5M.

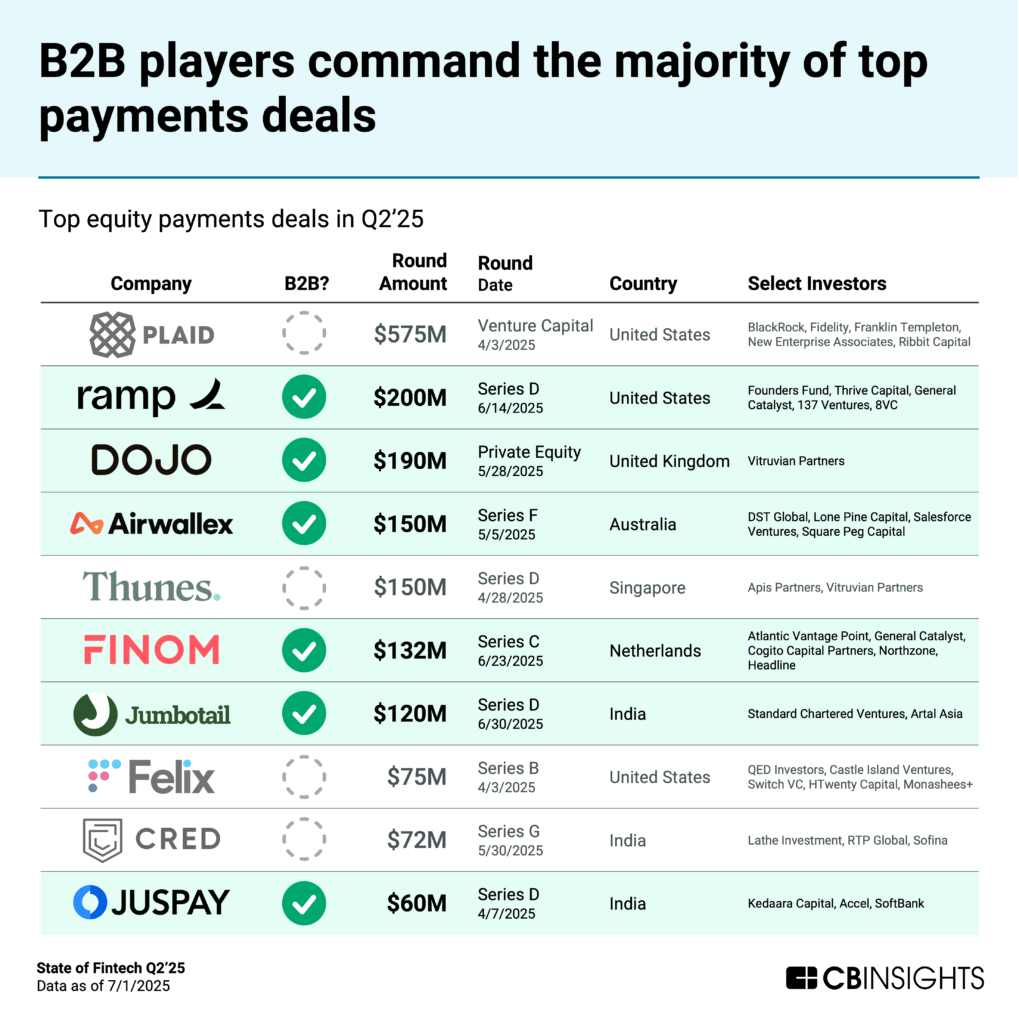

This quarter, the largest deal was Plaid‘s $575M round, reflecting rising demand for embedded finance and solutions that serve multiple fintech segments.

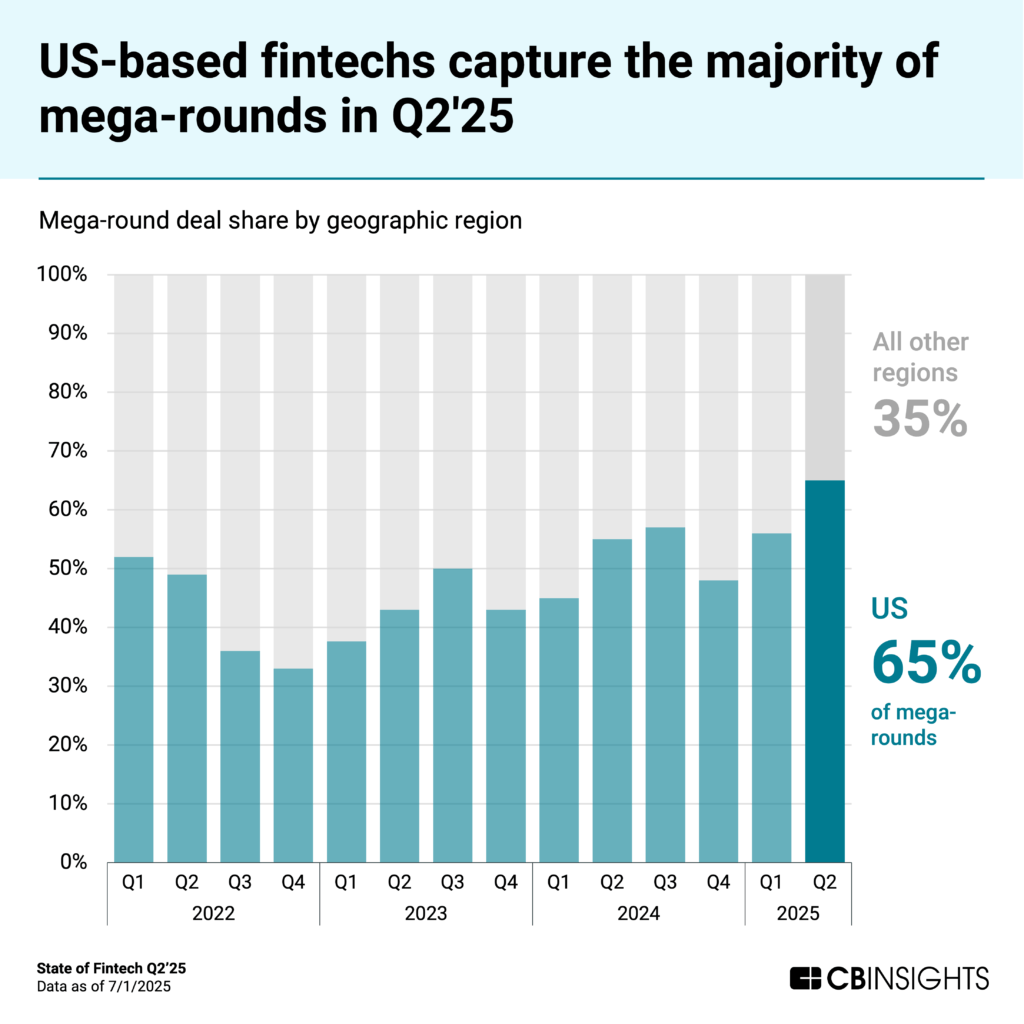

Mega-round activity was heavily concentrated in the US, which claimed a record 65% share of mega-round deals.

Digital assets saw momentum on the exit front, highlighted by Circle’s IPO and two of the largest M&A deals involving blockchain companies: Coinbase’s acquisition of Deribit ($2.9B) and Stripe’s acquisition of Privy (undisclosed).

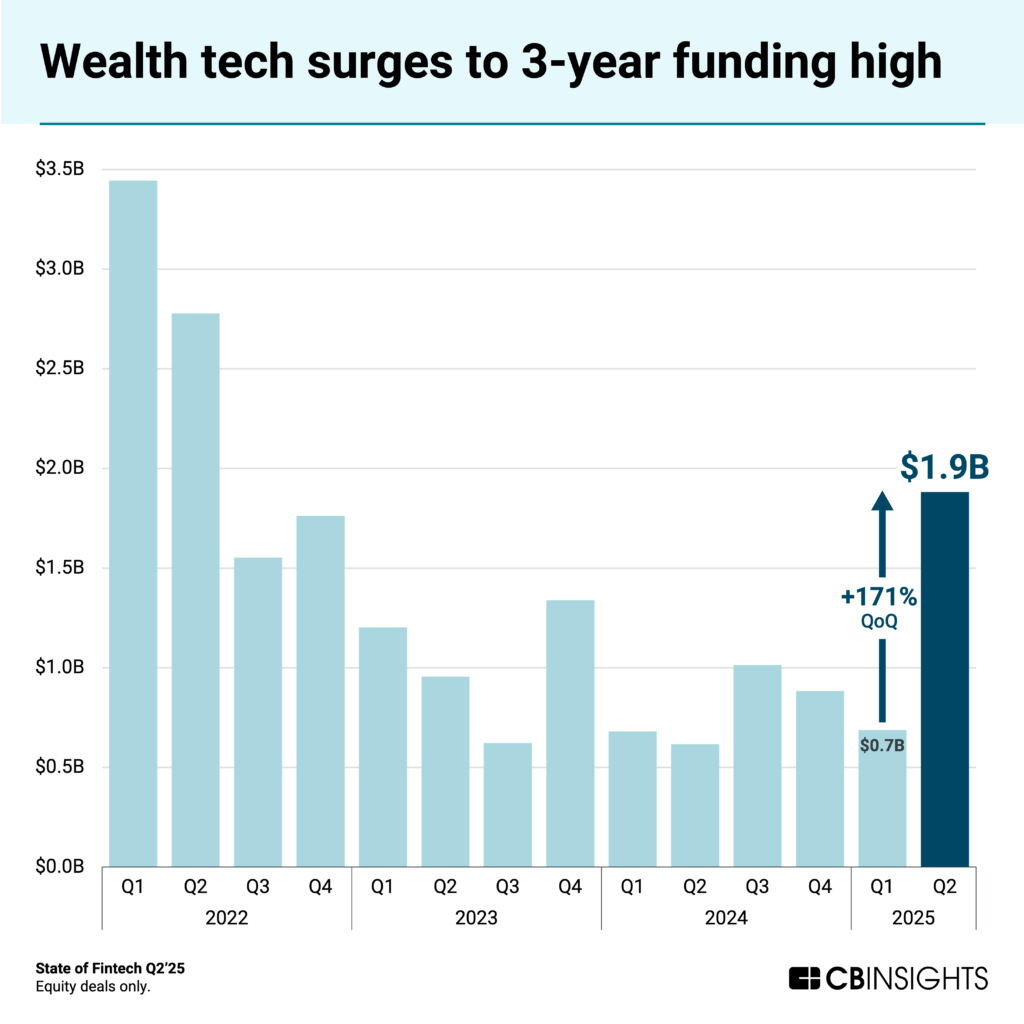

Wealth tech and B2B fintech stood out as higher-momentum segments in Q2, with wealth tech funding seeing a dramatic uptick (up 171% QoQ to reach $1.9B), while B2B fintechs attracted several of the largest banking and payments equity rounds this quarter.

Download the full report to access comprehensive data and charts on the evolving state of fintech.

Key takeaways from the report include:

- Fintech sector recovery continues with 2 consecutive $10B quarters, which hasn’t happened since early 2023. This quarter’s largest investment went to fintech infrastructure leader Plaid at $575M. Despite these recent highs, funding remains well below 2022 levels.

- US-based fintechs command record share of global investment. The US achieved unprecedented dominance in Q2’25, capturing 65% of mega-rounds and 43% of all deals, both all-time highs. The US also captured 71% of mega-round funding and 60% of total fintech investment, reflecting a clear investor preference for US-based fintech opportunities.

- B2B fintech attracts the majority of large deals. B2B fintech companies brought in 60% of the largest payments investments and 50% of the largest banking rounds in Q2’25, led by Ramp‘s $200M Series D and Dojo‘s $190M private equity round. The pattern signals a growing appetite for business-facing fintech platforms over consumer-oriented applications.

- Digital wealth management is seeing a dramatic funding revival. Q2’25 marked a turning point for wealth tech with $1.9B in funding — nearly triple the Q1 number of $0.7B and the sector’s strongest performance in 3 years. Large deals like Addepar‘s $230M Series G round and Groww‘s $200M Series F drove both average and median deal sizes higher

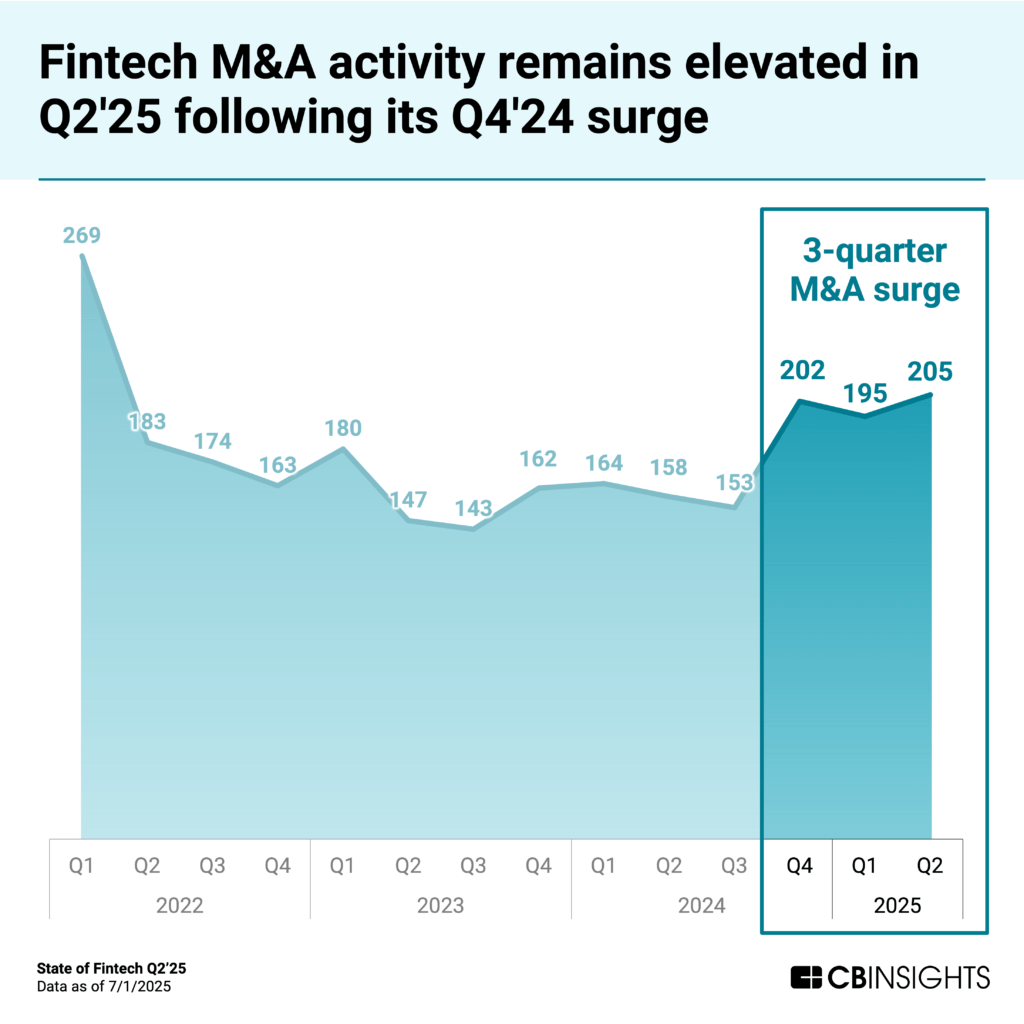

- Fintech M&A activity remains elevated. Fintech M&A deals rose to 205 in Q2’25, following a significant increase in Q4’24. Digital assets continue to drive exit activity, with Circle going public at a $6.9B valuation in June, Stripe’s acquisition of Privy, and Coinbase’s $2.9B acquisition of Deribit.

We dive into the trends below.

Fintech sector shows signs of recovery with two consecutive $10B quarters

For the first time since early 2023, fintech funding has exceeded $10B for 2 consecutive quarters.

Although Binance‘s $2B round propped up Q1’25, both Q1 and Q2 received 40% of total funding dollars from mega-rounds. Funding increased in most fintech subsectors in Q2, including capital markets, digital banking, digital lending, payments, and wealth tech. Notably the proportion of early-stage deals decreased across all sectors but one (digital lending) in 2025 YTD, indicating that investors are selectively funding mature companies across the fintech ecosystem.

The quarter’s largest investment went to fintech infrastructure leader Plaid, which raised $575M. New investors BlackRock, Fidelity, and Franklin Templeton led the round, which also included the company’s existing investors New Enterprise Associates and Ribbit Capital.

While Plaid’s latest valuation of $6.1B declined by half since its Series D round in 2021, this reflects a broader correction in tech valuations. In fact, Plaid’s fundamentals remain strong with 18% headcount growth over the last 12 months and 25% revenue growth in 2024. Plaid also reported that with an increase in the number of companies and markets it serves, now more than 1 in 2 Americans have used its products.

The second- and third-largest rounds of this quarter went to payroll fintech Rippling and Addepar, which is building investment portfolio management software. Late-stage deals across digital banking, capital markets, payments, and wealth tech also increased in Q2, suggesting current investment conditions favor established fintechs with proven business models.

US-based fintechs command record share of global investment

The US achieved unprecedented dominance across a variety of metrics in Q2’25, reflecting increased momentum for US-based fintechs.

US-based companies captured 65% of mega-rounds in Q2’25 — the highest share on record. US fintechs also secured 71% of all mega-round funding.

This geographic concentration extended beyond mega-rounds: US-based fintechs received 60% of total fintech investment dollars and 43% of all deals, with the latter representing another all-time high. Meanwhile, median and average deal size have both risen this quarter, and the proportion of early stage deals has dropped in 2025 YTD from 72% to 66%. Investors are focused on mid-to-late-stage, US-based fintechs, which benefit from a mature market and established financial infrastructure that facilitates scaling.

Mid-year 2025, stabilizing interest rates and improved market conditions accompany institutional appetite for later-stage fintech investments. Yet fintech lags behind other sectors in the broader market recovery. Quarterly venture funding has rebounded to over $90B each over the last 3 quarters (heights not seen since 2022) while the increase in 2025 fintech funding remains modest. The US offers compelling advantages for risk-conscious investors, including mature fintechs with proven business models and a large addressable market for end consumers and businesses.

B2B fintech solutions attract the majority of large deals

B2B fintech companies dominated in Q2’25, capturing 60% of the top 10 equity payments investments and 50% of the top 10 equity banking rounds.

This dominance signals a clear trend: businesses are increasingly hungry for digital-first financial tools that can streamline their operations, from automated spend management and corporate credit cards to comprehensive business banking platforms.

Major B2B deals included spend management leader Ramp’s $200M Series D at a record $16B valuation, payments platform Dojo’s $190M private equity round from Vitruvian Partners, and business banking provider Airwallex’s $150M Series F. Finom, which provides digital business banking for SMBs, obtained a $132M Series C round.

B2B-focused fintechs companies are rapidly scaling to meet demand — Ramp nearly doubled its headcount over the past 12 months, while its competitor Mercury more than doubled its valuation at the end of March in a $300M Series C round. Ramp launched treasury offerings in 2025, while Mercury Treasury recently upgraded with same-day liquidity. The introduction of new enterprise features, combined with funding rounds, headcount, and valuation increases, signals that these mid-to-late stage companies are expanding aggressively to capture B2B market share amid ample competition.

This shift towards B2B solutions suggests that the need for businesses to digitize their financial operations will drive fintech’s next growth phase, with investors betting on the larger deal sizes and stickier revenue models that business clients provide. Meanwhile, businesses accelerating digital transformation initiatives post-pandemic have created a large addressable market for financial software solutions that can demonstrate clear ROI through operational efficiency gains.

Digital wealth management sees dramatic funding revival

Q2’25 marked a turning point for wealth tech, with the subsector raising $1.9B in funding, nearly triple the previous quarter’s total and the highest level since Q2’22. A handful of mega-rounds drove the increase, as deal count remained on par with last quarter.

Notable deals included late-stage equity rounds to portfolio management platform Addepar ($230M), investment app Groww ($200M), digital broker Scalable Capital ($177M), RIA (registered investment advisor) platform Altruist ($152M), and personal finance toolkit Stash ($146M). These deals drove both average and median deal sizes higher across the sector.

Investors are gravitating toward wealth tech as AI unlocks new efficiencies in portfolio management, making investment services more scalable, cost-effective, and accessible to a broader market. Last month, Altruist acquired AI assistant Thyme to better serve financial advisors. Stash has earmarked their $146M round to support AI capabilities, including its consumer financial advice platform Money Coach AI. Addepar acquired AI workflow platform Arcus in May. Among the top 10 wealth tech companies by Mosaic, our proprietary startup health score, half have rolled out AI tools, earmarked new funding for AI capabilities, or made AI-related acquisitions in 2025 YTD.

M&A activity remains elevated

Fintech M&A deals rose to 205 in Q2’25, following a significant increase in Q4’24.

Notably, two of the most prominent M&A deals this quarter went to blockchain companies. The second largest fintech acquisition in Q2’25 was Coinbase’s $2.9B acquisition of crypto derivatives exchange Deribit. Meanwhile, Stripe acquired Privy, which provides white-label crypto wallet infrastructure, for an undisclosed sum in June. This follows its Q4’24 purchase of stablecoin company Bridge for $1.1B.

Major stablecoin issuer Circle went public in June at a $6.9B valuation, its stock quickly skyrocketing in value.

Other important exits this quarter involved neobanks and B2B tech, which have enjoyed momentum in 2025 to date:

The largest IPO in Q2’25 was neobank Chime at a $9.8B valuation based on outstanding shares. Like Plaid, Chime’s valuation represented a significant decrease from its high of $25B in 2021, attributable to broader market correction.

Xero’s $3B acquisition of accounts payable and receivable solution Melio was the largest of the quarter, tying into the surge in B2B interest.