Investments

276Portfolio Exits

39Funds

7Partners & Customers

1About Point Nine Capital

Point Nine Capital is an early-stage venture capital firm that focuses on investments in Internet companies, particularly SaaS (Software as a Service), e-commerce, marketplaces, and lead generation. The firm was founded in 2008 and is based in Berlin, Germany.

Expert Collections containing Point Nine Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Point Nine Capital in 1 Expert Collection, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Research containing Point Nine Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Point Nine Capital in 1 CB Insights research brief, most recently on Aug 7, 2025.

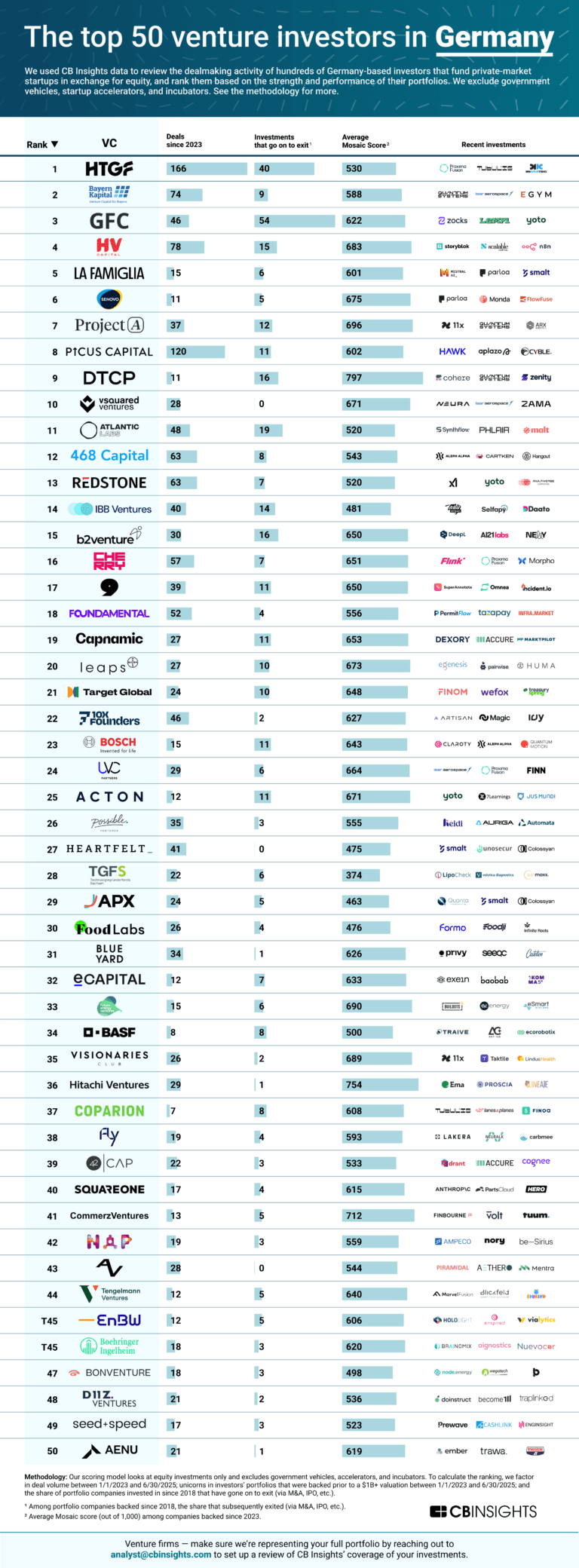

Aug 7, 2025

The top 50 venture investors in GermanyLatest Point Nine Capital News

Aug 27, 2025

As investor focus shifts from speculative valuations to proven performance, this new measure of success reflects a wider shift across fast-growth tech companies towards sustainable growth and financial discipline. As more companies stay private for longer, the focus is on driving economic prosperity through improved productivity, job creation, and tax contributions. Thoroughbreds 100 EMEA by numbers: The Thoroughbreds 100 EMEA represent the companies with the most momentum in 2025, out of over 700 Thoroughbreds across EMEA, with 38 created in the last two years alone. Thoroughbreds now account for 27% of EMEA’s $5.6 trillion tech ecosystem. As companies reaching $100 million in annual revenue become the benchmark of progress, Dealroom has published its annual Power Law Investor Ranking for EMEA, with Phoenix Court, home of LocalGlobe, Latitude and Solar, topping the list. The ranking now includes Thoroughbreds ($100m+ revenues) and Colts ($25-100m revenues) alongside Unicorns. Investors are ranked by the number of high-growth companies in their portfolios, with additional weight for those backing them earliest at Seed and Series A, when data is scarce and risk is highest. Phoenix Court is recognised as the region’s #1 investor in Thoroughbreds, Colts, and Unicorns for consistently backing high-revenue tech companies from Seed stage and in the top 0.01% of funds globally. Index Ventures secured second overall, while Point Nine, the Germany-based Seed investor, achieved third position. Phoenix Court and Index Ventures are the only European funds in the global top 20, led by Y Combinator and Sequoia. Yoram Wijngaarde, Founder and CEO of Dealroom, said: “Venture has long been measured by promise, but performance comes from proof. That’s why our 2025 ranking includes a focus on Thoroughbreds: companies generating $100m+ in ARR, rooted in strong customer demand and lasting value. These aren’t speculative bets; they’re regional assets. By prioritising tangible impact and sustainable growth, we offer unprecedented clarity for founders, LPs, and policymakers on where resilience lies and the investors that are truly bending the curve. Europe is no longer merely emerging; it is a demonstrable engine room for national, regional, and global champions." Saul Klein, Co-Founder and Executive Chair at Phoenix Court, said: "For over a decade, venture capital has been gripped by unicorns. But the real test of a company is not valuation, but fundamentals. The definition of success has changed. Europe has the raw ingredients to create the companies that matter, and it's encouraging to see 38 new Thoroughbreds created in the past two years. The challenge is not building them, but scaling them. As we mark ten years since founding Phoenix Court, we’ve seen what it takes to back long-term winners from the earliest stages via LocalGlobe through to our later stage funds Latitude and Solar. What’s needed now in Europe is the long-term conviction at growth – so that the value created here stays here and compounds for the next generation.” Within EMEA, the ‘New Palo Alto region – an interconnected network of innovation ecosystems within a five-hour train ride of London (including London, Paris, Amsterdam and Brussels) is the most productive region for Thoroughbreds in EMEA, home to over 250 Thoroughbreds and nearly 800 Colts, underlining its position as the world's second most productive innovation cluster, surpassed only by the Bay Area. Seven of Europe's 10 most valuable tech companies founded after 1990 originated from this ecosystem, including Booking.com, ASML, Adyen, Arm, Revolut, Tide, Wise, and Monzo. Despite this robust growth, the EMEA region faces an estimated $57 billion scaleup funding gap according to Dealroom, compared to the Bay Area. While Europe consistently nurtures innovative companies, long-term value creation could be significantly accelerated with a more plentiful supply of local capital at later growth stages. This represents a substantial, largely unaddressed investment opportunity for asset allocators and institutional investors, with nearly 2,000 venture-backed companies in EMEA now generating revenues of $25 million or more. For more startup news, check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem.

Point Nine Capital Investments

276 Investments

Point Nine Capital has made 276 investments. Their latest investment was in Attio as part of their Series B - II on August 26, 2025.

Point Nine Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

8/26/2025 | Series B - II | Attio | $19M | No | 3 | |

5/20/2025 | Series A | sensmore | $7.3M | Yes | Acequia Capital, Alexey Zhigarev, Amar Shah, Arnoud Balhuizen, Brandenburg Ministry of Economics, Elmar Leiblein, Entrepreneur First, European Union, Michael Wax, Prototype Capital, Robin Dechant, Roby Stancel, Thilo Konzok, tiny.vc, and Undisclosed Investors | 3 |

4/23/2025 | Seed VC | Draxon | Yes | 2 | ||

4/10/2025 | Series B | |||||

3/20/2025 | Seed VC - III |

Date | 8/26/2025 | 5/20/2025 | 4/23/2025 | 4/10/2025 | 3/20/2025 |

|---|---|---|---|---|---|

Round | Series B - II | Series A | Seed VC | Series B | Seed VC - III |

Company | Attio | sensmore | Draxon | ||

Amount | $19M | $7.3M | |||

New? | No | Yes | Yes | ||

Co-Investors | Acequia Capital, Alexey Zhigarev, Amar Shah, Arnoud Balhuizen, Brandenburg Ministry of Economics, Elmar Leiblein, Entrepreneur First, European Union, Michael Wax, Prototype Capital, Robin Dechant, Roby Stancel, Thilo Konzok, tiny.vc, and Undisclosed Investors | ||||

Sources | 3 | 3 | 2 |

Point Nine Capital Portfolio Exits

39 Portfolio Exits

Point Nine Capital has 39 portfolio exits. Their latest portfolio exit was Eversports on October 01, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/1/2024 | Acq - Fin | 3 | |||

3/19/2024 | Acquired | 2 | |||

3/5/2024 | Acquired | 3 | |||

Point Nine Capital Fund History

7 Fund Histories

Point Nine Capital has 7 funds, including Point Nine Capital Fund VI.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

9/26/2022 | Point Nine Capital Fund VI | $172.91M | 1 | ||

9/22/2020 | P9 V | ||||

12/3/2019 | Point Nine Capital Fund IV | ||||

12/3/2019 | Point Nine Capital Fund II | ||||

7/6/2016 | Point Nine Annex |

Closing Date | 9/26/2022 | 9/22/2020 | 12/3/2019 | 12/3/2019 | 7/6/2016 |

|---|---|---|---|---|---|

Fund | Point Nine Capital Fund VI | P9 V | Point Nine Capital Fund IV | Point Nine Capital Fund II | Point Nine Annex |

Fund Type | |||||

Status | |||||

Amount | $172.91M | ||||

Sources | 1 |

Point Nine Capital Partners & Customers

1 Partners and customers

Point Nine Capital has 1 strategic partners and customers. Point Nine Capital recently partnered with b.fine on May 5, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/25/2022 | Client | Belgium | 2 |

Date | 5/25/2022 |

|---|---|

Type | Client |

Business Partner | |

Country | Belgium |

News Snippet | |

Sources | 2 |

Point Nine Capital Team

3 Team Members

Point Nine Capital has 3 team members, including current Founder, Managing Partner, Christoph Janz.

Name | Work History | Title | Status |

|---|---|---|---|

Christoph Janz | Founder, Managing Partner | Current | |

Name | Christoph Janz | ||

|---|---|---|---|

Work History | |||

Title | Founder, Managing Partner | ||

Status | Current |

Compare Point Nine Capital to Competitors

BayBG Venture Capital is a private investment company that operates in the venture capital market. The company primarily provides equity investments and venture debt to mature startups that are close to breaking even. Its main customers are innovative post-revenue startups. It was founded in 1972 and is based in Munich, Germany.

1Pitch operates in the technology sector, with a focus on providing a platform for startups. The company offers an application that allows startups to create and share short video pitches, aiming to increase their visibility and attract potential stakeholders. Its primary customers are startups across various industries. It was founded in 2022 and is based in München, Germany.

InReach Ventures is a software-powered investment firm that is focused on early stage European companies.

FLEX Capital is a private equity firm that specializes in growth and buy-out opportunities in German internet and software companies. It focuses on majority stakes in medium-sized companies. The company was founded in 2018 and is based in Berlin, Germany.

Startupnight is an event that focuses on showcasing startups and facilitating interactions within the startup ecosystem, primarily in the technology and innovation sectors. The event offers a platform for startups to present themselves to corporates, investors, and potential customers, featuring various topics such as AI, energy, health, and mixed reality. Startupnight serves as a hub for interest-based matchmaking between startups, large companies, and investors, supporting the growth and visibility of new ventures. It was founded in 2012 and is based in Waltrop, Germany.

Institutional Venture Partners focuses on supporting growth for technology companies across various sectors. The company offers venture capital investment to improve the market presence of its portfolio companies. It invests in sectors such as artificial intelligence (AI), consumer, health, enterprise infrastructure, fintech, crypto, gaming, software-as-a-service (SaaS), and security. It was founded in 1980 and is based in Menlo Park, California.

Loading...