NVIDIA

Founded Year

1993Stage

PIPE - III | IPOTotal Raised

$12.6MMarket Cap

4317.45BStock Price

177.33Revenue

$0000About NVIDIA

NVIDIA operates in accelerated computing, focusing on artificial intelligence, high-performance computing, and graphics processing. The company provides products including graphics processing units (GPUs), AI platforms, and data center infrastructure for various applications. NVIDIA's solutions serve sectors such as gaming, creative design, autonomous vehicles, robotics, and edge computing. It was founded in 1993 and is based in Santa Clara, California.

Loading...

Loading...

Research containing NVIDIA

Get data-driven expert analysis from the CB Insights Intelligence Unit.

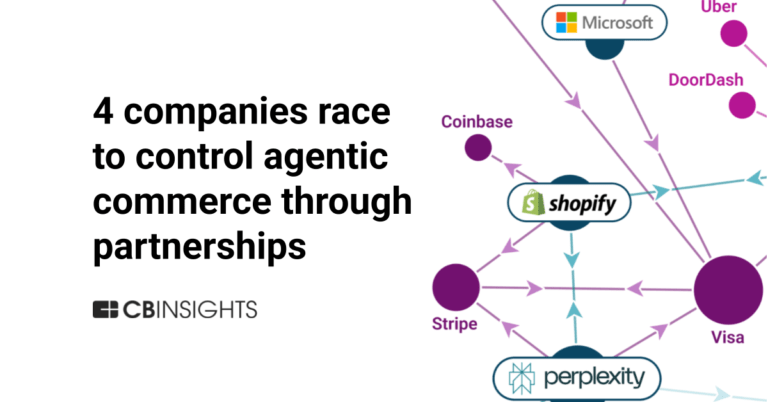

CB Insights Intelligence Analysts have mentioned NVIDIA in 75 CB Insights research briefs, most recently on Sep 11, 2025.

Sep 11, 2025

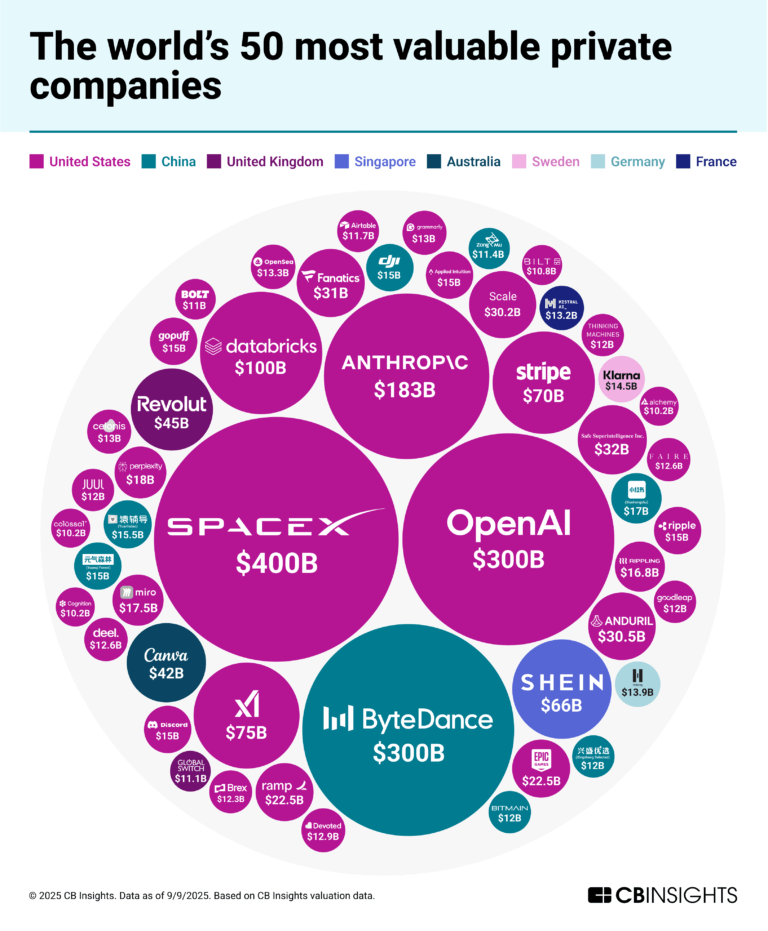

The world’s 50 most valuable private companies

Aug 26, 2025 report

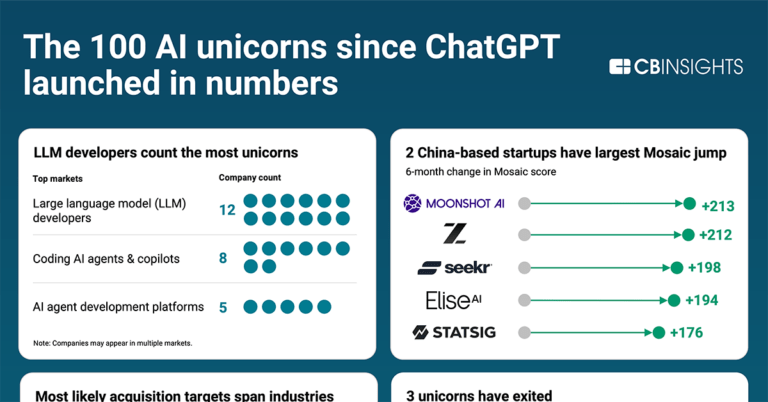

All 100 AI unicorns since ChatGPT launched

Aug 14, 2025

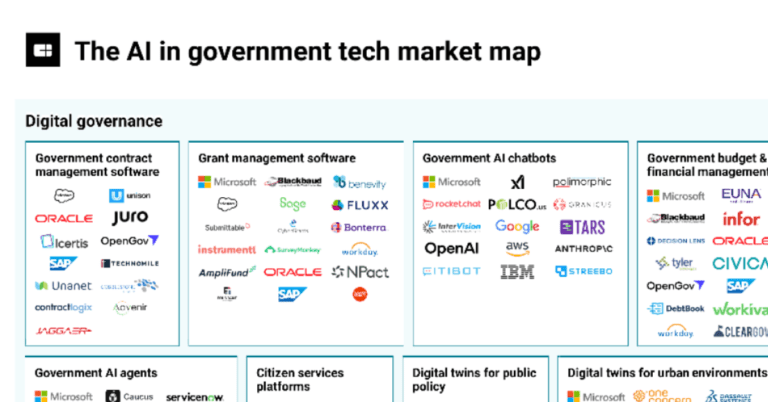

310+ AI companies transforming government

Aug 7, 2025

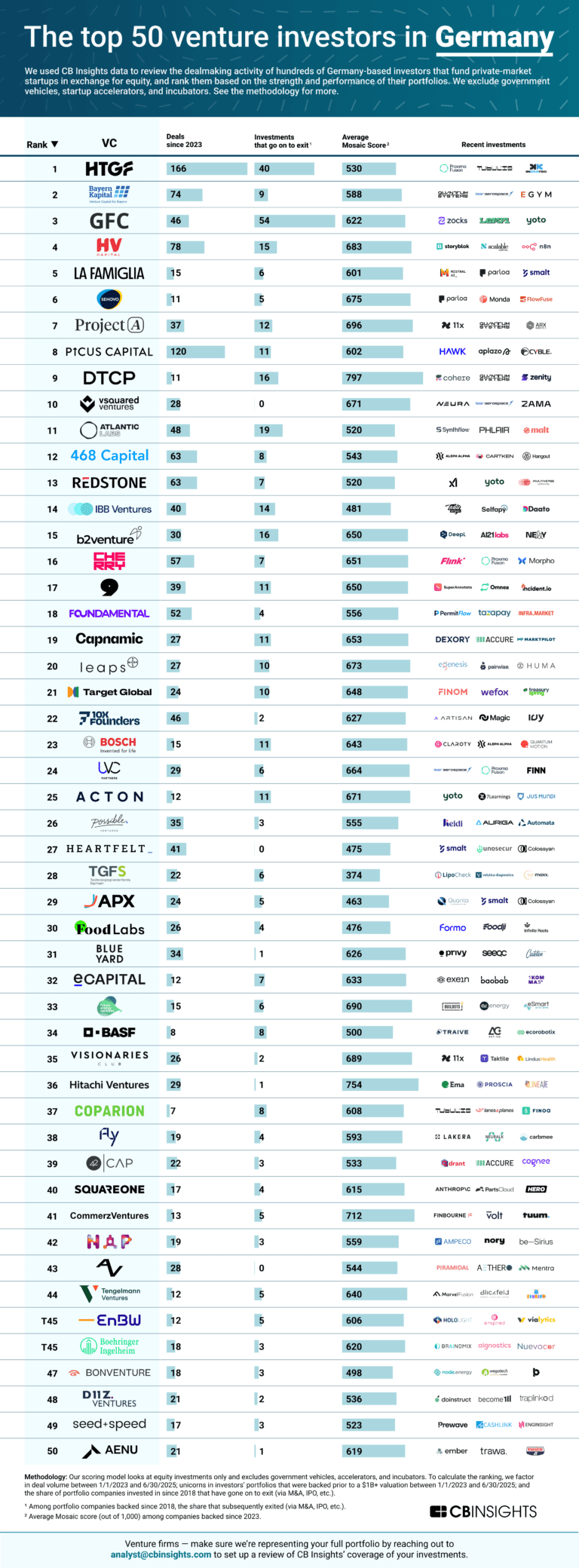

The top 50 venture investors in Germany

Jul 31, 2025 report

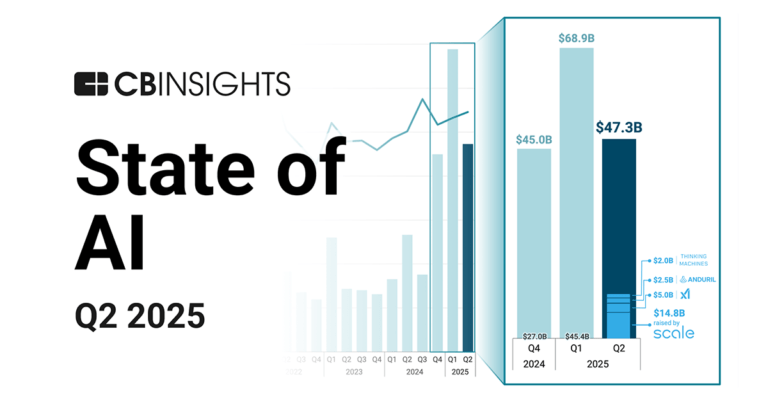

State of AI Q2’25 ReportExpert Collections containing NVIDIA

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

NVIDIA is included in 10 Expert Collections, including Auto Tech.

Auto Tech

2,188 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Conference Exhibitors

6,062 items

Companies that will be exhibiting at CES 2018

Gaming

5,683 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Semiconductors, Chips, and Advanced Electronics

7,431 items

Companies in the semiconductors & HPC space, including integrated device manufacturers (IDMs), fabless firms, semiconductor production equipment manufacturers, electronic design automation (EDA), advanced semiconductor material companies, and more

Advanced Manufacturing

3,928 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

NVIDIA Patents

NVIDIA has filed 6552 patents.

The 3 most popular patent topics include:

- artificial neural networks

- artificial intelligence

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/9/2020 | 4/8/2025 | Wireless networking, Radio electronics, Communication circuits, UMTS (telecommunication), Receiver (radio) | Grant |

Application Date | 4/9/2020 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Wireless networking, Radio electronics, Communication circuits, UMTS (telecommunication), Receiver (radio) |

Status | Grant |

Latest NVIDIA News

Sep 11, 2025

Meanwhile, wholesale inflation unexpectedly declined last month, bolstering the case for the Federal Reserve to cut rates next week. The S&P 500 ( ^GSPC ) climbed 0.3% while the Nasdaq Composite ( ^IXIC ) added 0.2% on the heels of record closing highs . The Dow Jones Industrial Average ( ^DJI ), which includes fewer tech stocks, fell 0.5%. NASDAQ Composite (^IXIC) Oracle stunned Wall Street as its CEO said its cloud revenue will skyrocket thanks to a big jump in bookings from the "who's who of AI." Its shares jumped over 40% Wednesday despite a quarterly earnings miss amid optimism that the AI infrastructure build-out — seen as fueling stock gains — is finally picking up pace. Elsewhere, a reading on wholesale inflation came in much cooler than expected, showing producer prices actually declined on a month-over-month basis vs. expectations for a 0.3% increase. Year over year, the Producer Price Index is up 2.6%, also lower than expectations for 3.3%. The data sets the stage for the Consumer Price Index (CPI) release on Thursday, the last clue to price pressures before the Fed's policy meeting next week. Markets have been more focused on labor market data, however, to gauge the Fed's next move. A revision to US job numbers on Tuesday confirmed weakness in that market, cementing the conviction that a September rate cut is coming and stoking a rally in stocks. Fed governor Lisa Cook is likely to take part in that Fed rate decision next week, after a judge blocked President Trump from removing her amid allegations of mortgage fraud. Trump has targeted Cook in pursuit of lower interest rates. On the trade front, Trump has urged the EU to join the US in imposing new 100% tariffs on India and China, media reports said . The tariff hikes are meant to push Russia — President Putin in particular — to participate in talks on the Ukraine war. Tensions in the region are rising after NATO member Poland shot down Russian drones that entered its airspace. Meanwhile, in corporate earnings, GameStop ( GME ) shares jumped after the company reported an over 20% rise in quarterly revenue. LIVE 18 updates Ines Ferré Trump's oft-repeated move is to claim 'no inflation.' Polls say it's his greatest economic vulnerability. Yahoo Finance's Ben Werschkul reports: Recent weeks have featured a curious sort of split screen: Americans have been increasingly clear to pollsters that inflation is their biggest worry about Donald Trump's economy. Meanwhile, the president doubled down on claims that inflation is an issue of the past. This week was just the latest example. On one front was a new Yahoo News/YouGov survey that asked respondents about Trump and the cost of living. The response — in a mirror of other recent polling — was a rock-bottom approval rating of 28%, Yet here was Trump's inflation message in a radio interview with WABC : "We have no inflation. Prices are down on just about everything." Grace O'Donnell Wall Street strategists pile on S&P 500 upgrades as AI mania bolsters 'glass-half-full' view of US economy Yahoo Finance's Allie Canal reports: Wall Street's bull case for stocks is increasingly tied to one force — artificial intelligence. Strategists at Wells Fargo, Barclays, and Deutsche Bank all boosted their respective S&P 500 ( ^GSPC ) targets this week while pointing to resilient earnings and a still-surging AI investment cycle as the backbone of the market's next leg higher. Deutsche Bank raised its 2025 forecast for the index to 7,000 from 6,550, the most optimistic among this week's upgrades. Its chief equity strategist, Binky Chadha, sees an opportunity for the rally " to widen to more cyclical parts and away from the mega-caps as a digestion period approaches after the capex boom." Wells Fargo, which previously projected the benchmark index to finish 2025 in the 6,300-6,500 range, now expects the index to reach 6,650 this year and sees the S&P 500 reaching 7,200 by the end of 2026. Barclays lifted its 2025 outlook to 6,450 from 6,050. The index was trading near 6,540 on Wednesday. Grace O'Donnell Apple stock extends losses amid lukewarm reception to the iPhone Air Apple ( AAPL ) stock extended losses on Wednesday after the company debuted its superthin iPhone Air and iPhone 17 lineup that underwhelmed Wall Street. Shares fell over 3% on Wednesday after a 1.5% decline on Tuesday. Year to date, Apple stock is down 9%, underperforming the S&P 500's 11% gain and lagging all its "Magnificent Seven" peers except for Tesla ( TSLA "It lacked some of the wow and excitement that I think was starting to get baked into expectations," Visible Alpha head of TMT research Melissa Otto told Yahoo Finance . "That's been reflected in the stock price." Apple Inc. (AAPL) Grace O'Donnell Potbelly to be acquired by convenience store chain RaceTrac, stock soars Potbelly ( PBPB ) stock surged on Wednesday after the restaurant chain announced it would be acquired RaceTrac, a gas station and convenience store chain, for $566 million in an all-cash deal expected to close in the fourth quarter. Potbelly stock was up 31% in the afternoon and traded at $17 per share. Potbelly Corporation (PBPB) Atlanta-based RaceTrac operates more than 800 locations in 14 states. Potbelly has 445 restaurants across the US, a number it aims to quadruple under the RaceTrac banner. “With RaceTrac's resources, we will unlock new opportunity for this incredible brand while staying true to the neighborhood sandwich shop experience that makes Potbelly special,” Potbelly CEO Bob Wright said in a statement Wednesday. Laura Bratton Nvidia, chip stocks climb after Oracle earnings stun Wall Street Nvidia ( NVDA ) stock jumped nearly 4% after Oracle ( ORCL ) lifted its capital expenditures for the year and gave a stunning revenue forecast Oracle said it will spend $35 billion in its 2026 fiscal year, above its previous estimate of $25 billion. At the same time, the AI software giant said it expects Cloud Infrastructure revenue to hit $144 billion by 2030 from $18 billion for the current year. Nvidia is a big partner of Oracle's, as the software company has accumulated a massive store of the chipmaker's GPUs and rented out its computing power to OpenAI ( OPAI.PVT ), Meta ( META ), xAI, and other companies. AMD ( AMD ), which also supplies its chips to Oracle, jumped 3.4%. Broadcom ( AVGO ) shares climbed more than 9%. Laura Bratton Klarna IPO prices at $40 per share, valuing BNPL leader at $15 billion Yahoo Finance's Jake Conley reports: Swedish buy now, pay later giant Klarna ( KLAR ) is set to begin publicly trading on Wednesday after raising $1.37 billion in its initial public offering, kicking off a strong week of New York stock debuts. Klarna Group plc (KLAR) Klarna priced its IPO at $40 per share , the company said Tuesday, marking an increase from its previous pricing estimate of $35-$37 per share and signaling strong demand for the stock. The pricing values the company at roughly $15.1 billion, based on the number of shares outstanding. The market cap is a third of its $45.6 billion valuation after a large investment from SoftBank in 2021, but more than double the $6.7 billion the company was worth following a private funding round in 2022 amid a down period for payments firms. Laura Bratton Nasdaq, S&P 500 rise at the open US stocks broadly rose on Wednesday, with the S&P 500 ( ^GSPC ) and the Nasdaq Composite ( ^IXIC ) jumping 0.4%, on the heels of record closing highs . The Dow Jones Industrial Average ( ^DJI ), which includes fewer tech stocks, fell below the flatline. The moves come after Oracle's ( ORCL ) earnings report included a blowout revenue forecast that lifted confidence that the AI-fueled tech rally has more room to run. Shares in Oracle jumped more than 30% at the open. Dow Jones Industrial Average (^DJI) Grace O'Donnell Stock futures rise following PPI report, traders boost jumbo rate cut bets Stock futures for the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite lifted in premarket trading after wholesale inflation data cooled unexpectedly in August, boosting hopes for a rate cut in September. Treasury yields slipped following the report, with the 10-year yield ( ^TNX ) drifting to 4.07%. As of 8:55 a.m. ET, traders were pricing in 100% odds that the Fed cuts interest rates in September. Odds of a 25 basis point cut were priced at 89.8%, while bets that the Fed would opt for a jumbo 50 basis point cut rose to 10.2% from 7% a day ago. CBOE Interest Rate 10 Year T No (^TNX) Grace O'Donnell Wholesale inflation unexpectedly cools in August Wholesale inflation unexpectedly declined in August, the Bureau of Labor Statistics reported on Wednesday. The Producer Price Index (PPI), a measure that tracks the selling prices of US producers of goods and services, declined 0.1% on a monthly basis in August. Analysts surveyed by Bloomberg were expecting a 0.3% rise. PPI inflation rose 2.6% on an annual basis in August, compared to expectations for a 3.3% increase. Last month's report also surprised, showing wholesale inflation rose 3.3% on an annual basis in July. The BLS said the decline was driven by a 0.2% month-over-month decrease in the cost of services, while the cost of goods edged up 0.1%. Grace O'Donnell Chewy stock falls on year-over-year profit decline Shares of the online pet supplies retailer Chewy ( CHWY ) fell 9% on Wednesday morning after the company reported a $0.54 per share profit drop compared to the same quarter a year ago. Chewy, Inc. (CHWY) Chewy posted diluted earnings per share of $0.14, meeting Wall Street analyst estimates, according to S&P Global Market Intelligence. But that earnings figure marked a significant decline from the $0.68 profit per share reported in the same quarter a year ago. The company said the decrease in earnings was due to share-based compensation expenses and related taxes. In the second quarter, revenue increased 8.6% year over year to $3.1 billion, coming in above estimates of $3.08 billion. Chewy said it had 20.9 million active customers at the end of the quarter, and net sales per active customer grew 4.6% to reach $591 million. Karen Friar Gold has had a golden 2025. It might have a golden 2026 too. The foundation of gold's ( GC=F ) bullishness is defensiveness, not a world-changing technology or financial innovation, argues Yahoo Finance's Hamza Shaban in today's Morning Brief. He reports: By the numbers, the precious metal is shimmering . Gold prices are up more than 40% this year, far outpacing the S&P 500's ( ^GSPC ) 10% gain. Even bitcoin ( BTC-USD ), which has enjoyed a record-setting year thanks to the Trump administration's embrace, has been left in the yellow-speckled dust with a mere 20% gain. ... Gold Dec 25 (GC=F) Unlike the stock market and its rising tides, there are people on the other end of this trade. Gold's rise also serves as a barometer of the economic mood — and not in a good way. Many of the factors lifting gold prices would be considered disconcerting outside of the context of an appreciating asset. Gold's identity and benefit as a store of value are intertwined with financial turmoil. People, governments, and institutions don't normally seek refuge when things are going well, and typically, when they do, they are competing with the US dollar and various iterations of longer-term bonds. ... The US dollar index ( DX.Y.NYB ) has declined nearly 10% year to date, while the long-dated Treasury yields have stayed high — even with the next rate cut coming into view. The world is having trust issues with US dollars and debt, and is turning to other, shinier things. Grace O'Donnell Swedish fintech Klarna set for hotly anticipated NYSE debut Swedish buy now, pay later lender Klarna ( KLAR ) is set to go public on the New York Stock Exchange on Wednesday after raising $1.37 billion in its initial public offering. According to Bloomberg, the fintech company and its backers sold 34.3 million shares for $40 per share in the oversubscribed IPO , which gives the company a $15.1 billion valuation, based on the outstanding shares. This is a drop-off from its $45.6 billion valuation in 2021, led by an investment from Japan's SoftBank Group, but an improvement from its $6.7 billion valuation in 2022 following a private funding round. Klarna had halted its IPO plans earlier in the spring as tariff volatility rocked markets. However, Klarna is now kicking off a busy week for IPOs, with seven other companies, including the Winklevoss twins' crypto exchange Gemini, in the lineup to make their public debuts this week. Jenny McCall Premarket trending tickers: Nvidia, GameStop and Synopsys Here's a look at some of the top stocks trending in premarket trading: Nvidia ( NVDA stock rose 2% before the bell on Wednesday, as investor hopes grew around AI-fueled reports from TSMC ( TSM ) and Oracle ( ORCL NVIDIA Corporation (NVDA) GameStop ( GME stock rose 10% before the bell on Wednesday after reporting a nearly 22% rise in second-quarter revenue on Tuesday. Synopsys ( SNPS missed Wall Street estimates for third-quarter revenue on Tuesday, hurt by weakness in its Design IP business, sending shares down 20% in premarket trading on Wednesday. Rian Howlett Trump urges EU to join US in new 100% tariffs on China, India to squeeze Russia President Trump has urged the EU to impose 100% tariffs on India and China to raise pressure on Russia over the war in Ukraine, the Financial Times reported Trump made the appeal in a call with US and EU officials in Washington on Tuesday. A US official said Washington would match any tariffs the EU imposed, adding: “We're ready to go, ready to go right now, but we're only going to do this if our European partners step up with us,” one US official said. This contradicts Trump's Truth Social post , where he said negotiations with India were "continuing" and will reach a "successful conclusion. Bloomberg reports: President Donald Trump told European officials he's willing to impose sweeping new tariffs on India and China to push President Vladimir Putin to the negotiating table with Ukraine — but only if EU nations do so as well. Trump made the ask when he called into a meeting with senior US and EU officials in Washington, according to people familiar with the discussion who asked not to be identified discussing private deliberations. The US is willing to mirror tariffs imposed by Europe on either country, one of the people said. The proposal amounted to a challenge given that several nations, including Hungary, have blocked more stringent EU sanctions targeting Russia's energy sector in the past. Such measures would require the backing of all member states. Other potential measures discussed by US and EU officials include further sanctions on Russia's shadow fleet of oil tankers as well as restrictions on its banks, financial sector and major oil companies, according to the people. Karen Friar Barclays lifts S&P 500 target for second time in three months Barclays has raised its year-end target for the S&P 500 ( ^GSPC ) to 6,450 from 6,050, citing stronger-than-expected corporate earnings, resilient US economic growth, and optimism around artificial intelligence. Reuters reports: The British brokerage joins a growing list of global research firms that have raised targets on the benchmark index, including Citigroup ( C ) and HSBC ( HSBC After hitting lows in April following President Donald Trump 's "Liberation Day" tariffs, the S&P 500 has rallied, steadily — gaining about 30% — buoyed by resilient earnings and investor enthusiasm around the AI boom. S&P 500 (^GSPC) However, the new target is slightly below the index's last close of 6,512.61 points, indicating labour market risks. Karen Friar Oracle stock jumps after blowout revenue forecast, despite earnings miss Shares of Oracle ( ORCL ) surged almost 30% in premarket trading after it boosted its forecast for AI-fueled cloud revenue, citing a jump in its contract backlog. The software giant now expects its Cloud Infrastructure sales to reach $144 billion by 2030 — a massive leap from its estimate of $18 billion for the current year. Oracle Corporation (ORCL) “We're all kind of in shock in a very, very good way,” Brad Zelnick, an analyst at Deutsche Bank, said during Oracle's earnings conference call, per Bloomberg . “There's no better evidence of a seismic shift happening in computing than these results that you just put up.” Yahoo Finance's Laura Bratton reports: The stock's gain comes despite Oracle reporting earnings for the first quarter of its fiscal year 2026 that fell below Wall Street's expectations. The company reported revenue of $14.9 billion, slightly below the $15 billion expected by analysts polled by Bloomberg. The software giant's adjusted earnings per share of $1.47 also came in below the projected $1.48. Oracle's optimistic revenue outlook came as it raised its RPO, or remaining performance obligation, the total value of contract revenue Oracle will deliver in the future, based on customer agreements. "We signed four multibillion-dollar contracts with three different customers in Q1," Catz said in a statement Tuesday. Catz said this resulted in the company's contract backlog increasing 359% to $455 billion in its first quarter. The executive added that the company expects to sign up several additional multibillion-dollar customers and for its RPO to exceed half a trillion dollars. "We have signed significant cloud contracts with the who's who of AI, including OpenAI, xAI, Meta, and many others," Catz said in a call with investors following the company's earnings report. Rian Howlett Robinhood announces plans for copy trading platform Reuters reports: Roughly nine months after suggesting that a young copy trading platform could only operate because it flew “under the radar” of regulators, Robinhood ( HOOD ) has announced its own entry into the space with “Robinhood Social,” a new feature that will allow users to follow and manually replicate the trades of prominent investors. Robinhood Markets, Inc. (HOOD) The move represents a striking about-face for the online brokerage, which has historically been cautious about features that could attract regulatory scrutiny. The company famously ditched its celebratory digital confetti feature ahead of its 2021 IPO after regulators raised concerns about gamifying trading, making its embrace of copy trading, another potentially gamified feature, all the more notable. Robinhood's version of copy trading differs meaningfully from platforms like Dub and established players like eToro, which has offered copy trading to U.S. users for years through its CopyTrader feature. While eToro allows automatic copying of other traders' portfolios in real-time (with U.S. users limited to copying only other U.S. traders due to regulations), Dub allows users to automatically copy entire portfolios for a $10 monthly subscription, and Robinhood Social will require users to manually replicate trades, a distinction that may help address regulatory concerns. The platform, set to launch early next year, will feature verified traders and display the activities of famous investors and members of Congress. Unlike the informal copy trading that happens on social media, Robinhood will require identity verification and proof of actual portfolio positions. The plan, according to the company, is to first invite 10,000 Robinhood Social users to test out the service before rolling it out more widely. Recommended Stories

NVIDIA Frequently Asked Questions (FAQ)

When was NVIDIA founded?

NVIDIA was founded in 1993.

Where is NVIDIA's headquarters?

NVIDIA's headquarters is located at 2788 San Tomas Expressway, Santa Clara.

What is NVIDIA's latest funding round?

NVIDIA's latest funding round is PIPE - III.

How much did NVIDIA raise?

NVIDIA raised a total of $12.6M.

Who are the investors of NVIDIA?

Investors of NVIDIA include Woodstock, CIBC World Markets, Alpine Woods Investments, SoftBank, Sequoia Capital and 6 more.

Who are NVIDIA's competitors?

Competitors of NVIDIA include Imagination, Arm, Hygon, Xilinx, Ambient Scientific and 7 more.

Loading...

Compare NVIDIA to Competitors

Bridgecom Semiconductors provides wireless semiconductor solutions for the Internet of Things (IoT) market. The company offers cellular modem chipsets for various IoT applications, including low-power and integration solutions for smart metering, wearables, and smart city infrastructure. Bridgecom serves sectors such as automotive, industry IoT, wearable technology, personal computing, and smart city development. It was founded in 2022 and is based in Munich, Germany.

Microchip Technology (NasdaqGS: MCHP) provides smart, connected, and secure embedded control solutions for the semiconductor industry. The company offers development tools and a comprehensive product portfolio that help customers create designs that minimize risk and reduce system cost and time to market. Microchip Technology primarily serves the industrial, automotive, consumer, aerospace and defense, communications, and computing markets with its solutions. It was founded in 1989 and is based in Chandler, Arizona.

Baya Systems provides customizable system IP solutions for the semiconductor industry, focusing on scaling for SoCs and Chiplets. The company offers computing systems and modular semiconductor technologies that assist in the design, analysis, and deployment of complex computing systems. Baya Systems serves sectors that require data movement and computing, including data centers, AI acceleration, automotive, and IoT. It was founded in 2023 and is based in Santa Clara, California.

Samsung Semiconductor offers semiconductor technology and operates within the semiconductor industry. It offers products including Dynamic Random Access Memory (DRAM), solid-state drive (SSD), processors, image sensors, and display ICs, which are components for electronic devices. It serves sectors such as mobile, automotive, computer, network, television, gaming, 5G, and Artificial Intelligence (AI) industries. It was founded in 1974 and is based in San Jose, California.

Arctic Semiconductor specializes in low-power, high-performance analog and mixed-signal RFIC products for the telecommunications sector. The company's products are designed to enable the deployment of advanced wireless network infrastructure, including 5G technology, by providing energy-efficient chipset solutions for a variety of applications such as small cells, fixed wireless access, and private networks. Arctic Semiconductor was formerly known as SiTune Corp. It was founded in 2007 and is based in San Jose, California.

Flow Computing specializes in enhancing CPU performance through its Parallel Processing Unit (PPU) technology within the technology sector. The company's main offering is the PPU architecture, which aims to improve CPU performance and enhance the efficiency of legacy applications with backward software compatibility. Flow Computing's solutions are applicable in sectors including AI, edge and cloud computing, multimedia processing, autonomous vehicles, and military-grade systems. It was founded in 2024 and is based in Helsinki, Finland.

Loading...