Roughly 1,200 Germany-based investors backed equity deals this year so far, creating a competitive landscape where strategic positioning is crucial.

To differentiate themselves, top German firms like High-Tech Grunderfonds are aggressively pursuing deals in high-growth areas like healthcare and AI that position them to capture outsized returns.

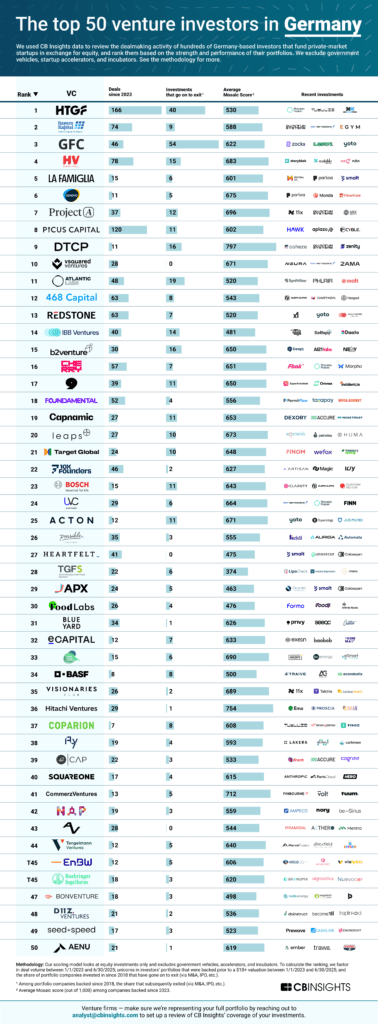

Using CB Insights data, we analyzed which investors are building the strongest foundations for portfolio success. Below, see our picks for the top 50 venture investors in Germany, key takeaways on the list, and a note on methodology.

Venture firms — make sure we’re representing your full portfolio by reaching out to analyst@cbinsights.com to set up a review of CB Insights’ coverage of your investments.

Key takeaways

- High-Tech Grunderfonds leads our ranking with 166 startup deals since 2023 (as of 6/30/2025). Of those, nearly one-fifth (or 32 deals) went to AI companies — including AI-powered precision medicine platform Aignostics and AI development startup Neural Concept.

- DTCP leads in terms of the quality of its recent investments. Its investments since 2023 have a higher average Mosaic score (797 out of 1,000) than any other investor on the list. Top performers in its portfolio include Cohere (890; $1.4B in total funding and backing from the likes of Nvidia, Oracle, and Salesforce Ventures) and Quantum Systems (874; partnerships with Sony and Airbus).

- Global Founders Capital shows the best exit track records, backing 54 startups since 2018 that went on to exit. Of those, at least 11% of exits are AI companies, including AI-powered quality management platform Klaus (acquired by Zendesk) and personalization AI startup Dynamic Yield (acquired by Mastercard). The firm recently transitioned to exclusively investing from Rocket Internet’s €300M balance sheet rather than operating as an independent venture firm.

Methodology

We used CB Insights data to review the dealmaking activity of hundreds of Germany-based investors that fund private-market startups in exchange for equity, and rank them based on the strength and performance of their portfolios.

Our scoring model factors in deal volume between Q1’23 and Q2’25; unicorns in investors’ portfolios that were backed prior to a $1B valuation; and the share of portfolio companies invested in since 2018 that have gone on to exit. We exclude government vehicles, startup accelerators, incubators.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.