Investments

1009Portfolio Exits

130Funds

17Partners & Customers

4About Mitsubishi UFJ Capital

Mitsubishi UFJ Capital or MUCAP is a venture capital firm within the Mitsubishi UFJ Financial Group. It is a commercial financial institution that specializes in healthcare, electronics, and high-technology investments. It supports companies in their pre-seed and pre-series A stages with growth capital investments, and aims to partner with the companies until initial public offering (IPO), mergers and acquisitions (M&A), and other exit strategies. It was founded in 1974 and is based in Tokyo, Japan.

Research containing Mitsubishi UFJ Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mitsubishi UFJ Capital in 4 CB Insights research briefs, most recently on Apr 29, 2025.

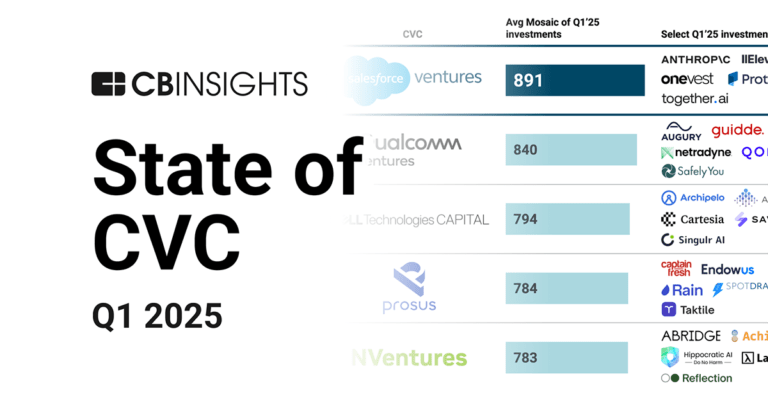

Apr 29, 2025 report

State of CVC Q1’25 Report

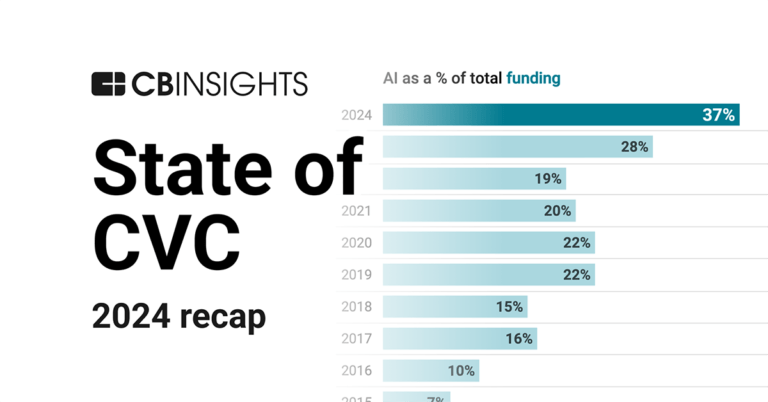

Feb 4, 2025 report

State of CVC 2024 Report

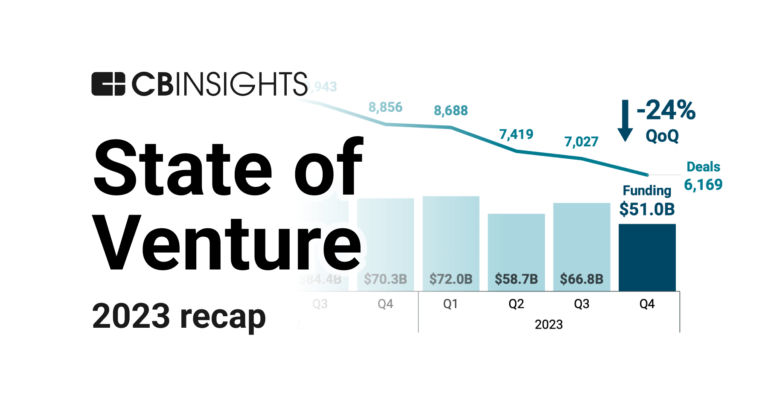

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest Mitsubishi UFJ Capital News

Sep 16, 2025

조미현 금융부 기자 지난 10일 이재명 대통령 주재의 국민성장펀드 국민보고대회에서 일반 지주회사 소속 기업형 벤처캐피털(CVC) 규제를 풀어달라는 요청이 나왔다. 일반 지주사는 물론 금융권에서 이런 제안을 한 건 현행 금산분리 규제 아래서는 은행 자금이 벤처 생태계로 이어지는 통로가 좁기 때문이다. 금융권 관계자는 “정부가 은행에 부동산이 아닌 기업과 산업에 자금을 공급하는 생산적 금융을 요구하지만, 은행 자금이 벤처 생태계로 직접 흘러드는 환경 자체가 충분히 조성되지 않았다”고 토로했다. 일본과 비교하면 상황은 더 극명하다. 이들은 각각 미쓰비시UFJ금융그룹, 스미토모미쓰이금융그룹, 미즈호파이낸셜그룹 등 일본 3대 금융그룹 산하 CVC다. 이 가운데 MUFJ캐피털, SMBC벤처캐피털은 각각 15건의 투자를 진행하며 미국의 구글벤처스(17건) 다음으로 이름을 올렸다. 미즈호캐피털은 11건 투자로 공동 4위였다. 나머지는 대부분 미국 CVC다. 은행계 CVC가 적극적으로 투자에 나서면서 일본 스타트업 생태계의 몸집이 커지고 있다는 부러움의 목소리가 국내 업계에서 꾸준히 나오는 이유다. 국내 은행이 벤처 투자에 과감히 투자하기 어려운 건 선진국에서는 찾아보기 힘든 금산분리 원칙 때문이다. 외환위기 이후 산업자본이 금융회사를 사실상 사금고로 활용하며 부실을 키운 폐해가 드러나자 금융과 산업의 결합을 원천 차단하는 규제가 자리 잡았다. 이명박 정부에서 금산분리 완화를 일부 추진했지만, 박근혜 정부 때인 2013년 경제민주화 바람으로 다시 원상 복귀됐다. 금융당국은 위기 재발 방지를 명분으로 규제를 붙들었고, 정치권은 재벌 견제를 내세웠다. 그러는 사이 한국에서 금산분리는 금과옥조가 됐다. 또 다른 금융권 관계자는 “어쩌면 2021년 일반 지주사에 제한적으로 CVC 설립이 허용된 건 기적에 가깝다”고 했다. 당시 기억을 돌아보면 그 기적을 현실화한 건 정부와 여당의 의지였다. 상법·공정거래법 등 개정에 대한 반발을 무마하기 위한 일종의 정치적 거래 성격이 강했지만, 어쨌든 그 결과 벤처 생태계에 조금이라도 숨통이 트일 수 있었다. 정치적 결단이 무엇보다 중요한 이유다. 생산적 금융을 활성화하기 위해서라도 금산분리 원칙의 현실적 조정이 필요하다. 은행을 손가락질하기 전에, 먼저 은행 자금이 혁신기업으로 흘러 들어가는 걸 가로막는 규제가 무엇인지부터 돌아볼 필요가 있다. 좋아요 2 3

Mitsubishi UFJ Capital Investments

1,009 Investments

Mitsubishi UFJ Capital has made 1,009 investments. Their latest investment was in Mechano Cross as part of their Seed VC - II on September 05, 2025.

Mitsubishi UFJ Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/5/2025 | Seed VC - II | Mechano Cross | Yes | 2 | ||

9/1/2025 | Series B | LayerX | $100M | No | Coreline, JAFCO, Japan Post Investment, Keyrock Capital Management, MUFG Bank, and Technology Crossover Ventures | 4 |

8/29/2025 | Series A | Fermelanta | $13.6M | Yes | 4 | |

8/19/2025 | Series B - II | |||||

8/7/2025 | Series C - II |

Date | 9/5/2025 | 9/1/2025 | 8/29/2025 | 8/19/2025 | 8/7/2025 |

|---|---|---|---|---|---|

Round | Seed VC - II | Series B | Series A | Series B - II | Series C - II |

Company | Mechano Cross | LayerX | Fermelanta | ||

Amount | $100M | $13.6M | |||

New? | Yes | No | Yes | ||

Co-Investors | Coreline, JAFCO, Japan Post Investment, Keyrock Capital Management, MUFG Bank, and Technology Crossover Ventures | ||||

Sources | 2 | 4 | 4 |

Mitsubishi UFJ Capital Portfolio Exits

130 Portfolio Exits

Mitsubishi UFJ Capital has 130 portfolio exits. Their latest portfolio exit was Axelspace on August 13, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/13/2025 | IPO | Public | 2 | ||

7/31/2025 | Acq - Fin | 2 | |||

7/29/2025 | Acq - Fin | 3 | |||

Date | 8/13/2025 | 7/31/2025 | 7/29/2025 | ||

|---|---|---|---|---|---|

Exit | IPO | Acq - Fin | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 2 | 2 | 3 |

Mitsubishi UFJ Capital Fund History

17 Fund Histories

Mitsubishi UFJ Capital has 17 funds, including Mitsubishi UFJ Capital VII.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

2/20/2019 | Mitsubishi UFJ Capital VII | Multi-Stage Venture Capital | Closed | $136.98M | 1 |

2/20/2019 | Mitsubishi UFJ Life Science II | Multi-Stage Venture Capital | Closed | $91.32M | 1 |

2/20/2017 | Mitsubishi UFJ Capital VI | Multi-Stage Venture Capital | Closed | $88.37M | 1 |

2/20/2017 | Mitsubishi UFJ Life Science I | ||||

11/30/2015 | Mitsubishi UFJ Venture Fund II |

Closing Date | 2/20/2019 | 2/20/2019 | 2/20/2017 | 2/20/2017 | 11/30/2015 |

|---|---|---|---|---|---|

Fund | Mitsubishi UFJ Capital VII | Mitsubishi UFJ Life Science II | Mitsubishi UFJ Capital VI | Mitsubishi UFJ Life Science I | Mitsubishi UFJ Venture Fund II |

Fund Type | Multi-Stage Venture Capital | Multi-Stage Venture Capital | Multi-Stage Venture Capital | ||

Status | Closed | Closed | Closed | ||

Amount | $136.98M | $91.32M | $88.37M | ||

Sources | 1 | 1 | 1 |

Mitsubishi UFJ Capital Partners & Customers

4 Partners and customers

Mitsubishi UFJ Capital has 4 strategic partners and customers. Mitsubishi UFJ Capital recently partnered with AGC on March 3, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/4/2025 | Partner | Japan | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | 1 | |

8/19/2021 | Partner | ||||

1/10/2019 | Partner | ||||

1/23/2015 | Vendor |

Date | 3/4/2025 | 8/19/2021 | 1/10/2019 | 1/23/2015 |

|---|---|---|---|---|

Type | Partner | Partner | Partner | Vendor |

Business Partner | ||||

Country | Japan | |||

News Snippet | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | |||

Sources | 1 |

Mitsubishi UFJ Capital Team

10 Team Members

Mitsubishi UFJ Capital has 10 team members, including current President, Kei Andoh.

Name | Work History | Title | Status |

|---|---|---|---|

Kei Andoh | President | Current | |

Name | Kei Andoh | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | President | ||||

Status | Current |

Compare Mitsubishi UFJ Capital to Competitors

Spiral Ventures is a venture capital firm. The film invests in fintech, logistics/transportation, artificial intelligence, IoT, sharing economy, marketplace, HR tech, big data, media platforms, healthcare, and online advertising sectors. Spiral Ventures was formerly known as IMJ Investment Partners. Spiral Ventures was founded in 2012 and is based in Tokyo, Japan.

Skyland Ventures is a Japanese investment company focused on seed-stage startups. It provides cashback and MEV (Miner Extractable Value) solutions with BNB, Polygon chain, etc. The company was founded in 2012 and is based in Tokyo, japan.

Inclusion Japan is a venture capital firm that invests in startups and provides consultancy services to large enterprises. The company collaborates with startups and offers consultancy to enterprises for business development. It was founded in 2011 and is based in Tokyo, Japan.

31VENTURES supports startups through a three-pillar approach of funding, workspace, and community building. It invests in sectors like PropTech, artificial intelligence (AI), mobility, healthcare, fintech, and climate tech, while also emphasizing sustainability and decarbonization. 31VENTURES also operates collaborative workspaces and fosters an ecosystem that connects startups with Mitsui Fudosan’s vast corporate network, enabling joint ventures, pilot projects, and strategic alliances. The company was founded in 2015 and is based in Tokyo, Japan.

Samurai Incubate operates as a venture capital firm. The company primarily invests in early-stage startups and provides growth support, including assistance with development plans, human resources, and fundraising strategies. It also offers incubation services for companies related to personal computers, mobile media, and software as a service (SaaS), as well as for executive, management, marketing, sales, and human resource departments. It was founded in 2008 and is based in Tokyo, Japan.

Carta Ventures is a wholly-owned venture capital subsidiary of Carta Holdings, a Japanese media, and advertising technology company. Carta Ventures focuses its efforts on the rapidly growing Asian markets.

Loading...