Investments

810Portfolio Exits

109Funds

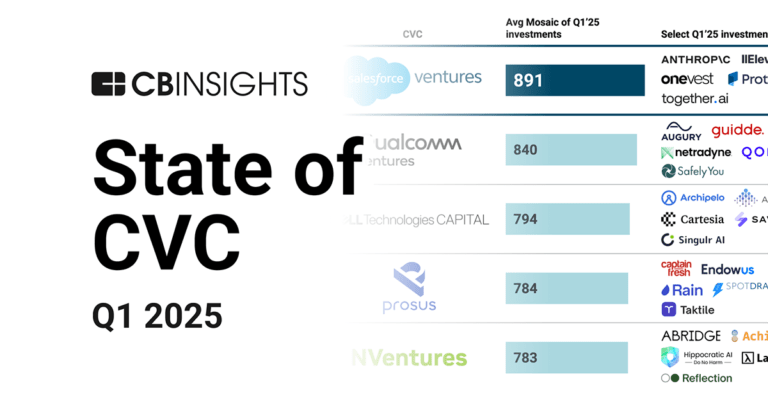

12Research containing SMBC Venture Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SMBC Venture Capital in 4 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

State of CVC Q1’25 Report

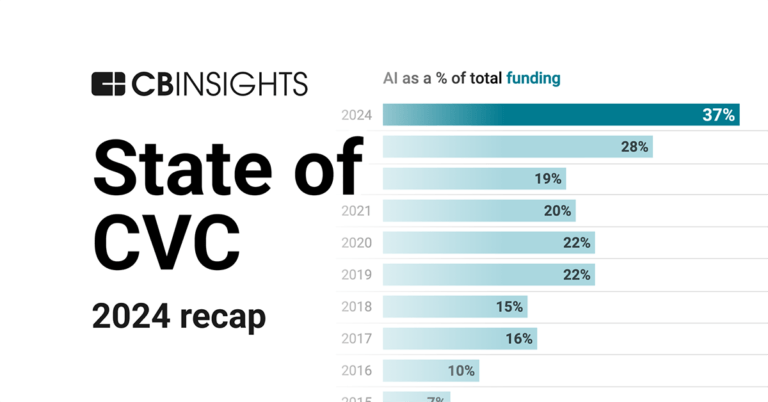

Feb 4, 2025 report

State of CVC 2024 Report

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest SMBC Venture Capital News

Sep 11, 2025

学校で大流行!GIGA端末対応のハマるAI英語アプリ『マグナとふしぎの少女』に、みずほキャピタルとSMBCベンチャーキャピタルが出資 〜1年で183校導入・アプリユーザーは10倍に。機関投資家からの資金調達を開始し、“結果につながるファンラーニング”で学校No.1へ〜 ミントフラッグ株式会社(以下、ミントフラッグ)は、みずほキャピタル株式会社およびSMBCベンチャーキャピタル株式会社を引受先とする第三者割当増資を実施しました。 これまで当社は、日本を代表する起業家・投資家である 孫泰蔵氏、島田 亨氏、楽天共同創業者である杉原章郎氏・由佳子氏、株式会社グランフーズ 創業者・小川雄一郎氏、文科省 中央教育審議会委員などを歴任する熊平美香氏、一般社団法人 FutureEdu 代表理事 竹村詠美氏をはじめとする錚々たる方々から当社ビジョンへの共感を頂き、個人投資家としてご支援を頂いてきました。 こうした強力なご支援を背景に、当社の開発する英語学習アプリ「マグナとふしぎの少女」(以下、マグナ)は急拡大を始めています。新たな事業ステージに合わせ、機関投資家からの出資や事業会社との資本を含むパートナーシップを通じて、プロダクト強化と事業展開を加速してまいります。本件は、その取り組みの第一弾です。 【結果につながるファンラーニングで学校No.1へ】 マグナでは、小中学生が高校卒業レベルの3000の英単語を習得し、英検合格者も続々と生まれています。こうした ”ただ楽しいだけじゃない、結果につながるファンラーニング” が評価され、マグナの学校への提供開始後1年で導入校は180校を超え、全国で利用が広がっています。「学校で大人気のAI英語アプリ」としてのTBS、フジテレビでの特集も追い風となり、1年間でアクティブユーザー数は10倍へと伸長しました。 今後、機関投資家からの出資、および事業会社との資本含めたパートナーシップを積極的に進めることで成長投資を一段と加速して参ります。『学校No.1』のポジションで蓄積される大規模学習データを土台に、より賢く、より個別最適化された学びを生み出すデータカンパニーに進化していきます。 【投資家からのメッセージ】

SMBC Venture Capital Investments

810 Investments

SMBC Venture Capital has made 810 investments. Their latest investment was in Mintflag as part of their Series A - II on September 11, 2025.

SMBC Venture Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/11/2025 | Series A - II | Mintflag | Yes | 2 | ||

8/29/2025 | Series A | Fermelanta | $13.6M | Yes | 4 | |

8/27/2025 | Series E | Helpfeel | $17.59M | Yes | 2 | |

8/25/2025 | Series B | |||||

8/19/2025 | Seed VC |

Date | 9/11/2025 | 8/29/2025 | 8/27/2025 | 8/25/2025 | 8/19/2025 |

|---|---|---|---|---|---|

Round | Series A - II | Series A | Series E | Series B | Seed VC |

Company | Mintflag | Fermelanta | Helpfeel | ||

Amount | $13.6M | $17.59M | |||

New? | Yes | Yes | Yes | ||

Co-Investors | |||||

Sources | 2 | 4 | 2 |

SMBC Venture Capital Portfolio Exits

109 Portfolio Exits

SMBC Venture Capital has 109 portfolio exits. Their latest portfolio exit was Axelspace on August 13, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/13/2025 | IPO | Public | 2 | ||

7/31/2025 | Corporate Majority | 2 | |||

7/31/2025 | Acq - Fin | 2 | |||

Date | 8/13/2025 | 7/31/2025 | 7/31/2025 | ||

|---|---|---|---|---|---|

Exit | IPO | Corporate Majority | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 2 | 2 | 2 |

SMBC Venture Capital Acquisitions

1 Acquisition

SMBC Venture Capital acquired 1 company. Their latest acquisition was Collabos on June 30, 2011.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

6/30/2011 | Other | Management Buyout | 1 |

Date | 6/30/2011 |

|---|---|

Investment Stage | Other |

Companies | |

Valuation | |

Total Funding | |

Note | Management Buyout |

Sources | 1 |

SMBC Venture Capital Fund History

12 Fund Histories

SMBC Venture Capital has 12 funds, including Next Generation Corporate Growth Support I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

3/29/2017 | Next Generation Corporate Growth Support I | Early-Stage Venture Capital | Open | $8.72M | 1 |

12/31/2016 | SMBC VC 3 | Early-Stage Venture Capital | Closed | 1 | |

12/31/2014 | SMBC VC 2 | Early-Stage Venture Capital | Closed | 1 | |

6/6/2012 | SMBC Business Development II | ||||

7/22/2011 | SMBC VC 1 |

Closing Date | 3/29/2017 | 12/31/2016 | 12/31/2014 | 6/6/2012 | 7/22/2011 |

|---|---|---|---|---|---|

Fund | Next Generation Corporate Growth Support I | SMBC VC 3 | SMBC VC 2 | SMBC Business Development II | SMBC VC 1 |

Fund Type | Early-Stage Venture Capital | Early-Stage Venture Capital | Early-Stage Venture Capital | ||

Status | Open | Closed | Closed | ||

Amount | $8.72M | ||||

Sources | 1 | 1 | 1 |

SMBC Venture Capital Team

3 Team Members

SMBC Venture Capital has 3 team members, including current Chief Executive Officer, President, Akira Ochiai.

Name | Work History | Title | Status |

|---|---|---|---|

Akira Ochiai | Chief Executive Officer, President | Current | |

Name | Akira Ochiai | ||

|---|---|---|---|

Work History | |||

Title | Chief Executive Officer, President | ||

Status | Current |

Compare SMBC Venture Capital to Competitors

Skyland Ventures is a Japanese investment company focused on seed-stage startups. It provides cashback and MEV (Miner Extractable Value) solutions with BNB, Polygon chain, etc. The company was founded in 2012 and is based in Tokyo, japan.

31VENTURES supports startups through a three-pillar approach of funding, workspace, and community building. It invests in sectors like PropTech, artificial intelligence (AI), mobility, healthcare, fintech, and climate tech, while also emphasizing sustainability and decarbonization. 31VENTURES also operates collaborative workspaces and fosters an ecosystem that connects startups with Mitsui Fudosan’s vast corporate network, enabling joint ventures, pilot projects, and strategic alliances. The company was founded in 2015 and is based in Tokyo, Japan.

Spiral Ventures is a venture capital firm. The film invests in fintech, logistics/transportation, artificial intelligence, IoT, sharing economy, marketplace, HR tech, big data, media platforms, healthcare, and online advertising sectors. Spiral Ventures was formerly known as IMJ Investment Partners. Spiral Ventures was founded in 2012 and is based in Tokyo, Japan.

KSK Angel Fund, founded by Keisuke Honda, makes angel investments in areas such as blockchain, sports, artificial intelligence, IoT, robotics, rockets, and more.

Carta Ventures is a wholly-owned venture capital subsidiary of Carta Holdings, a Japanese media, and advertising technology company. Carta Ventures focuses its efforts on the rapidly growing Asian markets.

Smilegate Investment operates as a venture capital firm, focusing on investing in potential unicorn companies across various industries. Smilegate Investment was formerly known as MVP창업투자가. It was founded in 1999 and is based in Gangnam-gu, South Korea.

Loading...