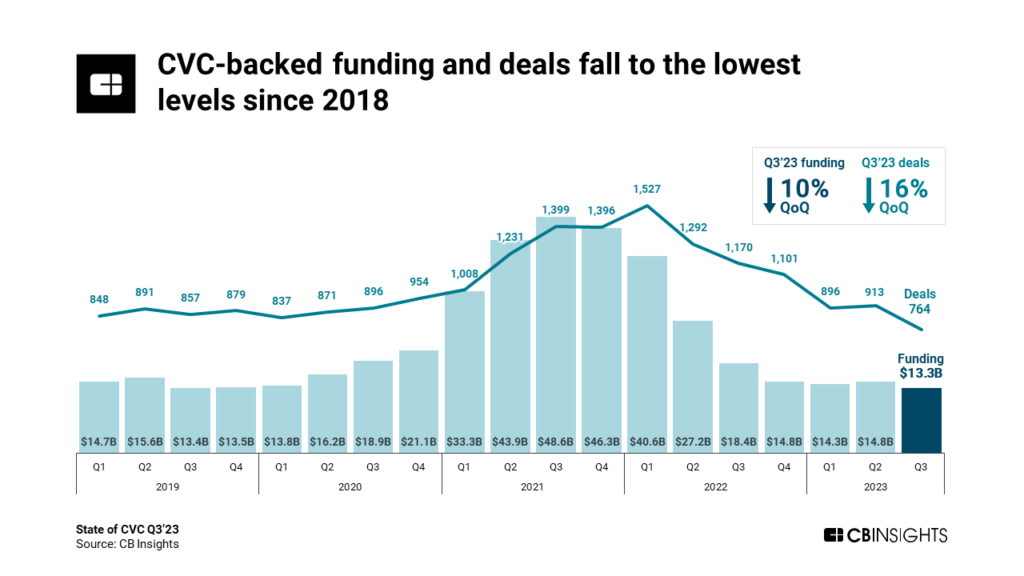

Quarterly corporate venture capital (CVC)-backed funding has fallen 73% from its all-time high ($48.6B) just 2 years ago. In that same period, CVC dealmaking has halved as corporations across the globe focus on cutting costs.

Even so, CVCs continue to make strategic investments — if just more selective. The 2 largest CVC-backed deals in Q3’23 raised nearly $1B in combined funding.

Using CB Insights data, we highlight key takeaways from our State of CVC Q3’23 Report, including:

- Global corporate venture capital-backed funding and deals drop to the lowest levels since 2018.

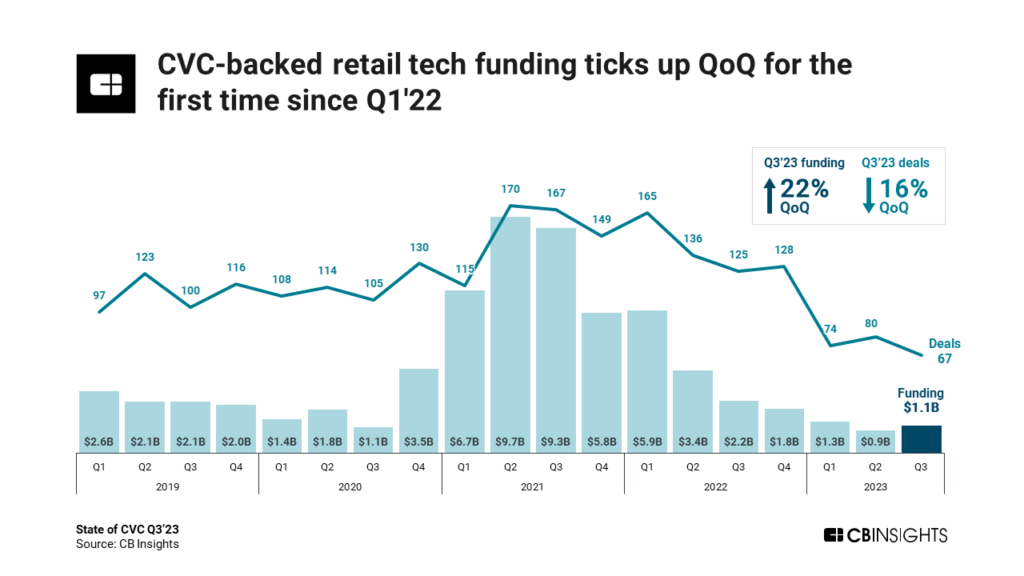

- CVC-backed retail tech funding ticks up quarter-over-quarter (QoQ) for the first time since Q1’22.

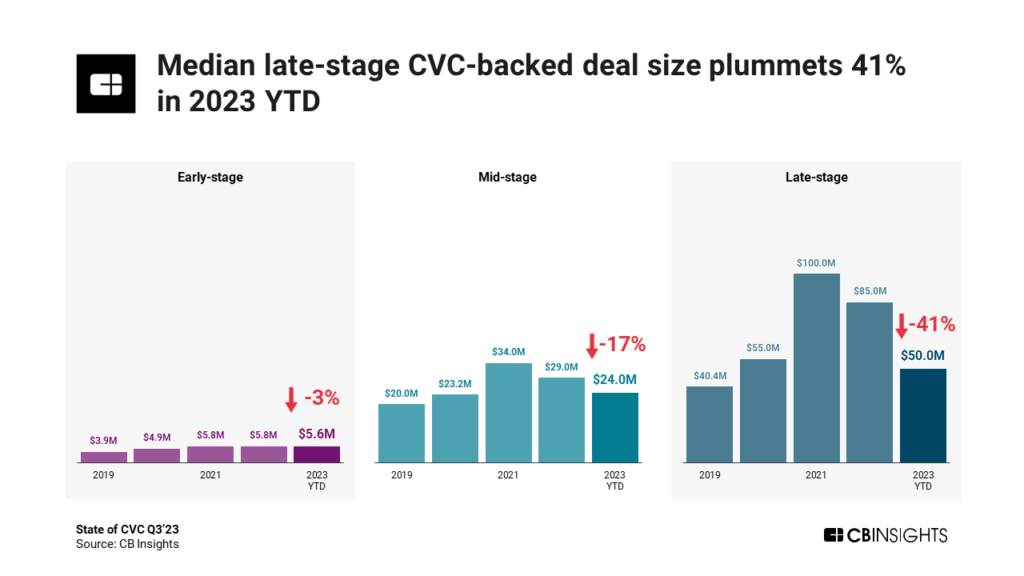

- Median late-stage CVC-backed deal size plummets 41% in 2023 YTD.

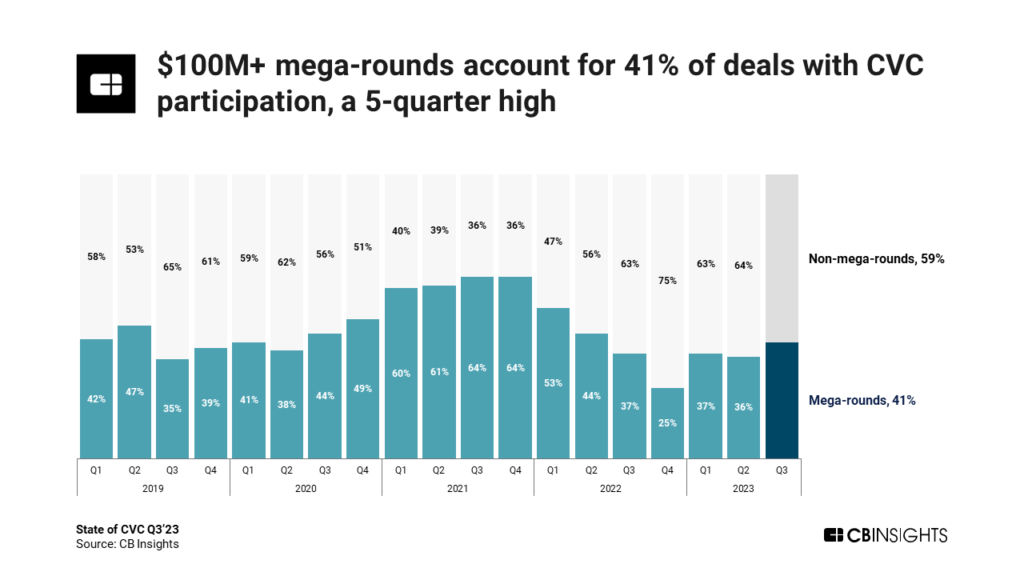

- $100M+ mega-rounds account for 41% of deals with CVC participation, a 5-quarter high.

- The US leads in CVC-backed funding in Q3’23, while Asia leads in deal count.

Let’s dive in.

CVC-backed funding and deals reached the lowest levels since 2018 in Q3’23.

Global CVC-backed funding dropped 10% QoQ, from $14.8B in Q2’23 to $13.3B in Q3’23. The drop ran counter to broader venture funding, which increased by 11% QoQ in Q3’23.

Deals with CVC participation fell by 16% QoQ, from 913 in Q2’23 to 764 in Q3’23. The broader venture market saw an 11% decline in deal count over the same period.

These drops coincided with a broader decline in the number of active CVC investors between the first 3 quarters of 2022 and the same period in 2023.

Mitsubishi UFJ Capital and SMBC Venture Capital were the top CVC investors in Q3’23 by company count (16 and 12, respectively).

Retail tech was the only sector to see CVC-backed funding increase QoQ, up 22% to $1.1B. This increase bucked the trend seen in the broader venture market, where retail tech funding fell in Q3’23 to its lowest point in nearly a decade.

Despite the increase in CVC-backed funding, retail tech deals with CVC participation dropped 16% QoQ to the lowest level since 2017.

Retail tech has a median CVC-backed deal size of $10.5M in 2023 so far — higher than digital health ($10.0M) or fintech ($7.9M).

The median CVC-backed deal size is $8.8M in 2023 so far, down from $10M in full-year 2022.

The median deal size is down across all stages of investment. Late-stage median CVC-backed deal size has dropped the most — down 41% from $85M in 2022 to $50M in 2023 YTD.

Meanwhile, median early-stage CVC-backed deal size is down just 3%, from $5.8M in 2022 to $5.6M this year.

41% of all CVC-backed funding went to $100M+ mega-round deals in Q3’23 — the highest share since Q2’22. This occurred amid a QoQ uptick in CVC-backed mega-round funding ($5.3B to $5.5B) and deals (28 to 30).

The 2 largest CVC-backed deals in Q3’23 saw nearly $1B in combined funding:

- Databricks: $504M Series I (also the largest CVC-backed deal in 2023 YTD)

- Ascend Elements: $460M Series D

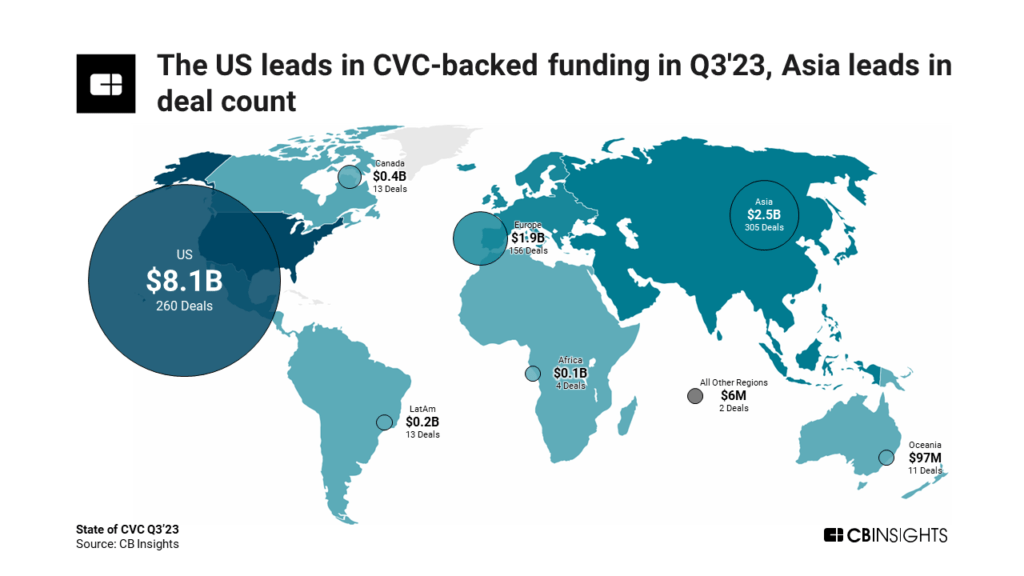

CVC-backed funding to US startups increased 9% QoQ, from $7.4B to $8.1B. A $1.7B surge in CVC-backed funding QoQ to Silicon Valley- and Boston-based companies drove this increase.

The US also saw a majority (61%) of CVC-backed funding in Q3’23. Meanwhile, Asia and Europe saw CVC-backed funding drop QoQ to the lowest levels since 2017 and 2020, respectively.

Asia continued to lead quarterly CVC-backed deal share (40%).

If you aren’t already a client, sign up for a free trial to learn more about our platform.