Skyfire

Founded Year

2024Stage

Seed VC - II | AliveTotal Raised

$10MLast Raised

$1M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+165 points in the past 30 days

About Skyfire

Skyfire focuses on providing financial services for the machine economy. The company offers a financial stack that enables artificial intelligence agents to perform transactions without the need for credit cards or bank accounts and allows businesses to monetize their products, services, and data to AI agents. It primarily sells to sectors that involve AI technology and digital transactions. The company was founded in 2024 and is based in San Francisco, California.

Loading...

ESPs containing Skyfire

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI agent payments infrastructure market enables secure financial transactions between AI agents, humans, and businesses without requiring traditional banking infrastructure. Vendors in this space provide APIs, SDKs, and specialized protocols that allow developers to build AI systems that can autonomously initiate, authenticate, and complete financial transactions online. These solutions levera…

Skyfire named as Leader among 9 other companies, including Stripe, Coinbase, and Nekuda.

Skyfire's Products & Differentiators

The Financial Stack for AI Agents

Powering autonomous transactions for developers, services, websites and LLMs across the AI Economy. Skyfire is the payment network built specifically for AI.

Loading...

Research containing Skyfire

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Skyfire in 7 CB Insights research briefs, most recently on Sep 5, 2025.

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

Aug 22, 2025

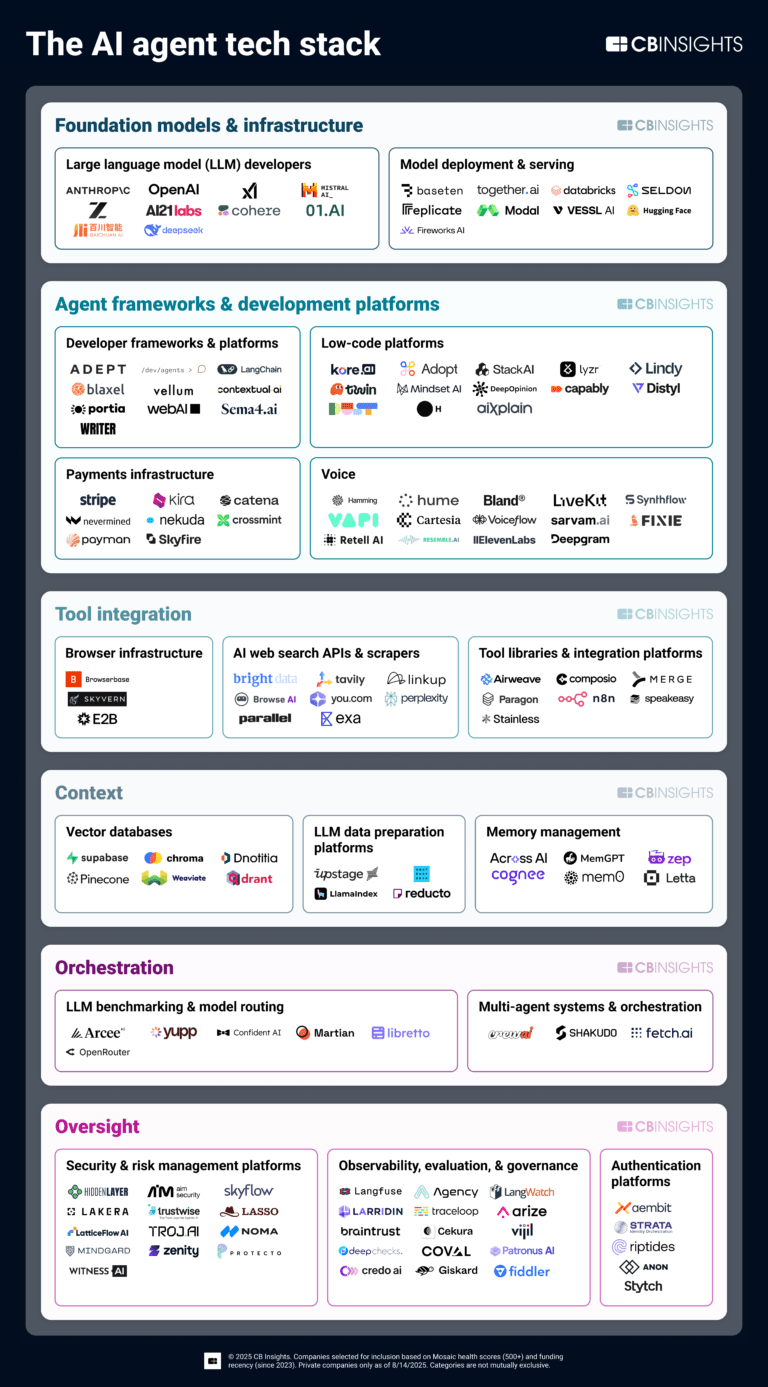

The AI agent tech stack

Aug 4, 2025

3 markets fueling the shift to agentic commerce

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

Apr 24, 2025 report

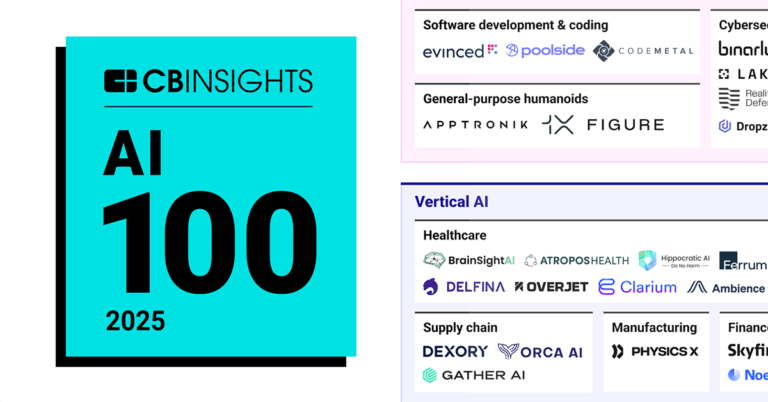

AI 100: The most promising artificial intelligence startups of 2025

Mar 6, 2025

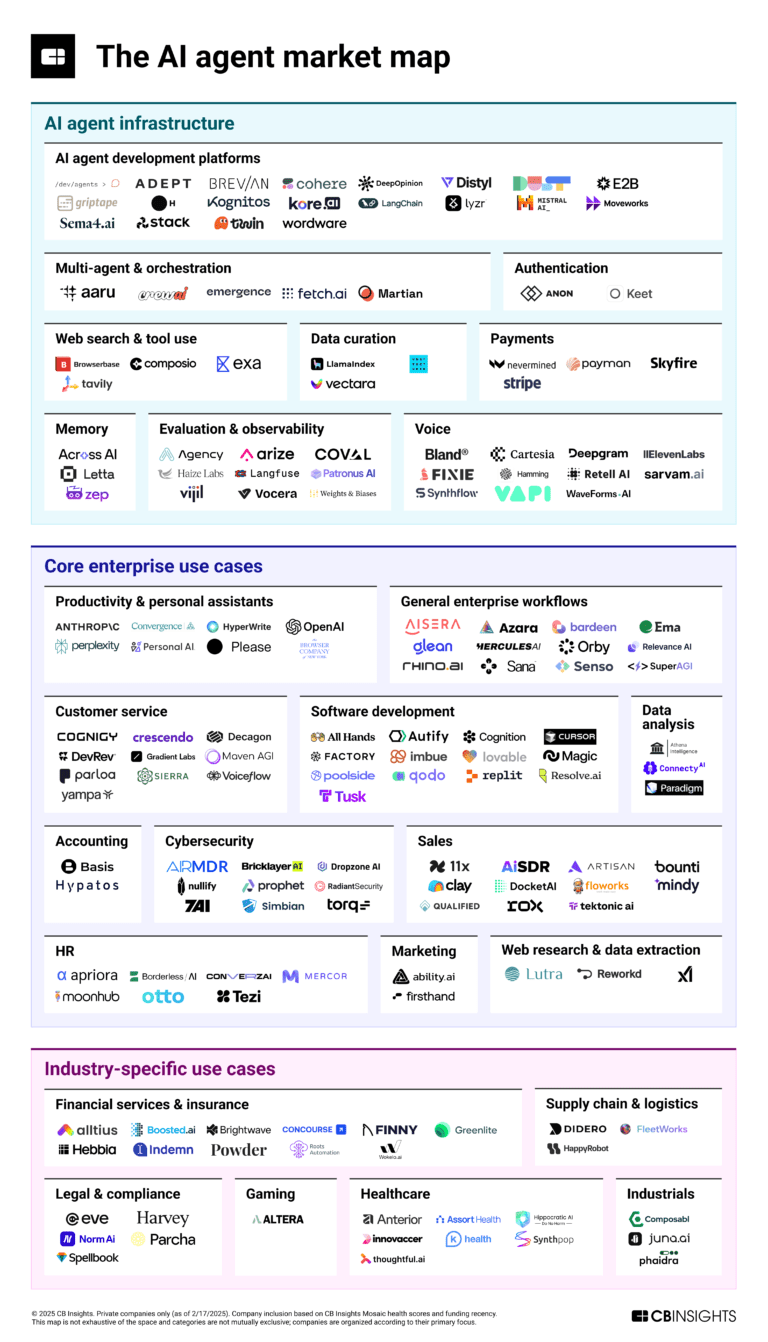

The AI agent market mapExpert Collections containing Skyfire

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Skyfire is included in 5 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

10,402 items

AI agents

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

AI 100 (2025)

100 items

Generative AI

2,826 items

Companies working on generative AI applications and infrastructure.

AI 100 (All Winners 2018-2025)

100 items

Latest Skyfire News

Aug 18, 2025

Powered by language models, automation frameworks and intelligent decision engines, AI agents are beginning to transact on behalf of individuals and businesses. They purchase software, pay for content and more. This new form of economic interaction is called "agentic commerce." If you're building a marketplace, software platform or online service, the critical question is no longer "How do I block bots?" but rather "How do I accept verified agents as paying customers?" How To Do Business With Verified Agents I've spent the last 15 years in fintech working at Bloomberg, building blockchain payment systems at Ripple that move hundreds of billions of dollars and exploring transformative tech at Berkeley and Stanford. I started Skyfire to solve a surprisingly big problem: AI agents still can't buy things online. Based on my experience, this article offers a practical, forward-looking guide for companies preparing for the next generation of commerce. Step 1: Define your agentic interface. The first decision you need to make is how AI agents will interact with your service. Broadly speaking, you have two choices: through your website or via an API/MCP (model context protocol) server. Web interfaces offer the advantage of reusing existing infrastructure. If your platform already supports human users making purchases or accessing content through a website, this might be the quickest path to agentic access. However, it requires adapting your bot protection layers to distinguish good agents from malicious bots and tweaking your checkout flow using an agentic commerce platform. APIs and MCP servers are inherently more agent-friendly but less ubiquitous than websites. They expose services in a structured, scalable way that's perfect for agent consumption. The tradeoff is that you must find a way to allow verified agents to get access to your APIs. This is where some payment processing protocols can help by allowing verified agents to get access credentials that leverage your existing authentication, rate-limiting and abuse-prevention mechanisms to ensure access doesn't lead to spam or scraping. In many cases, the best path is a hybrid approach: Expand your existing website to allow agent-compatible access and checkout while building key capabilities for agent access via APIs or MCP servers. Step 2: Make your interface discoverable. Just as SEO made websites discoverable to humans, agents need a way to find services they can safely and legally access. In the world of agentic commerce, discoverability means more than being indexed by search engines. It also helps to be listed in agent-friendly directories that allow agents to identify services that accept verified AI agents as users, offer programmatic access to resources (e.g., APIs, tools and content) and define clear requirements around identity and payment tokens. By registering your service in an agentic directory, you're effectively advertising to a new class of consumers. This step gives you a boost in tapping into the agent-driven economy. Step 3: Accept verified agents. The cat-and-mouse game of bot blocking is coming to an end. As agents become real economic actors, we need to shift from blunt-force blocking to intent-aware authentication. One possible solution is a tokenized identity. Some payment processing protocols can allow agents to pass a verified identity token with every HTTPS request. This token proves who the agent is acting on behalf of, determining whether that's a specific person, business or organization. If you're a website, you could work with bot protection providers to distinguish between malicious bots and verified agents. If you're operating an API or MCP server, consider working with auth providers and requiring identity tokens via an account creation endpoint for on-the-fly credentials via OAuth. This isn't just about security. It's about trust. When you know who the agent represents, you can apply existing access policies, pricing rules and personalization settings, just like you would for a human user. Step 4: Enable account creation via tokens. In most cases, agents will need to create accounts to access your services, especially if your platform supports fine-grained access control or persistent usage data. To support agent onboarding, expose a public create-account endpoint that accepts identity tokens and specifies required identity fields. These tokens carry structured identity fields (e.g., email and phone number) issued by a trusted provider. From there, you can link the new account to a verified principal and apply normal customer identity and access management (CIAM) flows. This token-based flow enables agents to onboard programmatically while still allowing you to enforce identity, rate limits and compliance. Step 5: Support agentic checkout. Agents work best with standardized checkouts instead of needing to dodge botblockers and captchas while filling out forms via screenscraping. They need an entirely programmatic checkout process. That means you must move beyond more brittle browser autofill and instead accept tokenized payments directly via API. These tokens can carry pre-authorized payment methods such as tokenized credit cards, digital wallets (e.g., Apple Pay and PayPal), stablecoins or on-chain assets and account-to-account transfers. When combined with identity tokens, these payment tokens allow agents to present a complete, scoped credential that you can inspect and charge instantly. Think Stripe Checkout but for AI. Building On Open Protocols I'm a strong believer that the best way to scale agentic commerce across the internet is through open standards. This isn't just an API—it's a bridge between agents and services. Open standards in the payment processing space can allow marketplaces, websites and SaaS platforms to accept tokenized credentials from agents, verify the identity of the principal and charge transparently. The Road Ahead Preparing for agentic commerce isn't just a matter of future-proofing. It's a chance to unlock new revenue streams that include agents purchasing content and data on behalf of users, AI workflows calling dozens of microservices per task and developer agents hiring other agents in open marketplaces. All of these require tokenized identity and payments. And from what I've been seeing, all of them are growing today. Agents are here and they want to buy, subscribe and transact. Will your platform be ready? Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?

Skyfire Frequently Asked Questions (FAQ)

When was Skyfire founded?

Skyfire was founded in 2024.

Where is Skyfire's headquarters?

Skyfire's headquarters is located at San Francisco.

What is Skyfire's latest funding round?

Skyfire's latest funding round is Seed VC - II.

How much did Skyfire raise?

Skyfire raised a total of $10M.

Who are the investors of Skyfire?

Investors of Skyfire include Crypto Startup Accelerator, Coinbase Ventures, FBG Invest, Intersection Growth Partners, Arrington Capital and 15 more.

Who are Skyfire's competitors?

Competitors of Skyfire include Visa.

What products does Skyfire offer?

Skyfire's products include The Financial Stack for AI Agents and 3 more.

Loading...

Compare Skyfire to Competitors

Druo is a financial technology company that provides direct-to-account payment networks. The company offers services that allow businesses to debit or credit bank accounts or digital wallets. Druo serves the financial services sector with its payment solutions. It was founded in 2021 and is based in Miami, Florida.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

UnionPay is an international company that operates in the financial services sector and provides digital wallet and account services. Users can store, convert, invest, and donate their digital assets. UnionPay provides access and adoption of digital assets through its services for individual and corporate clients. It is based in Campinas, Brazil.

Alternative Payments provides alternative payment solutions within the financial services industry. The company offers local payment methods and open banking solutions to facilitate transactions and cater to diverse consumer preferences. Alternative Payments serves the e-commerce sector and facilitates international transactions. It was founded in 1999 and is based in Pasadena, California.

Blackhawk Network (BHN) specializes in financial technology and operates within the payment solutions and technology sectors. The company offers products and services to improve sales, productivity, and customer loyalty through an integrated network that connects clients with their employees, sales channels, and customers across various platforms including in-store, online, and mobile. Blackhawk Network was formerly known as Blackhawk Marketing Services. It was founded in 2001 and is based in Pleasanton, California.

Loading...