Kraken

Founded Year

2011Stage

Secondary Market | AliveTotal Raised

$20.07MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-28 points in the past 30 days

About Kraken

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Loading...

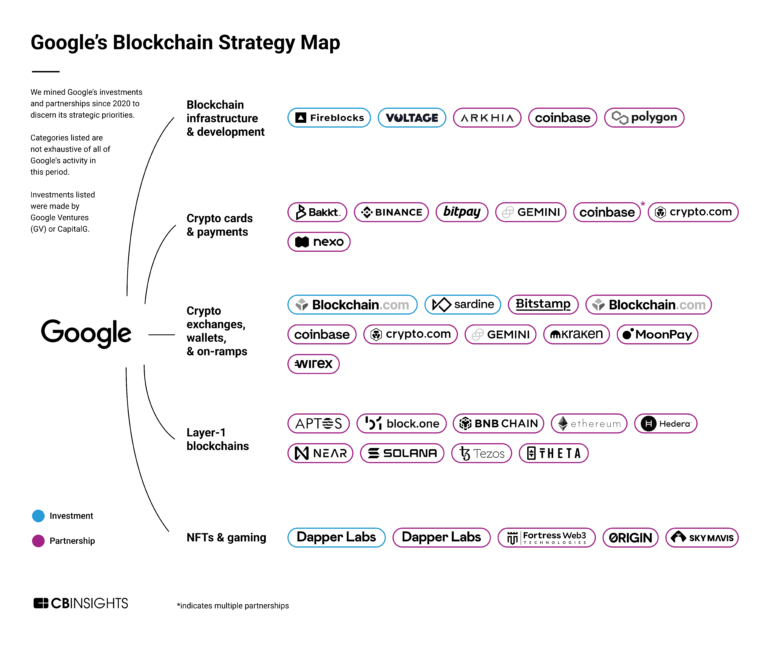

ESPs containing Kraken

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The institutional staking market provides enterprise-grade staking infrastructure and services to institutional investors, investment funds, exchanges, and crypto platforms seeking to earn yield on their digital assets. Companies in this market offer non-custodial and custodial staking solutions with institutional-grade security, compliance frameworks, multi-asset support, and specialized reportin…

Kraken named as Challenger among 15 other companies, including BitGo, Fireblocks, and Blockdaemon.

Loading...

Research containing Kraken

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kraken in 6 CB Insights research briefs, most recently on May 29, 2025.

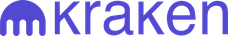

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

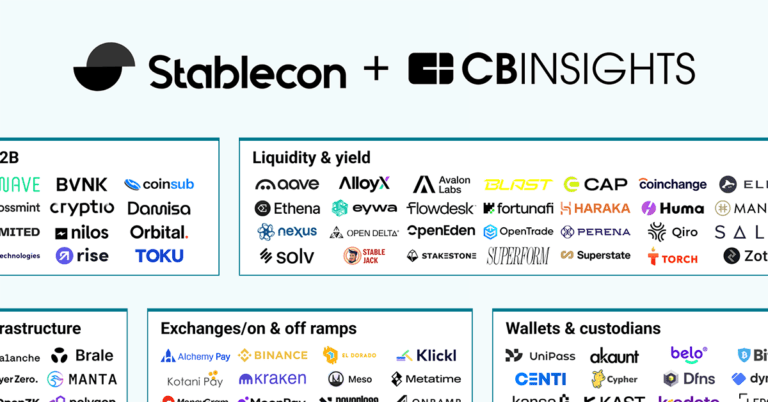

Apr 3, 2025 report

State of Venture Q1’25 Report

Oct 15, 2022

What is institutional staking?Expert Collections containing Kraken

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kraken is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Blockchain

10,236 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Stablecoin

450 items

Kraken Patents

Kraken has filed 27 patents.

The 3 most popular patent topics include:

- industrial gases

- chemical processes

- renewable energy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/27/2022 | 1/28/2025 | Automotive transmission technologies, Rotation, Engine technology, Gears, Mechanical power transmission | Grant |

Application Date | 10/27/2022 |

|---|---|

Grant Date | 1/28/2025 |

Title | |

Related Topics | Automotive transmission technologies, Rotation, Engine technology, Gears, Mechanical power transmission |

Status | Grant |

Latest Kraken News

Sep 7, 2025

Una nueva ley cripto en EEUU define cómo regular acciones y activos tokenizados El Senado de Estados Unidos avanza con la actualización de su proyecto de ley sobre criptomonedas, incorporando una disposición destinada a aclarar el tratamiento regulatorio de los activos tokenizados dentro de plataformas blockchain. Esta cláusula tiene como objetivo garantizar que acciones y otros valores mantengan su clasificación como tales, incluso cuando son tokenizados, evitando que se confundan con materias primas y queden bajo marcos regulatorios inadecuados para su naturaleza. Regulación de activos tokenizados en el Senado La medida representa un paso decisivo para empresas de activos digitales enfocadas en la tokenización, ya que confirma la aplicabilidad de las normativas tradicionales de valores, manteniendo coherencia con corredores de bolsa, sistemas de compensación y entornos de negociación. "Queremos que esto llegue al escritorio del presidente antes de que termine el año", expresó la senadora Cynthia Lummis , patrocinadora clave de la legislación, durante una entrevista televisiva, destacando la urgencia de establecer un marco regulatorio sólido. El proyecto, denominado Ley de Innovación Financiera Responsable de 2025, busca delimitar competencias entre la Comisión de Bolsa y Valores y la Comisión de Comercio de Futuros de Materias Primas (CFTC), según la naturaleza de los activos digitales. Lummis anticipó que el Comité Bancario del Senado podría votar este mes disposiciones vinculadas a la SEC, mientras que el Comité de Agricultura trataría en octubre los apartados relacionados con la CFTC, preparando el terreno para una votación general. De aprobarse este cronograma, la votación completa del Senado se realizaría en noviembre, lo que aceleraría la entrada en vigor de un marco legislativo esperado por gran parte de la industria y actores institucionales interesados en claridad regulatoria. Aunque la iniciativa aún no cuenta con apoyo demócrata pleno, Lummis resaltó la existencia de negociaciones bipartidistas: "Se han realizado esfuerzos para unir a demócratas y republicanos en determinadas cuestiones secundarias del proyecto de ley", puntualizó. El avance de estas conversaciones busca generar consenso suficiente para que la legislación logre apoyo transversal, consolidándose como un paso histórico hacia la regulación formal de criptomonedas y tokenización en Estados Unidos , en línea con tendencias internacionales. Reclamos de la industria cripto El mes pasado, una coalición de 112 empresas, inversores y organizaciones de defensa envió una carta al Senado exigiendo incorporar protecciones específicas para desarrolladores de software y proveedores de servicios no custodios en el nuevo marco regulatorio. La advertencia subrayó que normas financieras anticuadas podrían clasificar erróneamente a estos actores como intermediarios, imponiéndoles obligaciones inadecuadas y generando riesgos legales que desalienten la innovación en sectores estratégicos. Grandes compañías como Coinbase , Kraken, Ripple, a16z y Uniswap Labs respaldaron esta petición, señalando que la falta de reglas claras ya está provocando la salida de desarrolladores hacia otros mercados con marcos regulatorios más favorables. De acuerdo con cifras de Electric Capital citadas en la misiva, la participación de Estados Unidos en el ecosistema global de desarrolladores blockchain de código abierto descendió del 25 % en 2021 al 18 % en 2025, evidenciando un retroceso preocupante. Las acciones tokenizadas crecen un 220% Las acciones tokenizadas experimentaron un crecimiento explosivo de 220% desde junio y alcanzaron una capitalización de mercado de u$s370 millones, según el último informe mensual de Binance Research. Este aumento refleja un creciente interés en democratizar el acceso al mercado de acciones de Estados Unidos a través de activos digitales en blockchain. El impulso se vio favorecido por el reciente episodio de "Regulatory Clarity" emitido por la SEC, que apoya la integración de mercados de capital financiero en la cadena mediante iniciativas como el ‘Project Crypto’. En paralelo, el número de usuarios activos se disparó 56 veces, que pasó de 1.600 a más de 90.000, un crecimiento comparable al auge del sector DeFi en 2021. Entre los proveedores de acciones tokenizadas, Xstocks Finance se destaca como el más popular, especialmente en Europa y otros mercados fuera de Estados Unidos. De acuerdo con datos de Dune Analytics, el volumen total de negociación de Xstocks superó los u$s2.000 millones por primera vez lo que indicó un interés creciente entre los inversores. Temas relacionados

Kraken Frequently Asked Questions (FAQ)

When was Kraken founded?

Kraken was founded in 2011.

Where is Kraken's headquarters?

Kraken's headquarters is located at 100 Pine Street, San Francisco.

What is Kraken's latest funding round?

Kraken's latest funding round is Secondary Market.

How much did Kraken raise?

Kraken raised a total of $20.07M.

Who are the investors of Kraken?

Investors of Kraken include Fabrica Ventures, Bossa Invest, RIT Capital Partners, Soul Ventures, The 6ixth Event and 50 more.

Who are Kraken's competitors?

Competitors of Kraken include Circle, BurjX, Bitpanda, One Trading, Bitstamp and 7 more.

Loading...

Compare Kraken to Competitors

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Gemini is a cryptocurrency exchange and custodian in the financial technology sector. The company facilitates the buying, selling, and trading of various digital assets, including Bitcoin and Solana, while also offering services such as crypto staking and a cryptocurrency credit card. Gemini's platform serves individual and institutional investors for digital asset management. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

OKX is a cryptocurrency exchange platform that specializes in spot and derivatives trading within the financial ecosystem. The company offers a variety of services including cryptocurrency buying, selling, and trading, as well as providing a wallet for digital asset storage. OKX also provides advanced trading tools and features such as futures, options, and perpetual contracts to cater to a diverse range of trading strategies. OKX was formerly known as OKEx. It was founded in 2017 and is based in Mahe, Seychelles.

BlockFi is a financial services company that offers wealth management products for cryptocurrency investors, operating within the fintech and blockchain technology sectors. The company provides USD loans backed by cryptocurrency, interest-earning accounts for digital assets, and a platform for trading various cryptocurrencies. It was founded in 2017 and is based in Jersey City, New Jersey.

Loading...