Global banks are making big moves in blockchain this year. Several of the largest US banks such as Citigroup, Bank of America, and Wells Fargo are discussing issuance of a joint stablecoin. BBVA has partnered with Binance as an independent custodian for customers’ funds. And JPMorgan Chase just announced an unprecedented partnership with Coinbase to provide crypto services to 80 million customers.

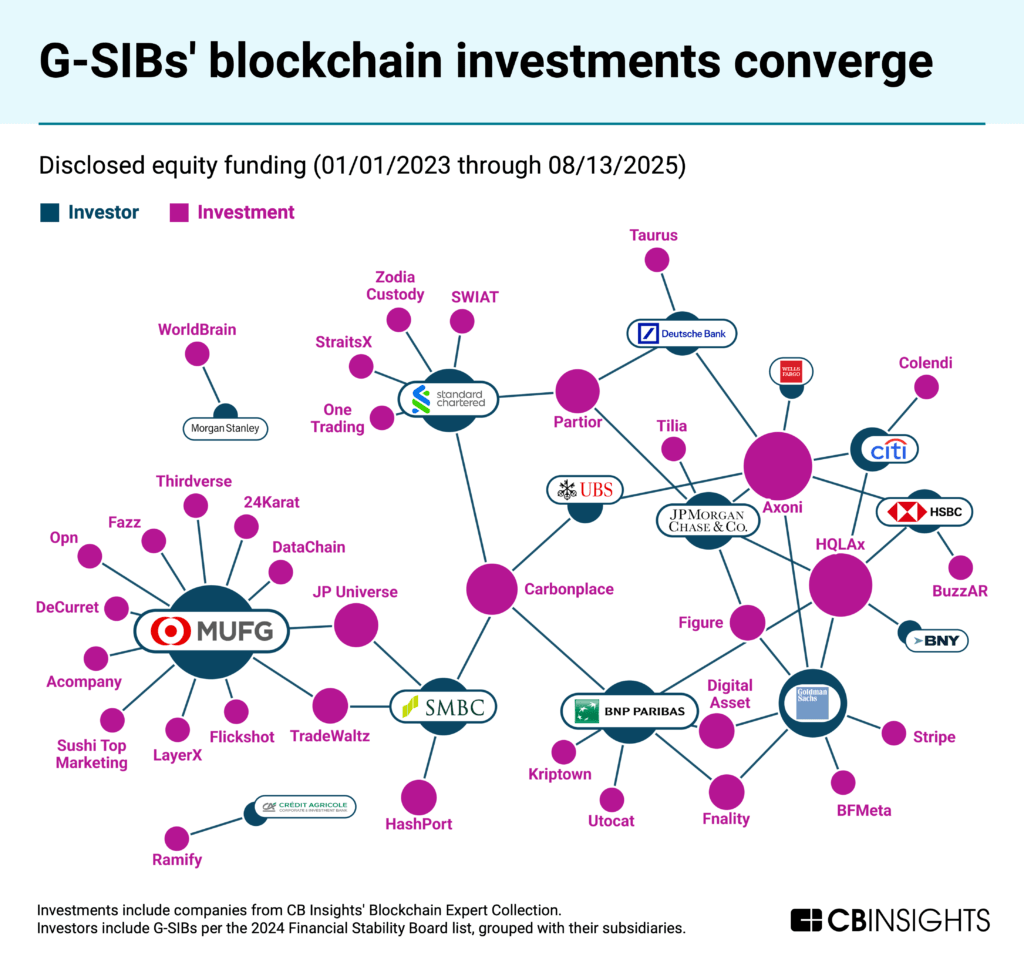

Yet this trend isn’t new — it’s been building for years with the 345 investments these institutions have made in the space between 2020 and 2024. In the visual below, we’ve highlighted the G-SIBs’ blockchain investments from 2023-present:

Using CB Insights Business Graph data, and in partnership with Ripple and the UK Centre for Blockchain Technologies, we used CB Insights Business Graph data to power Banking on Digital Assets, a report that explores how banks have made global investments in the digital asset ecosystem over a five-year period.

Download the report for an inside look at how, where, and why banks are investing in blockchain technology and digital asset applications.

If you aren’t already a client, sign up for a free trial to learn more about our platform.