Klarna’s IPO filing could signal the start of a new wave of buy now, pay later (BNPL) public debuts.

The BNPL leader’s listing is the first one for BNPL providers since Affirm in 2021 and follows Valu’s filing in June 2025. Regulators continue to raise concerns about BNPL’s impact on consumer debt, yet adoption keeps climbing. Nearly 90 million Americans used BNPL in 2024, up 7% year over year, and in certain global markets, usage is even higher.

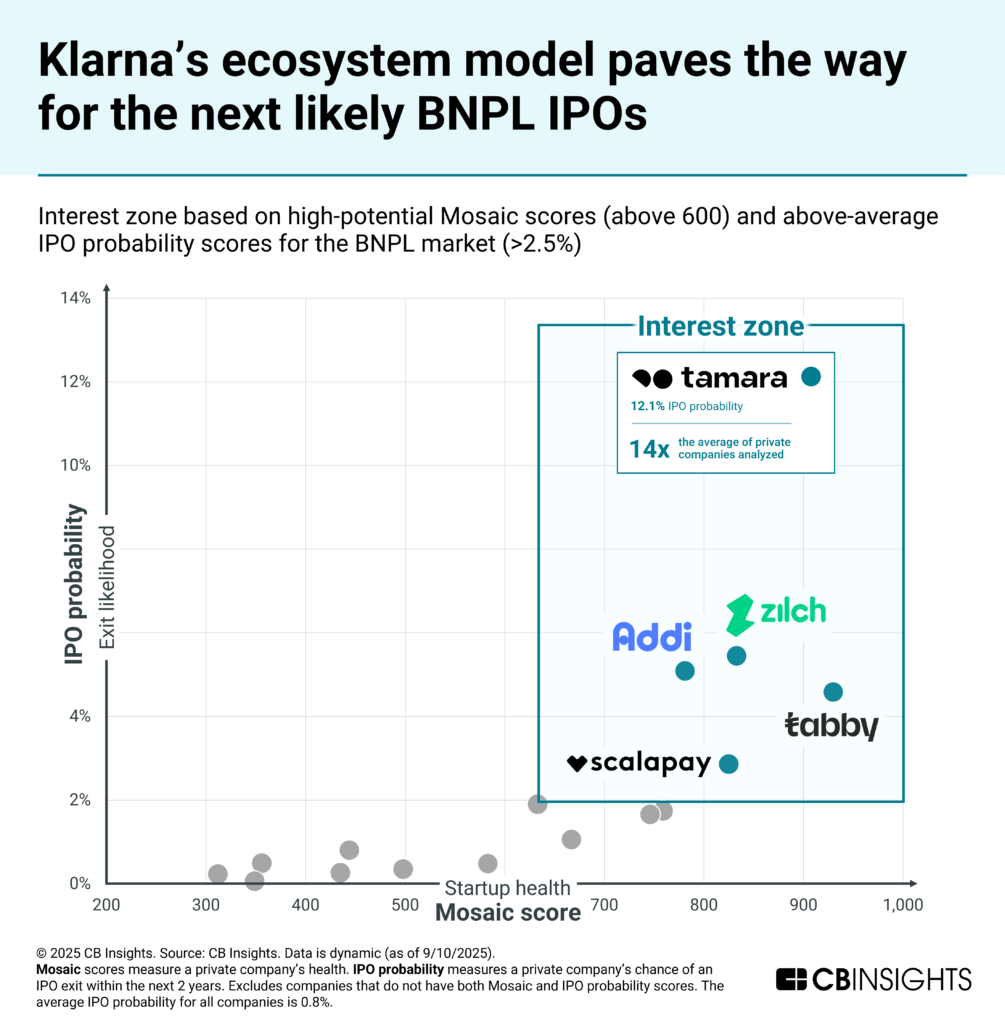

Despite the challenging market for exits overall, CB Insights’ IPO probability scores for the strongest BNPL companies are up to 14x the average for all companies. Using the IPO likelihood and CB Insights’ other predictive signals, including Mosaic scores, we’ve identified the BNPL platforms most likely to go public next and what their listings could reveal about the rest of the market.

Companies sourced from the CB Insights market for Buy now pay later (BNPL) — B2C payments.