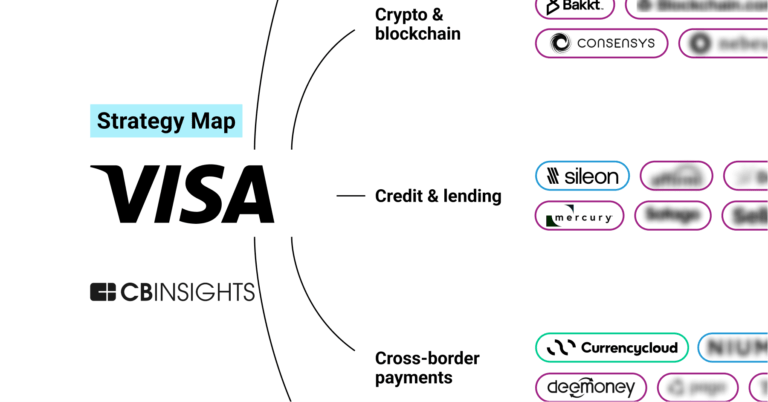

Blockchain.com

Founded Year

2011Stage

Series E | AliveTotal Raised

$600.5MValuation

$0000Last Raised

$110M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+7 points in the past 30 days

About Blockchain.com

Blockchain.com specializes in blockchain technology and cryptocurrency-related solutions. The company offers a platform where users can buy, sell, and swap cryptocurrencies like Bitcoin and Ethereum, as well as earn rewards on their cryptocurrency assets. It also provides a cryptocurrency wallet for the self-custody of digital assets and an exchange for trading in fiat currencies. It was founded in 2011 and is based in London, United Kingdom.

Loading...

ESPs containing Blockchain.com

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The web3 wallets market offers a decentralized solution for managing cryptocurrencies that is both user-friendly and secure. Prior to the emergence of web3 wallets, users had to choose between difficult-to-use decentralized options or centralized providers that were vulnerable to hacks and theft. Web3 wallets provide greater control over assets and enable faster innovation due to fewer technical, …

Blockchain.com named as Highflier among 15 other companies, including Coinbase, Ledger, and Binance.

Blockchain.com's Products & Differentiators

Blockchain.com Wallet

A non-custodial crypto wallet that supports Bitcoin, Ethereum, and other major assets. Enables users to send, receive, store, and swap crypto securely.

Loading...

Research containing Blockchain.com

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Blockchain.com in 5 CB Insights research briefs, most recently on Apr 3, 2025.

Expert Collections containing Blockchain.com

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Blockchain.com is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Blockchain

10,166 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

14,013 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Blockchain 50

100 items

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Blockchain.com Patents

Blockchain.com has filed 35 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- cryptography

- alternative currencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/28/2022 | 3/12/2024 | Wireless networking, Parallel computing, Network protocols, Network topology, Ethernet | Grant |

Application Date | 9/28/2022 |

|---|---|

Grant Date | 3/12/2024 |

Title | |

Related Topics | Wireless networking, Parallel computing, Network protocols, Network topology, Ethernet |

Status | Grant |

Latest Blockchain.com News

Aug 26, 2025

Created by industry experts and meticulously reviewed The highest standards in reporting and publishing How Our News is Made Strict editorial policy that focuses on accuracy, relevance, and impartiality Ad discliamer Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. A sudden move by a large holder and deep-pocketed early owners are being linked to a sharp wobble in Bitcoin prices this week. Related Reading Old Whales Hold Deep Profit According to Willy Woo, supply is tightly held by OG (“original gangster”) whales who built big positions around 2011 when Bitcoin traded at about $10. He warned that the gap in cost basis makes a difference: it now takes roughly $110,000 of fresh capital to absorb each Bitcoin those holders choose to sell. That math, he says, helps explain why price action has been slow even as overall market interest grows. According to market observers, a single whale’s rotation from Bitcoin into Ether helped trigger a rapid sell-off that briefly knocked roughly $45 billion off Bitcoin’s market cap. Why is BTC moving up so slowly this cycle? BTC supply is concentrated around OG whales who peaked their holdings in 2011 (orange and dark orange). They bought their BTC at $10 or lower. It takes $110k+ of new capital to absorb each BTC they sell. pic.twitter.com/7CbWXsvX2l Flash Crash Unfolded Quickly Based on reports, Bitcoin slid from $114,500to $112,980 in nine minutes, briefly touching $112,050, CoinMarketCap data shows. Ether fell 3.8% in the same window, dropping from $4,925 to $4,680. Prices later recovered about half of those losses. Traders point to a chain of transfers that set the move off. Whale Rotations And Large Transfers Blockchain.com records show that roughly 24,000 BTC — about $2.7 billion at the time — was sent to the decentralized perpetuals platform Hyperliquid across six transfers beginning Aug. 16. BTCUSD trading at $111,890 on the 24-hour chart: TradingView Of that sum, 18,142 BTC has been sold and much of the proceeds were rotated into 416,590 ETH, an analyst known as MLM reported. A chunk of those ETH — 275,500 — was staked, worth about $1.3 billion. Strategic Positioning And Big Gains It was also reported that the whale took on large leveraged positions, longing 135,260 ETH on Hyperliquid for a total exposure near 551,861 ETH, valued at more than $2.6 billion. That set up a trade that netted around $185 million, according to the same analyst. The longs boosted ETH prices as other traders followed the flows, and when the whale began closing positions, rapid reversals led to cascading sell orders. Related Reading Forces At Work Reports have disclosed the whale still controls 152,874 BTC across several addresses, and those funds originally moved off an exchange about six years ago. Market watchers say there are two forces at work: long-dormant holders sitting on massive unrealized gains, and active traders using large rotations to capture short-term moves. If more of the 152,874 BTC moves to market, sellers could test demand again. On the other hand, the amount of ETH being staked points to at least some longer-term intent from big players. Featured image from Meta, chart from TradingView They say journalists never truly clock out. But for Christian, that's not just a metaphor, it's a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn. Read more Christian's journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later). Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling - right up his alley! So, he landed a killer gig at NewsBTC, where he's one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill). Think Christian's all work and no play? Not a chance! When he's not at his computer, you'll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair. Speaking of chill, Christian's got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better. Here's the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day - and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies. Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors - and bosses - he deeply respects. So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one. Close Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk. Related News

Blockchain.com Frequently Asked Questions (FAQ)

When was Blockchain.com founded?

Blockchain.com was founded in 2011.

Where is Blockchain.com's headquarters?

Blockchain.com's headquarters is located at 145-157 St John Street, London.

What is Blockchain.com's latest funding round?

Blockchain.com's latest funding round is Series E.

How much did Blockchain.com raise?

Blockchain.com raised a total of $600.5M.

Who are the investors of Blockchain.com?

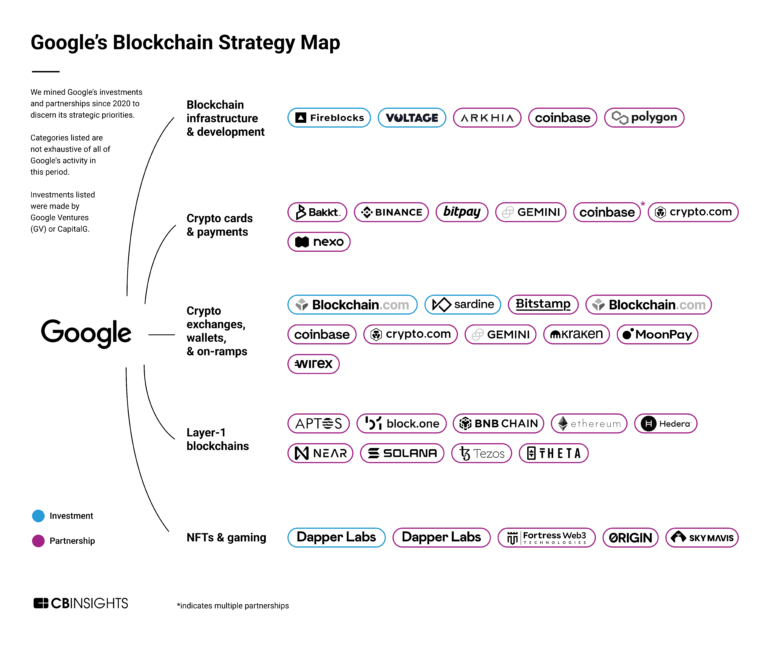

Investors of Blockchain.com include Lightspeed Venture Partners, Scottish Mortgage Investment Trust, R136 Ventures, Lakestar, Google Ventures and 34 more.

Who are Blockchain.com's competitors?

Competitors of Blockchain.com include Ledger and 8 more.

What products does Blockchain.com offer?

Blockchain.com's products include Blockchain.com Wallet and 4 more.

Loading...

Compare Blockchain.com to Competitors

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

BitPay provides cryptocurrency payment processing and digital wallet services within the financial technology (fintech) sector. It offers a platform for individuals and businesses to buy, store, swap, sell, and spend cryptocurrencies and tools for merchants to accept cryptocurrency payments. Its services are available to various sectors, including e-commerce and real estate technology. It was founded in 2011 and is based in Atlanta, Georgia.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

BitGo provides digital asset custody and financial services within the cryptocurrency sector. It offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. It serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

1WORLDBLOCKCHAIN (1WB) focuses on providing digital payment solutions and asset management using blockchain technology. The company offers a digital payment platform that facilitates multicurrency transactions and an e-wallet for both banked and unbanked users. It also offers services in crypto yield farming, cross-chain bridge services, and a non-fungible token (NFT) marketplace. It was founded in 2017 and is based in New York, New York.

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Loading...