X-energy

Founded Year

2009Stage

Series C - VI | AliveTotal Raised

$1.084BLast Raised

$22.8M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+131 points in the past 30 days

About X-energy

X-energy focuses on advanced nuclear reactor and fuel design engineering within the energy sector. The company specializes in developing Generation IV temperature gas-cooled nuclear reactors, known as small modular reactors (SMR), and TRISO fuel to power them. Its reactors are designed with safety features and are complemented by TRISO fuel that can withstand extreme temperatures. It was founded in 2009 and is based in Rockville, Maryland.

Loading...

ESPs containing X-energy

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The small modular reactor (SMR) developers market develops advanced nuclear reactors with power outputs typically under 300 MW per unit. These reactors feature modular designs enabling factory construction and transportation to deployment sites, with enhanced safety systems, reduced construction times, and flexible applications. SMR developers serve utilities, industrial companies, and government …

X-energy named as Leader among 15 other companies, including NuScale Power, TerraPower, and Terrestrial Energy.

Loading...

Research containing X-energy

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned X-energy in 3 CB Insights research briefs, most recently on Jul 10, 2025.

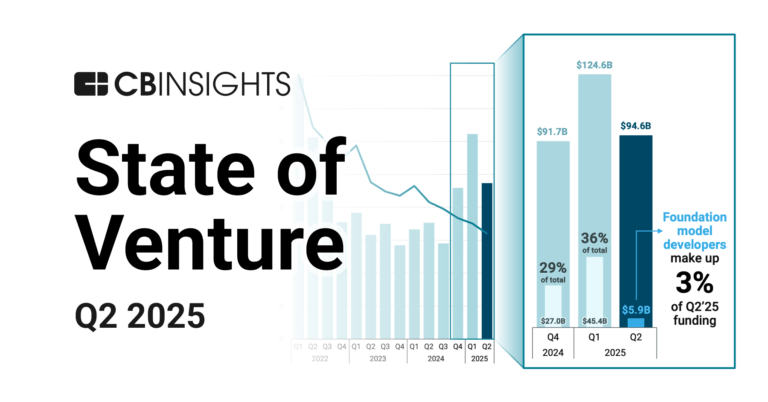

Jul 10, 2025 report

State of Venture Q2’25 Report

Feb 6, 2025 report

State of Climate Tech 2024 ReportExpert Collections containing X-energy

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

X-energy is included in 2 Expert Collections, including Oil & Gas Tech.

Oil & Gas Tech

4,702 items

Companies in the Oil & Gas Tech space, including those focused on improving operations across upstream, midstream, and downstream sectors, as well as those working on sustainable fuels.

Renewable Energy

4,803 items

X-energy Patents

X-energy has filed 24 patents.

The 3 most popular patent topics include:

- nuclear materials

- nuclear technology

- nuclear power reactor types

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/2/2023 | 4/1/2025 | Designer drugs, Acetylcholinesterase inhibitors, Gas technologies, Sensors, Industrial gases | Grant |

Application Date | 5/2/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Designer drugs, Acetylcholinesterase inhibitors, Gas technologies, Sensors, Industrial gases |

Status | Grant |

Latest X-energy News

Sep 7, 2025

Tech need spurs reactor rethink 6 minutes ago by Will Wade and Navya Menon Bloomberg (WPNS) Keep up with this topic Enter your email below to follow similar stories Sign Up Let us read it for you. Listen now. Your browser does not support the audio element. Centrus Energy Corp.'s facility in Ohio is large enough to house 11,000 centrifuges, the machines that create nuclear fuel. Right now, there are just 16 spinning away to produce a type of next-generation enriched uranium. But the remaining space could eventually be filled with many more. Rising interest in nuclear energy from both the Trump administration and consumers -- notably power-hungry tech companies trying to compete in artificial intelligence -- is spurring dozens of companies in the U.S. to develop innovative, advanced reactor designs. Many of those prototypes will require Haleu, or high-assay low-enriched uranium, and that's where Centrus comes in. Haleu supply is currently limited, and demand even more so, but that may be beginning to change. The U.S. Energy Department made conditional commitments to supply Haleu to three projects in late August. The agency made a similar deal with five other companies in April, including startup Radiant Industries Inc. The deal is a promising signal for the U.S. nuclear industry and companies that produce or consume Haleu. "We're really at this juncture, where the companies are there," said Rita Baranwal, Radiant's chief nuclear officer. "The appetite for Haleu in the market has grown substantially." Nuclear reactors rely on a specific isotope to sustain a fission chain reaction -- uranium-235 -- but it accounts for just 0.7% of the raw ore mined from the ground. There's a complex, multistep process to turn that into fuel, and the most critical part is enrichment, which boosts the concentration. Conventional reactors in service now use fuel with a 5% concentration, known as low-enriched uranium. For Haleu, it's about 20%. Demand for nuclear power is increasing due to the growing need for electricity for factories, more electrified homes, and especially the surge in data centers coming online. Radiant is developing a 1 megawatt microreactor, tiny compared with the nuclear plants in service now that typically have about 1 gigawatt of capacity. The El Segundo, Calif.-based company says its Kaleidos reactor can be delivered in a standard shipping container, and used to provide power to small data centers, military bases, disaster relief efforts and other remote sites. It expects to take delivery of the relatively small amount of Haleu this month and begin testing the first demonstration system at Idaho National Laboratory next spring. If demand for the fuel really starts to take off, the industry will likely lean heavily on Centrus, the only U.S. company approved to make Haleu. The company's Haleu production line went into service in 2023, long before anyone needed the fuel. It's only making a small amount now, but says it's ready to boost output as soon as demand starts to emerge. That moment may finally be close, according to Matt Snider, Centrus' enrichment operations plant manager. "They know they need it, and we know we can produce it," he said of Haleu. Yet, he added with a note of caution, "there are some hurdles." The main one is that no company has permission to build a commercial reactor that will use Haleu. And it's unclear when one will get approvals from regulators, let alone build a power plant that uses the advanced fuel. Radiant expects to deliver a commercial system in 2028, though it has yet to receive a Nuclear Regulatory Commission license. X-Energy LLC, another advanced reactor company selected by the Energy Department to receive Haleu, has deals to provide reactors for Dow Inc. and Amazon.com Inc. But developing nuclear power plants is a long, slow process, and the company's first one -- which will power a Dow chemical plant in Texas -- isn't expected to be in service until the early 2030s. The market dynamics are complicated by ongoing tensions with Russia, which currently controls about 44% of the world's enrichment capacity and supplies 20% of the fuel used in U.S. reactors. There's only one enrichment plant in the U.S. making conventional nuclear fuel, and the nation has sought to expand its capacity since the 2022 invasion of Ukraine, as have European countries. To spur the development of a domestic supply chain for all types of nuclear fuel, former President Joe Biden imposed a ban on Russian enriched uranium last year, though many companies have import waivers through 2028. That effort will be aided by $3.4 billion that Congress has allocated to help Haleu suppliers build out their production lines. The money was allocated under Biden, but it has yet to be distributed by the Energy Department. "We're in a nuclear renaissance," said Snider. "We need to develop a domestic enrichment supply chain." The Biden administration last year also set a goal to triple U.S. nuclear capacity by 2050, and atomic energy has been a rare area of overlap with his successor. With demand for electricity surging, President Donald Trump in May issued a set of executive orders aimed at quadrupling output from reactors. The industry is preparing for a construction surge of both conventional and next-generation reactors, and all of them are going to need uranium fuel. There are other advancements in nuclear fuel that are receiving federal support. In early August, Oak Ridge, Tenn.-based Standard Nuclear Inc. became the first manufacturer tapped by the U.S. Energy Department to scale production of TRISO fuel -- poppy-seed-sized uranium beads that burn hotter and longer than conventional fuel. The fuel is made using Haleu, some of which it's sourcing from Centrus. Standard Nuclear -- which emerged from the bankruptcy proceedings of Ultra Safe Nuclear Corp. -- has already drawn orders to produce TRISO and is working with advanced-reactor designers including Radiant, France's Jimmy Energy and New York-based Nano Nuclear Energy Inc. In late August, the Energy Department made a conditional commitment to supply Standard with Haleu. The empty space at Centrus' Piketon, Ohio, facility reflects classic early-market economics, according to Adam Stein, director of the Breakthrough Institute's nuclear energy innovation program. The company is making small amounts of the fuel as a bet that there will eventually be demand. That in turn provides an important signal to potential customers developing reactor technologies that the fuel will be available. The key question for Centrus is when to invest in expanding production. The Energy Department announced support for 11 advanced reactor pilot projects last month, including the Radiant test system, and many of them will require Haleu. They're seeking to switch on the reactors by mid-2026, which means the companies will need fuel very soon. But pilots are typically one-off projects that don't always translate into long-term sales contracts that might justify a major investment in production capacity for Centrus. "The fuel production companies want a larger and more stable market before they invest," said Stein. The 16 Centrus centrifuges can make about 1,980 pounds of Haleu annually, and the site has produced a metric ton of it to date. The Energy Department has purchased all of it, but with no use for it now, it sits in storage at Centrus' Piketon facility. X-Energy has already lined up its fuel supply for the Dow project from the Energy Department. Ben Reinke, an X-Energy senior vice president, said the company would be getting "several tons," which would be enough for "several years," though he wouldn't provide specific details. The company and its peers are carefully watching the emerging fuel-supply market. Besides Centrus, the British, Dutch and German consortium Urenco Ltd. is developing a Haleu production site in the U.K. that's expected to go into service in the early 2030s. The more options, the better, said Reinke. "We are confident there will be material available when we need it," he said. "Everyone is confident the market is developing." Once it's clear that the market is starting to develop, Centrus says will be ready to expand. The company makes its own centrifuges and has already invested $60 million to expand its internal supply chain. It plans to install them in a series of so-called cascades of 120 centrifuges. The first cascade will take about 42 months to install, and Snider said it would take six to seven years to fill the entire facility with 11,000 centrifuges. For now, though, the Centrus site is vast and mostly empty, but Snider can picture what full capacity will look like. "It's going to be a forest of tall, white centrifuges," he said. Information for this article was contributed by Jonathan Tirone of Bloomberg (WPNS).

X-energy Frequently Asked Questions (FAQ)

When was X-energy founded?

X-energy was founded in 2009.

Where is X-energy's headquarters?

X-energy's headquarters is located at 530 Gaither Road, Rockville.

What is X-energy's latest funding round?

X-energy's latest funding round is Series C - VI.

How much did X-energy raise?

X-energy raised a total of $1.084B.

Who are the investors of X-energy?

Investors of X-energy include IBX, Pittco Management, Ares Management, Alumni Ventures, The Climate Pledge and 19 more.

Loading...

Loading...