Wokelo

Founded Year

2022Stage

Convertible Note | AliveTotal Raised

$12.08MLast Raised

$5.08M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+371 points in the past 30 days

About Wokelo

Wokelo provides an investment research platform operating in the financial services sector. The company focuses on research workflows such as due diligence, sector research, and portfolio monitoring, using its proprietary large language model (LLM) based agents for data curation, synthesis, and triangulation. It serves private equity funds, investment banks, consulting firms, and corporates, assisting them in making informed decisions. It was founded in 2022 and is based in Seattle, Washington.

Loading...

ESPs containing Wokelo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI investment intelligence platforms market develops AI-powered solutions that assist investors in research, analysis, and decision-making. These platforms leverage generative AI, copilots, machine learning, and advanced algorithms to analyze financial data, generate investment insights, predict market movements, and provide personalized investment strategies. By automating research processes …

Wokelo named as Challenger among 15 other companies, including Bloomberg, BlackRock, and Morningstar.

Wokelo's Products & Differentiators

Company Research

LLM agent to create company research deliverable

Loading...

Research containing Wokelo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Wokelo in 2 CB Insights research briefs, most recently on Aug 29, 2025.

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

Mar 6, 2025

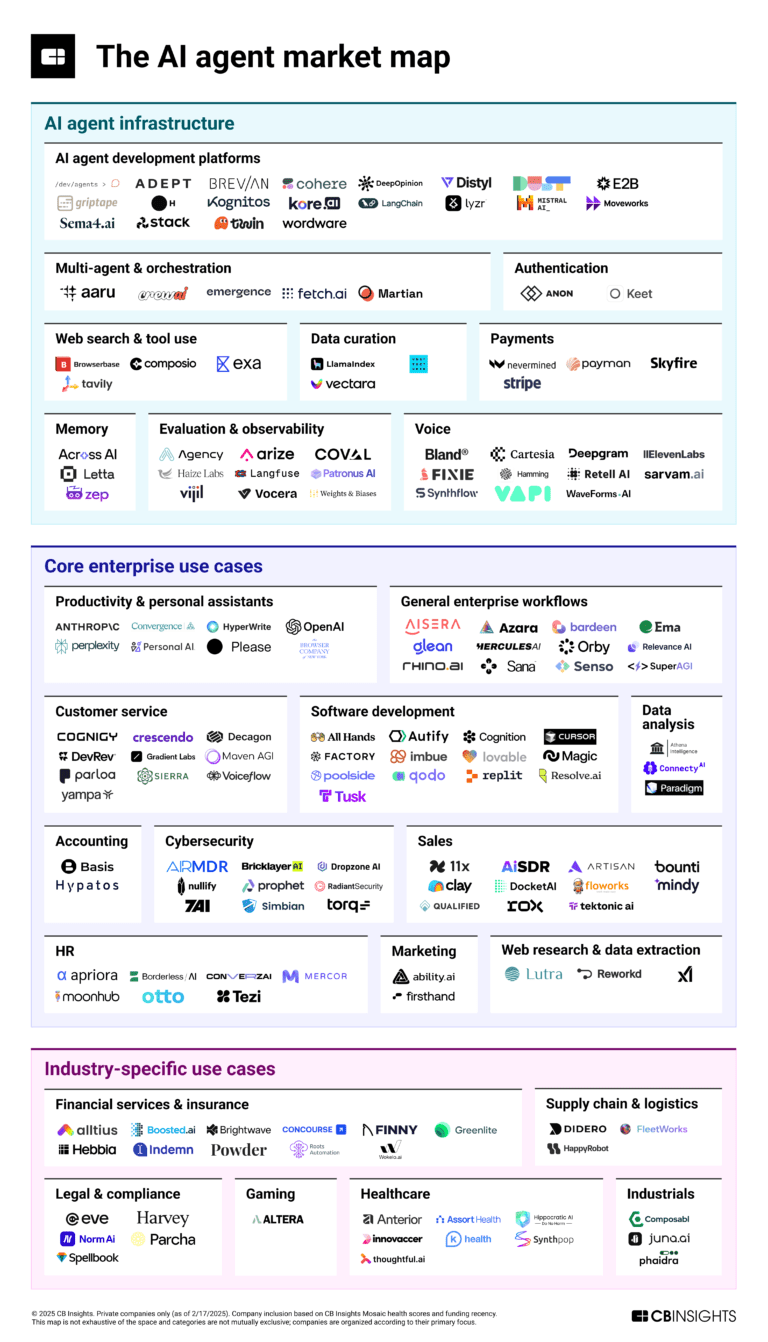

The AI agent market mapExpert Collections containing Wokelo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Wokelo is included in 7 Expert Collections, including Generative AI.

Generative AI

2,826 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence

10,402 items

AI Agents & Copilots Market Map (August 2024)

322 items

Corresponds to the Enterprise AI Agents & Copilots Market Map: https://app.cbinsights.com/research/enterprise-ai-agents-copilots-market-map/

AI agents

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Fintech

9,776 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Capital Markets Tech

1,062 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Latest Wokelo News

Aug 27, 2025

Nakajima, the Seattle-area venture capitalist at Untapped Capital , started experimenting with generative AI tools in 2022 — before ChatGPT became mainstream. These days he and his colleagues are using AI tools for just about everything: sourcing and assessing deals, data entry, marketing, and more. Perhaps most unique is the way Nakajima builds and tests his own AI-powered ideas in public . For example, he vibe-coded a startup intelligence platform earlier this year — VCpedia — and went viral for Baby AGI , a popular open source autonomous agent project he released in 2023. Untapped has also rolled out custom GPTs, including “ Mean VC ,” which helps startups refine their pitches and ideas. “Founders love using it,” Nakajima said. Building in public has not only helped Nakajima get access to developer communities and identify trends — “we are treated like builders ourselves,” he said — but also acts as a valuable strategy for Untapped. “It's both R&D and marketing and relationship-building all tied into one,” he said. “And it allows us to have a strong pulse on how AI is used. When we share how we use AI, we get a lot of feedback from others on their experiences.” It's also led to investments. Untapped was building due diligence tools with AI and got introduced to Wokelo , a Seattle-based startup that was developing a similar product. Untapped invested in Wokelo's pre-seed round in 2023. For other firms or companies looking to integrate AI into their own workflows, Nakajima encourages execs to lead by example. When he started getting questions from his colleagues that ChatGPT could answer, he'd start a thread with the bot and then share it with the team. “By seeing me use ChatGPT regularly, and seeing the benefit of it, my team started to pick it up,” he said. Nakajima is betting that companies will increasingly use AI to get work done. “We'll continue to see deep integrations of AI into human workflows, to a point where we'll see AI doing more work than humans,” he said. Nakajima said he's interested in trends around agents and authorization; AI governance at larger companies, and consumer apps in industries such as film, gaming, or music that are native to generative AI. Untapped describes itself as a pre-seed generalist investor focused on U.S. startups. It raised $9.5 million for its first fund, making 36 investments, and is currently investing out of its second fund.

Wokelo Frequently Asked Questions (FAQ)

When was Wokelo founded?

Wokelo was founded in 2022.

Where is Wokelo's headquarters?

Wokelo's headquarters is located at 92 Lenora Street, Seattle.

What is Wokelo's latest funding round?

Wokelo's latest funding round is Convertible Note.

How much did Wokelo raise?

Wokelo raised a total of $12.08M.

Who are the investors of Wokelo?

Investors of Wokelo include Array Ventures, Untapped Capital, Pack Ventures, KPMG, WellFound and 8 more.

Who are Wokelo's competitors?

Competitors of Wokelo include Auquan, AlphaSense, Hebbia, Canoe Intelligence, FloQast and 7 more.

What products does Wokelo offer?

Wokelo's products include Company Research and 1 more.

Loading...

Compare Wokelo to Competitors

AlphaSense is a market intelligence and search platform that uses artificial intelligence (AI) and natural language processing (NLP) technology to provide insights across various sectors. The company offers tools for financial research, including access to equity research, expert call transcripts, and the ability to integrate and analyze internal content alongside public data. AlphaSense serves the financial services, asset management, consulting, and corporate sectors with its market intelligence solutions. It was founded in 2011 and is based in New York, New York.

Generative Alpha operates at the intersection of finance and artificial intelligence. It provides services that convert raw data into usable insights, utilizing predictive models based on private data. The primary clients include sectors that need advanced financial solutions. It was founded in 2023 and is based in San Francisco, California.

Cabernet.ai uses artificial intelligence (AI) to assist in the deal discovery and execution process within the financial sector. The company provides a platform that helps users find, analyze, and close deals based on financial data. It was founded in 2024 and is based in Boulder, Colorado.

Alchemy Research & Analytics operates as a knowledge outsourcing firm focused on data analysis and insights within various business sectors. The company provides services such as market forecasting, cash flow analysis, fund raising support, strategic planning, budget accounting, and target marketing. Alchemy Research & Analytics primarily serves investment banks, private equity and venture capital firms, and corporate clients across different industries. It was founded in 2014 and is based in Durgapur, India.

Auquan provides artificial intelligence (AI)-driven solutions for the financial services industry, focusing on automating workflows in investment and credit prescreening, due diligence, risk monitoring, and compliance. The company offers AI agents that manage tasks such as generating investment committee memos, conducting due diligence, monitoring portfolio performance, and ensuring compliance with financial covenants. Auquan's technology is used by financial institutions, including private equity firms, asset managers, and investment banks, to streamline operations. It was founded in 2018 and is based in London, United Kingdom.

Hebbia offers tools that use generative artificial intelligence to assist with workflows, analyze documents, and provide insights. It serves industries such as asset management, legal, real estate, and corporate consulting, offering artificial intelligence (AI) solutions for their needs. It was founded in 2020 and is based in New York, New York.

Loading...