Uplift

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$292.7MValuation

$0000About Uplift

Uplift develops a fintech marketing platform for traveling purposes. The platform offers a buy now pay later scheme for travel through its partner websites and avails a range of payment plans. The company was founded in 2014 and is based in Sunnyvale, California. In July 2023, Uplift was acquired by Upgrade.

Loading...

Uplift's Product Videos

ESPs containing Uplift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Uplift named as Challenger among 15 other companies, including Klarna, Affirm, and Synchrony.

Uplift's Products & Differentiators

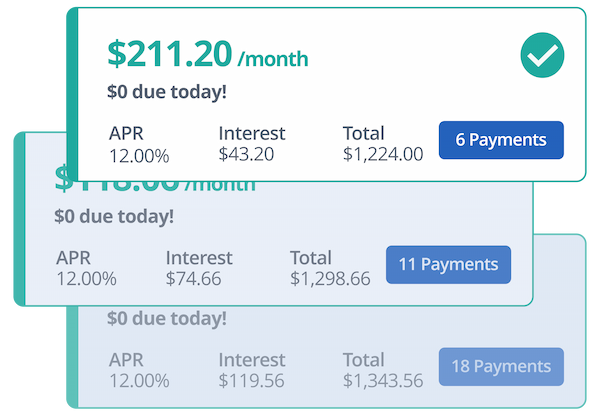

Pay Over Time

Monthly installment plan from 3 - 24 months with consumer funded interest from 7% - 36%. Min installment amount $100, maximum installment amount $25,000.

Loading...

Research containing Uplift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uplift in 1 CB Insights research brief, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Uplift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uplift is included in 5 Expert Collections, including Travel Technology (Travel Tech).

Travel Technology (Travel Tech)

2,715 items

The travel tech collection includes companies offering tech-enabled services and products for tourists and travel players (hotels, airlines, airports, cruises, etc.). It excludes financial services and micro-mobility solutions.

Digital Lending

2,661 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Uplift Patents

Uplift has filed 14 patents.

The 3 most popular patent topics include:

- analog circuits

- electric power conversion

- electronic amplifiers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/15/2021 | 9/3/2024 | Semiconductor lasers, Solar phenomena, Diagrams, Total solar eclipses, Irregular military | Grant |

Application Date | 4/15/2021 |

|---|---|

Grant Date | 9/3/2024 |

Title | |

Related Topics | Semiconductor lasers, Solar phenomena, Diagrams, Total solar eclipses, Irregular military |

Status | Grant |

Latest Uplift News

Jul 28, 2025

Rapid Growth of BNPL in 2025 Analysts expect the global BNPL market to expand reflecting a compound annual growth rate around 48 percent. Adoption of BNPL across sectors beyond retail is a key trend this year, especially in travel, healthcare, and education. Despite expectations for slower growth ahead, eMarketer still projects BNPL payment volume to rise by approximately 15 percent in 2025. Why Travel Is a Natural Fit for BNPL Travel is both emotional and expensive. Consumers often purchase flights and accommodation months before departure. BNPL removes friction at purchase by offering structured payments. For budget-conscious or younger travelers, it offers flexibility and aligns with modern spending habits. Research suggests Gen Z and Millennials are significantly more likely to use BNPL for travel than older demographics. One study indicates they are nearly 50 percent more likely to choose pay-later options when booking trips. How Fintech Firms Are Embedding BNPL in Travel Companies including Uplift, Zip, and Klarna now partner with airlines and online travel agencies to embed pay-later options into booking flows. These integrations eliminate the need for traditional credit at checkout. Travel-first platforms also enable users to select regional pay-later services at booking. That includes options like GrabPay Later in Southeast Asia or Afterpay and Zip in Australia. Many offer clear terms and no processing fees, aligning with traveler expectations. Some newer platforms also enable users to select regional pay-later services at booking. One example is Fly Fairly, a travel site that integrates BNPL options like GrabPay Later and Zip, offering transparent pricing and no added payment fees. Consumer Behavior and Demographics While BNPL gained traction through retail, travel-oriented usage is shaping a distinct profile. Urban, multicultural families earning under USD 60,000 annually are among the most active BNPL users across purchase types. These households rely on flexible payments to smooth consumption cycles. Convenience remains a key driver. Users who trust BNPL often spend more readily across platforms, including flights and hotel bookings. Risk Factors and Regulatory Considerations The popularity of BNPL is prompting regulatory scrutiny. In the U.S., FICO will begin incorporating BNPL loans into credit scores from fall 2025. That change may affect Gen Z consumers most, as they account for the majority of BNPL use and may carry multiple concurrent plans. While default rates remain low—typically under 2 percent—they are rising. Late payments increased to roughly 25 percent in recent years. Missed payments now trigger more alerts from traditional lenders and credit bureaus. Why BNPL Matters to Travel Providers Integrating BNPL delivers measurable benefits for travel businesses. It boosts conversion, increases average booking value, and helps reduce abandonment. Travel platforms that embed pay-later at checkout blend fintech features with commerce to drive loyalty and satisfaction. The term embedded finance describes this seamless experience. When BNPL becomes core to the payment flow, customer trust increases. But providers must ensure clear disclosure and support for refunds or cancellations, especially given travel’s complexity. What Lies Ahead for Travel and BNPL By embedding flexible payments, travel brands are reshaping expectations. The next wave may include embedded insurance, loyalty financing, real-time payouts, and AI-powered financing tools designed for context-aware booking experiences. As travel demand grows, payment methods beyond cards and wire transfers will define competitive advantage. BNPL systems that offer transparency, regional options, and responsible lending will win long-term trust. What This Means for Fintech and Travel The travel sector’s embrace of BNPL is a turning point for fintech and tourism alike. For travelers, it translates to manageable cash flow and reduced financial friction. For companies, it means higher bookings and stronger engagement. As regulators tighten oversight and fintech products mature, BNPL may evolve into a mainstream payment option for booking flights, lodging, and travel packages.

Uplift Frequently Asked Questions (FAQ)

When was Uplift founded?

Uplift was founded in 2014.

Where is Uplift's headquarters?

Uplift's headquarters is located at 440 N. Wolfe Road, Sunnyvale.

What is Uplift's latest funding round?

Uplift's latest funding round is Acquired.

How much did Uplift raise?

Uplift raised a total of $292.7M.

Who are the investors of Uplift?

Investors of Uplift include Upgrade, Atalaya Capital Management, Paycheck Protection Program, PAR Capital, DNX Ventures and 11 more.

Who are Uplift's competitors?

Competitors of Uplift include Kadogo and 7 more.

What products does Uplift offer?

Uplift's products include Pay Over Time and 1 more.

Loading...

Compare Uplift to Competitors

Zilch provides buy now pay later services across various online retail sectors. The company offers a payment solution that allows customers to make purchases and pay for them over six weeks. It primarily serves the ecommerce industry with its virtual Mastercard. The company was founded in 2018 and is based in London, United Kingdom.

Klarna provides buy now pay later services and payment options within the ecommerce industry. The company offers products that enable consumers to make purchases online and pay in installments, as well as tools for secure shopping. Klarna's technology is used by various global retailers. Klarna was formerly known as Kreditor. It was founded in 2005 and is based in Stockholm, Sweden.

Anyday is a financial technology company specializing in consumer finance solutions within the retail sector. The company offers services that allow customers to split their purchases into multiple payments without interest or fees. Anyday primarily serves the ecommerce industry, providing payment options to consumers at various online stores. It was founded in 2020 and is based in Denmark.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

Partial.ly is a business focused on providing payment plan software within the financial technology sector. The company offers installment payment solutions for e-commerce and invoicing, allowing customers to pay at their own pace. Partial.ly primarily serves the e-commerce and invoicing sectors. It was founded in 2015 and is based in Tampa, Florida.

Butter focuses on financial services in the e-commerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the e-commerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, United Kingdom.

Loading...