Upgrade

Founded Year

2016Stage

Series F | AliveTotal Raised

$550.5MValuation

$0000Last Raised

$280M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+50 points in the past 30 days

About Upgrade

Upgrade specializes in personal loans and credit card products. The company offers financial services including personal loans, credit card options, and savings accounts. Upgrade primarily serves individuals seeking solutions such as debt consolidation, home improvements, or major purchases. It was founded in 2016 and is based in San Francisco, California.

Loading...

ESPs containing Upgrade

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The home improvement financing market provides loans, credit lines, and payment solutions to fund home renovation, remodeling, and repair projects. Companies in this market offer personal loans, specialized renovation financing, contractor point-of-sale solutions, and buy-now-pay-later options to homeowners and contractors. These solutions enable property improvements without requiring large upfro…

Upgrade named as Leader among 12 other companies, including LendingClub, Synchrony, and SoFi.

Upgrade's Products & Differentiators

Upgrade Card

Upgrade Card is the only credit card that is "good for you": it comes with low-cost credit and helps consumers pay down their balance faster

Loading...

Research containing Upgrade

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Upgrade in 2 CB Insights research briefs, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Upgrade

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Upgrade is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

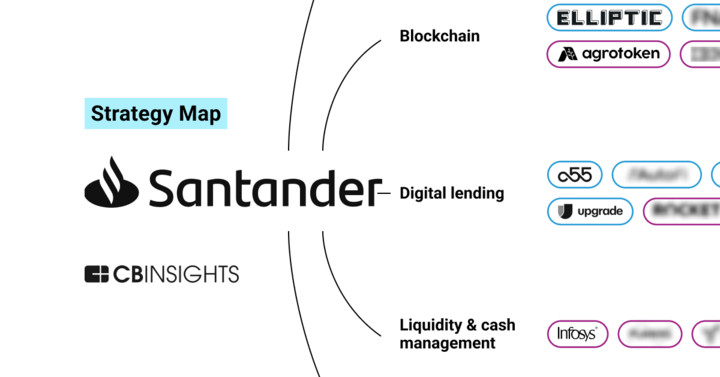

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Future Unicorns 2019

50 items

Upgrade Patents

Upgrade has filed 4 patents.

The 3 most popular patent topics include:

- assisted reproductive technology

- battery charging

- battery electric cars

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/20/2022 | 9/17/2024 | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Semen | Grant |

Application Date | 10/20/2022 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Semen |

Status | Grant |

Latest Upgrade News

Aug 28, 2025

securities (ABS) issued by UPX HIL 2025-1 Issuer Trust (UPX 2025-1), a securitization sponsored by LuminArx. The notes are backed by a pool of loan draws (HI loan draws) on unsecured, fixed-rate home improvement (HI) loans originated by Cross River Bank, the originating partner bank, via the originating and underwriting platform provided by the Upgrade HI program. The underlying pool of HI loan draws are serviced by Upgrade Inc. UPX 2025-1 is the first public HI ABS ultimately back by HI loans originated under the Upgrade HI program. The Rating Outlook for the notes is Stable. KEY RATING DRIVERS Consistent Receivable Quality: UPX 2025-1 is backed by a pool of HI loan draws on unsecured HI loans originated at the point of sale to U.S. homeowners through a national contractor network. The loan proceeds are designated for financing windows and doors, roofing, kitchens and bathrooms, HVAC systems, basements and a variety of other HI products and services, typically excluding water filtration and solar systems. LuminArx, as the sponsor, contributes the underlying pool of HI loans for the securitization. The Upgrade program offers four core loan products: Reduced Rate (RR), Zero Interest (ZIL), No-Interest No-Payment (No-No) and No-Interest Yes-Payment (No-Yes) loans. The RR product is a standard interest-bearing amortized loan and the ZIL product is its no interest-bearing equivalent. No-No and No-Yes are promotional products with a promotional period of up to 24 months, during which no interest is accrued or billed. For all promotional products, principal and interest amortization occurs after the promotional period. The No-Yes product requires a minimum principal payment during the promotional period. Additional promotional product variations, Deferred No-No and Deferred No-Yes, work similarly, with deferred interest accruing during the promotional period and extinguished if full prepayment of the loan occurs prior to the completion of the promotional period; otherwise, the deferred accrued interest will amortize in equal installments over the amortization period. The weighted average (WA) FICO score of the asset pool is 769. The WA original term of the asset pool is 145 months and the WA loan seasoning is 15 months. Rating Cap at 'Asf': Upgrade HI loan origination program began in 2022. Consequently, Fitch was provided with about two years of historical performance data. With a WA original term of about 12.1 years for the asset pool and 20 years the longest term offered by Upgrade, two years of historical data only provide limited insights into the lifetime performance of the loans, in Fitch's view. To complement Upgrade-specific historical data, Fitch used available performance data from comparable HI and unsecured consumer loan originators in the U.S. Due to the limitations in historical data, Fitch applies a rating cap at'Asf' to the transaction. Asset Pool Assumptions: Fitch's WA lifetime base case lifetime default rate assumption is 8.1%, based on the mix of product type and FICO scores for the asset pool. Fitch assumes a rating case default multiple of 3.0x at the'A-sf' rating level with a corresponding lifetime default rate of 24.3%. The multiple is assessed at the median-high end of the range of Fitch's applicable rating criteria, primarily reflecting the limited data history for originator-specific performance. Fitch assumes a zero-recovery rate on defaulted loans, due to the unsecured nature of the loans and limited historical data available on recoveries. Fitch differentiates prepayment rate assumptions primarily by product type, recognizing prepayment incentives for deferred products, given payment step-up after the promotional period, the extent of which depends on the specific product structure. The assumed base case WA prepayment rate is 12.9% per annum (pa) during the promotional period and 10.5% pa thereafter, based on the mix of FICO scores in the asset pool. All other asset pool and cash flow modeling assumptions are as described in Fitch's applicable rating criteria and throughout this report. Transaction Structure: The pool of HI assets is financed via three classes of rated notes (class A, class B and class C notes; together, the notes). The notes pay a monthly fixed interest rate set at closing, with the first payment date in September 2025. Credit enhancement (CE) to the notes is provided by overcollateralization (OC; initially equal to 4.75% of the asset pool at closing), OC via the subordination of more junior notes, a fully funded non-amortizing reserve fund sized at 0.5% of the initial notes balance, and excess spread to the extent generated by the asset pool (initially estimated at 3.9% pa). The structure provides for an OC build-up to target 7.60% of the outstanding asset pool, with a floor of 0.5% of the initial asset pool. Additionally, the target OC for class A notes is 25.63%. Total hard CE at closing (as a percentage of the initial asset pool, including reserve fund and excluding excess spread) is 16.36%, 11.46% and 5.23% for class A, class B and class C notes, respectively. Adequate Servicing Capabilities: Upgrade and Systems & Services Technologies, Inc. (SST) will act as servicer and backup servicer, respectively, for the transaction upon closing. Minimum counterparty ratings as well as replacement and other counterparty-related provisions in the transaction documents are in line with Fitch's counterparty criteria. Fitch views backup servicing arrangements and mitigants to servicer disruption risk to be in line with ratings of up to'A-sf'. RATING SENSITIVITIES Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade For its sensitivity analysis, Fitch examines the magnitude of the multiplier compression by projecting expected cash flows and loss coverage levels over the life of investments under default assumptions that are higher than the initial base case. Fitch models cash flows with the revised default estimates while holding all other modeling assumptions constant. Rating sensitivity to increased base case defaults rates: -- Ratings for class A, B and C notes: 'A-sf'/'BBB-sf'/'BB-sf'; --Increased base case default by 10%: 'BBBsf'/'BB+sf'/'B+sf'; --Increased base case default by 25%: 'BBB-sf'/'BBsf'/'Bsf'; --Increased base case default by 50%: 'BB+sf'/'BB-sf'/'CCCsf'. Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade Stable to improved asset performance driven by stable delinquencies and defaults would lead to increasing CE levels and consideration for potential upgrades. Due to the limitations in historical data, Fitch applies a rating cap at 'Asf'to the transaction. Rating sensitivity to decreased base case defaults rates: -- Ratings for class A, B and C notes: 'A-sf'/'BBB-sf'/'BB-sf'; --Decreased base case default by 50%: 'Asf'/'Asf'/'BBBsf'. USE OF THIRD PARTY DUE DILIGENCE PURSUANT TO SEC RULE 17G -10 Fitch was provided with Form ABS Due Diligence-15E (Form 15E) as prepared by KPMG LLP. The third-party due diligence described in Form 15E focused on a comparison and recalculation of certain characteristics with respect to 150 randomly selected statistical receivables. Fitch considered this information in its analysis and it did not have an effect on Fitch's analysis or conclusions. REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING The principal sources of information used in the analysis are described in the Applicable Criteria. REPRESENTATIONS, WARRANTIES AND ENFORCEMENT MECHANISMS A description of the transaction's representations, warranties and enforcement mechanisms (RW&Es) that are disclosed in the offering document and which relate to the underlying asset pool is available by clicking the link to the Appendix. The appendix also contains a comparison of these RW&Es to those Fitch considers typical for the asset class as detailed in the Special Report titled'Representations, Warranties and Enforcement Mechanisms in Global Structured Finance Transactions'. ESG Considerations The highest level of ESG credit relevance is a score of '3', unless otherwise disclosed in this section. A score of '3'means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch's ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch's ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products#esg-relevance-scores. Additional information is available on www.fitchratings.com PARTICIPATION STATUS The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure. APPLICABLE CRITERIA Structured Finance and Covered Bonds Counterparty Rating Criteria (pub. 28 Nov 2023) Structured Finance and Covered Bonds Counterparty Rating Criteria: Derivative Addendum (pub. 28 Nov 2023) Consumer ABS Rating Criteria (pub. 11 Oct 2024) (including rating assumption sensitivity) Structured Finance and Covered Bonds Interest Rate Stresses Rating Criteria (pub. 24 Oct 2024) Global Structured Finance Rating Criteria (pub. 18 Nov 2024) (including rating assumption sensitivity) Structured Finance and Covered Bonds Country Risk Rating Criteria (pub. 17 Jun 2025) APPLICABLE MODELS Numbers in parentheses accompanying applicable model(s) contain hyperlinks to criteria providing description of model(s). Solar Loans ABS Cash Flow Model, v1.0.1 ( 1 ) Read More On This Topic UPX HIL 2025-1 Issuer Trust - Representations & Warranties ADDITIONAL DISCLOSURES Dodd-Frank Rating Information Disclosure Form ABS Due Diligence Form 15E 1 Solicitation Status Endorsement Policy ENDORSEMENT STATUS UPX HIL 2025-1 Issuer Trust EU Endorsed, UK Endorsed DISCLAIMER & DISCLOSURES All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings. In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch's rating definitions for each rating s Read More Solicitation Status The ratings above were solicited and assigned or maintained by Fitch at the request of the rated entity/issuer or a related third party. Any exceptions follow below. Fitch's solicitation status policy can be found at www.fitchratings.com/ethics. Endorsement Policy Fitch’s international credit ratings produced outside the EU or the UK, as the case may be, are endorsed for use by regulated entities within the EU or the UK, respectively, for regulatory purposes, pursuant to the terms of the EU CRA Regulation or the UK Credit Rating Agencies (Amendment etc.) (EU Exit) Regulations 2019, as the case may be. Fitch’s approach to endorsement in the EU and the UK can be found on Fitch’s Regulatory Affairs page on Fitch’s website. The endorsement status of international credit ratings is provided within the entity summary page for each rated entity and in the transaction detail pages for structured finance transactions on the Fitch website. These disclosures are updated on a daily basis.

Upgrade Frequently Asked Questions (FAQ)

When was Upgrade founded?

Upgrade was founded in 2016.

Where is Upgrade's headquarters?

Upgrade's headquarters is located at 275 Battery Street, San Francisco.

What is Upgrade's latest funding round?

Upgrade's latest funding round is Series F.

How much did Upgrade raise?

Upgrade raised a total of $550.5M.

Who are the investors of Upgrade?

Investors of Upgrade include Ribbit Capital, VY Capital, Sands Capital, Ventura Capital, G Squared and 25 more.

Who are Upgrade's competitors?

Competitors of Upgrade include Tala, Best Egg, Kissht, Prodigy Finance, Conductiv and 7 more.

What products does Upgrade offer?

Upgrade's products include Upgrade Card and 2 more.

Loading...

Compare Upgrade to Competitors

Tala provides digital financial services. The company offers a money app that facilitates access to credit, payments, savings, and transfers, utilizing artificial intelligence (AI) and machine learning to create financial experiences. Tala primarily serves individuals seeking services beyond traditional banking. It was founded in 2011 and is based in Santa Monica, California.

Branch International provides digital banking services. The company offers financial products including loans, money transfers, bill payments, investments, and savings, accessible through a smartphone app. Branch serves individuals in emerging markets. It was founded in 2015 and is based in Mumbai, India.

Prodigy Finance offers collateral-free loans for international master's students at various educational institutions. It provides co-signer and no co-signer loan options, focusing on terms and interest rates that relate to the borrower's future earning potential. It serves the education sector, allowing students from over 120 countries to study at universities globally. It was founded in 2007 and is based in London, United Kingdom.

Brighte is a financial services company that offers financing solutions for solar panels, energy-efficient home products, and electrification services, serving homeowners interested in sustainable energy technologies. It was founded in 2015 and is based in Sydney, Australia.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

Avant is a financial technology company that specializes in providing personal loans and credit cards. The company offers a range of financial solutions designed to help individuals manage their finances and achieve their personal goals. Avant primarily serves consumers looking for credit and loan products to support their financial needs. It was founded in 2012 and is based in Chicago, Illinois.

Loading...