Investments

31Portfolio Exits

6Partners & Customers

10About Truist

Truist focuses on financial services within the banking and finance sectors. The company offers personal and commercial banking, asset management, mortgages, insurance, and investment advisory services. Truist primarily serves individual consumers, small businesses, and commercial clients. It was founded in 2019 and is based in Charlotte, North Carolina.

Research containing Truist

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Truist in 1 CB Insights research brief, most recently on Jul 31, 2025.

Jul 31, 2025 report

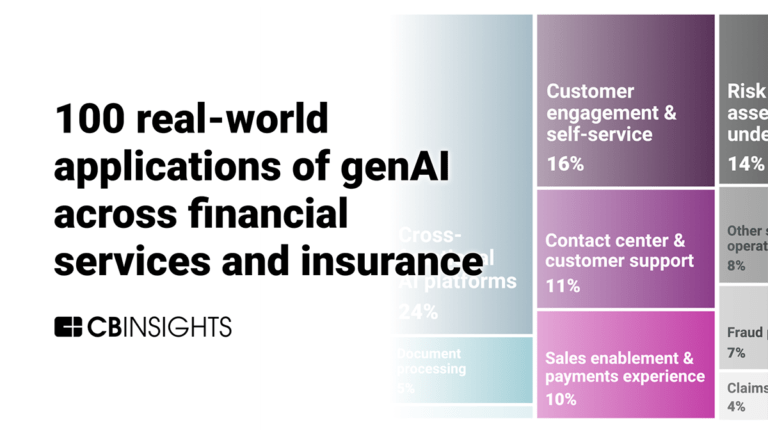

100 real-world applications of genAI across financial services and insuranceLatest Truist News

Sep 17, 2025

About Truist Truist Financial Corporation is a purpose-driven financial services company committed to inspiring and building better lives and communities. Headquartered in Charlotte, North Carolina, Truist has leading market share in many of the high-growth markets in the U.S. and offers a wide range of products and services through wholesale and consumer businesses, including consumer and small business banking, commercial and corporate banking, investment banking and capital markets, wealth management, payments, and specialized lending businesses. Truist is a top-10 commercial bank with total assets of $544 billion as of June 30, 2025. Truist Bank, Member FDIC. Equal Housing Lender. Learn more at Truist.com. Contacts: Investors: Brad Milsaps investors@truist.com Media: Shelley Miller media@truist.com Attachments Original document Permalink Disclaimer Truist Financial Corporation published this content on September 17, 2025 , and is solely responsible for the information contained herein. Distributed via Public Technologies (PUBT) , unedited and unaltered, on September 17, 2025 at 18:52 UTC

Truist Investments

31 Investments

Truist has made 31 investments. Their latest investment was in Arevon as part of their Loan on July 01, 2025.

Truist Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/1/2025 | Loan | Arevon | $600M | Yes | MUFG Bank, RBC Bank (U.S.), and TD Bank | 2 |

3/12/2025 | Line of Credit - II | Imprint | $500M | Yes | 2 | |

3/4/2025 | Line of Credit - II | Duetti | $200M | Yes | City National Bank, Regions Bank, Truist Securities, and Viola Credit | 2 |

1/17/2025 | Debt - III | |||||

11/20/2024 | Line of Credit |

Date | 7/1/2025 | 3/12/2025 | 3/4/2025 | 1/17/2025 | 11/20/2024 |

|---|---|---|---|---|---|

Round | Loan | Line of Credit - II | Line of Credit - II | Debt - III | Line of Credit |

Company | Arevon | Imprint | Duetti | ||

Amount | $600M | $500M | $200M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | MUFG Bank, RBC Bank (U.S.), and TD Bank | City National Bank, Regions Bank, Truist Securities, and Viola Credit | |||

Sources | 2 | 2 | 2 |

Truist Portfolio Exits

6 Portfolio Exits

Truist has 6 portfolio exits. Their latest portfolio exit was Growve on June 02, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

6/2/2025 | Acq - Fin | 2 | |||

Date | 6/2/2025 | ||||

|---|---|---|---|---|---|

Exit | Acq - Fin | ||||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 |

Truist Acquisitions

9 Acquisitions

Truist acquired 9 companies. Their latest acquisition was Zaloni on August 22, 2022.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

8/22/2022 | Debt | $29.32M | Acquired | 11 | ||

5/3/2022 | Other | |||||

8/27/2021 | ||||||

8/10/2021 | Private Equity | |||||

12/7/2020 |

Date | 8/22/2022 | 5/3/2022 | 8/27/2021 | 8/10/2021 | 12/7/2020 |

|---|---|---|---|---|---|

Investment Stage | Debt | Other | Private Equity | ||

Companies | |||||

Valuation | |||||

Total Funding | $29.32M | ||||

Note | Acquired | ||||

Sources | 11 |

Truist Partners & Customers

10 Partners and customers

Truist has 10 strategic partners and customers. Truist recently partnered with Qlik on June 6, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

6/20/2025 | Vendor | United States | 1 | ||

9/11/2024 | Partner | United States | 09:00 ET Azimuth extends relationship with Truist to enhance its automation capabilities With this multi-year expansion of their current partnership , Truist Financial Corp will implement Azimuth 's VALIDATOR software , enabling the bank to deploy automated , full-population compliance monitoring across multiple consumer businesses . | 2 | |

8/6/2024 | Partner | United States | Truist named title sponsor of PGA TOUR's Charlotte-based Signature Event `` We look forward to the partnership with Truist Financial Corporation and the PGA TOUR and are grateful for their shared commitment to both Charlotte and the game of golf . '' | 1 | |

10/31/2023 | Partner | ||||

10/24/2023 | Vendor |

Date | 6/20/2025 | 9/11/2024 | 8/6/2024 | 10/31/2023 | 10/24/2023 |

|---|---|---|---|---|---|

Type | Vendor | Partner | Partner | Partner | Vendor |

Business Partner | |||||

Country | United States | United States | United States | ||

News Snippet | 09:00 ET Azimuth extends relationship with Truist to enhance its automation capabilities With this multi-year expansion of their current partnership , Truist Financial Corp will implement Azimuth 's VALIDATOR software , enabling the bank to deploy automated , full-population compliance monitoring across multiple consumer businesses . | Truist named title sponsor of PGA TOUR's Charlotte-based Signature Event `` We look forward to the partnership with Truist Financial Corporation and the PGA TOUR and are grateful for their shared commitment to both Charlotte and the game of golf . '' | |||

Sources | 1 | 2 | 1 |

Compare Truist to Competitors

First United Bank is a banking organization that provides financial services across various sectors. The bank includes retail and commercial banking, trust, brokerage, mortgage, and insurance products. First United Bank serves consumers and small-to-mid-sized businesses. First United Bank was formerly known as Durant National Bank. It was founded in 1900 and is based in Durant, Oklahoma.

MidFirst Bank is a privately owned financial institution offering various banking services across different sectors. The bank provides personal, commercial, trust, private, and mortgage products and services, including loans, deposit accounts, and wealth management. MidFirst Bank serves individual and business customers seeking banking solutions. It was founded in 1982 and is based in Oklahoma City, Oklahoma.

Stifel Bank is a financial institution that offers banking and lending services across various sectors. The company provides financial planning, business banking, and individual banking services, with a focus on financial solutions for businesses, entrepreneurs, and individuals. Stifel Bank collaborates with Stifel Financial Advisors to offer a suite of services tailored to the needs of its clients. It was founded in 2007 and is based in St Louis, Missouri.

Cross River is a financial technology company that provides API-driven banking infrastructure and embedded financial services. Their offerings include payment solutions, card programs, and a lending platform, which integrate with their partners' systems. Cross River serves sectors such as fintech, digital lending, and neobanks. It was founded in 2008 and is based in Fort Lee, New Jersey.

TD Bank offers banking services within the retail banking sector. The company provides personal and commercial banking services, including checking and savings accounts, credit cards, loans, and home lending. TD Bank also provides investment and wealth management services to its customers. It was founded in 1852 and is based in Cherry Hill, New Jersey.

Sunrise Bank specializes in providing a comprehensive range of financial services within the banking sector. The company offers personal and business banking solutions, including checking and savings accounts, consumer and business loans, as well as residential mortgages. They also provide specialized accounts such as health savings accounts (HSAs) and individual retirement accounts (IRAs). It was founded in 2005 and is based in Orlando, Florida.

Loading...