Thoughtful AI

Founded Year

2020Stage

Private Equity | AliveTotal Raised

$25MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+108 points in the past 30 days

About Thoughtful AI

Thoughtful AI provides AI-powered revenue cycle management (RCM) automation for the healthcare sector. The company has AI agents that automate key RCM tasks such as eligibility verification, prior authorization, coding and notes review, claims management, denials management, and payment posting. These AI agents operate within existing RCM tech stacks. It was founded in 2020 and is based in Austin, Texas.

Loading...

ESPs containing Thoughtful AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The prior authorization software market provides technology solutions to streamline the process of obtaining approval from health insurance plans before providing certain medical services or medications to patients. Companies in this market offer platforms that automate prior authorization workflows, use AI/ML to enable real-time decisions, and integrate into provider and payer systems. Key featur…

Thoughtful AI named as Leader among 15 other companies, including Waystar, Cohere Health, and Infinitus Systems.

Loading...

Research containing Thoughtful AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Thoughtful AI in 3 CB Insights research briefs, most recently on Aug 22, 2025.

Aug 22, 2025 report

Book of Scouting Reports: Generative AI in Healthcare & Life Sciences

Mar 6, 2025

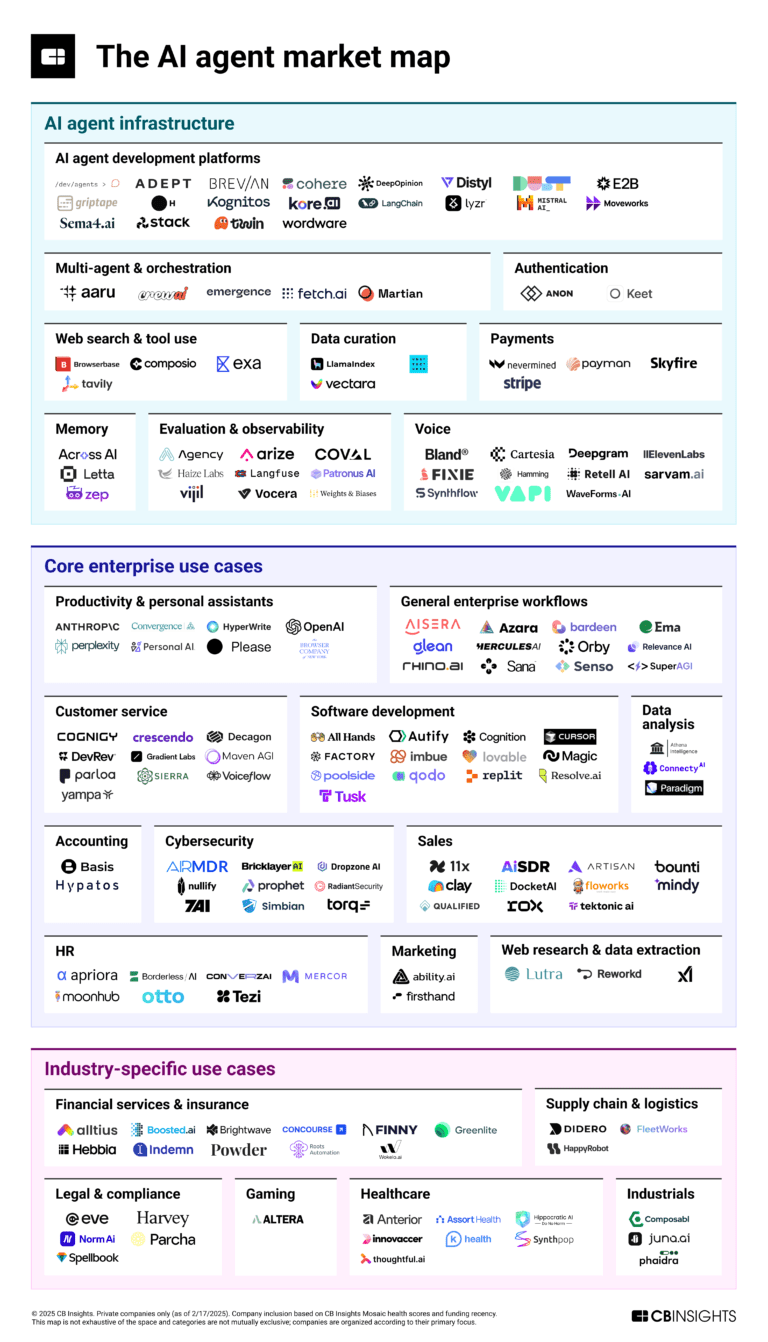

The AI agent market mapExpert Collections containing Thoughtful AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Thoughtful AI is included in 4 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

10,402 items

Digital Health

11,440 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

AI agents

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Generative AI

2,841 items

Companies working on generative AI applications and infrastructure.

Latest Thoughtful AI News

Jul 5, 2025

1:25 PM PDT · July 5, 2025 The venture capital world has always had a hot-and-cold relationship with the Midwest. Investors rush in during boom times, then retreat to the coasts when markets turn sour. For Columbus, Ohio-based Drive Capital , this cycle of attention and disinterest played out against the backdrop of its own internal upheaval several years ago — a co-founder split that could have ended the firm but may have ultimately strengthened it. At a minimum, Drive achieved something newsworthy in today’s venture landscape this past May. The firm returned $500 million to investors in a single week, distributing nearly $140 million worth of Root Insurance shares within days of cashing out of Austin-based Thoughtful Automation and another undisclosed company. It could be seen as a gimmick, sure, but limited partners were undoubtedly pleased. “I’m unaware of any other venture firm having been able to achieve that kind of liquidity recently,” said Chris Olsen, Drive’s co-founder and now sole managing partner, who spoke to TechCrunch from the firm’s offices in Columbus’s Short North neighborhood. It’s a remarkable turnaround for a firm that faced existential questions just three years ago when Olsen and his co-founder Mark Kvamme — both former Sequoia Capital partners — went their separate ways. The split, which surprised the firm’s investors, saw Kvamme eventually launch the Ohio Fund, a broader investment vehicle focused on the state’s economic development that includes real estate, infrastructure, and manufacturing alongside technology investments. Drive’s recent success stems from what Olsen calls a deliberately contrarian strategy in an industry preoccupied with “unicorns” and “decacorns” — companies valued at $1 billion and $10 billion, respectively. “If you were to just read the newspapers or listen to coffee shops on Sand Hill Road, everyone always talks about the $50 billion or $100 billion outcomes,” Olsen said. “But the reality is, while those outcomes do happen, they’re really rare. In the last 20 years, there have only been 12 outcomes in America over $50 billion.” By contrast, he noted, there have been 127 IPOs at $3 billion or more, plus hundreds of M&A events at that level. “If you’re able to exit companies at $3 billion, then you’re able to do something that happens every single month,” he said. Techcrunch event Save $450 on your TechCrunch All Stage pass Build smarter. Scale faster. Connect deeper. Join visionaries from Precursor Ventures, NEA, Index Ventures, Underscore VC, and beyond for a day packed with strategies, workshops, and meaningful connections. Save $450 on your TechCrunch All Stage pass Build smarter. Scale faster. Connect deeper. Join visionaries from Precursor Ventures, NEA, Index Ventures, Underscore VC, and beyond for a day packed with strategies, workshops, and meaningful connections. Boston, MA|July 15 That rationale underpinned the Thoughtful Automation exit, which Olsen described as “near fund-returning” despite being “below a billion dollars.” The AI healthcare automation company was sold to private equity firm New Mountain Capital, which combined it with two other companies to form Smarter Technologies. Drive owned “multiples” of the typical Silicon Valley ownership stake in the company, said Olsen, who added that Drive’s typical ownership stake is around 30% on average compared to a Valley firm’s 10% — often because it is the sole venture investor across numerous funding rounds. “We were the only venture firm who invested in that company,” Olsen said of Thoughtful Automation, which was previously backed by New Mountain, the PE firm. “About 20% of the companies in our portfolio today, we are the sole venture firm in those businesses.” Portfolio Wins and Losses Drive’s track record includes both big successes and also stumbles. The firm was an early investor in Duolingo, backing the language-learning platform when it was pre-revenue after Olsen and Kvamme met founder Luis von Ahn at a bar in Pittsburgh, where Duolingo is based. Today, Duolingo trades on NASDAQ with a market cap of nearly $18 billion. The firm also invested in Vast Data, a data storage platform last valued at $9 billion in late 2023 (and is reportedly fundraising right now), and Drive made money on the recent Root Insurance distribution despite that company’s rocky public market performance since its late 2020 IPO. But Drive also experienced the spectacular failure of Olive AI, a Columbus-based healthcare automation startup that raised over $900 million and was valued at $4 billion before eventually selling portions of its business in a fire sale. “You have to be able to produce returns in bad markets as well as good markets,” Olsen said. “When markets really get tested is when there’s not as much liquidity.” What sets Drive apart, Olsen argues, is its focus on companies building outside Silicon Valley’s hyper-competitive ecosystem. The firm now has employees in six cities — Columbus, Austin, Boulder, Chicago, Atlanta, and Toronto — and says it backs founders who would otherwise face a choice between building near their customers or their investors. It’s Drive’s secret sauce, he suggests. “Early-stage companies that are based outside of Silicon Valley have a higher bar. They have to be a better business to garner a venture investment from a venture firm in Silicon Valley,” Olsen said. “The same thing applies to us with companies in Silicon Valley. For us to invest in a company in Silicon Valley, it has a higher bar.” Much of the firm’s portfolio centers not on companies trying to come up with something entirely novel, but instead on those applying tech to traditional industries that coastal VCs might overlook. Drive has invested in an autonomous welding company, for example, and what Olsen calls “next-generation dental insurance” — sectors that arguably represent America’s $18 trillion economy beyond Silicon Valley’s tech darlings. Whether that focus — or Drive’s momentum — translates into a big new fund for Drive remains to be seen. The firm is currently managing assets that it raised when Kvamme was still on board, and according to Olsen, it has 30% left to invest of its current fund, a $1 billion vehicle announced in June 2022. Asked about cash-on-cash returns to date, Olsen said that with $2.2 billion in assets under management across all of Drive’s funds, all are “top quartile funds” with “north of 4x net on our most mature funds” and “continuing to grow from there.” In the meantime, Drive’s thesis about Columbus as a legitimate tech hub received further validation this week when Palmer Luckey, Peter Thiel, and other tech billionaires announced plans to launch Erebor , a crypto-focused bank headquartered in Columbus. “When we started Drive in 2012, people thought we were nuts,” Olsen said. “Now you’re seeing literally the people I think of as being the smartest minds in technology — whether it’s Elon Musk or Larry Ellison or Peter Thiel — moving out of Silicon Valley and opening massive presences in different cities.” Topics

Thoughtful AI Frequently Asked Questions (FAQ)

When was Thoughtful AI founded?

Thoughtful AI was founded in 2020.

Where is Thoughtful AI's headquarters?

Thoughtful AI's headquarters is located at 823 Congress Avenue, Austin.

What is Thoughtful AI's latest funding round?

Thoughtful AI's latest funding round is Private Equity.

How much did Thoughtful AI raise?

Thoughtful AI raised a total of $25M.

Who are the investors of Thoughtful AI?

Investors of Thoughtful AI include New Mountain Capital, Drive Capital and TriplePoint Capital.

Who are Thoughtful AI's competitors?

Competitors of Thoughtful AI include Notable Systems and 8 more.

Loading...

Compare Thoughtful AI to Competitors

Mantys is a company that focuses on automating revenue cycle management (RCM) for the healthcare sector. It offers AI-driven solutions that transform unstructured healthcare documents into structured data, automate front-end operations, and streamline claim reviews and reconciliations. Mantys AI Agents integrate with electronic health records and practice management systems to enhance productivity and financial accuracy for healthcare providers. It was founded in 2022 and is based in Bengaluru, India.

R1 RCM provides solutions that focus on the operational efficiency of healthcare providers. The company offers services that improve revenue cycles for institutions, leading to better financial outcomes and patient interactions. R1 RCM serves the healthcare sector, including hospitals and medical facilities. R1 RCM was formerly known as Accretive Health Inc.. It was founded in 2003 and is based in Salt Lake City, Utah. R1 RCM operates as a subsidiary of Sarnova.

Quadax provides healthcare revenue cycle management services, including claims management, reimbursement, denial management, patient access, and client engagement, supported by analytics and reporting tools. The company serves hospitals, health systems, laboratories, physician groups, specialty practices, durable medical equipment providers, and post-acute and long-term care facilities. It was founded in 1973 and is based in Cleveland, Ohio.

InnoviHealth is a company that specializes in providing coding, reimbursement, and compliance resources within the healthcare sector. Its main offerings include an extensive online library for medical coding and billing, platforms for diagnostic coding and medical chart abstraction, and databases for healthcare abbreviations. The company primarily serves professionals in the healthcare industry seeking coding and billing solutions, compliance information, and certification support. It was founded in 1997 and is based in Spanish Fork, Utah.

Cedar is a company that operates within the healthcare sector. It offers a platform that integrates billing and insurance information to assist with the payment process for patients and healthcare providers. Cedar's services aim to address the revenue cycle for healthcare providers by focusing on patient payments and loyalty through technology. It was founded in 2016 and is based in New York City, New York.

Hansei Solutions provides revenue cycle management for the healthcare sector, focusing on addiction and mental health facilities. The company offers services that include billing, utilization review, credentialing, and denial management, which assist clients with cash flow and compliance. Hansei Solutions serves the behavioral healthcare industry, offering solutions that address the challenges and opportunities within this sector. It is based in Los Angeles, California.

Loading...