Tabby

Founded Year

2019Stage

Series E | AliveTotal Raised

$1.804BValuation

$0000Last Raised

$160M | 7 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+14 points in the past 30 days

About Tabby

Tabby is a financial technology company that operates in the consumer financing sector, offering buy now pay later services. The company allows consumers to split their purchases into four monthly payments, with no fees for timely payments. Tabby provides services such as a rewards program, purchase protection, and a shopping assistant app. It was founded in 2019 and is based in Riyadh, Saudi Arabia.

Loading...

Tabby's Product Videos

ESPs containing Tabby

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Tabby named as Leader among 15 other companies, including Klarna, Affirm, and Synchrony.

Tabby's Products & Differentiators

Split in 4

Provide customers the freedom to split their purchase into 4 equal payments billed every month at no interest.

Loading...

Research containing Tabby

Get data-driven expert analysis from the CB Insights Intelligence Unit.

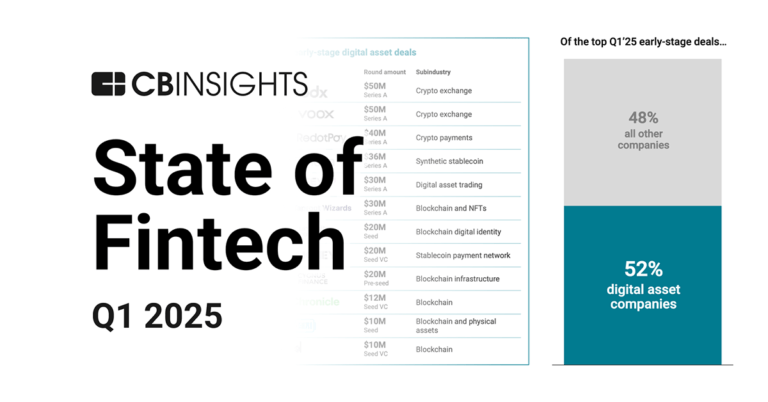

CB Insights Intelligence Analysts have mentioned Tabby in 6 CB Insights research briefs, most recently on Apr 10, 2025.

Apr 10, 2025 report

State of Fintech Q1’25 Report

May 8, 2024

The embedded banking & payments market map

Jan 31, 2024

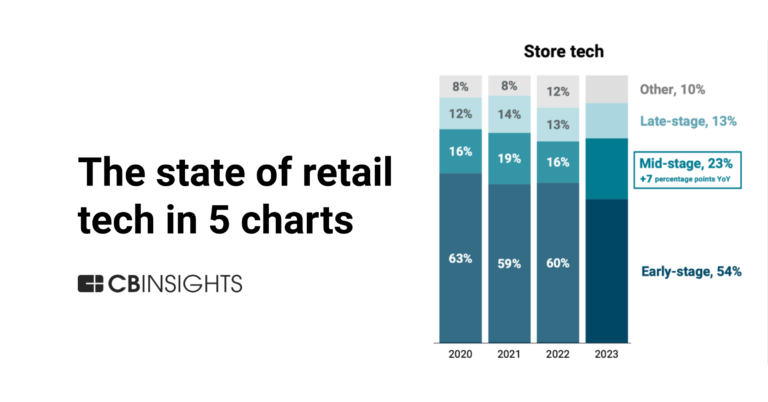

Retail tech in 5 charts: 2023

Jan 18, 2024 report

State of Fintech 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportExpert Collections containing Tabby

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tabby is included in 8 Expert Collections, including E-Commerce.

E-Commerce

11,559 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Store tech (In-store retail tech)

1,798 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,286 items

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Artificial Intelligence

12,580 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,013 items

Excludes US-based companies

Latest Tabby News

Sep 5, 2025

Cost of Cash Acceptance Ranges Between 1.3% to 3% in MEA: Study While cash remains widely used in the Middle East and Africa, electronic payment adoption, including digital wallets, BNPL, and A2A transactions, is growing. Get the hottest Fintech Middle East News once a month in your Inbox While cash appears cost-free, the payment method’s true cost of acceptance in the Middle East and Africa (MEA) ranges from 1.3% to 3%, driven by direct and indirect costs, such as cash-in-transit (CIT) and shrinkage, as well as back-office costs like reconciliation, a new study by Boston Consulting Group (BCG) shows . South Africa currently faces the highest costs, largely due to elevated spending on CIT. CIT refers to specialized services used by merchants to securely transport their physical cash to and from banks, such as armored vehicles, security guards, and insurance to protect against theft, robbery, or loss. Because South Africa faces high crime rates, merchants rely heavily on CIT services, which significantly increases the direct cost of handling cash compared to other countries in the region. By contrast, the United Arab Emirates (UAE) has the lowest cost of acceptance, in part because of the declining use of cash. Indirect costs, meanwhile, range from 0.9% to 1.2% across the MEA markets studied. These costs account for the majority of expenses in the UAE, Saudi Arabia, and Egypt, and can be divided into less than 0.2% for equipment costs relating to the cash register, safe and teller, and around 0.7% to 1% for cash shrinkage, such as handling errors, theft, and fraud. Finally, back-office processes, which include reconciliation and cash register preparation, add a further 0.3% to 0.7% to the cost of cash acceptance. Cost of acceptance for cash transactions, Source: Boston Consulting Group, Aug 2025 Cost of new payment methods The study also finds that the cost of accepting alternative payment methods, such as digital wallets and account-to-account (A2A) payments, varies by market. In markets where these options have reached scale, their acceptance costs are comparable to cash and debit cards. In South Africa, for example, cash acceptance costs 3% for in-store transactions, compared to 2.7% for digital wallets and 2.6% for debit cards. In contrast, in Egypt and the UAE, where alternatives are less established, merchants often rely on informal, typically free, peer-to-peer (P2P) solutions. This lowers costs, but also leaves consumers with limited financial protection against fraudulent or unauthorized charges. Meanwhile, in countries where alternative payment methods are backed by the government to drive adoption, acceptance costs are lower compared to other payment methods. In Saudi Arabia, for example, digital wallet and A2A transactions cost 0.3% versus 1% for debit cards. Cost of acceptance for in-store transactions, Source: Boston Consulting Group, Aug 2025 The study also examines the cost of accepting credit-based payment methods. It finds that across the markets studied, buy now, pay later (BNPL) arrangements are more than twice as expensive as credit cards, mainly due to higher direct costs associated with financing and default risks. In-store BNPL costs range from 2.4% for Egypt to 6.3% for South Africa. For online transactions, BNPL costs are 0.3% to 0.6% higher. By comparison, credit card acceptance costs for in-store transactions are 2.1% in Egypt, 2.4% in the UAE, 2.1% in Saudi Arabia, and 2.7% in South Africa. Online credit card transactions carry an additional cost of between 0.5% and 0.8% across markets. Cost of acceptance for e-commerce transactions, Source: Boston Consulting Group, Aug 2025 Cash use declines in MEA In the MEA, cash still accounts for a relatively high share of transactions at around 35% compared to about 20% in Europe. However, this share has been decreasing sharply in recent years as the adoption of electronic payment methods grows, driven by consumer behavior and government initiatives. Saudi Arabia, for example, aims for 70% of all transactions to be executed electronically by the end of 2025 as part of the government’s Saudi Vision 2030 strategy. Similarly, Dubai’s Cashless Strategy targets 90% of transactions in the emirate to be cashless by 2026, potentially boosting economic growth by over AED 8 billion (US$2.2 billion) annually through fintech innovation. At the national level, the Central Bank of the UAE has launched the Digital Dirham initiative to support the country’s push toward a cashless society, improve both domestic and cross-border payment efficiency, enhance financial inclusion, and pave the way for asset tokenization. Fintech and digital payments are also on the rise. In MEA, many of the region’s largest and most successful fintech startups operate in the digital payments and digital wallets space. In Egypt, Fawry is a dominant electronic payment platform with a user base of more than 52 million . The platform facilitates 5.5 millions daily transactions and has seen explosive growth in both users and financial metrics. Across the Middle East, the most valuable fintech startups are BNPL players. Saudi Arabia-based Tabby boasts more than 14 million users, and over 40,000 partnered brands and businesses. The startup is worth US$3.3 billion, according to CB Insights. Tamara, another leading BNPL platform in Saudi Arabia and the broader Gulf Cooperation Council (GCC) region, serves more than 20 million users and partners with leading global and regional brands such as Apple, SHEIN, Jarir, noon, IKEA, and Amazon, as well as numerous small and medium businesses. The platform is valued at US$1 billion. A BCG survey conducted as part of the report finds that electronic payments continue to gain popularity among merchants, who are increasingly adopting the payment methods preferred by consumers. Access to customers was cited as the top driver, ranked first by 37% of merchants, followed by transaction frequency at 20%, and higher transaction value at 11%. Merchant preferences and value of payment instruments, Source: Boston Consulting Group, Aug 2025

Tabby Frequently Asked Questions (FAQ)

When was Tabby founded?

Tabby was founded in 2019.

Where is Tabby's headquarters?

Tabby's headquarters is located at 7259 Jabal Ashaqir, Riyadh.

What is Tabby's latest funding round?

Tabby's latest funding round is Series E.

How much did Tabby raise?

Tabby raised a total of $1.804B.

Who are the investors of Tabby?

Investors of Tabby include STV, Wellington Management, Blue Pool Capital, Hassana Investments, J.P. Morgan Chase and 22 more.

Who are Tabby's competitors?

Competitors of Tabby include Klarna, Atome, Treyd, Khazna, Zilch and 7 more.

What products does Tabby offer?

Tabby's products include Split in 4 and 4 more.

Loading...

Compare Tabby to Competitors

Tamara serves as a shopping and payment platform. It operates in the financial technology sector. The company provides a mobile application offering flexible payment solutions and allows customers to divide their bills into multiple installments without delay fees, in compliance with Islamic law. Tamara primarily serves the e-commerce industry, with global and regional brands to local small and medium businesses. It was founded in 2020 and is based in Riyadh, Saudi Arabia.

Postpay is a financial services company that provides buy now pay later solutions. The company offers a service that allows customers to make purchases and pay for them in three installments without interest. Postpay primarily serves the retail sector and partners with various brands to provide payment options to consumers. It was founded in 2019 and is based in Dubai, United Arab Emirates.

MNT Halan operates as a financial technology company focusing on digitizing traditional banking and cash-based markets. The company offers services, including digital payment solutions, lending services to the unbanked and underbanked, and an e-commerce platform. It primarily serves the financial sector and the e-commerce industry. It was founded in 2017 and is based in Cairo, Egypt.

Khazna is a financial technology company specializing in digital financial services. The company offers a financial super app that provides underbanked Egyptians with access to smartphone-based financial services. Khazna primarily serves the corporate sector by offering financial solutions to employees through a mobile application that allows them to access a portion of their earned salary as needed. It was founded in 2019 and is based in Cairo, Egypt.

Cashew specializes in flexible payment solutions within the financial services sector. The company offers a range of products, including buy now, pay later options, interest-free installment plans, and comprehensive financial management services. Cashew primarily caters to individual consumers seeking manageable payment options for their purchases. It was founded in 2020 and is based in Dubai, United Arab Emirates.

Shahry is a digital financial services company that specializes in buy-now-pay-later (BNPL) solutions within the consumer finance sector. The company provides a mobile credit card and wallet that enables consumers to purchase goods and services in installments over a period of up to 36 months. Shahry primarily serves individual consumers looking for payment options and merchants aiming to increase sales through BNPL services. It was founded in 2019 and is based in cairo, Egypt.

Loading...