Synctera

Founded Year

2020Stage

Series A - IV | AliveTotal Raised

$94MLast Raised

$15M | 10 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+19 points in the past 30 days

About Synctera

Synctera is a banking and payments platform that provides technology infrastructure and a compliance framework for companies to launch FinTech and embedded banking products. The company offers services including APIs for digital wallets, debit and charge cards, and money movement experiences, supporting financial solutions. Synctera primarily serves FinTechs, embedded banking providers, and banks looking to build their sponsor banking programs. It was formerly known as Entangle. It was founded in 2020 and is based in Palo Alto, California.

Loading...

Synctera's Product Videos

ESPs containing Synctera

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

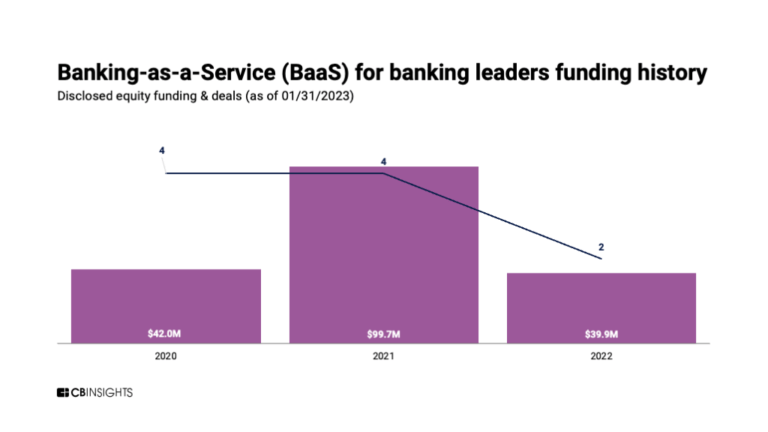

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to modernize their services and expand their customer base through embedded banking and payment options. These providers offer APIs that enable businesses to integrate banking capabilities such as account opening, transaction processing, card issuance, payment rails, and compliance tools. BaaS solutions…

Synctera named as Challenger among 15 other companies, including Stripe, FIS, and Plaid.

Synctera's Products & Differentiators

Synctera Platform

Synctera provides the infrastructure companies need to launch FinTech and embedded finance products, including accounts, cards, and money movement. Additionally the Synctera Platform enables sponsor banks to compliantly manage and have oversight over their FinTech partners.

Loading...

Research containing Synctera

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Synctera in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Synctera

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Synctera is included in 4 Expert Collections, including Fintech.

Fintech

9,696 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,016 items

Fintech 100

200 items

Fintech 100 (2024)

100 items

Latest Synctera News

Sep 4, 2025

Companies that have previously wanted to deliver both deposit and credit products had to either build an entire ecosystem from over 20 vendors, resulting in a costly process and a fragmented operational experience, or use pre-made solutions that restrained their ability to create a tailored experience or embed offerings into their existing product set. Synctera and LoanPro aim to tackle this challenge by supporting firms while allowing them to retain the flexibility needed to tailor services to customers' needs and demands. Improving credit solutions Synctera aims to be a centralised platform for all financial ecosystem components, customer data, and operational frameworks, seeking the flexibility to create banking solutions tailored to unique demands for nonprofits, international students, and other specialised verticals. Through the alliance, Synctera integrated LoanPro's credit and loan servicing technology into its platform, offering an end-to-end solution that enables companies to accelerate speed to market by building both banking and credit products using a single set of APIs. Additionally, the partnership allows users to unify all end-user data for both deposit and credit products into a single ledger, and equip their sponsor bank with complete visibility into the entire programme lifecycle. Companies using the solution will also be able to improve operational efficiency by managing all compliance and operational workflows, like credit decisioning and loan servicing, from the Synctera Console. As credit card usage continues to grow, fintechs and SaaS platforms extend their offerings to make credit cards more accessible and valuable to their shoppers. Leveraging their unique insights, clients will be able to offer credit cards with flexible spend controls, fees, and pre-category interest rates, rewards tailored to their business or lifestyle, and the ability to embed and customise the entire user experience.

Synctera Frequently Asked Questions (FAQ)

When was Synctera founded?

Synctera was founded in 2020.

Where is Synctera's headquarters?

Synctera's headquarters is located at 228 Hamilton Avenue, Palo Alto.

What is Synctera's latest funding round?

Synctera's latest funding round is Series A - IV.

How much did Synctera raise?

Synctera raised a total of $94M.

Who are the investors of Synctera?

Investors of Synctera include Diagram Ventures, Lightspeed Venture Partners, NAventures, Fin Capital, Mana Ventures and 22 more.

Who are Synctera's competitors?

Competitors of Synctera include Sandbox Banking, BM Technologies, ASA, Bond, Rize and 7 more.

What products does Synctera offer?

Synctera's products include Synctera Platform.

Loading...

Compare Synctera to Competitors

Unit is a financial technology company that specializes in embedded finance and financial infrastructure within the banking and lending sectors. The company offers a platform that enables tech companies to integrate banking services, such as storing, moving, and lending money, into their products. Unit's services are designed to facilitate compliance and simplify technical integration for businesses looking to offer financial services. It was founded in 2019 and is based in New York, New York.

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Its main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC-insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms and focuses on digital financial and transactional services. The company offers a suite of bank-grade solutions, including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems for financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize services. It was founded in 2007 and is based in Miami, Florida.

Productfy is a platform that specializes in the embedding of financial products within various business sectors. The company offers a suite of services, including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

Alviere operates in the financial services sector. The company offers a range of financial products, including accounts, payments, card issuance, global money transfers, and wallet solutions, which can be integrated into existing business offerings. Alviere serves sectors such as retail, travel, hospitality, marketplaces, and financial services. Alviere was formerly known as Mezu. It was founded in 2020 and is based in Denver, Colorado.

Hydrogen operates as a no-code embedded finance company. It offers United States dollar (USD) banking services, wealth management, personal financial management (PFM), and cryptocurrency payments solutions. The company was founded in 2017 and is based in Miami, Florida.

Loading...