SumUp

Founded Year

2012Stage

Line of Credit - II | AliveTotal Raised

$4.107BLast Raised

$62.06M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-26 points in the past 30 days

About SumUp

SumUp is a financial technology company that provides payment processing and point-of-sale solutions for small businesses. It offers products including card readers, POS systems, and financial management tools to facilitate transactions and manage business operations. SumUp serves small to medium-sized enterprises across sectors such as retail and food and beverage. SumUp was formerly known as Ka-Ching Payments. It was founded in 2012 and is based in Wilmington, Delaware.

Loading...

ESPs containing SumUp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The restaurant point-of-sale (POS) systems market provides software-centric platforms — often paired with purpose-built hardware and integrated payments — for managing on-premise and digital restaurant operations. Core capabilities include order entry (counter, table, handheld, kiosk), menu and pricing management, kitchen display systems, payments, reporting/analytics, labor and inventory tools, a…

SumUp named as Challenger among 15 other companies, including NCR Voyix, Block, and Lightspeed Commerce.

SumUp's Products & Differentiators

SumUp Solo Lite

Our card readers, like SOLO Lite, are also a major milestone. They’re portable, affordable, and designed for merchants who are always on the go. We’ve also developed business accounts that allow merchants to manage their finances, pay suppliers, and track income, all in one place.

Loading...

Research containing SumUp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SumUp in 3 CB Insights research briefs, most recently on Jan 18, 2024.

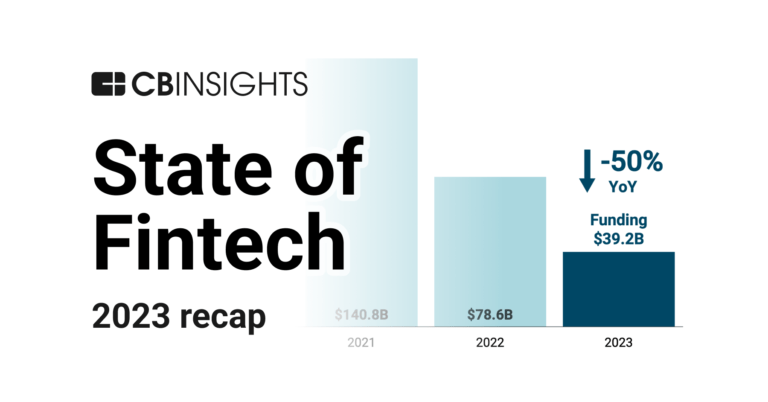

Jan 18, 2024 report

State of Fintech 2023 Report

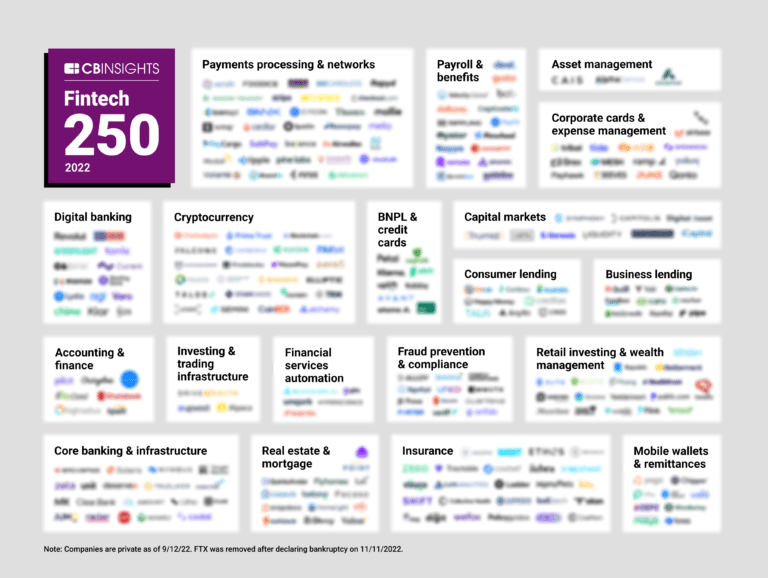

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing SumUp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SumUp is included in 7 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,798 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,286 items

SMB Fintech

1,648 items

Payments

3,255 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,049 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SumUp Patents

SumUp has filed 9 patents.

The 3 most popular patent topics include:

- payment systems

- banking technology

- payment service providers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/24/2021 | 9/17/2024 | Payment systems, Cryptocurrencies, Mobile payments, Banking technology, Payment service providers | Grant |

Application Date | 9/24/2021 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Payment systems, Cryptocurrencies, Mobile payments, Banking technology, Payment service providers |

Status | Grant |

Latest SumUp News

Sep 13, 2025

Este contenido es presentado por SumUp SumUp lanzó en Chile su Smart POS , un terminal Android que reúne en un solo equipo cobros con tarjeta, punto de venta, control de inventario y reportería. El dispositivo busca simplificar la operación de comercios y pymes al centralizar funciones que antes requerían sistemas distintos. El equipo no se limita a recibir pagos. Permite administrar ventas, productos y reportes desde una interfaz diseñada para adopción rápida . “Después de años trabajando directamente con pymes chilenas, identificamos que el principal dolor no era solo cobrar, sino gestionar todo el negocio de forma simple”, señaló el equipo de SumUp Chile. TE PUEDE INTERESAR: SumUp presentó su propio Smart POS en Chile, el más avanzado de su portafolio El terminal ofrece funciones que antes estaban reservadas a sistemas de mayor complejidad : toma de pedidos en el propio dispositivo, órdenes abiertas para atender varias mesas a la vez, propinas integradas y cierre de caja documentado. Con esto, la compañía apunta a que el dispositivo sea el centro de la operación diaria. Funcionalidades del nuevo Smart POS de SumUp Entre sus características destacan: 1.Cobros e impresión con validez SII : Acepta tarjetas y billeteras digitales y emite boletas electrónicas conforme a lo exigido por el Servicio de Impuestos Internos. Esto evita depender de impresoras externas o integraciones complejas. Por qué importa: acelera la atención y elimina impresoras externas. 2. Reportería y cierre de caja : Genera reportes de ventas por período, medios de pago o usuarios, y permite cierres diarios desde el terminal. La información queda disponible para administración y contabilidad. Por qué importa: Control de caja inmediato por turno/día; menos errores de conciliación y ahorro de tiempo al final de la jornada. 3. Catálogo e inventario : Crea productos con categorías, precios y unidades de medida (kilo, litro, metro o unidad), descontando stock automáticamente en cada venta. El control se actualiza en tiempo real. Por qué importa: Menos quiebres de stock y mejor reposición. Evita recontar a mano y centraliza la información sin planillas. 4. Carga asistida de productos : Facilita la configuración inicial del catálogo con digitalización por cámara y funciones de inteligencia artificial, lo que reduce el tiempo de implementación. 5. Gastronomía y atención en mesa : Permite tomar pedidos desde la mesa, dividir cuentas, gestionar propinas y controlar turnos. Estas funciones buscan agilizar la atención en restaurantes y cafeterías. Por qué importa: Flujo ágil en horas punta, cuentas sin errores y mejor experiencia de cliente. Comparativa del mercado Aunque varios terminales permiten imprimir boletas válidas ante el SII, desde SumUp explican que la reportería y el cierre de caja integrados en el dispositivo no son comunes . Además, la combinación de inventario con unidades de medida y control en tiempo real tampoco suele estar disponible en la mayoría de las soluciones de compra directa. Para restaurantes y negocios de comidas preparadas, el Smart POS ofrece propinas, división de cuentas, órdenes abiertas y turnos, un paquete de funciones que varía entre proveedores y que no siempre se ofrece completo. Precios y modalidades SumUp comercializa el Smart POS en dos formatos. En compra directa, el precio de lanzamiento es de $69.900, por tiempo limitado. También existe la opción de arriendo por $19.900, que incluye el uso del equipo, servicio de boleta electrónica y comisiones preferentes. De esta manera, la fintech entrega flexibilidad a los negocios que prefieren optar entre inversión inicial o gasto mensual predecible, según su flujo de ventas. La compañía plantea que el Smart POS es una alternativa para comercios que ya superaron la etapa de solo cobrar y necesitan integrar orden, velocidad y control en una sola plataforma. Con un precio competitivo y la opción de suscripción, SumUp apunta a que el dispositivo se convierta en un aliado para todas las pymes que quieran seguir creciendo sin fricciones.

SumUp Frequently Asked Questions (FAQ)

When was SumUp founded?

SumUp was founded in 2012.

Where is SumUp's headquarters?

SumUp's headquarters is located at 1209 Orange Street, Wilmington.

What is SumUp's latest funding round?

SumUp's latest funding round is Line of Credit - II.

How much did SumUp raise?

SumUp raised a total of $4.107B.

Who are the investors of SumUp?

Investors of SumUp include BlackRock, Oaktree Capital Management, Vista Credit Partners, Goldman Sachs Asset Management, Apollo Global Management and 32 more.

Who are SumUp's competitors?

Competitors of SumUp include Kleo, Melio, CloudWalk, Dojo, Tide and 7 more.

What products does SumUp offer?

SumUp's products include SumUp Solo Lite and 4 more.

Who are SumUp's customers?

Customers of SumUp include Deb Dobney-Cobb, Aidan Conway and Arlene Wedgbury.

Loading...

Compare SumUp to Competitors

Hash operates a financial technology platform. It enables companies to create and test payment and other financial solutions. It provides non-financial business-to-business (B2B) enterprises wishing to offer banking services with payment infrastructure. The company was founded in 2017 and is based in Sao Paulo, Brazil.

Ingenico is a company focused on payment acceptance and services within the financial technology sector. It offers a range of products including smart terminals, a cloud-based payments platform, and terminal management solutions. Ingenico also provides services such as advanced payment methods, buy now pay later options, digital receipts, and omnichannel services. It was founded in 1980 and is based in Suresnes, France.

Softpay is a technology company that operates in the financial services sector. The company provides a service that transforms any Android device into a payment terminal, enabling businesses to set up wireless online payments quickly and easily. Softpay primarily caters to sectors such as retail, hospitality, and transportation. It was founded in 2019 and is based in Copenhagen, Denmark.

Veem offers a payment platform for businesses to send and receive money globally. It provides flexible digital payments, competitive exchange rates, payment tracking, and workflow automation. It serves various industries such as e-commerce, freelancers, manufacturing, and others. The company was formerly known as Align Commerce. It was founded in 2014 and is based in San Francisco, California.

GoCardless provides online payment processing solutions for various business sectors. The company offers services for one-off, recurring, and invoice payments, including options for subscriptions, installments, and automated payment collection. GoCardless serves sectors that require payment processing and management, such as e-commerce, real estate tech, and cloud computing. It was founded in 2011 and is based in London, United Kingdom.

ASAAS focuses on financial process automation for businesses. It provides a digital account for billing management, invoicing, receivables anticipation, and supplier payments. It serves freelancers, microentrepreneurs, and large companies. It was founded in 2010 and is based in Joinville, Brazil.

Loading...