Zero Hash

Founded Year

2017Stage

Series D - II | AliveTotal Raised

$267.33MLast Raised

$100M | 2 mos agoRevenue

$0000About Zero Hash

Zero Hash is a company providing financial infrastructure for the crypto and stablecoin sectors. The company's offerings include API technology and regulatory infrastructure that allow businesses to launch crypto products while ensuring compliance, covering the functions for fiat and crypto. Zero Hash serves sectors including fintechs, trading platforms, payment issuers, brands, and developers. It was founded in 2017 and is based in Chicago, Illinois. Zero Hash operates as a subsidiary of Bittrex.

Loading...

Zero Hash's Product Videos

_thumbnail.png?w=3840)

_thumbnail.png?w=3840)

ESPs containing Zero Hash

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

Zero Hash named as Challenger among 13 other companies, including Circle, Coinbase, and Ripple.

Zero Hash's Products & Differentiators

Account Funding

a 24/7 alternative to traditional fiat rails allowing for users to fund brokerage, payments, and investment accounts seamlessly using crypto assets and stablecoins.

Loading...

Research containing Zero Hash

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zero Hash in 4 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

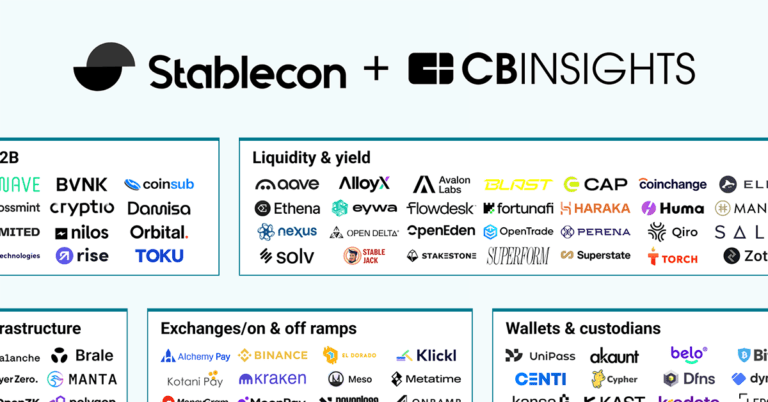

The stablecoin market map

May 8, 2024

The embedded banking & payments market mapExpert Collections containing Zero Hash

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zero Hash is included in 5 Expert Collections, including Blockchain.

Blockchain

10,900 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Wealth Tech

234 items

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Stablecoin

450 items

Latest Zero Hash News

Sep 4, 2025

Fireblocks, the $8 billion crypto infrastructure provider, has launched a stablecoin payment network with over 40 institutional participants. According to a Fortune report, the Fireblocks Network for Payments includes members such as Bridge (recently acquired by Stripe), stablecoin companies Zerohash and Yellow Card, and issuer Circle This network plans to streamline how financial institutions and crypto firms move stablecoins between each other while building new stablecoin products, addressing what CEO Michael Shaulov describes as costly infrastructure challenges Unlike Circle's existing payments network, which focuses exclusively on USDC, Fireblocks' platform supports multiple stablecoins, giving participants greater operational flexibility. The network provides users access to banking relationships and regulatory licenses from a broader range of companies than customers would typically reach independently. Multi-Stablecoin Infrastructure Addresses Enterprise Pain Points Fireblocks already processes billions of dollars in stablecoin volume daily, achieving a record $212 billion in July alone across its existing infrastructure. However, Shaulov noted that the company's original network was built primarily for crypto trading rather than specialized stablecoin operations. The new network fills this operational gap by allowing seamless conversion between different stablecoins and facilitating cross-border transfers. This launch builds on Fireblocks' recent expansion into stablecoin-focused infrastructure, including its June integration with Codex , a purpose-built blockchain for stablecoin finance. Codex offers instant settlement capabilities and allows institutions to create wallets with zero additional integration work. The company has also partnered with Japan's SMBC (through parent Sumitomo Mitsui Financial Group) and Ava Labs to pilot stablecoin launches, with trials expected to begin in the second half of 2025. SMFG, the parent company of Japan's second-largest bank SMBC, is preparing to launch a stablecoin in partnership with @avax and @FireblocksHQ #SMBC #Avalabs https://t.co/rLwHg1TNUi If successful, SMBC could launch its stablecoin as early as next year, potentially reducing cross-border payment costs by bypassing traditional SWIFT intermediaries. Institutional Adoption Accelerates Across Stablecoin Ecosystem The Fireblocks launch coincides with rapidly accelerating institutional adoption, as revealed in the company's May survey of 295 executives across banks, fintech firms, and payment processors. Research has shown that 90% of financial institutions are either actively using or exploring stablecoin integration into their operations. Meanwhile, corporate giants are moving beyond exploration toward active development, with Amazon and Walmart reportedly considering their own USD-backed stablecoins to reduce transaction fees. Payment processor Stripe is also developing a dollar-backed stablecoin for markets outside the U.S., UK, and Europe, building on its October 2024 launch of stablecoin payment options. According to DefiLlama data, the total stablecoin market capitalization now stands at approximately $285 billion, reflecting 56% year-over-year growth Industry projections suggest the sector could reach $1 trillion in annual payment volume by 2028, with Citigroup forecasting even more dramatic expansion to a market cap of over $2 trillion by 2030. Banking Industry Raises Systemic Risk Concerns However, this rapid growth has seen pushback from traditional banking institutions, with Citigroup executive Ronit Ghose warning that stablecoin interest payments could trigger a deposit flight similar to the 1980s crisis, when money market funds drained $32 billion from banks in two years. ⭕️ Citi executive warns stablecoin interest payments could drain bank deposits like the 1980s crisis amid GENIUS Act loophole concerns. #Stablecoin #Banks https://t.co/aaHxz9bXHM Major banking groups, including the American Bankers Association, are lobbying Congress to close what they call a “loophole” in the GENIUS Act that allows crypto exchanges to offer yields on third-party stablecoins. Former People's Bank of China Governor Zhou Xiaochuan has separately warned that stablecoin issuers may pursue aggressive expansion without understanding systemic risks. Zhou cited amplification effects that can create redemption pressure beyond initial reserves, referencing the May 2022 TerraUSD collapse , where arbitrage mechanisms accelerated rather than contained the crisis. Recent research suggests that major stablecoins face a roughly one-in-three chance of a crisis over the next decade due to design vulnerabilities in how they handle extreme market stress. Despite these concerns, Treasury Secretary Scott Bessent has expressed support for stablecoin adoption, arguing that digital dollars will “expand dollar access for billions across the globe and lead to a surge in demand for U.S. Treasuries” as backing assets.

Zero Hash Frequently Asked Questions (FAQ)

When was Zero Hash founded?

Zero Hash was founded in 2017.

Where is Zero Hash's headquarters?

Zero Hash's headquarters is located at 327 North Averdeen, Chicago.

What is Zero Hash's latest funding round?

Zero Hash's latest funding round is Series D - II.

How much did Zero Hash raise?

Zero Hash raised a total of $267.33M.

Who are the investors of Zero Hash?

Investors of Zero Hash include Interactive Brokers, Plug and Play Crypto & Digital Assets, Nyca Partners, Point72 Ventures, Bain Capital and 23 more.

Who are Zero Hash's competitors?

Competitors of Zero Hash include BVNK, Bosonic, Bridge, Fireblocks, Wallet Engine and 7 more.

What products does Zero Hash offer?

Zero Hash's products include Account Funding and 4 more.

Loading...

Compare Zero Hash to Competitors

Paxos develops a regulated blockchain infrastructure and tokenization platform within the financial services sector. The company offers products including stablecoin issuance, crypto brokerage, and digital asset trading. It primarily serves enterprises looking to tokenize, custody, and trade assets. The company was founded in 2012 and is based in New York, New York.

Fordefi operates as a financial technology company and specializes in secure digital asset management for institutions. The company offers a multi-party computation (MPC) wallet platform and web3 gateway that allows users to self-custody private keys, connect to decentralized applications (dApps), and manage digital assets with enhanced security policies. Fordefi primarily serves funds and trading firms, market makers, and Web3 companies, providing them with tools to scale their strategies and manage their digital asset operations securely. It was founded in 2021 and is based in Woodmere, New York.

Bosonic provides services for the trading, clearance, and settlement of digital assets, and addresses counterparty credit and settlement risk. Bosonic's solutions include an alternative trading system (ATS) registered with FINRA and the SEC, utilizing blockchain technology for digital asset securities. Bosonic was formerly known as OTCXN. It was founded in 2016 and is based in San Francisco, California.

OwlTing develops blockchain technology solutions across various sectors. It offers a range of services, including a blockchain-based hotel management system, cross-border financial services, and platforms for both B2C marketplaces and travel experiences, as well as an NFT marketplace and a news platform. The company was founded in 2010 and is based in Taipei City, Taiwan.

TransFi develops a payment platform for the purchase of digital assets and nonfungible tokens (NFTs). The company's main service involves providing fiat-to-crypto ramps, allowing users to easily buy and sell cryptocurrency using their local currency and banking or e-wallet services. It was founded in 2022 and is based in Tampa, Florida.

CFX Labs provides digital dollar infrastructure and global payment solutions. The company offers services that connect digital assets with local currency through a regulated payment network, allowing transactions for businesses and individuals. It serves sectors that require digital remittance, cross-border payments, and the integration of digital currencies with traditional financial systems. It was founded in 2021 and is based in Chicago, Illinois.

Loading...