Securitize

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$193.02MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+83 points in the past 30 days

About Securitize

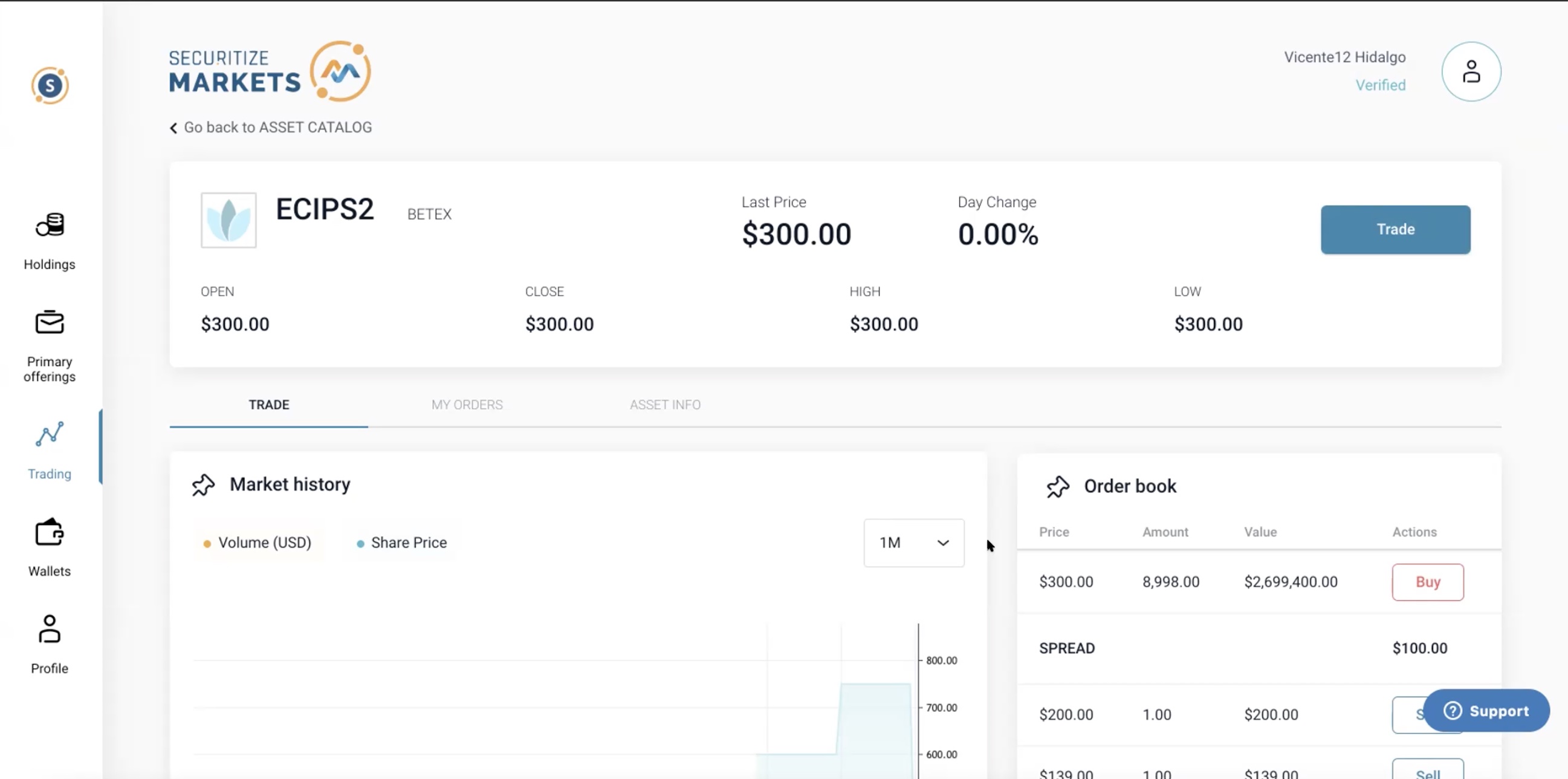

Securitize operates as a financial services company that provides liquidity and access to private markets. The company offers a platform for private businesses to raise capital and for investors to access exclusive investment opportunities. Securitize also provides transfer agent services, supporting businesses through capital formation, issuance of securities, financial distributions, corporate actions, and public filings. It was founded in 2017 and is based in San Francisco, California.

Loading...

Securitize's Product Videos

ESPs containing Securitize

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The asset tokenization market enables the conversion of ownership rights in various assets such as real estate, artwork, or securities into digital tokens tradable on blockchain networks. This technology allows for more efficient asset management, enhanced security, and increased liquidity through secondary trading markets. Asset tokenization solutions provide investors with fractional ownership o…

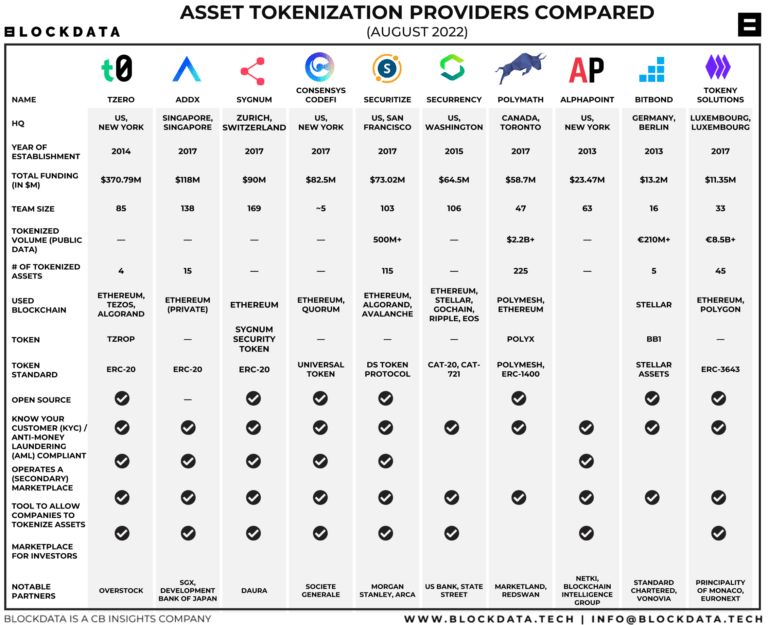

Securitize named as Leader among 15 other companies, including Fireblocks, Digital Asset, and Sygnum.

Securitize's Products & Differentiators

BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

Tokenized treasury fund with a current AUM of $2.4B+

Loading...

Research containing Securitize

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Securitize in 4 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market mapExpert Collections containing Securitize

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Securitize is included in 7 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

9,385 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,470 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,062 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,715 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Latest Securitize News

Sep 9, 2025

Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, September 9, 2025 / EINPresswire.com / -- Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors How Large Will The Real-World Asset (RWA) Tokenization Market Be By 2025? In recent times, the size of the real-world asset (RWA) tokenization market has experienced a quick expansion. The projections show an increase from $0.59 billion in 2024 to $0.67 billion in 2025, indicating a compound annual growth rate (CAGR) of 12.9%. This remarkable growth in the past years has been as a result of an escalating demand for liquid assets, an increase in the adoption of blockchain in financial services, a mounting interest in alternative investments, increased clearness in regulations concerning digital securities, and the growing inefficiencies in conventional asset management. In the coming years, we anticipate rapid expansion in the tokenization market size of real-world assets (RWA), with predictions for it reaching $1.07 billion in 2029 at a compound annual growth rate (CAGR) of 12.5%. This growth is expected to spring from factors such as burgeoning institutional interest in tokenized assets, an increasing demand for modular ownership models, broader adoption of digital custody systems, escalating security issues, and growing calls for immediate settlement and openness. Key trends in this forecast period involve the progression in cross-chain tokenization platforms, the sophisticated incorporation of artificial intelligence in tokenized asset management, the creation of compliant tokenized investment structures, the innovation in on-chain identification and customer knowledge solutions, along with the evolution of immediate asset valuation tools. Download a free sample of the real-world asset (rwa) tokenization market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=26964&type=smp What Are The Major Driving Forces Influencing The Real-World Asset (RWA) Tokenization Market Landscape? The surge in smartphone usage is predicted to stimulate the progression of the real-world asset (RWA) tokenization market. A smartphone, being a compact electronic gadget, unifies mobile communication, internet usage, and computing capabilities, facilitating users to interact, surf the web, and operate various apps. The broadening penetration of smartphones, fuelled by the increased affordability of these devices, is making sophisticated mobile technology widely available. Smartphones aid RWA tokenization by providing users rapid and effortless admittance to platforms allowing them to securely invest in, keep track, and trade tokenized physical assets at their convenience. As an example, in February 2023, a study by Uswitch Limited, a UK-based online and telephone comparison services provider, reported that there were 71.8 million active mobile connections in 2022, which signifies an uptick of 3.8% from 2021. Additionally, by 2025, the UK's population will reach 68.3 million, and 95% of the populace will possess smartphones. Consequently, the escalating adoption of smartphones is fuelling the expansion of the real-world asset (RWA) tokenization market. Who Are The Top Players In The Real-World Asset (RWA) Tokenization Market? Major players in the Real-World Asset (RWA) Tokenization Global Market Report 2025 include: • Securitize Inc. • Fireblocks Ltd. • Polymath Research Inc. • SoluLab Inc. • Brickken Finance S.L. • Tokeny Solutions S.A. • Debut Infotech Private Limited. • Archax Ltd. • Bitbond GmbH • Blocksquare d.o.o. What Are The Major Trends That Will Shape The Real-World Asset (RWA) Tokenization Market In The Future? Leading businesses in the market for tokenization of real-world assets (RWA) are shifting their focus towards producing innovative solutions, like blockchain-based tokenized funds. This move aims to uplift liquidity, promote efficiency, and establish transparency while handling real-world financial tools. These blockchain-based tokenized funds are essentially digital versions of conventional assets which are listed on blockchain frameworks. This makes fractional ownership, on-the-spot settlements, and worldwide ease of access possible. For instance, Fasanara Capital Ltd, an investment management firm from the UK, introduced a tokenized money market fund on the Polygon blockchain, the Fasanara MMF Token (FAST), in January 2025. The purpose of this fund is to merge the dependability of standard money market instruments with the effectiveness and clearness of blockchain technology. Utilizing the scalable facility of Polygon boosts real-time settlement, broader distribution, and eases fund management. Regulatory compliance is ensured with the use of ERC-3643 smart contracts, providing investors an accelerated, more transparent and economical method to access money market investments. Market Share And Forecast By Segment In The Global Real-World Asset (RWA) Tokenization Market The real-world asset (rwa) tokenization market covered in this report is segmented – 1) By Token Type: Security Tokens, Utility Tokens, Hybrid Tokens 2) By Asset Class: Real Estate, Commodities, Art And Collectibles, Intellectual Property, Other Asset Classes 3) By Blockchain Network: Public, Private, Consortium 4) By Application: Investment, Trading, Asset Financing, Other Applications Subsegments: 1) By Security Tokens: Equity Tokens, Debt Tokens, Real Estate Tokens, Commodity-Backed Tokens, Fund Tokens 2) By Utility Tokens: Access Tokens, Service Tokens, Payment Tokens, Platform Tokens, Governance Tokens 3) By Hybrid Tokens: Equity Utility Tokens, Asset Utility Tokens, Governance Security Tokens, Dividend Utility Tokens, Rights-Based Tokens View the full real-world asset (rwa) tokenization market report: https://www.thebusinessresearchcompany.com/report/real-world-asset-rwa-tokenization-global-market-report Real-World Asset (RWA) Tokenization Market Regional Insights In 2024, North America dominated the real-world asset (RWA) tokenization market. The fastest-growing region projected for this market in the estimated period is Asia-Pacific. The regions discussed in the report on the global real-world asset (RWA) tokenization market include Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global Real-World Asset (RWA) Tokenization Market 2025, By The Business Research Company Tokenization Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/tokenization-global-market-report Non Fungible Token Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/Non-Fungible-Token-global-market-report Asset Backed Securities Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/asset-backed-securities-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Securitize Frequently Asked Questions (FAQ)

When was Securitize founded?

Securitize was founded in 2017.

Where is Securitize's headquarters?

Securitize's headquarters is located at 100 Pine Street, San Francisco.

What is Securitize's latest funding round?

Securitize's latest funding round is Series C - II.

How much did Securitize raise?

Securitize raised a total of $193.02M.

Who are the investors of Securitize?

Investors of Securitize include Jump Crypto, 4Founders Capital, Tradeweb Markets, Aptos Labs, Circle and 38 more.

Who are Securitize's competitors?

Competitors of Securitize include Centrifuge, Brickken, Tokeny, Alt DRX, Pontoro and 7 more.

What products does Securitize offer?

Securitize's products include BlackRock USD Institutional Digital Liquidity Fund (BUIDL) and 4 more.

Loading...

Compare Securitize to Competitors

Brickken specializes in the tokenization of assets, operating within the blockchain and fintech sectors. The company offers a platform for creating, selling, and managing digital assets, enabling businesses to tokenize various asset types such as real estate, startups, and entertainment ventures. Brickken's services facilitate global investor reach, compliance with regulations, and on-chain management of tokenized assets. It was founded in 2020 and is based in Barcelona, Spain.

Polymath Network is a company involved in security tokenization within the financial services technology sector. Its offerings include a platform for creating, issuing, and managing security tokens, as well as tools for raising capital and managing investor relations in compliance with regulatory frameworks. Polymath serves the financial services industry, including broker-dealers, banks, and asset managers, by providing solutions for digital asset management. It was founded in 2017 and is based in Toronto, Canada.

Societe Generale - FORGE focuses on integrating capital markets with digital assets through financial services. The company offers blockchain-based products, including stablecoins, digital bonds, and structured products, for institutional issuers and investors. Its products are built to ensure compliance with capital market practices and integration with existing financial systems. It was founded in 2018 and is based in Puteaux, France.

tZERO is a financial technology company that provides market-based solutions within the capital markets sector. The company offers a platform for raising capital through various compliant fundraising methods, as well as trading and investment opportunities in private and digital securities. tZERO serves private and public companies, entrepreneurs, and retail and institutional investors. It was founded in 2014 and is based in Salt Lake City, Utah.

Taurus is a company specializing in digital asset infrastructure within the financial technology sector. The company offers a platform for the custody, issuance, and management of cryptocurrencies, tokenized assets, and digital currencies. Taurus provides services including storage solutions, tokenization of various assets, and a trading platform for institutional investors. It was founded in 2018 and is based in Geneva, Switzerland.

Bitbond is an asset tokenization platform operating in the financial technology sector. The company offers a smart contract generator, known as Token Tool, which enables users to create and manage the lifecycle of tokens without technical expertise. Bitbond's services also include regulatory-compliant offerings for tokenized financial instruments, digital asset custody solutions, and on-chain payment settlement using stable coins, catering to regulated financial institutions and large issuers. It was founded in 2013 and is based in Berlin, Germany.

Loading...