Ramp

Founded Year

2019Stage

Series E - II | AliveTotal Raised

$2.528BValuation

$0000Last Raised

$500M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+26 points in the past 30 days

About Ramp

Ramp develops a financial operations platform. The company offers a suite of services including corporate cards, expense management, accounts payable solutions, and accounting automation. Its platform serves startups, small businesses, mid-market companies, and enterprises across various sectors. The company was founded in 2019 and is based in New York, New York.

Loading...

ESPs containing Ramp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Ramp named as Leader among 15 other companies, including Coupa, Pleo, and Brex.

Ramp's Products & Differentiators

Ramp Card

Smart corporate cards - both physical and virtual - with embedded software controls.

Loading...

Research containing Ramp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ramp in 21 CB Insights research briefs, most recently on Sep 12, 2025.

Sep 12, 2025

How payments leaders are seizing the SMB opportunity

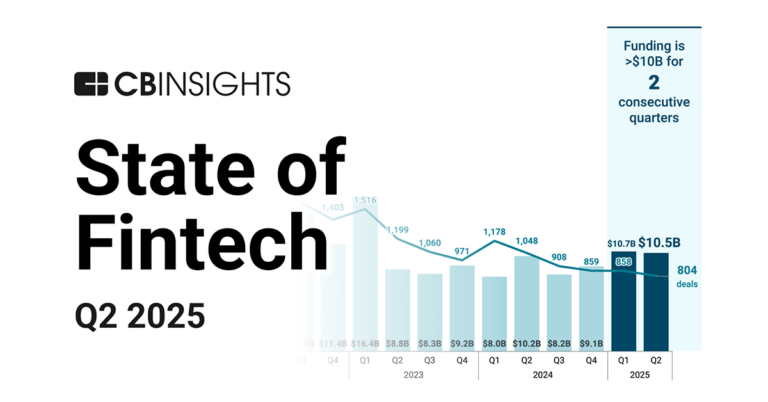

Jul 17, 2025 report

State of Fintech Q2’25 Report

Jun 6, 2025

The SMB fintech market map

May 29, 2025

The stablecoin market map

Aug 23, 2024

The B2B payments tech market mapExpert Collections containing Ramp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ramp is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,287 items

SMB Fintech

2,003 items

Payments

3,255 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,777 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Generative AI

2,841 items

Companies working on generative AI applications and infrastructure.

Latest Ramp News

Sep 17, 2025

但在 AI 时代,C 端和 B 端的用户们,都在与各种 AI 助手和 Agent 们打交道,越来越少地使用传统信息获取渠道。 ChatGPT 的周活跃用户数已经超过 7 亿大关;Perplexity 刚刚获得 2 亿美元 D 轮融资,月查询量超过 7.8 亿次。ChatGPT 等 ChatBot 和 AI 搜索引擎类应用,正在成为新的流量入口。 我们此前介绍过专为 AI 打造的搜索引擎 You.com 和 Exa ,搜索引擎在技术和产品方面也有巨大改变。 显然,人们获取信息的方式已经出现了范式转变级别的变化,这将彻底改变营销行业。面对这种变化,会有新一代营销技术公司来帮助品牌方,例如 Profound,它是专为 AI 时代搜索引擎打造的营销优化工具。 近日,Profound 获得 Sequoia Capital 领投的 3500 万美元 B 轮融资,参投方包括 Kleiner Perkins(A 轮领投方)、Khosla Ventures(种子轮领投方)、Saga VC 及 South Park Commons,Profound 的总融资额已达 5850万 美元。而就在 2025 年 6 月,它刚获得 2000 万美元的 A 轮融资,两轮融资相隔时间如此接近,显然它的增长速度和被客户接受的程度,让这些知名投资机构快速做决定。 Profound 由 James Cadwallader (CEO)和 Dylan Babbs(CTO)联合创立, Profound 的团队也吸引了来自 AMD、Microsoft、Datadog、Uber、Bridgewater 和 OpenAI 的前员工。 Profound 的创始团队(来源:Sequoia Capital) James Cadwallader 曾是数据驱动型网红营销机构 Kyra 的联合创始人,这段经历让他拥有了与《财富》500 强品牌深度合作的经验。在 Kyra 的创业过程中,他敏锐地洞察到品牌在新兴 AI 渠道中面临的巨大挑战与机遇:Nike 每年在营销上花费 40 亿美元,但如果问 ChatGPT 哪款跑鞋好,它会给四五个建议,这其中却不一定包含 Nike 跑鞋。 现在,AI 助手和 AI 搜索们,不会罗列出一系列排名链接,而是基于其对品牌的“认知”,生成一个单一、权威且基于概率的回答。 在传统搜索引擎优化(SEO)中至关重要的流量、反向链接和点击率,如今其影响力已大为减弱。 Gartner 预测,“到 2028 年,随着消费者拥抱由生成式 AI 驱动的搜索,品牌的自然搜索流量将减少 50% 或更多。”根据超过 Profound 调查, 60% 的消费者如今会首先求助 AI 助手,而非传统搜索引擎,来进行产品调研。 现在,流量入口正在迭代,使用这些流量入口的人群在迭代,这些新一代消费者的品牌认知也会迭代。 对于品牌商,如果营销方式不相应迭代,就很容易被淘汰。 品牌公司们在AI时代的痛点是,对于AI工具如何评价自己的品牌毫无洞察,也无从施加影响。 Profound 是一个AEO (Answer Engine Optimization) 平台,它的根本目标是当用户在任何 AI 平台(无论是 Google 的精选摘要,还是 ChatGPT、Perplexity 等 AI 助手)上提出问题时,让品牌商的内容能够被直接采纳,并作为一个值得信赖的、权威的答案呈现给用户。 具体来说,Profound 的产品按照功能主要可以分为监测、创作、活动统筹三类。 监测类产品主要解决的是品牌在 AI 搜索引擎中的“可见度黑箱”问题,让品牌从不知道AI怎么介绍和展示它,变得更清楚明了。 例如,Answer Engine Insights (答案引擎洞察),它是平台的核心监测仪表盘,可以实时展示各大主流 AI 搜索引擎是如何描述企业客户的品牌、产品、行业以及竞争对手的。 还有 Agent Analytics (智能体分析),它专门用于识别和分析访问企业自己网站的 AI 爬虫。它可以精确显示哪些 AI 平台在抓取企业的网站、抓取频率、以及它们对哪些页面最感兴趣。 Agent Analytics 的页面(来源:Profound) 最后是Conversation Explorer (对话探索器),它可以帮助企业发现用户正在围绕其行业和产品进行哪些类型的 AI 对话,发掘新兴的热门话题和深层用户意图。其子功能包括批量关键词分析和关键词层次结构。 在知道了AI 搜索引擎怎么介绍和展示企业的产品后,企业们下一步要做的是将监测到的洞察转化为实际行动,主动塑造和优化自身在 AI 中的叙事。 Profound Actions的页面(来源:Profound) Profound Actions整合所有监测数据,识别高影响力的内容机遇,并包含两个核心功能。 数据驱动的内容创作简报:为人类营销团队生成一份详尽的“作战计划”,包含建议的主题、标题结构、需引用的事实数据等,确保创作出的内容精准命中 AI 偏好。 AEO 内容创作模板 :直接将洞察转化为可随时发布的、基于成功范式构建的完整内容(如博客文章、对比指南等)。 这个工具将针对AI搜索引擎的内容创作,从猜测转变为一门有数据支撑的科学,并解决了内容生产的效率和规模化问题。 以往,策划和执行一场大型营销活动需要花费巨大的时间和人力,现在Profound的平台可以让小型团队使用多个Agent配合,在几分钟内就策划出一个以往需要以月为单位筹备的营销活动。 目前,Profound 针对不同规模的客户提供了两种收费方式。大型企业可以使用其定制化的 Profound Enterprise 计划,以满足其复杂的需求;而初创公司和小型企业则可以选择 Profound Lite,这是一个定价为每月 499 美元的自助服务计划,旨在让所有企业都能拥有 AI 曝光度。 Profound 已经吸引了来自 500 多个组织的广泛客户,其中不仅包括《财富》10 强企业和大型银行(如 U.S. Bank),还涵盖了 AI 时代众多顶尖的科技公司,例如 Ramp、MongoDB、DocuSign、Plaid 和 Clay。 以金融科技独角兽 Ramp 为例,在使用 Profound 的平台后,其应付账款产品在 AI 渠道的品牌曝光度实现了 7 倍的增长。 网络广告模式,是上一代互联网巨头的核心商业模式,无论是 Meta 还是 Google,其营收的绝大部分,还是来自网络广告。它们的护城河,来自网络效应,根源于它们占住了互联网用户的流量入口。 但是,当 AI 原生应用(想想 ChatGPT 的 7 亿周活)展现出成为流量入口的潜力时,传统的互联网巨头就有可能被颠覆。例如 Google,明明已经拥有强大的 Gemini 系列模型,也有 Google 搜索这个核心入口,但是对于传统 Google 搜索的 AI 改造还是扭扭捏捏,因为传统搜索带来的收入,是它们不敢也不能舍弃的。 流量入口的转变,势必推动营销方式的转变,所以让品牌被更多人看到的方式,也从 SEO,变成了 AEO。当然,在 AI 时代,营销本身就是一个热门方向,不过之前的思路主要在素材上,具体方向就是让AI生成更低成本更高效率的生成各种模态的高质量素材;但是不能被目标用户和消费者看到的素材,显然是没有价值的。 在 AI 领域,中国既有世界级的 AI 模型,也有将产品和服务卖到全球的 AI 应用公司(无论它卖的是硬件还是软件),那么这些新一代的公司都面向全球的巨大市场,有强烈的营销需求。 在营销范式转变的背景下,一批新一代的AI营销公司将由中国的非凡创业者创立,无论他们的方向是瞄准营销素材还是 AEO。

Ramp Frequently Asked Questions (FAQ)

When was Ramp founded?

Ramp was founded in 2019.

Where is Ramp's headquarters?

Ramp's headquarters is located at 28 West 23rd Street, New York.

What is Ramp's latest funding round?

Ramp's latest funding round is Series E - II.

How much did Ramp raise?

Ramp raised a total of $2.528B.

Who are the investors of Ramp?

Investors of Ramp include Founders Fund, Thrive Capital, D1 Capital Partners, General Catalyst, Coatue and 58 more.

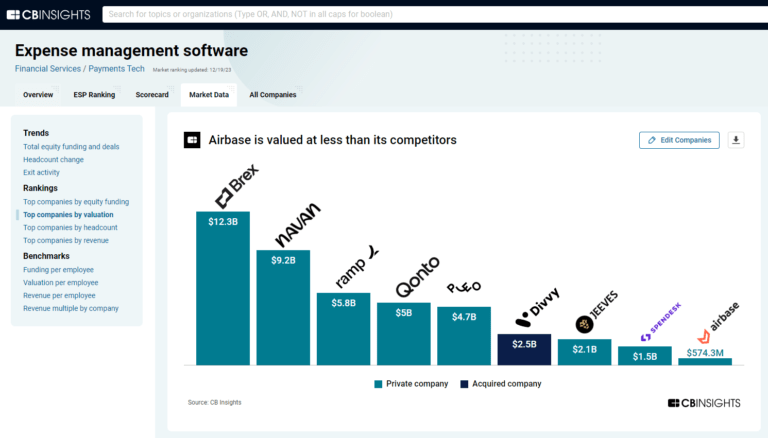

Who are Ramp's competitors?

Competitors of Ramp include Fyle, Capital on Tap, Center, Brex, Extend and 7 more.

What products does Ramp offer?

Ramp's products include Ramp Card and 4 more.

Who are Ramp's customers?

Customers of Ramp include Mode Analytics.

Loading...

Compare Ramp to Competitors

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Mesh focuses on travel and expense management for enterprises operating within the financial technology sector. The company offers a platform that provides solutions for travel management, spend management, and expense management, aiming to provide real-time visibility, control, and insights into all expenses. Mesh primarily serves modern global enterprises. It was founded in 2018 and is based in New York, New York.

Navan is a corporate travel management and expense management platform operating in the business travel sector. The company provides services for booking business travel and managing expenses, including tools for travel booking automation and expense report automation. Navan serves sectors such as energy and utilities, industrial and manufacturing, professional services, real estate and construction, retail and e-commerce, and technology and software. Navan was formerly known as TripActions. It was founded in 2015 and is based in Palo Alto, California.

Custodia focuses on corporate expense management in the financial technology sector. The company offers a range of services, including smarter expense management, AI-driven budgeting and spending, and real-time approvals and insights, all designed to empower employees and maintain financial control. Primarily, it caters to businesses ranging from small to large scale, providing them with tools for digital finance. It was founded in 2018 and is based in New York, New York.

Rho focuses on providing financial services and operates within the finance and technology sectors. The company offers a financial platform that includes services such as commercial banking, corporate cards, expense management, and accounts payable automation. Rho primarily serves organizations looking to manage their finances. Rho was formerly known as Rho Business Banking. It was founded in 2018 and is based in New York, New York.

Loading...