PolicyGenius

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$276.05MAbout PolicyGenius

PolicyGenius is an online insurance platform. The company provides a place to shop online for life, long-term disability, renters, and pet insurance through its quoting engines that offer comparisons of tailored policies. It was formerly known as KnowltOwl. The company was founded in 2014 and is based in New York, New York. In April 2023, PolicyGenius was acquired by Zinnia. The terms of the transaction were not disclosed.

Loading...

ESPs containing PolicyGenius

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech producers — home market comprises insurtech agents, brokers, distributors, and other intermediaries that provide homeowners and renters insurance. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for insureds — are often a focus of these companies. This market excludes managing general agents.

PolicyGenius named as Leader among 11 other companies, including Wefox, Insurify, and The Zebra.

PolicyGenius's Products & Differentiators

Life Insurance

Life insurance is an affordable way to provide financial support to the people you love after you die.

Loading...

Research containing PolicyGenius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned PolicyGenius in 7 CB Insights research briefs, most recently on May 19, 2025.

Feb 23, 2024

The B2C US insurtech market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

Aug 8, 2023 report

State of Insurtech Q2’23 ReportExpert Collections containing PolicyGenius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

PolicyGenius is included in 4 Expert Collections, including Fintech 100.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

3,373 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest PolicyGenius News

Sep 5, 2025

Shutterstock In and outside of the modern business world, we are having more conversations about wellness, stress management and burnout than previous generations. It’s becoming less taboo to “not be OK” at every given moment. Companies, too, are realizing that in order to have the strongest team possible, mental health benefits need to be included in perks packages. After experiencing a drastically changing world and unprecedented exposure to isolation in 2020, it’s especially important that teams find new ways to engage and connect in order to feel a sort of pre-pandemic normalcy. Taking care of mind, body and spirit through at-home fitness programs, online therapy, pursuing creative endeavors, or even streaming service subscriptions as an uplifting distraction have become as important as a health insurance plan or dental coverage. “Adapting today’s ‘new normal’ is crucial for all businesses,” said Dailymotion Chief People Officer Karine Aubry. “It became an opportunity to redefine our company culture and lean more into fostering an inclusive workplace for all.” Even though many coworkers still remain apart from each other physically, team collaboration is as inclusive – if not more – than ever before. Built In NYC caught up with four tech companies that created a dedicated virtual support system for their teams. Professionals share what newly introduced benefits they anticipate will be sticking around for the long haul. Chief People Officer • Dailymotion Dailymotion is a global video streaming platform for discovering the latest events in news, sports, entertainment and music. Chief People Officer Karine Aubry explained that schedule customizing and encouraging employees to take time for themselves has been crucial for team wellness. How have your company benefits changed over the last year of working remotely? Since transitioning to remote work, we have idolized surveys for direct feedback from our employees to ensure we give them a voice to actively put in place benefits that respond to their needs. We’ve been committed to helping our people adapt and feel empowered during these times by providing them a caring, secure and supportive work environment in their new normal. We have been increasingly more aware of people’s needs to disconnect work from home life – therefore, helping our employees take time for themselves when rethinking our benefits. One of the changes we made was to turn our usual gym membership into a monthly wellness stipend allowance for each employee to spend where they feel benefits them most (i.e. babysitting for parents, massages, therapy, meditation app subscription, etc...) We have been able to maintain the best health plans possible for our employees and their family, as well as offer generous PTO for our people to enjoy and disconnect from work. What’s a benefit you had pre-COVID-19 that you’ve doubled down on since going remote? We have decided to keep all the usual activities and office events, even if this meant bringing them online. Newsletters, stand-ups, after-work happy hours, team lunches, and coffee breaks have all moved to a Zoom setting. We have established a virtual cafeteria that people can pop in and out from to keep up on office life. We’ve moved from weekly to bi-weekly stand-ups in order to take a break from screen time and maximize our time together. Our personal routines are catered to our personal needs where we can customize our work schedules in order to be both more productive and embrace these interactions we get with our colleagues. Benefits are a big part of the employee experience and journey; this is why it became pertinent to redefine and create new ones that cater to our new employees’ experiences. The remote setting has directly inspired certain initiatives. Early on, we decided to train our managers on burnout and Zoom fatigue by introducing flexible mental health days and flexible working hours for parents. We have been increasingly more aware of people’s needs to disconnect work from home life.” What’s a new benefit you’ve added since the transition to remote work that you plan to keep after your team returns to the office, and why? We now offer to our employees the ability to choose the type of remote setting they prefer (fully remote, hybrid setting – freedom to choose which days to be in the office). Of course, taking into account that each team functions a bit differently, we all work together on the best plans of action to ensure equality across the board as well as leaning into the new ways of working. Adapting today’s “new normal” is crucial for all businesses and for Dailymotion; it became an opportunity to redefine our company culture and lean more into fostering an inclusive workplace for all. We thrive to stay informed, learn, and adapt as remote work continues to change and evolve globally. Our mission statement “Caring Matters” has remained at the core of how we lead and inspire change internally. As a company that has offices in many different parts of the world, the remote setting that we have been experiencing for the last year and a half is helping us shape the global vision we have for the future of Dailymotion. Senior Manager, People Operations • Policygenius Policygenius offers an online insurance marketplace that helps people understand their options, compare quotes and buy policies. According to Becca Goland-Van Ryn, senior manager of people operations, doubling down on mental health and wellness benefits has created collective spaces for employees of every background to have more inclusive conversations. How have your company benefits changed over the last year of working remotely? While we’ve always had a budget for workstation setup, it was used primarily for in-office needs, such as a standing desk. Since going remote, we’ve increased that budget and directed it toward at-home workstation setups, with the expectation that employees use it for anything they might need to make working from home a bit more pleasant. That may mean a desk and comfy chair, or a high-end coffee maker. In addition, company events have (not surprisingly) changed drastically over the past year. While we used to have in-office happy hours or kickball games, we’ve had to get creative with new ideas. Our employee experience team has put together some really fun and engaging company-wide remote events, like a hilarious version of The Newlywed Game, and my kids along with many others just participated in our second annual Take Your Kids to Work Day virtual talent show. What’s a benefit you had pre-COVID-19 that you’ve doubled down on since going remote? We’ve taken the past year to double down on mental health and wellness benefits. This includes partnering with online therapy provider Talkspace (which we offer to all of our employees as well as their spouses/dependents over the age of 13) and working with one of our existing benefits vendors, HealthJoy, to offer low-cost teletherapy. We’ve also added “Feel Good Fridays” – sessions that focus on physical, mental or emotional health. Additionally, while we’ve always had affinity groups at Policygenius, we’ve really focused on broadening them. This has included building specialized programming driven by our employees and creating collective spaces for marginalized groups for discussion and healing. We added an annual floating holiday to use for any major religious, cultural or federal holidays not included in our regular calendar.” What’s a new benefit you’ve added since the transition to remote work that you plan to keep after your team returns to the office, and why? Since transitioning to remote work we’ve added more flexibility to our PTO guidelines. While we’ve always offered generous and flexible PTO, we knew that the individual struggles folks were experiencing during COVID-19 necessitated additional time off. To that end, we’ve expanded our COVID-19 leave beyond what is required by law including time off for illness, caregiving, and to get or recover from the vaccine. To ensure we’re being inclusive of the different cultural and religious backgrounds of our employees, we also added an annual floating holiday to use for any major religious, cultural or federal holidays not included in our regular holiday calendar. In addition to the changes to time off, we offer expanded flexibility to our employees in a few other ways. We’ve encouraged parents and other caregivers to work flexible hours and note those blocks on their calendar so their teammates can respect non-working time. Additionally, while everyone at Policygenius is still working remotely, we’re building a “future of work” plan to allow employees to work remotely more frequently after we return to the office – a new benefit that we know many employees are excited to take advantage of! Head of People Operations • Skillshare Skillshare is an online learning community offering thousands of classes on topics including illustration, design, photography, video, freelancing and more. Since all employees have gone fully remote at Skillshare, they are now planning bi-annual team retreats and investing in a creativity fund to boost inspiration, Head of People Operations Ashley Burnstad said. How have your company benefits changed over the last year of working remotely? Prior to the pandemic, about 35 percent of our team worked remotely. Being fully distributed now affords us an exciting opportunity to curate a more uniform and equitable day-to-day employee experience for everyone, wherever they are located. Since then, we’ve updated the following benefits: Work from home expense allowance for physical items (headphones, coffee machine, ergonomic accessories, plants, etc.) of up to $750 Monthly reimbursement of up to $75 for high-speed internet services Monthly coffee/tea reimbursement of up to $25 Annual wellness reimbursement of up to $250 Revised unlimited PTO minimum requirement to 12 day minimum per year to encourage folks to take at least one day a month to reduce burnout A corporate wellness benefit that provides employees access to steep discounts on physical and mental wellness plans In the coming months, we will also offer on-demand co-working options so folks can change up their scenery and work in an environment that’s most productive for them. What’s a benefit you had pre-COVID-19 that you’ve doubled down on since going remote? We rebranded our conference and education credit to a learning and creativity fund, whereby employees have an increased expense allowance of $2,000 per year to explore their creativity. By going fully remote, people have had more free or personal time to fill that they didn’t necessarily have before. We wanted to encourage folks to fill their time in productive ways that support self care and fuels inspiration. Whether folks want to work with a career coach, learn how to play the guitar, attend a virtual conference in their field, buy loads of art supplies to tap into their inner Picasso, or cook like a master chef – the goal of this perk is to allow each person to really invest in the parts of their lives where they can feel fulfilled. We’ve gone fully remote, so we’re in this for the long haul.” What’s a new benefit you’ve added since the transition to remote work that you plan to keep after your team returns to the office, and why? We’ve gone fully remote, so we’re in this for the long haul. While folks will have the opportunity to use co-working spaces in their respective cities, we won’t have a dedicated Skillshare office. Historically, we used to fly remote team members to the headquarters a few times a year. Now that we’re all remote, we’re really looking forward to hosting two high-impact, fun team retreats per year to bring the team together in different locations – once it’s safe to do so, of course! Senior Manager, Talent Operations • Animoto Online video creation platform Animoto seeks to make it easy for any user to drag and drop their way to powerful and professional marketing videos. Senior Manager of Talent Operations Ellen Protsyk said introducing four-day workweeks during the summer months and an additional five days off for employee recovery has made a drastic difference in both employee happiness and drive. How have your company benefits changed over the last year of working remotely? 2020 brought many unexpected challenges. Companies, including Animoto, had to reimagine benefits, perks, norms, employee engagement, policies, and work culture in a matter of days. As a people-first company, Animoto is proud of our culture, which is rooted in our company virtues. The pandemic was an opportunity to “betterfy” our offerings as follows: Animoto provides all full-time employees with a full work-from-home setup that includes monitors, standing desks, ergonomic chairs, keyboards, trackpads, laptop stands, etc. All Animoto employees were given Fridays off in July and August of 2020 Focus Fridays ensure that our employees have a day during the week with limited meetings and emails so that they are able to focus on work, and themselves, without incurring additional Zoom or video hangout fatigue What’s a benefit you had pre-COVID-19 that you’ve doubled down on since going remote? One of Animoto’s quirkier benefits is our legacy subscriptions perk. As a SaaS company, Animoto wants the team to regularly engage with other best-of-breed web-based subscription services. As a result, we allowed our employees to be reimbursed for their Amazon Prime, Spotify or Apple Music and Netflix subscriptions. With COVID-19 disrupting so much of our lives, Animoto’s people team engaged in a listening tour to hear what our employees had to say about their new work lives. Through these chats, we learned that many of our employees were yearning for additional means to stay connected or have some semblance of our pre-pandemic lives. Some employees struggled with their mental health while social distancing at home. Based on the feedback we received from our employees, Animoto increased the budget to $600 and expanded its subscription perk to provide resources to our employees. We also provided a list of recommendations, including mental health, physical health, creative, TV and music subscriptions. In addition to making Focus Fridays permanent, Animoto granted employees an additional five days of rest.” What’s a new benefit you’ve added since the transition to remote work that you plan to keep after your team returns to the office, and why? Finally, our last big benefits change was to normalize company-wide discussions around mental health and burnout. Animoto’s people team conducted a wellness survey to measure employee happiness prior and after implementing summer Fridays. The results showed that employees’ happiness and productivity increased and stress levels decreased as a result of four-day summer weeks. In addition to making Focus Fridays permanent, Animoto granted employees an additional five days of rest to ensure that the team is building space for rest and avoiding the potential to burnout.

PolicyGenius Frequently Asked Questions (FAQ)

When was PolicyGenius founded?

PolicyGenius was founded in 2014.

Where is PolicyGenius's headquarters?

PolicyGenius's headquarters is located at 32 Old Slip, 30th Floor, New York.

What is PolicyGenius's latest funding round?

PolicyGenius's latest funding round is Acquired.

How much did PolicyGenius raise?

PolicyGenius raised a total of $276.05M.

Who are the investors of PolicyGenius?

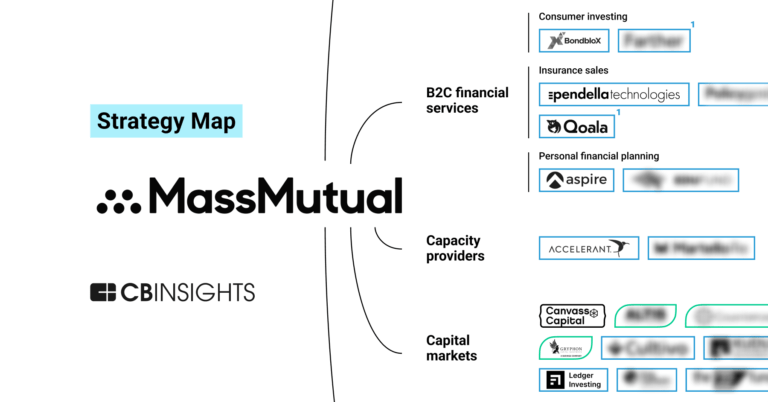

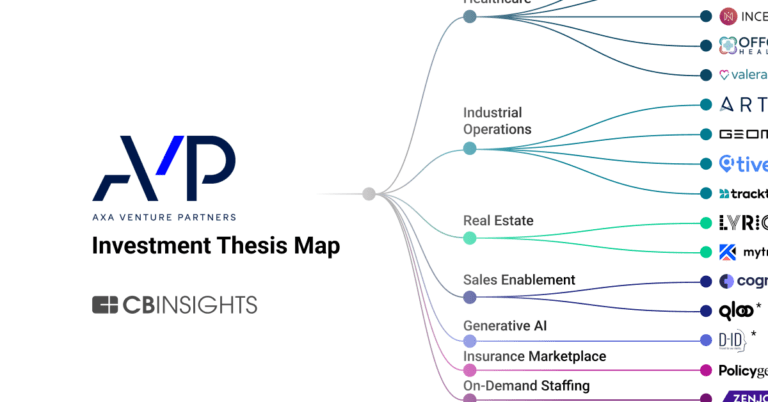

Investors of PolicyGenius include Zinnia, Atlantic Vantage Point, MassMutual Ventures, Norwest Venture Partners, KKR and 19 more.

Who are PolicyGenius's competitors?

Competitors of PolicyGenius include UniVista, Bestow, Next Insurance, NeueHealth, BIMA and 7 more.

What products does PolicyGenius offer?

PolicyGenius's products include Life Insurance and 2 more.

Loading...

Compare PolicyGenius to Competitors

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment by generating communication between consumers, shops, and carriers. The company offers a range of services, including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

NeueHealth operates within the medical sector, providing care through its owned and affiliated clinics. It offers arrangements and tools for independent providers and medical groups, focusing on performance and population health. It serves health consumers, providers, and payors in the healthcare industry. It was formerly known as Bright Health Group. It was founded in 2015 and is based in Minneapolis, Minnesota.

BIMA operates in the healthcare sector. The company provides services such as telemedicine, specialist care, health screening, personalized health programs, medicine delivery, laboratory testing, and insurance. The company serves individuals seeking health solutions. It was founded in 2010 and is based in Singapore.

Alan provides health insurance services and preventive health solutions within the healthcare industry. It offers health insurance plans, a healthcare system navigation tool through Alan Clinic, and mental well-being support with Alan Mind, designed to improve the health and productivity of individuals and corporate employees. It primarily serves diverse sectors, including tech startups, hospitality, the public sector, retail, and industrial businesses. It was founded in 2016 and is based in Paris, France.

Ladder provides term life insurance through a digital platform within the insurance industry. It offers affordable term life insurance policies with the flexibility to adjust coverage as the policyholder's life circumstances change. Its services are designed to be accessible online, with a paperless application process and tools like an insurance calculator to help customers determine their coverage needs. It was founded in 2015 and is based in Palo Alto, California.

HPOne operates within the healthcare sector, focusing on health insurance and Medicare plans. The company provides sales, marketing, and member outreach services to facilitate the management of Medicare and health insurance members. It was founded in 2006 and is based in Trumbull, Connecticut.

Loading...