Plug and Play Ventures

Investments

2184Portfolio Exits

257Funds

4Partners & Customers

10About Plug and Play Ventures

Plug and Play Ventures is a global technology accelerator and venture fund. Plug and Play Ventures participates in Seed, Angel and Series A funding where they often co-invest with strategic partners. Through years of experience and as part of its network, the firm has put together a world-class group of serial entrepreneurs, strategic investors, and industry leaders who actively assist the firm with successful and growing investment portfolio.

Expert Collections containing Plug and Play Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Plug and Play Ventures in 2 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Research containing Plug and Play Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plug and Play Ventures in 5 CB Insights research briefs, most recently on Oct 24, 2024.

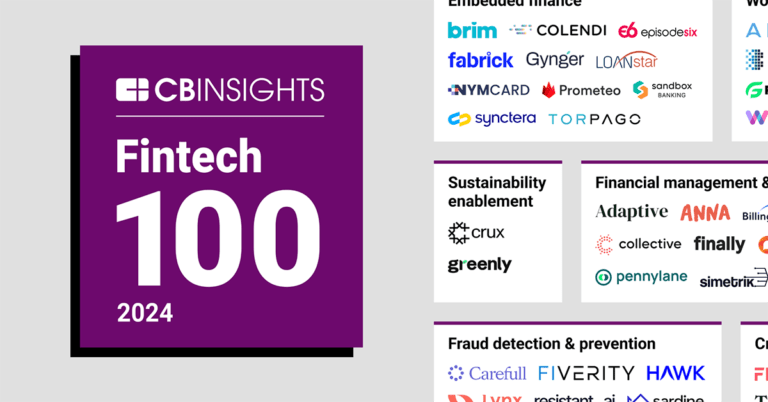

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024

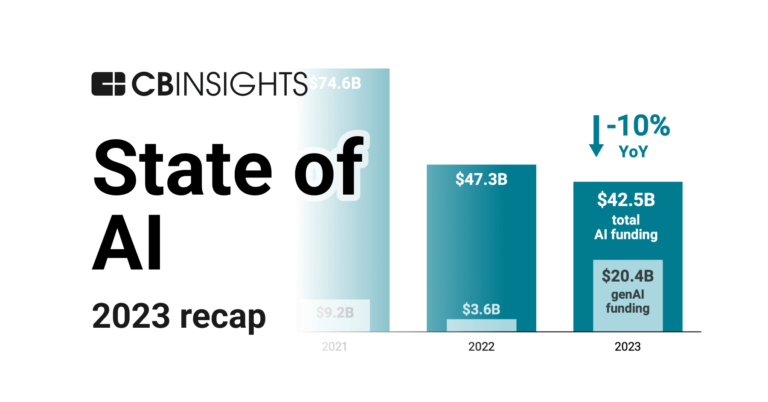

Feb 1, 2024 report

State of AI 2023 Report

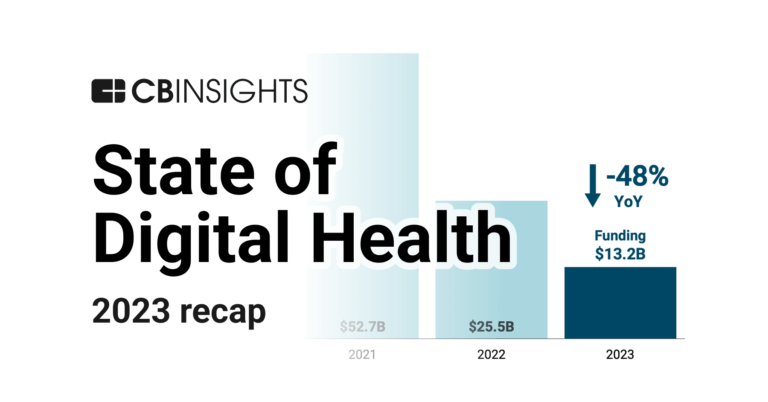

Jan 25, 2024 report

State of Digital Health 2023 Report

Jan 4, 2024 report

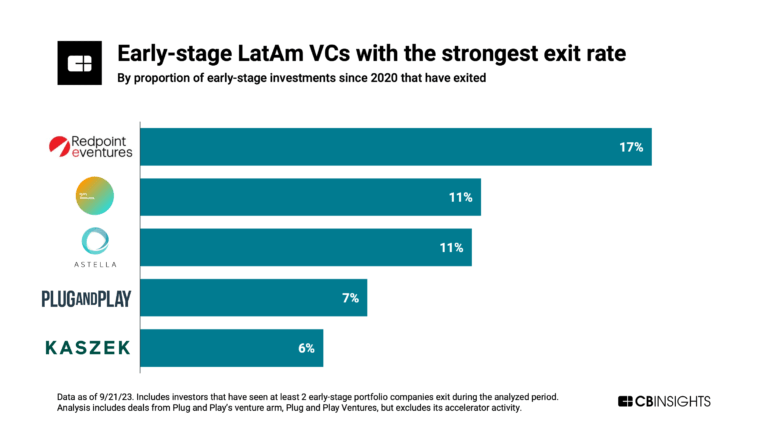

State of Venture 2023 ReportLatest Plug and Play Ventures News

Aug 14, 2025

SAN FRANCISCO–( BUSINESS WIRE )– Matrice.ai , which builds modular Vision AI Factories for real-world environments, today announced a strategic expansion of its seed funding round led by Voltage Park with participation from Ax3.ai, Plug and Play Ventures, and a syndicate of prominent industry angel investors. With Voltage Park's AI infrastructure and backing, Matrice.ai can accelerate the development and deployment of real-time computer vision solutions for complex industrial and commercial environments Share Matrice.ai's factory platform is already powering hundreds of live cameras for enterprises in the energy, retail, and public sectors in the Middle East and the Philippines. This funding round validates Matrice.ai's strong market traction as the company focuses on plans for expansion into North America and Europe. With Voltage Park's AI infrastructure and backing, Matrice.ai can accelerate the development and deployment of real-time computer vision solutions for complex industrial and commercial environments – across oil fields, retail floors, smart cities, and stadiums. “Voltage Park is more than a financial backer — they are our partner for jointly developing and deploying Vision AI Factories,” said Amar Krishna, Co-founder of Matrice.ai. “With their world-class AI infrastructure for training and inference, and enterprise-grade software stack for deploying, integrating, and operating production workloads, we can build and deploy highly accurate, custom vision models at a speed and cost that was previously unimaginable. We're industrializing AI for the real world.” Voltage Park's mission is to empower innovators by making high-performance AI infrastructure accessible. The investment in Matrice.ai underscores this commitment, targeting practical, high-value enterprise applications. “Voltage Park's mission is to help enterprises transform data into business intelligence using AI,” said Saurabh Giri, Chief Product and Technology Officer of Voltage Park. “We look for companies that are moving AI from theoretical to transformational, and Matrice.ai's platform is the perfect example. Their domain expertise in vision models enables our customers to convert pixels into intelligence with vertical-specific solutions across multiple industries. We are thrilled to provide the AI infrastructure backbone for deploying Matrice.ai Vision Models in a modular, cohesive, and fully integrated hardware-software stack with no security and data privacy trade-offs.” “This partnership gives us the AI infrastructure edge to industrialize real-world vision AI,” said Dipendra Jha, Co-founder & CTO of Matrice.ai. “We're now building GPU-optimized inference pipelines that turn live video into precise, real-time insights—with minimal latency and full enterprise control.” The funding will be used to: Quickly build and deploy targeted AI pipelines for use cases like flare detection, crowd analytics, and queue monitoring. Scale training and inference stacks for scalable deployment using Voltage Park infrastructure. Expand enterprise operations across North America and Europe to meet growing demand. About Matrice.ai Matrice.ai is building Vision AI Factories: an end-to-end platform for building, deploying, and scaling computer vision solutions across enterprise environments. From model training to edge inference, Matrice.ai makes real-time AI vision accessible and production-ready. Learn more at matrice.ai About Voltage Park Voltage Park is building AI Factory infrastructure from the ground up: a production solution consisting of hardware and software components working together to transform data into adoptable intelligence. We provide flexible, cost-effective cloud GPU solutions that power an enterprise's entire AI lifecycle with the compute they need and service they deserve. For more information visit www.voltagepark.com About Ax3.ai & Plug and Play Ventures Ax3.ai is a globally distributed GPU cloud provider that supports elastic training and inference at scale. Plug and Play Ventures is a global innovation platform backing Matrice.ai's enterprise growth journey. Contacts Media Contact: Sam Totah Public Relations stotah@voltagepark.com (c)2025 Business Wire, Inc., All rights reserved.

Plug and Play Ventures Investments

2,184 Investments

Plug and Play Ventures has made 2,184 investments. Their latest investment was in Gobano Robotics as part of their Seed VC on September 09, 2025.

Plug and Play Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/9/2025 | Seed VC | Gobano Robotics | $3.51M | Yes | Axeleo Capital, Bpifrance, Kima Ventures, Motier Ventures, Polytechnique Ventures, Undisclosed Angel Investors, and Undisclosed Venture Investors | 2 |

9/3/2025 | Series A | ArcaScience | $7M | No | 4 | |

7/30/2025 | Pre-Seed | Solidec | $2M | Yes | Collaborative Fund, Echo River Capital, Ecosphere Ventures, New Climate Ventures, Safar Partners, Semilla Capital, and Undisclosed Investors | 5 |

7/29/2025 | Seed VC | |||||

6/23/2025 | Pre-Seed |

Date | 9/9/2025 | 9/3/2025 | 7/30/2025 | 7/29/2025 | 6/23/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Series A | Pre-Seed | Seed VC | Pre-Seed |

Company | Gobano Robotics | ArcaScience | Solidec | ||

Amount | $3.51M | $7M | $2M | ||

New? | Yes | No | Yes | ||

Co-Investors | Axeleo Capital, Bpifrance, Kima Ventures, Motier Ventures, Polytechnique Ventures, Undisclosed Angel Investors, and Undisclosed Venture Investors | Collaborative Fund, Echo River Capital, Ecosphere Ventures, New Climate Ventures, Safar Partners, Semilla Capital, and Undisclosed Investors | |||

Sources | 2 | 4 | 5 |

Plug and Play Ventures Portfolio Exits

257 Portfolio Exits

Plug and Play Ventures has 257 portfolio exits. Their latest portfolio exit was Tractable on August 29, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/29/2025 | Acquired | NTTME | 2 | ||

8/19/2025 | Acquired | 6 | |||

7/2/2025 | Acquired | Hokan Group | 2 | ||

Date | 8/29/2025 | 8/19/2025 | 7/2/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | NTTME | Hokan Group | |||

Sources | 2 | 6 | 2 |

Plug and Play Ventures Fund History

4 Fund Histories

Plug and Play Ventures has 4 funds, including Plug and Play Supply Chain Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/19/2022 | Plug and Play Supply Chain Fund I | $25.5M | 1 | ||

Plug & Play Umbrella Fund | |||||

Plug & Play Future Commerce Fund I | |||||

Plug & Play Growth Fund |

Closing Date | 4/19/2022 | |||

|---|---|---|---|---|

Fund | Plug and Play Supply Chain Fund I | Plug & Play Umbrella Fund | Plug & Play Future Commerce Fund I | Plug & Play Growth Fund |

Fund Type | ||||

Status | ||||

Amount | $25.5M | |||

Sources | 1 |

Plug and Play Ventures Partners & Customers

10 Partners and customers

Plug and Play Ventures has 10 strategic partners and customers. Plug and Play Ventures recently partnered with The Rawlings Group on June 6, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

6/17/2024 | Partner | United States | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | 1 | |

6/1/2023 | Partner | Netherlands | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | 1 | |

11/15/2022 | Partner | United Kingdom, United States, Netherlands, and Gibraltar | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | 1 | |

8/23/2022 | Partner | ||||

6/15/2022 | Partner |

Date | 6/17/2024 | 6/1/2023 | 11/15/2022 | 8/23/2022 | 6/15/2022 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | Netherlands | United Kingdom, United States, Netherlands, and Gibraltar | ||

News Snippet | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | ||

Sources | 1 | 1 | 1 |

Compare Plug and Play Ventures to Competitors

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Rice AI Venture Accelerator Program, which advances early-stage artificial intelligence innovation and commercialization within different sectors. The program provides AI research, resources, and a network of early-stage AI startups, serving Fortune 500 companies and public sector organizations looking to integrate AI into their operations. It was founded in 2025 and is based in Houston, Texas.

LaunchPad is a venture builder that identifies and maximizes tech-related opportunities across Southeast Asia. It supports ventures in the pre-seed to seed stages, putting in the initial investment, which typically ranges from US$50,000 to US$100,000. It was founded in 2015 and is based in Petaling Jaya, Malaysia.

AngelList specializes in providing a suite of services and software for the venture capital and private equity sectors. The company offers tools for venture fund management, rolling fund administration, and syndicate capital raising, as well as equity management solutions for high-growth companies. Its platform is designed to streamline fund management and investor relations, offering features such as cap table automation, investor onboarding, and portfolio management. It was founded in 2010 and is based in San Francisco, California.

MassChallenge is a startup accelerator that supports early-stage entrepreneurs. It awards cash prizes to winning startups with zero equity taken. It also offers additional benefits for startups, including mentorship and training, free office space, access to funding, legal advice, media attention, and in-kind support. The company was founded in 2009 and is based in Boston, Massachusetts.

WiL is a venture capital firm that invests in startups and helps them enter markets in Japan, Asia, and the US. The company also provides services to corporate investors. It was founded in 2013 and is based in Palo Alto, California.

Loading...