Palantir

Founded Year

2003Stage

PIPE - II | IPOTotal Raised

$2.494BMarket Cap

406.69BStock Price

171.21Revenue

$0000About Palantir

Palantir specializes in data integration and analysis. The company offers software solutions for organizations to integrate and analyze their data. Palantir serves national security, healthcare, energy, finance, and manufacturing sectors. It was founded in 2003 and is based in Denver, Colorado.

Loading...

Loading...

Research containing Palantir

Get data-driven expert analysis from the CB Insights Intelligence Unit.

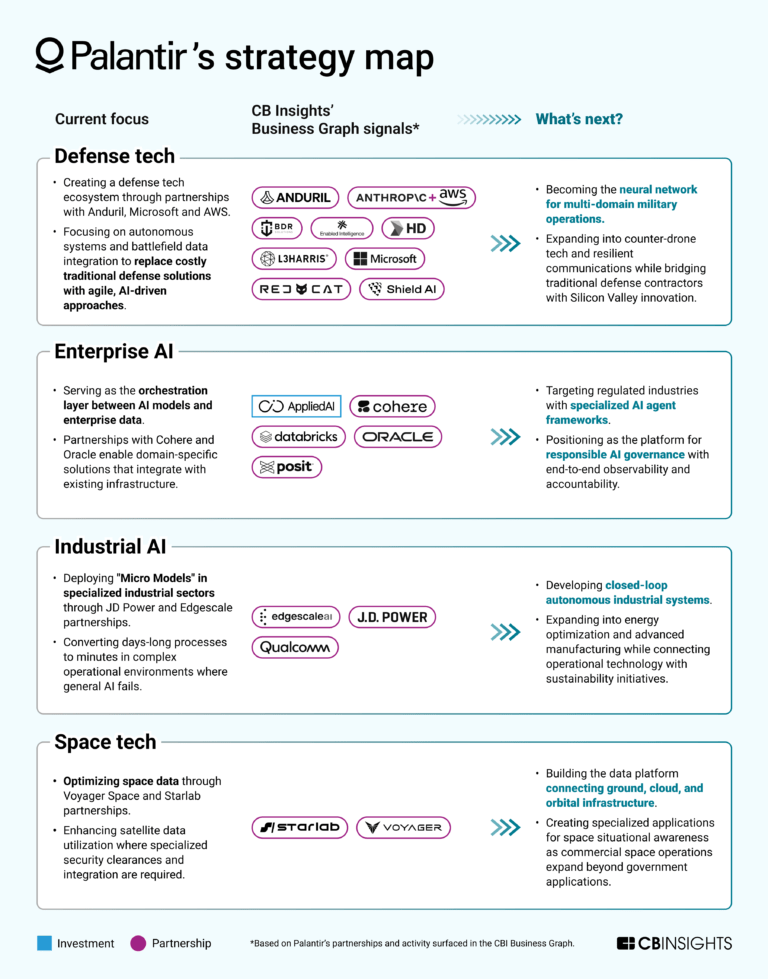

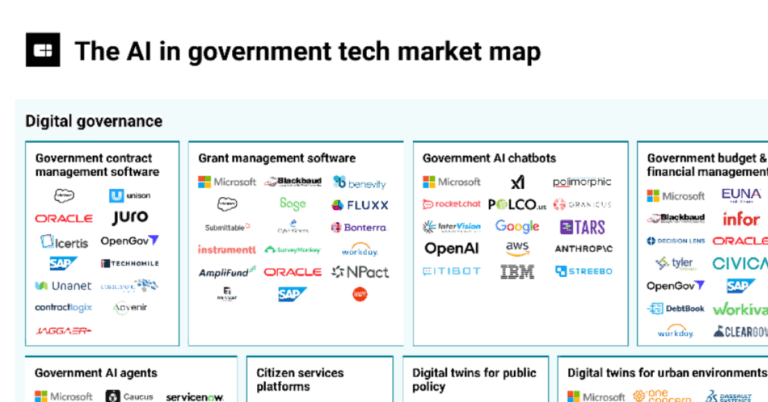

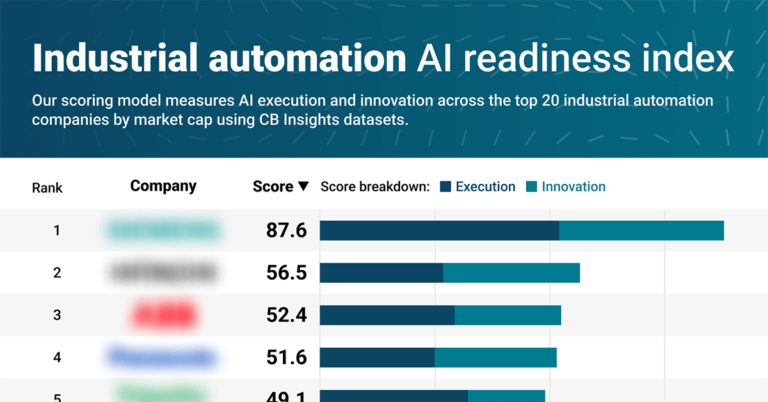

CB Insights Intelligence Analysts have mentioned Palantir in 11 CB Insights research briefs, most recently on Aug 27, 2025.

Aug 14, 2025

310+ AI companies transforming government

Mar 6, 2025

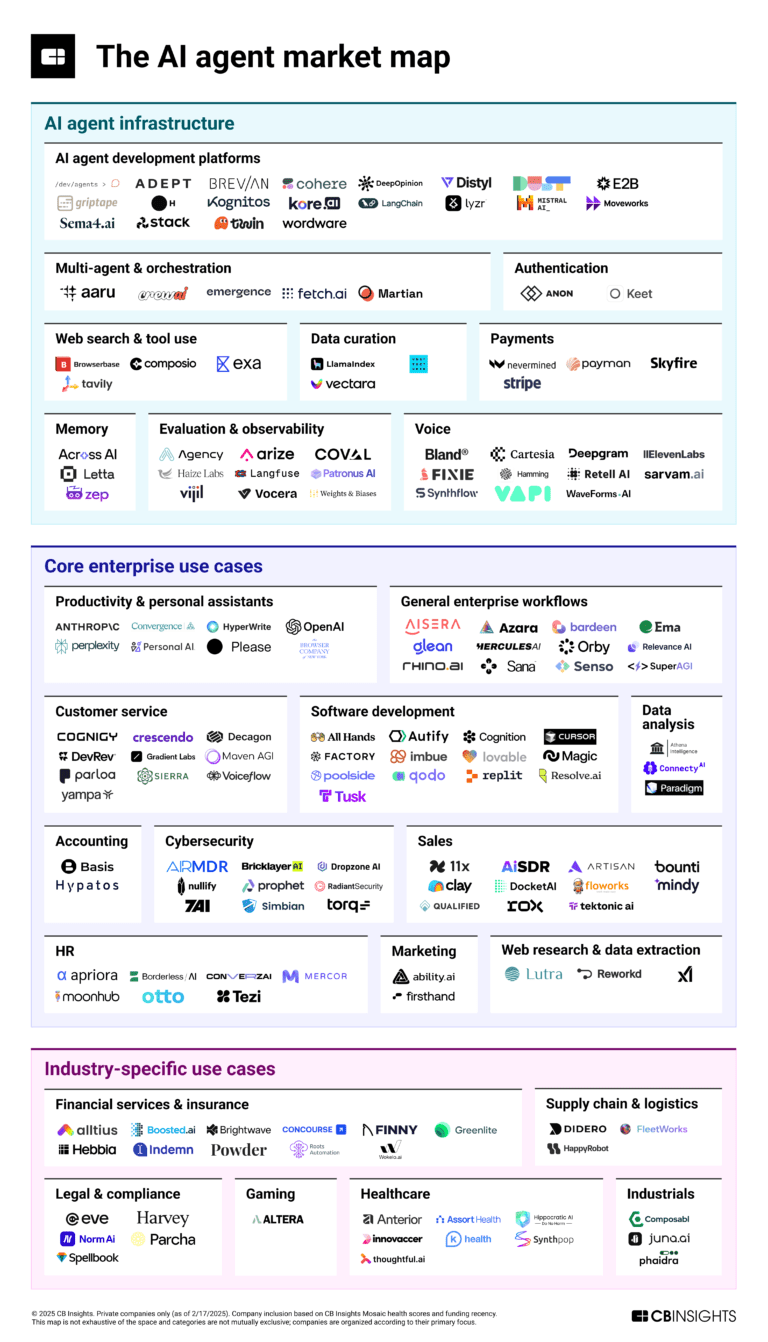

The AI agent market map

Dec 23, 2024

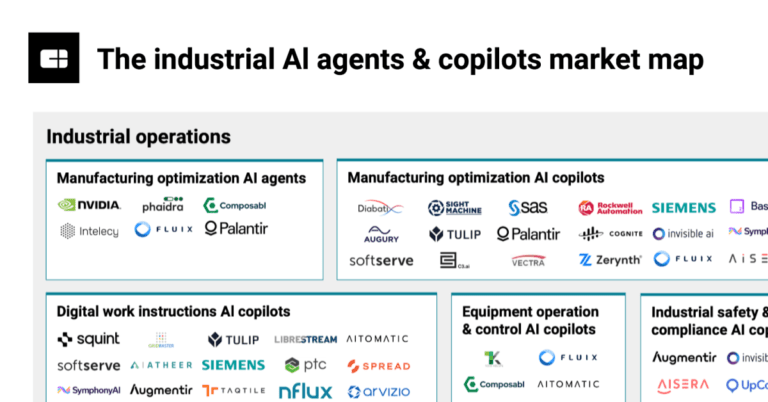

The industrial AI agents & copilots market map

Aug 14, 2024

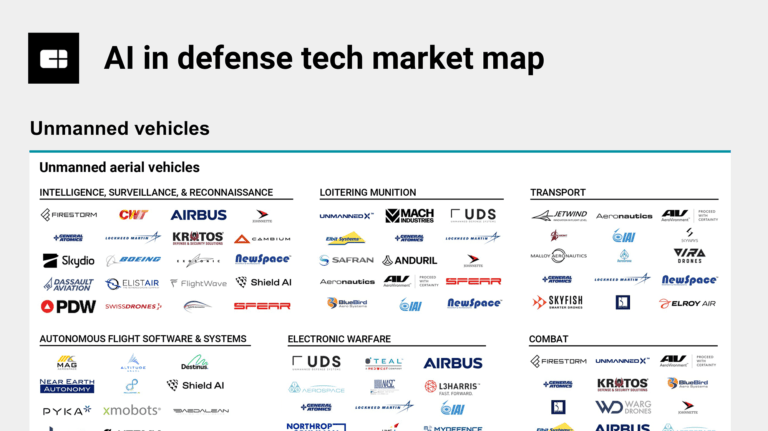

The AI in defense tech market mapExpert Collections containing Palantir

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

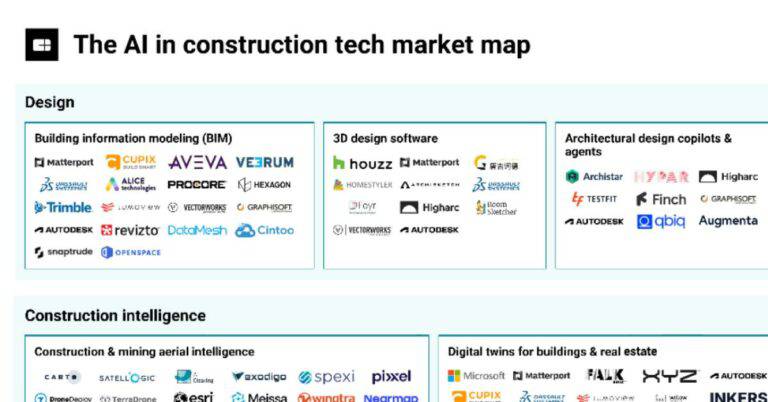

Palantir is included in 11 Expert Collections, including Construction Tech.

Construction Tech

1,508 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Tech IPO Pipeline

286 items

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,777 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Advanced Manufacturing

3,928 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Aerospace & Space Tech

4,177 items

These companies provide a variety of solutions, ranging from industrial drones to electrical vertical takeoff vehicles, space launch systems to satellites, and everything in between

Palantir Patents

Palantir has filed 1831 patents.

The 3 most popular patent topics include:

- data management

- database management systems

- databases

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/15/2021 | 4/8/2025 | Bioinformatics, Genomics, Biological databases, Database management systems, Data management | Grant |

Application Date | 6/15/2021 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Bioinformatics, Genomics, Biological databases, Database management systems, Data management |

Status | Grant |

Latest Palantir News

Sep 16, 2025

This preliminary prospectus supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to Completion. Dated September 15, 2025. GS Finance Corp. Fixed Coupon Equity-Linked Notes due guaranteed by The Goldman Sachs Group, Inc. The notes will pay a fixed coupon of $16.125 (1.6125% monthly, or up to 19.35% per annum) for each $1,000 face amount on each payment date (expected to be the 18th day of each month (provided that the payment date for September 2027 is expected to be the stated maturity date (expected to be September 20, 2027)), commencing in October 2025 and ending on the stated maturity date). The amount that you will be paid on your notes on the stated maturity date, in addition to the final coupon, is based on the performances of the common stock of NVIDIA Corporation, the Class A common stock of Palantir Technologies Inc. and the common stock of Upstart Holdings, Inc. as measured from September 12, 2025 (the date the initial index stock price of each index stock was set) to and including the determination date (expected to be September 15, 2027). The amount that you will be paid on your notes at maturity, in addition to the final coupon, is based on the performance of the lesser performing index stock (the index stock with the lowest index stock return). The index stock return for each index stock is the percentage increase or decrease in the final index stock price of such index stock on the determination date from its initial index stock price ($177.82 with respect to the common stock of NVIDIA Corporation, $171.43 with respect to the Class A common stock of Palantir Technologies Inc. and $63.08 with respect to the common stock of Upstart Holdings, Inc. (which in each case is the closing price of one share of such index stock on September 12, 2025 and may be higher or lower than the closing price of such index stock on the trade date (expected to be September 15, 2025). At maturity, in addition to the final coupon, for each $1,000 face amount of your notes you will receive an amount in cash equal to: • if the index stock return of each index stock is greater than or equal to -15% (the final index stock price of each index stock is greater than or equal to 85% of its initial index stock price), $1,000; or • if the index stock return of any index stock is less than -15% (the final index stock price of any index stock is less than 85% of its initial index stock price), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the sum of the lesser performing index stock return plus 15%. You will receive less than the face amount of your notes. You should read the disclosure herein to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. See page S-17. The estimated value of your notes at the time the terms of your notes are set on the trade date is expected to be between $925 and $955 per $1,000 face amount. For a discussion of the estimated value and the price at which Goldman Sachs & Co. LLC would initially buy or sell your notes, if it makes a market in the notes, see the following page. Original issue date: expected to be September 18, 2025 Original issue price: 100% of the face amount Underwriting discount: % of the face amount Net proceeds to the issuer: % of the face amount Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank. Goldman Sachs & Co. LLC Prospectus Supplement No. dated , 2025. The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this prospectus supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes. GS Finance Corp. may use this prospectus in the initial sale of the notes. In addition, Goldman Sachs & Co. LLC, or any other affiliate of GS Finance Corp. may use this prospectus in a market-making transaction in a note after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction. Estimated Value of Your Notes The estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by Goldman Sachs & Co. LLC (GS&Co.) and taking into account our credit spreads) is expected to be between $925 and $955 per $1,000 face amount, which is less than the original issue price. The value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.'s customary bid and ask spreads) at which GS&Co. would initially buy or sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately the estimated value of your notes at the time of pricing, plus an additional amount (initially equal to $ per $1,000 face amount). Prior to , the price (not including GS&Co.'s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes (as determined by reference to GS&Co.'s pricing models) plus (b) any remaining additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through ). On and after , the price (not including GS&Co.'s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models. About Your Prospectus The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This prospectus includes this prospectus supplement and the accompanying documents listed below. This prospectus supplement constitutes a supplement to the documents listed below, does not set forth all of the terms of your notes and therefore should be read in conjunction with such documents: ● Prospectus supplement dated February 14, 2025 ● Prospectus dated February 14, 2025 The information in this prospectus supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes. We refer to the notes we are offering by this prospectus supplement as the "offered notes" or the "notes". Each of the offered notes has the terms described below. Please note that in this prospectus supplement, references to "GS Finance Corp.", "we", "our" and "us" mean only GS Finance Corp. and do not include its subsidiaries or affiliates, references to "The Goldman Sachs Group, Inc.", our parent company, mean only The Goldman Sachs Group, Inc. and do not include its subsidiaries or affiliates and references to "Goldman Sachs" mean The Goldman Sachs Group, Inc. together with its consolidated subsidiaries and affiliates, including us. The notes will be issued under the senior debt indenture, dated as of October 10, 2008, as supplemented by the First Supplemental Indenture, dated as of February 20, 2015, each among us, as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee. This indenture, as so supplemented and as further supplemented thereafter, is referred to as the "GSFC 2008 indenture" in the accompanying prospectus supplement. The notes will be issued in book-entry form and represented by master note no. 3, dated March 22, 2021. S-2 TERMS AND CONDITIONS CUSIP / ISIN: 40058Q6U8 / US40058Q6U88 Company (Issuer): GS Finance Corp. Guarantor: The Goldman Sachs Group, Inc. Index stocks (each individually, an index stock): the common stock of NVIDIA Corporation (current Bloomberg ticker: "NVDA UW"), the Class A common stock of Palantir Technologies Inc. (current Bloomberg ticker: "PLTR UW") and the common stock of Upstart Holdings, Inc. (current Bloomberg ticker: "UPST UW"), as each may be replaced or adjusted from time to time as provided herein Face amount: $ in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof Principal amount: On the stated maturity date, in addition to the final coupon, the company will pay, for each $1,000 of the outstanding face amount, an amount in cash equal to the cash settlement amount. Cash settlement amount: • if the final index stock price of each index stock is greater than or equal to its buffer price, $1,000; or • if the final index stock price of any index stock is less than its buffer price, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the buffer rate times (c) the sum of the lesser performing index stock return plus the buffer amount Initial index stock price: $177.82 with respect to the common stock of NVIDIA Corporation, $171.43 with respect to the Class A common stock of Palantir Technologies Inc. and $63.08 with respect to the common stock of Upstart Holdings, Inc. The initial index stock price of each index stock is the closing price of one share of such index stock on September 12, 2025 and may be higher or lower than the closing price of one share of such index stock on the trade date. Final index stock price: with respect to an index stock, the closing price of one share of such index stock on the determination date, subject to adjustment as provided in "- Consequences of a market disruption event or non-trading day" and "- Anti-dilution adjustments" below Index stock return: with respect to an index stock, the quotient of (i) its final index stock price minus its initial index stock price divided by (ii) its initial index stock price, expressed as a percentage Lesser performing index stock return: the index stock return of the lesser performing index stock Lesser performing index stock: the index stock with the lowest index stock return Buffer price: for each index stock, 85% of its initial index stock price Buffer amount: 15% Buffer rate: 100% Coupon: On each coupon payment date, for each $1,000 of the outstanding face amount, the company will pay an amount in cash equal to $16.125 (1.6125% monthly, or up to 19.35% per annum). The coupon paid on any coupon payment date will be paid to the person in whose name this note is registered as of the close of business on the regular record date for such coupon payment date. If the coupon is due at maturity but on a day that is not a coupon payment date, the coupon will be paid to the person entitled to receive the principal of this note. Trade date: expected to be September 15, 2025 Original issue date (set on the trade date): expected to be September 18, 2025 Determination date (set on the trade date): expected to be September 15, 2027, unless the calculation agent determines that, with respect to any index stock, a market disruption event occurs or is continuing on such day or such day is not a trading day. S-3 In the event the originally scheduled determination date is a non-trading day with respect to any index stock, the determination date will be the first day thereafter that is a trading day for all index stocks (the "first qualified trading day") provided that no market disruption event occurs or is continuing with respect to an index stock on that day. If a market disruption event with respect to an index stock occurs or is continuing on the originally scheduled determination date or the first qualified trading day, the determination date will be the first following trading day on which the calculation agent determines that each index stock has had at least one trading day (from and including the originally scheduled determination date or the first qualified trading day, as applicable) on which no market disruption event has occurred or is continuing and the closing price of each index stock will be determined on or prior to the postponed determination date as set forth under "- Consequences of a market disruption event or a non-trading day" below. (In such case, the determination date may differ from the date on which the price of an index stock is determined for the purpose of the calculations to be performed on the determination date.) In no event, however, will the determination date be postponed to a date later than the originally scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date, either due to the occurrence of serial non-trading days or due to the occurrence of one or more market disruption events. On such last possible determination date, if a market disruption event occurs or is continuing with respect to an index stock that has not yet had such a trading day on which no market disruption event has occurred or is continuing or if such last possible day is not a trading day with respect to such index stock, that day will nevertheless be the determination date. Stated maturity date (set on the trade date): expected to be September 20, 2027, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under "- Determination date" above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date. Coupon payment dates (set on the trade date): expected to be 18th day of each month (provided that the coupon payment date for September 2027 is expected to be the stated maturity date), commencing in October 2025 and ending on the stated maturity date, unless, for any such coupon payment date, that day is not a business day, in which case such coupon payment date will be postponed to the next following business day. Closing price: on any trading day, with respect to an index stock, the closing sale price or last reported sale price, regular way, for such index stock, on a per-share or other unit basis: • on the principal national securities exchange on which such index stock is listed for trading on that day, or • if such index stock is not listed on any national securities exchange on that day, on any other U.S. national market system that is the primary market for the trading of such index stock. If an index stock is not listed or traded as described above, then the closing price for such index stock on any day will be the average, as determined by the calculation agent, of the bid prices for such index stock obtained from as many dealers in such index stock selected by the calculation agent as will make those bid prices available to the calculation agent. The number of dealers need not exceed three and may include the calculation agent or any of its or the company's affiliates. The closing price of an index stock is subject to adjustment as described under "- Anti-dilution adjustments" below. Trading day: with respect to an index stock, a day on which the principal securities market for such index stock is open for trading Index stock issuer: with respect to an index stock, the issuer of such index stock as then in effect Market disruption event: With respect to any given trading day, any of the following will be a market disruption event with respect to an index stock: • a suspension, absence or material limitation of trading in the index stock on its primary market for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, S-4 • a suspension, absence or material limitation of trading in option or futures contracts relating to the index stock in the primary market for those contracts for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, or • the index stock does not trade on what was the primary market for the index stock, as determined by the calculation agent in its sole discretion, and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note. The following events will not be market disruption events: • a limitation on the hours or numbers of days of trading, but only if the limitation results from an announced change in the regular business hours of the relevant market, and • a decision to permanently discontinue trading in option or futures contracts relating to an index stock. For this purpose, an "absence of trading" in the primary securities market on which shares of an index stock are traded, or on which option or futures contracts relating to an index stock are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in shares of an index stock or in option or futures contracts, if available, relating to the index stock in the primary market for that index stock or those contracts, by reason of: • a price change exceeding limits set by that market, • an imbalance of orders relating to the shares of the index stock or those contracts, or • a disparity in bid and ask quotes relating to the shares of the index stock or those contracts, will constitute a suspension or material limitation of trading in shares of the index stock or those contracts in that market. A market disruption event with respect to one index stock will not, by itself, constitute a market disruption event for any unaffected index stock. Consequences of a market disruption event or a non-trading day: With respect to any index stock, if a market disruption event occurs or is continuing on a day that would otherwise be the determination date or such day is not a trading day, then the determination date will be postponed as described under "- Determination date" above. If the determination date is postponed to the last possible date due to the occurrence of serial non-trading days, the price of each index stock will be the calculation agent's assessment of such price, in its sole discretion, on such last possible postponed determination date. If the determination date is postponed due to a market disruption event with respect to any index stock, the final index stock price of each index stock with respect to the determination date will be calculated based on (i) for any index stock that is not affected by a market disruption event on the originally scheduled determination date or the first qualified trading day thereafter (if applicable), the closing price of the index stock on that date, (ii) for any index stock that is affected by a market disruption event on the originally scheduled determination date or the first qualified trading day thereafter (if applicable), the closing price of the index stock on the first following trading day on which no market disruption event exists for such index stock and (iii) the calculation agent's assessment, in its sole discretion, of the price of any index stock on the last possible postponed determination date with respect to such index stock as to which a market disruption event continues through the last possible postponed determination date. As a result, this could result in the final index stock price on the determination date of each index stock being determined on different calendar dates. For the avoidance of doubt, once the closing price for an index stock is determined for the determination date, the occurrence of a later market disruption event or non-trading day will not alter such calculation. Regular record dates: the scheduled business day immediately preceding the day on which payment is to be made (as such payment date may be adjusted) Anti-dilution adjustments: The calculation agent will adjust the reference amount of an index stock in respect of each event for which adjustment is required under any of the six subsections beginning with "Stock splits" below S-5 (and not in respect of any other event). (If more than one such event occurs, the calculation agent shall adjust the reference amount as so provided for each such event, sequentially, in the order in which such events occur, and on a cumulative basis.) Having adjusted the reference amount for any and all such events as so provided, the calculation agent shall determine a closing price for the reference amount as so adjusted on the determination date. (If the reference amount is adjusted pursuant to "Reorganization events" below so as to consist of distribution property, then the closing price on the determination date shall equal the sum of the respective closing prices or other values for all such distribution property on the determination date, as provided in "Reorganization events" below.) Having determined the closing price on the determination date, the calculation agent shall use such prices to calculate the cash settlement amount. The calculation agent shall make all adjustments no later than the determination date. Notwithstanding any other provision in this note, if an event for which adjustment is required under any of the six subsections beginning with "Stock splits" below occurs, the calculation agent may make the adjustment and any related determinations and calculations in a manner that differs from that specified in this note as necessary to achieve an equitable result. Upon written request by the holder to the calculation agent, the calculation agent will provide the holder with such information about these adjustments as such agent determines is appropriate. Stock splits. A stock split is an increase in the number of a corporation's outstanding shares of stock without any change in its stockholders' equity. Each outstanding share will be worth less as a result of a stock split. If an index stock is subject to a stock split, then at the opening of business on the first day on which such index stock trades without the right to receive the stock split, the calculation agent will adjust the reference amount to equal the sum of the reference amount in effect immediately prior to such adjustment plus the product of (i) the number of new shares issued in the stock split with respect to one share of such index stock times (ii) the reference amount in effect immediately prior to such adjustment. The reference amount will not be adjusted, however, unless such first day occurs after the trade date and on or before the determination date. Reverse stock splits. A reverse stock split is a decrease in the number of a corporation's outstanding shares of stock without any change in its stockholders' equity. Each outstanding share will be worth more as a result of a reverse stock split. If an index stock is subject to a reverse stock split, then once the reverse stock split becomes effective, the calculation agent will adjust the reference amount to equal the product of the reference amount in effect immediately prior to such adjustment and the quotient of (i) the number of shares of such index stock outstanding immediately after the reverse stock split becomes effective divided by (ii) the number of shares of such index stock outstanding immediately before the reverse stock split becomes effective. The reference amount will not be adjusted, however, unless the reverse stock split becomes effective after the trade date and on or before the determination date. Stock dividends. In a stock dividend, a corporation issues additional shares of its stock to all holders of its outstanding shares of its stock in proportion to the shares they own. Each outstanding share will be worth less as a result of a stock dividend. If an index stock is subject to a stock dividend that is given ratably to all holders of such index stock, then at the opening of business on the ex-dividend date, the calculation agent will adjust the reference amount to equal the reference amount in effect immediately prior to such adjustment plus the product of (i) the number of shares issued in the stock dividend with respect to one share of such index stock times (ii) the reference amount in effect immediately prior to such adjustment. The reference amount will not be adjusted, however, unless such ex-dividend date occurs after the trade date and on or before the determination date. Other dividends and distributions. There will be no adjustments to the reference amount to reflect dividends or other distributions paid with respect to an index stock other than: • stock dividends as provided in "Stock dividends" above, • issuances of transferable rights or warrants as provided in "Transferable rights and warrants" below, • dividends or other distributions constituting spin-off events as provided in "Reorganization events" below, or • extraordinary dividends described below. A dividend or other distribution with respect to an index stock will be deemed to be an "extraordinary dividend" if its per share value of such dividend or other distribution exceeds the per share value of the immediately preceding dividend or distribution with respect to such index stock, if any, that is not an extraordinary dividend by an amount equal to at least 10% of the closing price of such index stock on the trading day immediately preceding the ex-dividend date for such extraordinary dividend. S-6 If an extraordinary dividend occurs with respect to an index stock, the calculation agent will adjust the reference amount to equal the product of (a) the reference amount in effect immediately prior to such adjustment and (b) a fraction, the numerator of which is the closing price of such index stock on the trading day immediately preceding the ex-dividend date and the denominator of which is the amount by which such closing price exceeds the extraordinary dividend amount. The "extraordinary dividend amount" with respect to an extraordinary dividend for an index stock will equal: • in the case of an extraordinary dividend that is paid in lieu of a regular quarterly dividend, the amount per share of such extraordinary dividend minus the amount per share of the immediately preceding dividend or distribution with respect to such index stock, if any, that is not an extraordinary dividend or • in the case of an extraordinary dividend that is not paid in lieu of a regular quarterly dividend, the amount per share of such extraordinary dividend. To the extent an extraordinary dividend is not paid in cash, the value of the non-cash component will be determined by the calculation agent. A distribution on an index stock that constitutes a stock dividend, an issuance of transferable rights or warrants or a spin-off event and also constitutes an extraordinary dividend will result only in an adjustment to the reference amount pursuant to "Stock dividends" above, "Transferable rights and warrants" below or "Reorganization events" below, as applicable. The reference amount will not be adjusted pursuant to this subsection unless the ex-dividend date for the extraordinary dividend occurs after the trade date and on or before the determination date. Transferable rights and warrants. With respect to an index stock, if the index stock issuer issues transferable rights or warrants to all holders of the index stock to subscribe for or purchase the index stock at an exercise price per share less than the closing price of the index stock on the trading day immediately before the ex-dividend date for such issuance, then the calculation agent will adjust the reference amount by multiplying the reference amount in effect immediately prior to such adjustment by a fraction: • the numerator of which is the number of shares of index stock outstanding at the close of business on the day before such ex-dividend date plus the number of additional shares of index stock offered for subscription or purchase under such transferable rights or warrants, and • the denominator of which is the number of shares of index stock outstanding at the close of business on the day before such ex-dividend date plus the number of additional shares of index stock that the aggregate offering price of the total number of shares of index stock so offered for subscription or purchase would purchase at the closing price of the index stock on the trading day immediately before such ex-dividend date, with such number of additional shares being determined by multiplying the total number of shares so offered by the exercise price of such transferable rights or warrants and dividing the resulting product by the closing price of the index stock on the trading day immediately before such ex-dividend date. The reference amount will not be adjusted, however, unless such ex-dividend date occurs after the trade date and on or before the determination date. Reorganization events. With respect to an index stock, if: • any reclassification or other change of the index stock occurs, • the index stock issuer has been subject to a merger, consolidation, amalgamation, binding share exchange or other business combination and is not the surviving entity or it does survive but all the shares of index stock are reclassified or changed, • the index stock has been subject to a takeover, tender offer, exchange offer, solicitation proposal or other event by another person to purchase or otherwise obtain all of the outstanding shares of the index stock, such that all of the outstanding shares of the index stock (other than shares of the index stock owned or controlled by such other person) are transferred, or irrevocably committed to be transferred, to another person, • the index stock issuer or any subsidiary of the index stock issuer has been subject to a merger, consolidation, amalgamation or binding share exchange in which the index stock issuer is the surviving entity and all the outstanding shares of the index stock (other than shares of the index stock owned or controlled by such other person) immediately prior to such event collectively represent less than 50% of the outstanding shares of the index stock immediately following such event, S-7 • the index stock issuer sells or otherwise transfers its property and assets as an entirety or substantially as an entirety to another entity • the index stock issuer issues to all holders of index stock equity securities of an issuer other than the index stock issuer (other than in a transaction described in any of the bullet points above) (a "spin-off event"), • the index stock issuer is liquidated, dissolved or wound up or is subject to a proceeding under any applicable bankruptcy, insolvency or other similar law, or • any other corporate or similar events that affect or could potentially affect market prices of, or shareholders' rights in, the index stock or distribution property, which will be substantiated by an official characterization by either the Options Clearing Corporation with respect to options contracts on the index stock or by the primary securities exchange on which the index stock or listed options on the index stock are traded, and will ultimately be determined by the calculation agent in its sole discretion (any such event in this bullet point or any of the bullet points above in this subsection, a "reorganization event"), then the calculation agent will adjust the reference amount so that the reference amount consists of the respective amounts of each type of distribution property deemed, for the purposes of this note, to be distributed in such reorganization event in respect of the reference amount as in effect immediately prior to such adjustment, taken together. Notwithstanding the foregoing, however, the calculation agent will not make any adjustment for a reorganization event unless the event becomes effective - or, if the event is a spin-off event, unless the ex-dividend date for the spin-off event occurs - after the trade date and on or before the determination date. The calculation agent will determine the value of each component type of distribution property, using the closing price on the relevant day for any such type consisting of securities and such other method as it determines to be appropriate, in its sole discretion, for any other type. If a holder of an index stock may elect to receive different types or combinations of types of distribution property in the reorganization event, the distribution property will be deemed to include the types and amounts thereof distributed to a holder that makes no election, as determined by the calculation agent in its sole discretion. If a reorganization event occurs and as a result the reference amount is adjusted to consist of distribution property, the calculation agent will make further adjustments for subsequent events that affect such distribution property or any component type thereof, to the same extent that it would make adjustments if an index stock were outstanding and were affected by the same kinds of events. The closing price on the determination date will be the total value, as determined by the calculation agent at the close of trading hours of an index stock on the determination date of all components of the reference amount, with each component having been adjusted on a sequential and cumulative basis for all relevant events affecting it. The calculation agent may, in its sole discretion, modify the adjustments described in "Reorganization events" as necessary to ensure an equitable result. If at any time the reference amount consists of distribution property, as determined by the calculation agent, then all references in this note to an "index stock" shall thereupon be deemed to mean such distribution property and all references in this note to a "share of index stock" shall thereupon be deemed to mean a comparable unit of each type of property comprising such distribution property, as determined by the calculation agent. Minimum adjustments. Notwithstanding the foregoing, no adjustment will be required in respect of any event specified in "Stock splits", "Reverse stock splits", "Stock dividends", "Other dividends and distributions" and "Transferable rights and warrants" above unless such adjustment would result in a change of at least 0.1% in the closing price of such index stock. The closing price of an index stock resulting from any adjustment shall be rounded up or down, as appropriate, to the nearest ten-thousandth, with five hundred-thousandths being rounded upward - e.g., 0.12344 will be rounded down to 0.1234 and 0.12345 will be rounded up to 0.1235. Distribution property: cash, securities and/or other property distributed in any reorganization event in respect of the relevant reference amount and, in the case of a spin-off event, includes such reference amount Ex-dividend date: for any dividend or other distribution with respect to an index stock, the first day on which the index stock trades without the right to receive such dividend or other distribution Reference amount: with respect to an index stock, initially, one share of such index stock which shall be adjusted, as to the amount(s) and/or type(s) of property comprising the same, by the calculation agent as provided under "Anti-dilution adjustments" above S-8 Business day: each Monday, Tuesday, Wednesday, Thursday and Friday that is not a day on which banking institutions in New York City generally are authorized or obligated by law, regulation or executive order to close. A day is a scheduled business day if, as of the trade date, such day is scheduled to be a Monday, Tuesday, Wednesday, Thursday or Friday that is not a day on which banking institutions in New York City generally are authorized or obligated by law, regulation or executive order to close. Calculation agent: Goldman Sachs & Co. LLC ("GS&Co.") Default amount: If an event of default occurs and the maturity of this note is accelerated, the company will pay the default amount in respect of the principal of this note at the maturity, instead of the amount payable on the stated maturity date as described earlier. The default amount for the notes on any day (except as provided in the last sentence under "Default quotation period" below) will be an amount, in U.S. dollars, for the face amount of this note, equal to the cost of having a qualified financial institution, of the kind and selected as described below, expressly assume all of the company's payment and other obligations with respect to this note as of that day and as if no default or acceleration had occurred, or to undertake other obligations providing substantially equivalent economic value to you with respect to this note. That cost will equal: • the lowest amount that a qualified financial institution would charge to effect this assumption or undertaking, plus • the reasonable expenses, including reasonable attorneys' fees, incurred by the holder of this note in preparing any documentation necessary for this assumption or undertaking. During the default quotation period for this note, which is described below, the holder of the notes and/or the company may request a qualified financial institution to provide a quotation of the amount it would charge to effect this assumption or undertaking. If either party obtains a quotation, it must notify the other party in writing of the quotation. The amount referred to in the first bullet point above will equal the lowest - or, if there is only one, the only - quotation obtained, and as to which notice is so given, during the default quotation period. With respect to any quotation, however, the party not obtaining the quotation may object, on reasonable and significant grounds, to the assumption or undertaking by the qualified financial institution providing the quotation and notify the other party in writing of those grounds within two business days after the last day of the default quotation period, in which case that quotation will be disregarded in determining the default amount. Default quotation period: The default quotation period is the period beginning on the day the default amount first becomes due and ending on the third business day after that day, unless: • no quotation of the kind referred to above is obtained, or • every quotation of that kind obtained is objected to within five business days after the day the default amount first becomes due. If either of these two events occurs, the default quotation period will continue until the third business day after the first business day on which prompt notice of a quotation is given as described above. If that quotation is objected to as described above within five business days after that first business day, however, the default quotation period will continue as described in the prior sentence and this sentence. In any event, if the default quotation period and the subsequent two business day objection period have not ended before the determination date, then the default amount will equal the principal amount of this note. Qualified financial institutions: For the purpose of determining the default amount at any time, a qualified financial institution must be a financial institution organized under the laws of any jurisdiction in the United States of America, Europe or Japan, which at that time has outstanding debt obligations with a stated maturity of one year or less from the date of issue and that is, or whose securities are, rated either: • A-1 or higher by Standard & Poor's Ratings Services or any successor, or any other comparable rating then used by that rating agency, or • P-1 or higher by Moody's Investors Service, Inc. or any successor, or any other comparable rating then used by that rating agency. Overdue principal rate and overdue coupon rate: the effective Federal Funds rate Defeasance: not applicable S-9 DEFAULT AMOUNT ON ACCELERATION If an event of default occurs and the maturity of your notes is accelerated, the company will pay the default amount in respect of the principal of your notes at the maturity, instead of the amount payable on the stated maturity date as described earlier. We describe the default amount under "Terms and Conditions" above. For the purpose of determining whether the holders of our Series F medium-term notes, which include your notes, are entitled to take any action under the indenture, we will treat the outstanding face amount of your notes as the outstanding principal amount of that note. Although the terms of the offered notes differ from those of the other Series F medium-term notes, holders of specified percentages in principal amount of all Series F medium-term notes, together in some cases with other series of our debt securities, will be able to take action affecting all the Series F medium-term notes, including your notes, except with respect to certain Series F medium-term notes if the terms of such notes specify that the holders of specified percentages in principal amount of all of such notes must also consent to such action. This action may involve changing some of the terms that apply to the Series F medium-term notes or waiving some of our obligations under the indenture. In addition, certain changes to the indenture and the notes that only affect certain debt securities may be made with the approval of holders of a majority in principal amount of such affected debt securities. We discuss these matters in the accompanying prospectus under "Description of Debt Securities We May Offer - Default, Remedies and Waiver of Default" and "Description of Debt Securities We May Offer - Modification of the Debt Indentures and Waiver of Covenants". S-10 Hypothetical ExampleS Payment Examples The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and are intended merely to illustrate the impact that various hypothetical closing prices of the lesser performing index stock on the determination date could have on the cash settlement amount at maturity assuming all other variables remain constant. The examples below are based on a range of index stock prices that are entirely hypothetical; no one can predict what the closing price of any index stock will be on any day throughout the life of your notes and what the final index stock price of the lesser performing index stock will be on the determination date. The index stocks have been highly volatile in the past - meaning that the index stock prices have changed substantially in relatively short periods - and their performance cannot be predicted for any future period. The information in the following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on the original issue date at the face amount and held to the stated maturity date. If you sell your notes in a secondary market prior to the stated maturity date, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below such as interest rates, the volatility of the index stocks, the creditworthiness of GS Finance Corp., as issuer, and the creditworthiness of The Goldman Sachs Group, Inc., as guarantor. In addition, the estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by GS&Co.) is less than the original issue price of your notes. For more information on the estimated value of your notes, see "Additional Risk Factors Specific to Your Notes - The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes" on page S-17 of this prospectus supplement. The information in the examples also reflects the key terms and assumptions in the box below. Key Terms and Assumptions Face amount .. Buffer price .. with respect to each index stock, 85% of its initial index stock price Buffer amount .. Buffer rate Neither a market disruption event nor a non-trading day occurs on the originally scheduled determination date No change in or affecting any of the index stocks The effect of the coupons have been excluded Notes purchased on original issue date at the face amount and held to the stated maturity date For these reasons, the actual performance of the index stocks over the life of your notes, as well as the amount payable at maturity, may bear little relation to the hypothetical examples shown below or to the historical index stock prices shown elsewhere in this prospectus supplement. For information about the index stock prices during recent periods, see "The Index Stocks - Historical Closing Prices of the Index Stocks" on page S-27. Before investing in the notes, you should consult publicly available information to determine the index stock prices between the date of this prospectus supplement and the date of your purchase of the notes. Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the index stocks. S-11 The prices in the left column of the table below represent hypothetical final index stock prices of the lesser performing index stock and are expressed as percentages of the initial index stock price of the lesser performing index stock. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final index stock price of the lesser performing index stock, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final index stock price of the lesser performing index stock and the assumptions noted above. Hypothetical Final Index Stock Price of the Lesser Performing Index Stock Hypothetical Cash Settlement Amount (as Percentage of Initial Index Stock Price) (as Percentage of Face Amount)* * Does not include the final coupon If, for example, the final index stock price of the lesser performing index stock were determined to be 25.000% of its initial index stock price, the cash settlement amount that we would deliver on your notes at maturity would be 40.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the face amount and held them to the stated maturity date, you would lose 60.000% of your investment (if you purchased your notes at a premium to face amount you would lose a correspondingly higher percentage of your investment). In addition, if the final index stock price of the lesser performing index stock were determined to be 175.000% of its initial index stock price, the cash settlement amount that we would deliver on your notes at maturity would be limited to 100.000% of each $1,000 face amount of your notes, as shown in the table above. As a result, if you held your notes to the stated maturity date, you would not benefit from any increase in the final index stock price of the lesser performing index stock over its initial index stock price. The cash settlement amounts shown above are entirely hypothetical; they are based on market prices for the index stocks that may not be achieved on the determination date and on assumptions that may prove to be erroneous. The actual market value of your notes on the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical cash settlement amounts shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The hypothetical cash settlement amounts on notes held to the stated maturity date in the examples above assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the face amount, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please read "Additional Risk Factors Specific to Your Notes - The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors" on page S-19. Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent to a combination of an interest-bearing bond bought by the holder and one or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this prospectus supplement. S-12 We cannot predict the actual final index stock prices of the index stocks or what the market value of your notes will be on any particular trading day, nor can we predict the relationship between the closing prices of the index stocks and the market value of your notes at any time prior to the stated maturity date. The actual amount that you will receive at maturity and the rate of return on the offered notes will depend on the actual final index stock prices determined by the calculation agent as described above. Moreover, the assumptions on which the hypothetical examples are based may turn out to be inaccurate. Consequently, the cash amount to be paid in respect of your notes on the stated maturity date may be very different from the information reflected in the examples above. S-13 Anti-dilution Adjustment Examples The calculation agent will adjust the closing price of an index stock on the determination date only if an event described under one of the six subsections beginning with "Stock splits" under "Terms and Conditions - Anti-dilution adjustments" occurs and only if the relevant event occurs during the period described under the applicable subsection. The adjustments described under "Terms and Conditions - Anti-dilution adjustments" do not cover all events that could affect the closing price of an index stock on the determination date such as an issuer tender or exchange offer for such index stock at a premium to its market price or a tender or exchange offer made by a third party for less than all outstanding shares of such index stock. We describe the risks relating to dilution under "Additional Risk Factors Specific to Your Notes - You Have Limited Anti-dilution Protection" below. How Adjustments Will Be Made In this prospectus supplement, we refer to anti-dilution adjustment of the closing price of an index stock on the determination date. With respect to an index stock, if an event requiring anti-dilution adjustment occurs, the calculation agent will make the adjustment by taking the following steps: Step One. The calculation agent will adjust the reference amount. This term refers to the amount of the index stock or other property that must be used to determine the closing price of the index stock on the determination date. For example, if no adjustment described under "Terms and Conditions - Anti-dilution adjustments" is required at a time, the reference amount for that time will be one share of the index stock. In that case, the closing price of the index stock on the determination date will be the closing price of one share of the index stock on the determination date. We describe how the closing price will be determined under "Terms and Conditions - Closing price" above. If an adjustment described under "Terms and Conditions - Anti-dilution adjustments" is required because one of the dilution events described in the first five subsections beginning with "Stock splits" under "Terms and Conditions - Anti-dilution adjustments" - these involve stock splits, reverse stock splits, stock dividends, other dividends and distributions and issuances of transferable rights and warrants - occurs, then the adjusted reference amount at that time might instead be, for example, two shares of the index stock or a half share of the index stock, depending on the event. In that example, the closing price of the index stock on the determination date would be the price (determined as specified under "Terms and Conditions - Closing price" above) at the close of trading on the determination date of two shares of the index stock or a half share of the index stock, as applicable. If an adjustment described under "Terms and Conditions - Anti-dilution adjustments" is required at a time because one of the reorganization events described under "Terms and Conditions - Reorganization events" - these involve events in which cash, securities or other property is distributed in respect of the index stock - occurs, then the reference amount at that time will be adjusted to be as follows, assuming there has been no prior or subsequent anti-dilution adjustment: the amount of each type of the property distributed in the reorganization event in respect of one share of the index stock, plus one share of the index stock if the index stock remains outstanding. In that event, the closing price of the index stock on the determination date would be the value of the adjusted reference amount at the close of trading on the determination date. The manner in which the calculation agent adjusts the reference amount in step one will depend on the type of dilution event requiring adjustment. These events and the nature of the required adjustments are described in the six subsections beginning with "Stock splits" under "Terms and Conditions - Anti-dilution adjustments". Step Two. Having adjusted the reference amount in step one, the calculation agent will determine the closing price of the index stock on the determination date in the following manner. If the adjusted reference amount at the applicable time consists entirely of shares of the index stock, the index stock price will be the closing price (determined as described under "Terms and Conditions - Closing price" above) of the adjusted reference amount on the applicable date. On the other hand, if the adjusted reference amount at the applicable time includes any property other than shares of the index stock, the closing price of the index stock on the determination date will be the value of the adjusted reference amount as determined by the calculation agent in the manner described under "- Adjustments for Reorganization Events" below at the applicable time. S-14 Step Three. Having determined the closing price of the index stock on the determination date in step two, the calculation agent will use such price to calculate the cash settlement amount. If more than one event requiring adjustment as described under "Terms and Conditions - Anti-dilution adjustments" occurs, the calculation agent will first adjust the reference amount as described in step one above for each event, sequentially, in the order in which the events occur, and on a cumulative basis. Thus, having adjusted the reference amount for the first event, the calculation agent will repeat step one for the second event, applying the required adjustment to the reference amount as already adjusted for the first event, and so on for each event. Having adjusted the reference amount for all events, the calculation agent will then take the remaining applicable steps in the process described above, determining the closing price of the index stock on the determination date using the reference amount as sequentially and cumulatively adjusted for all the relevant events. The calculation agent will make all required determinations and adjustments no later than the determination date. The calculation agent will adjust the reference amount for each reorganization event described under "Terms and Conditions - Reorganization events" above. For any other dilution event described above, however, the calculation agent will not be required to adjust the reference amount unless the adjustment would result in a change of at least 0.1% in the index stock price that would apply without the adjustment. The closing price of the index stock on the determination date resulting from any adjustment will be rounded up or down, as appropriate, to the nearest ten-thousandth, with five hundred-thousandths being rounded upward - e.g., 0.12344 will be rounded down to 0.1234 and 0.12345 will be rounded up to 0.1235. If an event requiring anti-dilution adjustment occurs, the calculation agent will make the adjustment with a view to offsetting, to the extent practical, any change in the economic position of the holder, GS Finance Corp., as issuer, and The Goldman Sachs Group, Inc., as guarantor, relative to your notes, that results solely from that event. The calculation agent may, in its sole discretion, modify the anti-dilution adjustments as necessary to ensure an equitable result. The calculation agent will make all determinations with respect to anti-dilution adjustments, including any determination as to whether an event requiring adjustment has occurred, as to the nature of the adjustment required and how it will be made or as to the value of any property distributed in a reorganization event, and will do so in its sole discretion. In the absence of manifest error, those determinations will be conclusive for all purposes and will be binding on you and us, without any liability on the part of the calculation agent. The calculation agent will provide information about the adjustments it makes upon written request by the holder. In this prospectus supplement, when we say that the calculation agent will adjust the reference amount for one or more dilution events, we mean that the calculation agent will take all the applicable steps described above with respect to those events. The six subsections beginning with "Stock splits" under "Terms and Conditions - Anti-dilution adjustments" describe the dilution events for which the reference amount is to be adjusted. Each subsection describes the manner in which the calculation agent will adjust the reference amount - the first step in the adjustment process described above - for the relevant event. Adjustments for Reorganization Events If a reorganization event occurs, then the calculation agent will adjust the reference amount so that it consists of the amount of each type of distribution property described under "Terms and Conditions - Reorganization events" above distributed in respect of one share of an index stock - or in respect of whatever the prior reference amount may be - in the reorganization event, taken together. For purposes of the three-step adjustment process described under "- How Adjustments Will Be Made" above, the distribution property so distributed will be the adjusted reference amount described in step one, the value of that property at the close of trading hours for an index stock on the applicable date will be the index stock price described in step two, and the calculation agent will determine the cash settlement amount as described in step three. As described under "- How Adjustments Will Be Made" above, the calculation agent may, in its sole discretion, modify the adjustments described in this paragraph as necessary to ensure an equitable result. The calculation agent will determine the value of each type of distribution property in its sole discretion. For any distribution property consisting of a security, the calculation agent will use the closing price (calculated according to the same methodology as specified in this prospectus supplement, without any anti-dilution adjustments) of one S-15 share of such security on the applicable date. The calculation agent may value other types of property in any manner it determines, in its sole discretion, to be appropriate. If a holder of an index stock may elect to receive different types or combinations of types of distribution property in the reorganization event, the distribution property will consist of the types and amounts of each type distributed to a holder that makes no election, as determined by the calculation agent in its sole discretion. As described under "- How Adjustments Will Be Made" above, the calculation agent may, in its sole discretion, modify the adjustments described in this paragraph as necessary to ensure an equitable result. If a reorganization event occurs and the calculation agent adjusts the reference amount to consist of the distribution property distributed in the reorganization event, as described above, the calculation agent will make any further anti-dilution adjustments for later events that affect the distribution property, or any component of the distribution property, comprising the new reference amount. The calculation agent will do so to the same extent that it would make adjustments if an index stock were outstanding and were affected by the same kinds of events. If a subsequent reorganization event affects only a particular component of the reference amount, the required adjustment will be made with respect to that component, as if it alone were the reference amount. For example, if an index stock issuer merges into another company and each share of such index stock is converted into the right to receive two common shares of the surviving company and a specified amount of cash, the reference amount will be adjusted to consist of two common shares of the surviving company and the specified amount of cash for each share of index stock (adjusted proportionately for any partial share) comprising the reference amount before the adjustment. The calculation agent will adjust the common share component of the adjusted reference amount to reflect any later stock split or other event, including any later reorganization event, that affects the common shares of the surviving company, to the extent described in this subsection entitled "- Anti-dilution Adjustment Examples" as if the common shares of the surviving company were such index stock. In that event, the cash component will not be adjusted but will continue to be a component of the reference amount. Consequently, each component included in the reference amount will be adjusted on a sequential and cumulative basis for all relevant events requiring adjustment up to the relevant date. The calculation agent will not make any adjustment for a reorganization event, however, unless the event becomes effective (or, if the event is a spin-off, unless the ex-dividend date for the spin-off occurs) after the trade date and on or before the determination date. S-16 Additional Risk Factors Specific to Your Notes An investment in your notes is subject to the risks described below, as well as the risks and considerations described in the accompanying prospectus and in the accompanying prospectus supplement. You should carefully review these risks and considerations as well as the terms of the notes described herein and in the accompanying prospectus and the accompanying prospectus supplement. Your notes are a riskier investment than ordinary debt securities. Also, your notes are not equivalent to investing directly in the index stocks. You should carefully consider w

Palantir Frequently Asked Questions (FAQ)

When was Palantir founded?

Palantir was founded in 2003.

Where is Palantir's headquarters?

Palantir's headquarters is located at 1200 17th Street, Denver.

What is Palantir's latest funding round?

Palantir's latest funding round is PIPE - II.

How much did Palantir raise?

Palantir raised a total of $2.494B.

Who are the investors of Palantir?

Investors of Palantir include Third Point Ventures, Soros Fund Management, Manhattan Venture Partners, Artis Ventures, Fabrica Ventures and 54 more.

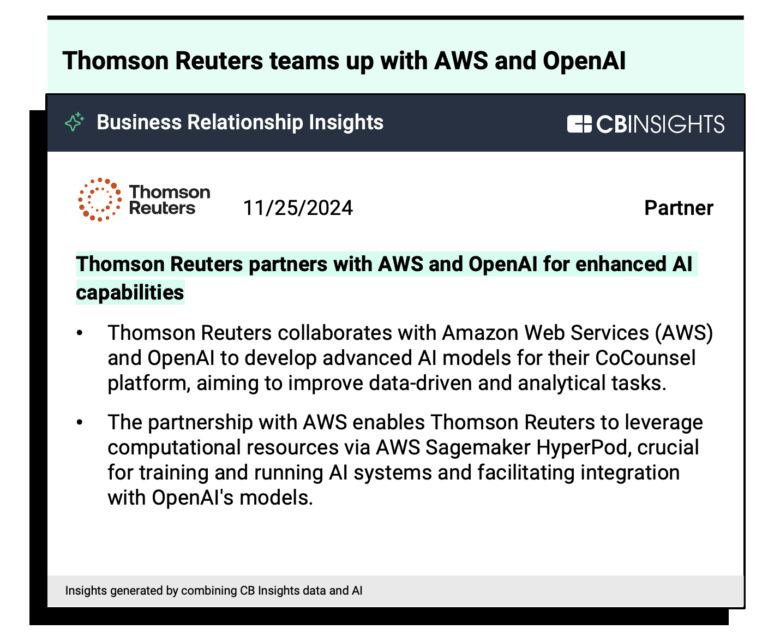

Who are Palantir's competitors?

Competitors of Palantir include Databricks, OpenTeams, Clarium, Cognida, MakinaRocks and 7 more.

Loading...

Compare Palantir to Competitors

The Vertex Project focuses on technology development for analytical teams in the security operations domain. The company's primary offering, Synapse, is a central intelligence system that covers the intelligence lifecycle from data collection to analysis and reporting. The system allows analysts to work together and provides insights for decision makers. It was founded in 2016 and is based in Reston, Virginia.

Databricks operates within the technology sector and provides data and artificial intelligence (AI) solutions. The company offers a platform that integrates data management, analytics, and AI for data-centric applications and services. Databricks serves industries such as communications, financial services, healthcare, manufacturing, media and entertainment, public sector, and retail. It was founded in 2013 and is based in San Francisco, California.

Alteryx is a company specializing in enterprise analytics, providing a platform that facilitates data preparation and analytics processes. The company's products allow users to conduct data analysis, develop predictive models, and visualize data insights. Alteryx serves sectors that require data analytics capabilities, including financial services, retail, healthcare, and manufacturing. Alteryx was formerly known as SRC. It was founded in 1997 and is based in Irvine, California.

DataRobot provides artificial intelligence (AI) applications and platforms within the enterprise AI suite and agentic AI platform domains. Its offerings include a suite of AI tools that integrate into business processes, allowing teams to manage AI, along with AI governance, observability, and foundational tools. DataRobot serves sectors including finance, supply chain, energy, financial services, government, healthcare, and manufacturing. It was founded in 2012 and is based in Boston, Massachusetts.

Qlik specializes in data integration, quality assurance, and analytics, operating within the data technology sector. The company provides tools and solutions that allow organizations to manage their data effectively. Qlik serves sectors that require data management and analytics, such as various business enterprises looking to utilize artificial intelligence (AI). It was founded in 1993 and is based in King of Prussia, Pennsylvania.

Cloudera operates in the hybrid data management and analytics sector. Its offerings include a hybrid data platform that is intended to manage data in various environments, featuring secure data management and cloud-native data services. Cloudera's tools are used in sectors such as financial services, healthcare, and manufacturing, focusing on areas like data engineering, stream processing, data warehousing, operational databases, machine learning, and data visualization. It was founded in 2008 and is based in Santa Clara, California.

Loading...