Next Insurance

Founded Year

2016Stage

Acquired | AcquiredTotal Raised

$1.146BValuation

$0000Revenue

$0000About Next Insurance

Next Insurance provides insurance services, specifically for the needs of small businesses. It offers insurance products, including general liability insurance, workers’ compensation insurance, professional liability insurance, commercial auto insurance, and commercial property insurance, among others. It primarily serves sectors such as retail, food and beverage, construction, consulting, education, entertainment, fitness, financial services, real estate, and more. It was founded in 2016 and is based in Palo Alto, California. In March 2025, Next Insurance was acquired by ERGO Group.6B.

Loading...

ESPs containing Next Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Next Insurance named as Leader among 6 other companies, including Coalition, Cowbell Cyber, and At-Bay.

Next Insurance's Products & Differentiators

NEXT’s Comprehensive Insurance Platform

Powered by automation, AI and industry-leading expertise, NEXT removes traditional coverage complexity and empowers entrepreneurs to protect their businesses in minutes. It delivers a seamless digital insurance experience for small and growing businesses through a customizable, all-in-one coverage platform. Customers can quickly secure essential protection, including general liability, BOP, professional liability, and workers’ compensation in one streamlined package using our online tools. The platform adapts alongside businesses as they expand, including multi-location capabilities and policy bundling, all accessible via a self-service portal and smartphone app.

Loading...

Research containing Next Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Next Insurance in 8 CB Insights research briefs, most recently on May 8, 2025.

May 8, 2025 report

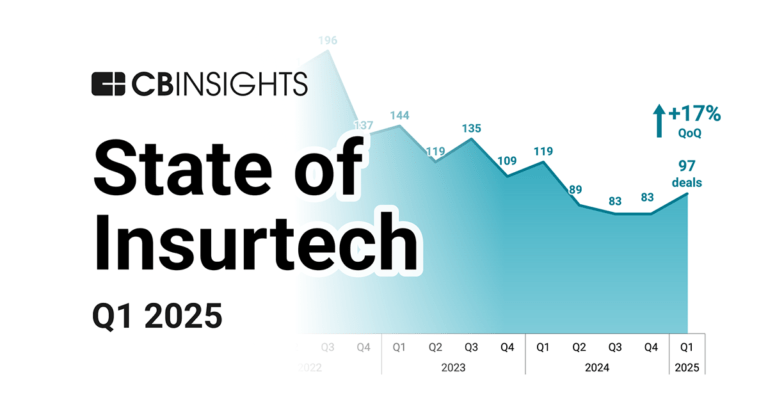

State of Insurtech Q1’25 Report

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

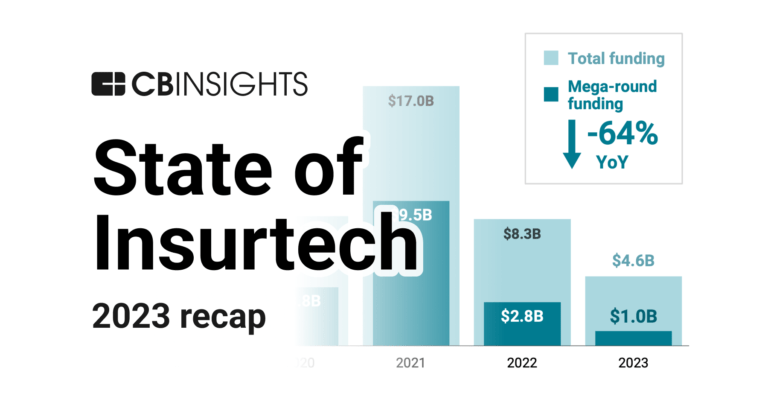

State of Insurtech 2023 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Next Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Next Insurance is included in 8 Expert Collections, including Fintech 100.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,586 items

Insurtech

4,596 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Fintech

9,695 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

150 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest Next Insurance News

Sep 10, 2025

Survey: Small business owners are less confident about year-end profits Survey: Small business owners are less confident about year-end profits Business owners are heading into the last quarter of 2025 — often the most important time of year for retail, e-commerce, restaurants and hospitality — with less confidence in profit growth expectations than this time last year, according to a recent NEXT Insurance survey. This year, just under half of business owners (49%) expect their profits to increase, down from 55% in 2024. That six‑point drop may reflect that small business owners continue to grapple with rising uncertainty across demand, inflation, policy and costs. In August, NEXT surveyed 1,500 business owners about their outlook and planning for the end of the year. NEXT At the same time, business owners not expecting any change in profits jumped from 27% to 35%. This swing could suggest that many owners are concerned about growth. Slightly fewer business owners expect profit shortfalls at year’s end compared to 2024 (16% vs.18% last year). Business owners could be watching the economy closely before they get too optimistic about big-numbers expansion and growth. Business investment spending is flat across the board More business owners say they have extra income to reinvest compared to 2024. However, there were only nominal changes in the five key investment areas to track: Customer acquisition NEXT The most significant change reported by business owners is a 3% increase in hiring and retraining employees. Business owners plan to hire more workers While the percentage of business owners who said they were hiring in 2024 and 2025 remains flat, the number of employees businesses plan to hire has increased as we approach the holiday sales quarter. Thirteen percent of business owners who plan to hire said they would hire 10 or more new workers, and 12% said they would hire six to 10 new employees. Both numbers are up 3% from last year. Those that said they were bringing in just one to five new employees have dropped 5%. NEXT Of course, not every employer is looking to fill their ranks. Some respondents said they don’t need to hire (26%) or can’t afford to (18%), both roughly in sync with 2024 numbers. NEXT It’s getting easier to hire and find new employees Only 8% of owners said they are not hiring in the final months of this year because it’s too hard to find employees. This is a significant drop from 15% of employers who reported it was too hard to find talent last year at this time. First half of 2025 profits remained steady The first half of 2025 brought a slightly better mix of results as compared to last year. The number of businesses that exceeded profit expectations ticked up slightly from 22% compared to 20% last year. The largest group of respondents said profits met expectations at 42%. Fewer business owners reported worse-than-expected profits (36% in 2025 vs. 38% in 2024). NEXT These findings line up with broader national trends. In 2024, the Federal Reserve found just 46% of small businesses turned a profit , while 35% operated at a loss, and more reported revenue declines (41%) than gains (38%) — the first time that’s happened since 2021. Though profits aren’t yet dropping, slowing demand, rising expenses and economic uncertainty could keep business owners holding steady.

Next Insurance Frequently Asked Questions (FAQ)

When was Next Insurance founded?

Next Insurance was founded in 2016.

Where is Next Insurance's headquarters?

Next Insurance's headquarters is located at 975 California Avenue, Palo Alto.

What is Next Insurance's latest funding round?

Next Insurance's latest funding round is Acquired.

How much did Next Insurance raise?

Next Insurance raised a total of $1.146B.

Who are the investors of Next Insurance?

Investors of Next Insurance include ERGO Group, Allstate Strategic Ventures, Allianz X, Mitsui Sumitomo Insurance, Group 11 and 17 more.

Who are Next Insurance's competitors?

Competitors of Next Insurance include Amwins, Vouch, Thimble, Superscript, Pie Insurance and 7 more.

What products does Next Insurance offer?

Next Insurance's products include NEXT’s Comprehensive Insurance Platform.

Loading...

Compare Next Insurance to Competitors

Pie Insurance operates a platform for workers' compensation insurance. It matches price with risk across a broad spectrum of small business types that offer sustainable insurance to small business owners. The company was founded in 2017 and is based in Washington, District of Columbia.

Coverdash is a digital business insurance agency that specializes in providing tailored insurance solutions for various business sectors. The company offers a range of products, including general liability, business owner's policies, workers' compensation, cyber, professional, and management liability insurance. Coverdash primarily serves small businesses, startups, e-commerce merchants, and freelancers. It was founded in 2022 and is based in New York, New York.

Embroker offers digital insurance brokerage specializing in business insurance solutions across various industries. The company offers a range of commercial insurance packages, including professional liability, cybersecurity, and directors and officers insurance, tailored to meet the specific needs of businesses. It primarily serves sectors such as startups, law firms, tech companies, and financial services. It was founded in 2015 and is based in San Francisco, California.

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Alliant Insurance Services focuses on insurance, risk management, employee benefits, and consulting. The company offers a range of services, including claims assistance, disaster preparedness and recovery, risk management solutions, and employee benefits. Alliant Insurance Services primarily serves sectors such as agribusiness, aviation, construction, cyber, energy and marine, financial institutions, healthcare, real estate and hospitality, among others. It was founded in 1925 and is based in Irvine, California.

State Farm Insurance provides various insurance and financial services. The company offers products such as auto, homeowners, and life insurance, along with financial services like investment planning and retirement savings. State Farm Insurance serves individual customers and small businesses with their insurance and financial needs. It was founded in 1922 and is based in Bloomington, Illinois.

Loading...