Munich Re

Founded Year

1880Stage

IPO | IPOMarket Cap

68.92BStock Price

531.80Revenue

$0000About Munich Re

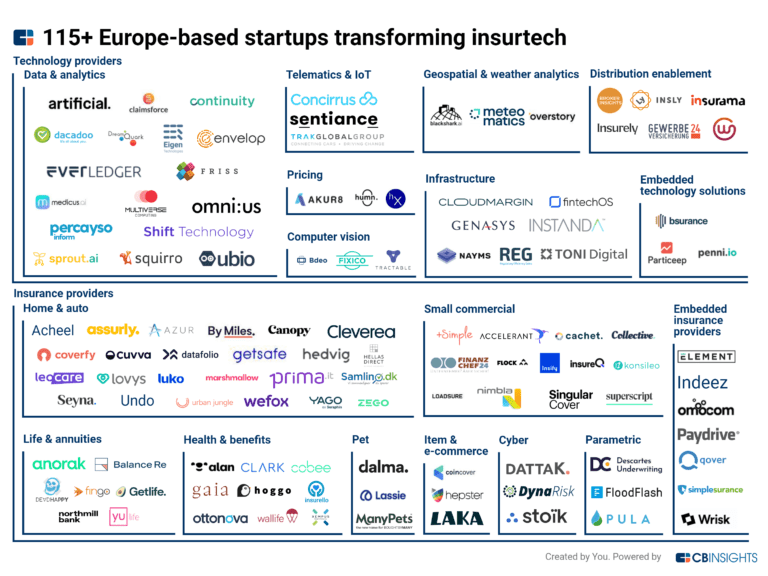

Munich Re is a global entity specializing in reinsurance, primary insurance, and insurance-related risk solutions across various sectors. The company offers financial protection and risk management services, and provides coverage options for various risks. Munich Re participates in the digital transformation of the insurance industry, enhancing risk assessment capabilities and expanding service offerings. Munich Re was formerly known as Münchener Rückversicherungs-Gesellschaft. It was founded in 1880 and is based in Munich, Germany.

Loading...

Loading...

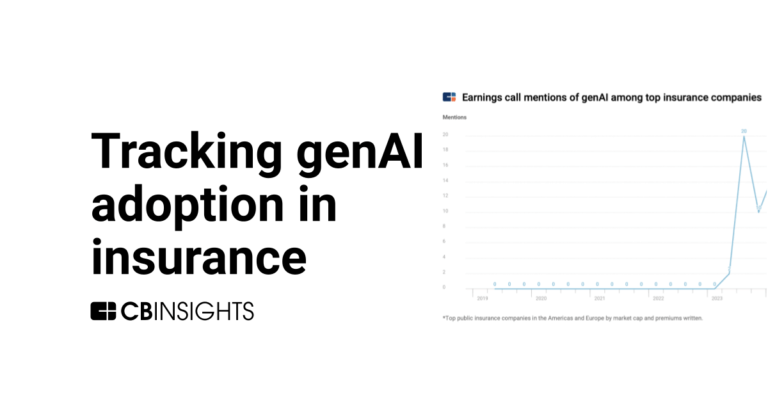

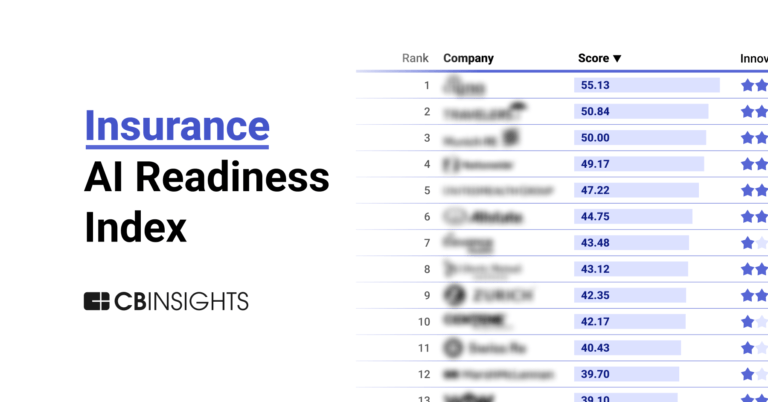

Research containing Munich Re

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Munich Re in 6 CB Insights research briefs, most recently on May 8, 2025.

Expert Collections containing Munich Re

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

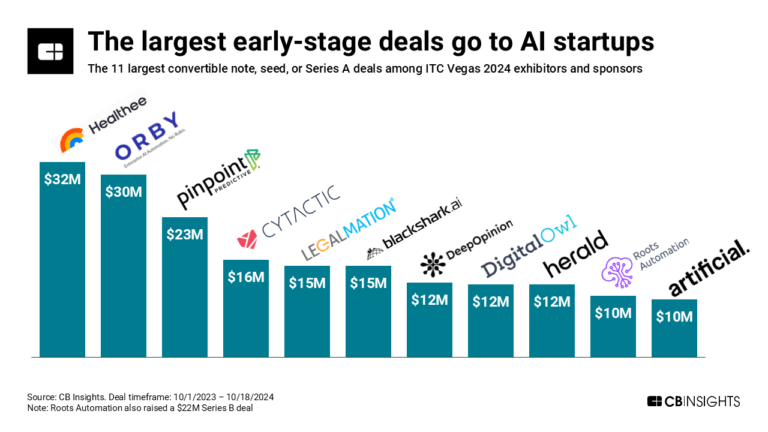

Munich Re is included in 1 Expert Collection, including ITC Vegas 2024 - Exhibitors and Sponsors.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Munich Re Patents

Munich Re has filed 7 patents.

The 3 most popular patent topics include:

- computer memory

- free game engines

- memory management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/22/2023 | 9/24/2024 | Natural language processing, Method (computer programming), Insurance, Computational linguistics, Classification algorithms | Grant |

Application Date | 9/22/2023 |

|---|---|

Grant Date | 9/24/2024 |

Title | |

Related Topics | Natural language processing, Method (computer programming), Insurance, Computational linguistics, Classification algorithms |

Status | Grant |

Latest Munich Re News

Sep 5, 2025

A+ (Superior) from A- (Excellent) and the Long-Term Issuer Credit Rating to “aa” (Superior) from “a-” (Excellent) of Next Insurance US Company (Next US) (headquartered in Palo Alto, CA). The outlook assigned to these Credit Ratings (ratings) is stable. The ratings reflect Next US's inclusion as a member of the lead rating unit, Munich Reinsurance Company (Munich Re), which on a consolidated basis has a balance sheet strength that AM Best assesses as strongest, as well as its strong operating performance, very favorable business profile and very strong enterprise risk management. Next US was acquired by Munich Re to support expansion into the U.S. small and medium-size business segment. Munich Re had previously been a significant minority shareholder in Next US. Under Munich Re, Next US is anticipated to benefit from a greater amount of both implicit and explicit support, as it supports ongoing strategic initiatives for the greater group. This press release relates to Credit Ratings that have been published on AM Best's website. For all rating information relating to the release and pertinent disclosures, including details of the office responsible for issuing each of the individual ratings referenced in this release, please see AM Best's Recent Rating Activity web page. For additional information regarding the use and limitations of Credit Rating opinions, please view Guide to Best's Credit Ratings . For information on the proper use of Best's Credit Ratings, Best's Performance Assessments, Best's Preliminary Credit Assessments and AM Best press releases, please view Guide to Proper Use of Best's Ratings & Assessments AM Best is a global credit rating agency, news publisher and data analytics provider specializing in the insurance industry. Headquartered in the United States, the company does business in over 100 countries with regional offices in London, Amsterdam, Dubai, Hong Kong, Singapore and Mexico City. For more information, visit www.ambest.com Copyright © 2025 by A.M. Best Rating Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

Munich Re Frequently Asked Questions (FAQ)

When was Munich Re founded?

Munich Re was founded in 1880.

Where is Munich Re's headquarters?

Munich Re's headquarters is located at Koniginstrasse 107, Munich.

What is Munich Re's latest funding round?

Munich Re's latest funding round is IPO.

Who are Munich Re's competitors?

Competitors of Munich Re include Brit Insurance, Jumpstart Insurance Solutions, Lloyd's, AmTrust Financial Services, Tokio Marine and 7 more.

Loading...

Compare Munich Re to Competitors

General Re is a provider of reinsurance solutions for the life & health and property & casualty insurance industries. The company offers services including underwriting, claims management, market research, analytics, and digital solutions. It was founded in 1846 and is based in Stamford, Connecticut. In December 1998, General Re was acquired by Berkshire Hathaway.

Lloyd's is an insurance and reinsurance marketplace that provides a platform for risk-sharing and underwriting across various industries. The company offers services that facilitate the underwriting and brokerage of insurance policies, leveraging collective intelligence and expertise to cover risks globally. Lloyd's ensures a wide range of risks, from standard to highly complex. It was founded in 1688 and is based in London, United Kingdom.

EMC Insurance Group is a company in the insurance sector, providing property and casualty insurance products and services. The company's offerings include protection against risks for individuals and businesses, as well as reinsurance. EMC serves the insurance and reinsurance markets across the United States and globally. EMC Insurance Group was formerly known as Emcasco. It was founded in 1974 and is based in Des Moines, Iowa.

American Family Insurance is a company that provides a range of personal insurance services within the insurance industry. Its main offerings include policies for auto, home, life, and umbrella insurance, aimed at protecting individuals and their assets. It was founded in 1927 and is based in Madison, Wisconsin.

Chartis focuses on providing strategic, performance, and technology consulting to the healthcare sector. The company offers a broad range of services, including strategy and performance improvement, clinical quality and patient safety, and digital and technology solutions to improve care delivery. Chartis serves a diverse clientele, including healthcare providers, payers, health service and technology companies, and investors. It was founded in 2001 and is based in Chicago, Illinois.

Nurnberger Versicherung provides individual and business insurance within the financial services sector. The company offers various insurance products including disability insurance, benefits for cancer, savings plans for children, pension insurance, and household insurance. Nurnberger Versicherung serves the general public and businesses seeking insurance and investment solutions. It was founded in 1884 and is based in Nuremberg, Germany.

Loading...