Mondu

Founded Year

2021Stage

Debt | AliveTotal Raised

$122.05MLast Raised

$32.62M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-43 points in the past 30 days

About Mondu

Mondu specializes in Buy Now, Pay Later (BNPL) solutions for B2B transactions within the financial services sector. The company offers a suite of payment solutions that allow businesses to provide their customers with various deferred payment options, including flexible payment terms, installment plans, and digital trade accounts. Mondu primarily serves the ecommerce industry, B2B marketplaces, and multichannel sales sectors. It was founded in 2021 and is based in Berlin, Germany.

Loading...

Mondu's Product Videos

ESPs containing Mondu

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2B payments market allows businesses to acquire goods and services immediately and pay for them in installments over time, helping to increase purchasing power and manage working capital and cash flow. These solutions provide streamlined application processes, quick approvals, and transparent terms. They typically include online platforms, embedded finance tools, or…

Mondu named as Outperformer among 15 other companies, including Affirm, PayPal, and Hokodo.

Mondu's Products & Differentiators

BNPL

A product suite for online checkouts - for merchants and marketplaces. It Includes invoice payments (30-90 days) instalements (3-12 months) and Digital Trade Accounts (for consolidating several purchases into one payment, with net terms).

Loading...

Research containing Mondu

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mondu in 4 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

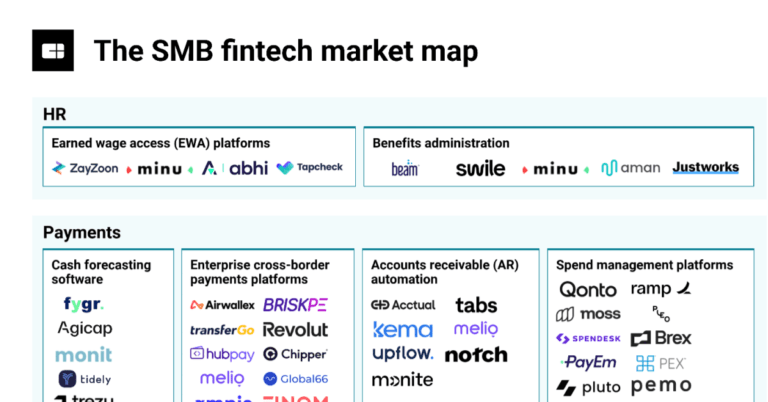

The SMB fintech market map

Aug 23, 2024

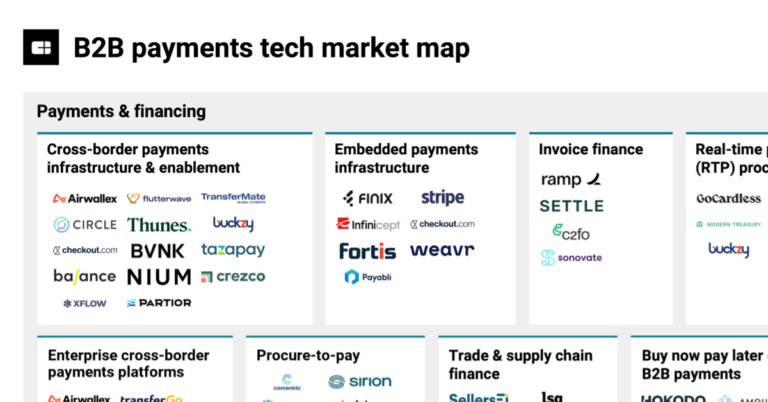

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Mondu

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mondu is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,559 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Artificial Intelligence

12,580 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,013 items

Excludes US-based companies

Digital Lending

197 items

Track and capture company information and workflow.

Fintech 100

100 items

Latest Mondu News

Jul 25, 2025

Source: CEW Communications / Mondu Mondu, the fast-growing B2B fintech, has launched Pay Now, an account-to-account (A2A) instant payment solution for B2B e-commerce. This new offering complements Mondu’s existing Buy Now, Pay Later (BNPL) products, providing a comprehensive payment experience for online business buyers. The European B2B e-commerce market is experiencing explosive growth, projected to reach $2.2 trillion by 2027, almost double the value in 2022. This rapid shift to online sales highlights the increasing demand for more flexible and streamlined payment solutions. As businesses adapt to this digital-first environment, digital B2B payments are becoming a crucial tool. The European B2B BNPL market is projected to grow at an annual rate of 27.5% percent, reaching $256.7 billion by 2029. Mondu’s new Pay Now product is the latest addition to its BNPL suite, which includes invoice payments, instalments, and digital trade accounts, creating a holistic proposition that directly addresses market needs. Pay Now allows buyers to pay directly from their bank accounts, providing a secure and streamlined checkout experience. It enables merchants to serve all buyers, whether they are eligible for deferred payments or not. For merchants, this means a hassle-free integration that eliminates the need for a separate A2A payment provider and simplifies reconciliation. Mondu handles risk and fraud checks, provides payment confirmation, and manages all buyer communication, allowing merchants to focus on their business. Malte Huffmann, co-chief executive officer of Mondu, said: “We’ve seen immense interest from existing customers in Pay Now. Our goal is to provide a comprehensive payment solution that caters to the evolving needs of B2B buyers and sellers. With Pay Now, we offer a best-in-class experience, combining the flexibility of BNPL with the simplicity of instant payments. “In just three years, Mondu has become a prominent player in the European B2B payments industry, working with leading retailers and marketplaces, including Notebooksbilliger, WirMachenDruck, GGM Gastro, Enpal, Autodoc, Solago, and Qogita.”

Mondu Frequently Asked Questions (FAQ)

When was Mondu founded?

Mondu was founded in 2021.

Where is Mondu's headquarters?

Mondu's headquarters is located at Alexanderstrasse 36, Berlin.

What is Mondu's latest funding round?

Mondu's latest funding round is Debt.

How much did Mondu raise?

Mondu raised a total of $122.05M.

Who are the investors of Mondu?

Investors of Mondu include Volksbanken Raiffeisenbanken, FinTech Collective, Valar Ventures, Cherry Ventures and Peter Thiel.

Who are Mondu's competitors?

Competitors of Mondu include Two, Treyd, Hokodo, Tranch, Alma and 7 more.

What products does Mondu offer?

Mondu's products include BNPL and 4 more.

Loading...

Compare Mondu to Competitors

Billie specializes in BNPL payment methods for the B2B sector and offers digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Hokodo is a digital trade credit platform that provides B2B payment solutions. The company offers payment terms, trade accounts, and payment plans for B2B transactions. Hokodo's services include credit protection, collections management, and integration options for both online and offline sales channels. It was founded in 2018 and is based in London, United Kingdom.

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors, including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

Aria offers a solution that enables businesses to make instant payments and manage their cash flow. Aria primarily serves the business-to-business marketplace and vertical software-as-a-service (SaaS) industries. It was founded in 2020 and is based in Saint-Denis, France.

Klarna provides buy now pay later services and payment options within the ecommerce industry. The company offers products that enable consumers to make purchases online and pay in installments, as well as tools for secure shopping. Klarna's technology is used by various global retailers. Klarna was formerly known as Kreditor. It was founded in 2005 and is based in Stockholm, Sweden.

PayPay is a fintech company that provides QR code-based payment solutions and digital wallet services. The company offers a platform for users to make payments at various retail locations, online, and for public utilities, as well as facilitating peer-to-peer money transfers. PayPay primarily serves the consumer goods retail, dining, and public utility payment sectors. It was founded in 2018 and is based in Tokyo, Japan.

Loading...