Mastercard

Founded Year

1966Stage

IPO | IPODate of IPO

5/25/2006Market Cap

532.22BStock Price

588.73Revenue

$0000About Mastercard

Mastercard focuses on digital payment processing and financial technology services. The company provides digital payment solutions that ensure transactions are secure and accessible. Mastercard's products and services cater to individuals, businesses, and governments. Mastercard was formerly known as Interbank. It was founded in 1966 and is based in Purchase, New York.

Loading...

ESPs containing Mastercard

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital insurance payments market enables insurance companies to manage and optimize payment processes for both premium billing and claims disbursements. These platforms facilitate electronic transactions through various payment methods including credit cards, ACH transfers, and digital wallets. Some solutions offer integrations with policy administration and claims lifecycle management system…

Mastercard named as Leader among 15 other companies, including Guidewire, Stripe, and PayPal.

Loading...

Research containing Mastercard

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mastercard in 19 CB Insights research briefs, most recently on Aug 22, 2025.

Aug 22, 2025

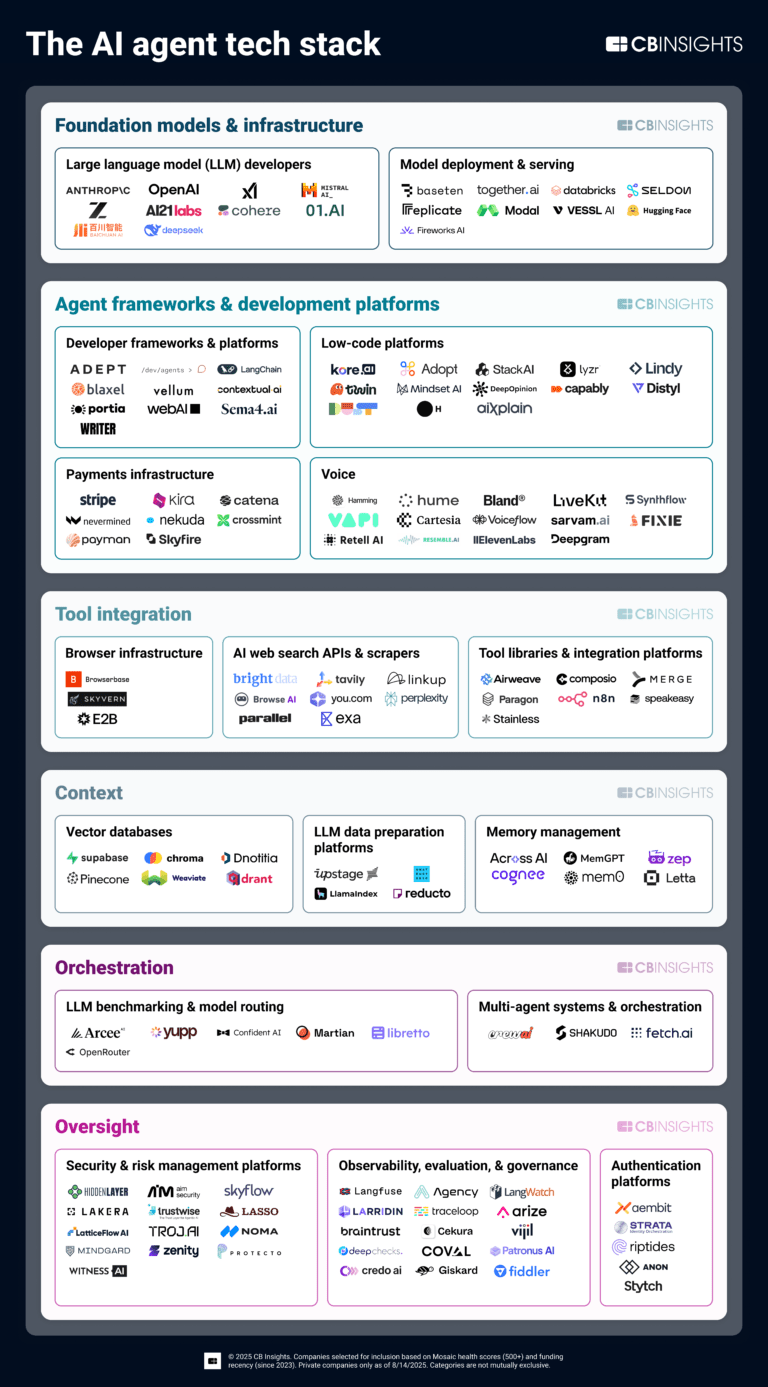

The AI agent tech stack

Aug 7, 2025

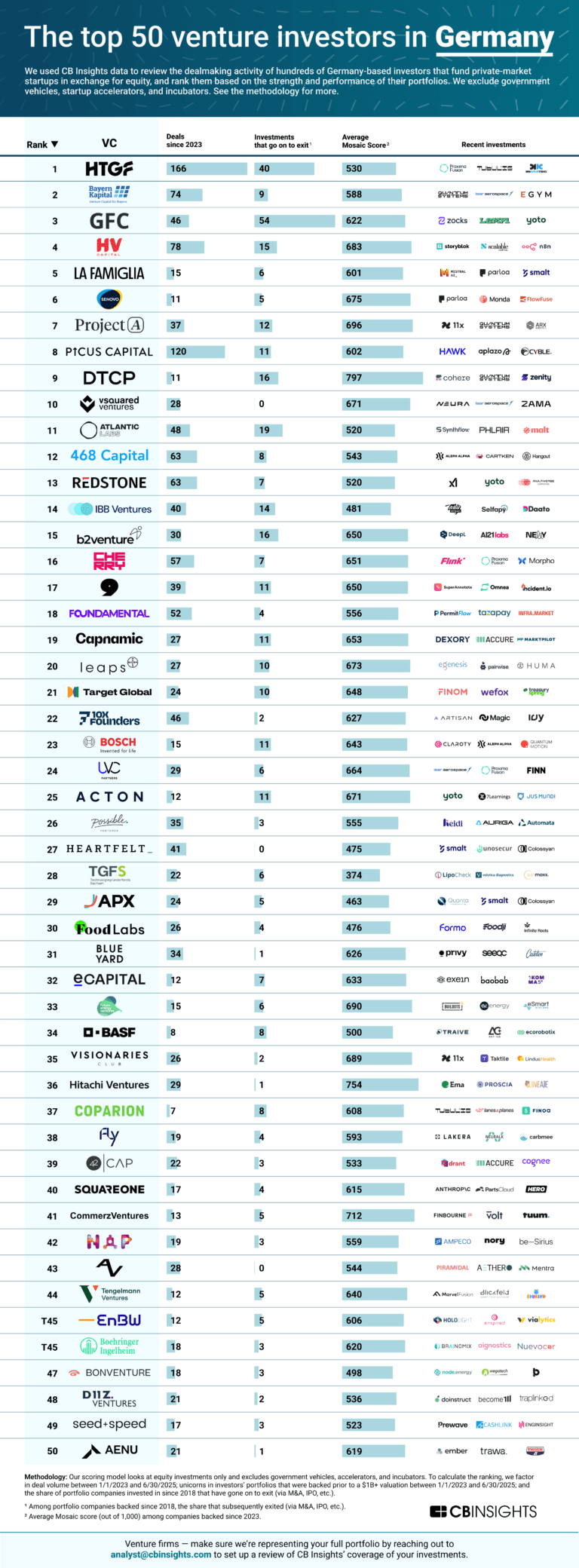

The top 50 venture investors in Germany

Aug 4, 2025

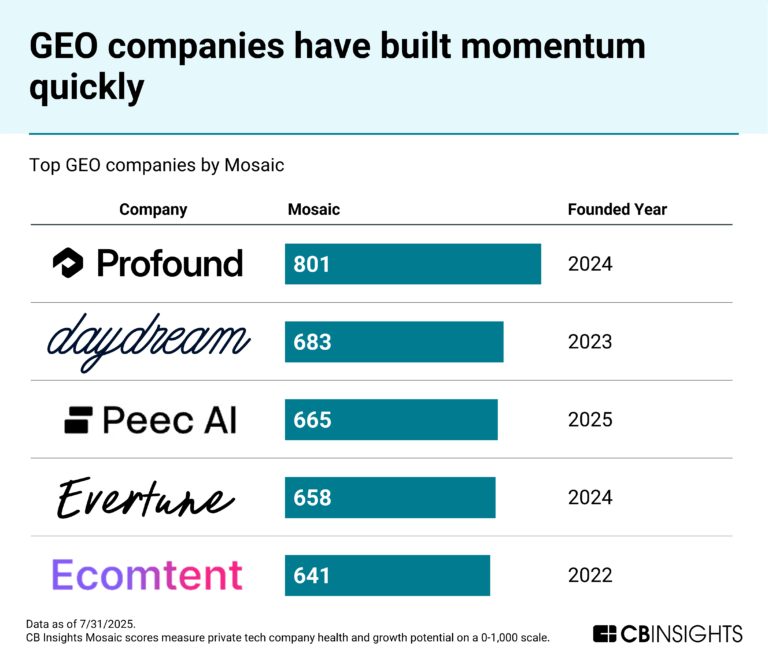

3 markets fueling the shift to agentic commerce

Jul 31, 2025 report

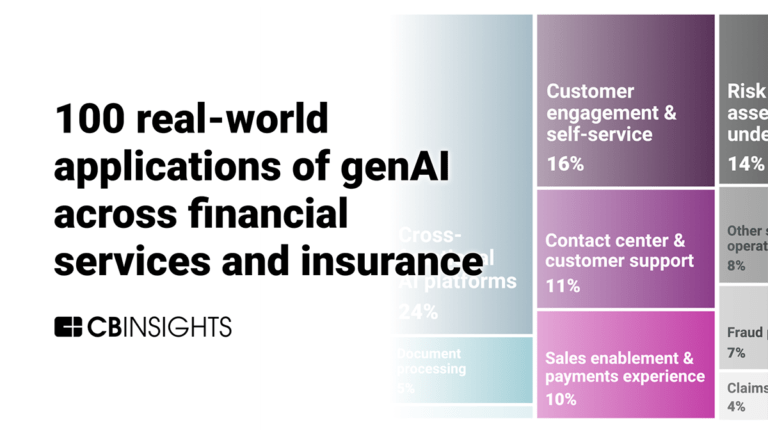

100 real-world applications of genAI across financial services and insurance

Jul 10, 2025 report

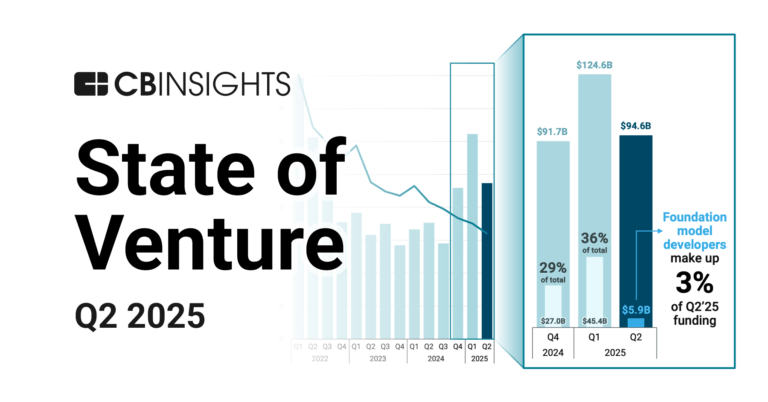

State of Venture Q2’25 Report

Jun 6, 2025

The SMB fintech market map

May 29, 2025

The stablecoin market mapExpert Collections containing Mastercard

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mastercard is included in 8 Expert Collections, including Blockchain.

Blockchain

9,147 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Conference Exhibitors

5,302 items

Fintech

9,696 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

108 items

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Mastercard Patents

Mastercard has filed 4329 patents.

The 3 most popular patent topics include:

- payment systems

- credit cards

- payment service providers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/27/2021 | 4/8/2025 | Data modeling, Software engineering researchers, Data management, Database researchers, Parallel computing | Grant |

Application Date | 9/27/2021 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Data modeling, Software engineering researchers, Data management, Database researchers, Parallel computing |

Status | Grant |

Latest Mastercard News

Sep 12, 2025

Agentic AI, systems that can perform tasks and solve issues with minimal human intervention, are set to disrupt the economic foundations for finance. According to a new report by McKinsey, this technology is poised to affect billions in revenue and challenge the business models and revenue at banks, small and medium-sized enterprises (SMEs), credit-card companies, and others. This disruption will stem largely from making traditionally passive aspects of banking programmable and dynamic. Deposits will become fluid The report, released in August, highlights two especially vulnerable revenue streams in banking: deposits and credit cards. These areas rely heavily on customer inertia and brand loyalty, making them especially vulnerable to agentic AI. Deposits, including consumer checking and SME operating accounts, currently power bank profitability. Globally, net income interest income accounts for roughly 30% of retail banking profits. Most consumers don't notice the interest rate they are receiving, or they lack the time, tools, and incentive to maximize interest returns on their deposits. Instead, they prioritize convenience, focusing on areas such as waived fees, ATM networks, and integrated services like bill payments and wealth portals. Agentic AI systems have the potential to reverse this logic. These agents can monitor balances in real time, compare returns across institutions, sweep idle cash into higher-yield accounts, and then sweep cash back to a checking account in time for bills. This shift would redirect part of the spreads once captured by banks back to account holders. SMEs are already leveraging API-driven treasury automation to optimize cash and foreign exchange (FX) in real time. For example, several businesses are using cash management platforms that automate daily reporting, forecasting, sweep operations, and even FX hedging. Agentic AI would take this further, integrating these capabilities into continuous, preference-driven treasury operations. The stakes here are high. Each year, banks in Europe earn over US$100 billion from deposits. If just 10% to 20% of people used AI agents that automatically move their cash into higher-paying accounts, constantly shifting their money to get the best deal, banks' profits from deposits could shrink by about 0.3-0.5%, McKinsey estimates, posing a clear threat to lenders, it warns. Optimizing rewards and spending on credit cards Similarly, credit cards are another major source of revenue banks, generating US$234 billion in 2024. These revenues come from a blend of interest income from customers who carry a balance, interchange fees, annual and penalty fees, and unredeemed rewards. Yet, many consumers fail to maximize rewards. A 2024 survey conducted by Bankrate in the US found that almost a quarter of rewards cardholders (23%) didn't redeem any rewards in the prior year. According to the US Consumer Financial Protection Bureau, about 3-5% of earned rewards points disappear each year through either account closure or expiration. AI agents are poised to change this by automatically directing spending to the best card in real time. These systems could also roll balances to another card before promotional rates expire, and apply for new cards with better offers. Some of this automation is already happening. Klarna's Money Story feature, for example, uses data from all spending with the payment services company, such as purchases made with the Klarna App, the Klarna Card and at partnered retailers' checkouts, to offer a snapshot into a customer's spending patterns, and help them better budget. Another example is Apple's Daily Cash instant cashback program, which allows customers to earn when using the Apple Card. If customers choose to, these rewards can be automatically sent to a high-yield savings account. Adoption of agentic AI on the rise Agentic AI are AI systems designed to act with autonomy, making decisions and taking actions without constant human oversight in pursuit of defined outcomes. Unlike other AI models, agentic AI can plan, adapt, and coordinate across tasks, giving these systems more initiative and independence in complex environments. In banking, real-world agentic AI applications are still in nearly stages but adoption is accelerating. According to 2024 and 2025 studies by the International Data Corporation (IDC), 78% of banks are actively exploring agentic AI: 38% are already investing with a defined spending plan for the technology, while 40% already tested some agent solutions but have no spending plan yet. Several banks are already employing agentic AI. At Bank of New York Mellon (BNY), for example, AI agents are working autonomously in areas like coding and payment instruction validation. Meanwhile, payment firms including Mastercard, PayPal and Visa, are experimenting with “ agentic commerce ”, where AI agents autonomously execute transactions on behalf of consumers. In Asia, banks see the greatest potential in improving customer experience (39%), operational efficiency (36%), data-based decision making (28%), and task automation (28%), according to IDC research. Research firm Gartner forecasts that by 2028, at least 15% of everyday workplace decisions will be made autonomously through agentic AI, up from none in 2024. By then, 33% of enterprise software applications will include agentic AI features, compared to fewer than 1% in 2024. Featured image by alexander85ru on Freepik

Mastercard Frequently Asked Questions (FAQ)

When was Mastercard founded?

Mastercard was founded in 1966.

Where is Mastercard's headquarters?

Mastercard's headquarters is located at 2000 Purchase Street, Purchase.

What is Mastercard's latest funding round?

Mastercard's latest funding round is IPO.

Who are Mastercard's competitors?

Competitors of Mastercard include Klarna, Payall, Discover, Worldpay, Affirm and 7 more.

Loading...

Compare Mastercard to Competitors

InComm Payments is a provider of payment technology solutions across various industries. The company specializes in cash digitization, card solutions, account funding, and payment services, including healthcare benefits, gifting, and incentives. InComm Payments serves sectors such as retail, healthcare, and transit with its suite of payment products and services. It was founded in 1992 and is based in Atlanta, Georgia.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Pay.UK focuses on the bill payment process for both consumers and businesses. The company offers a communication platform for managing bills, providing options to pay in full, pay in part, ask for more time, or decline to pay for reconciliation and invoicing for organizations. It primarily serves consumers and businesses in their bill payment and collection processes. Pay.UK was formerly known as New Payment System Operator. The company was founded in 2017 and is based in London, United Kingdom.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Pay.com provides online payment solutions within the financial technology sector. The company offers services that include integrating multiple payment methods, customizing checkout experiences, ensuring secure transactions with card authentication, and providing tools for customer insights. Pay.com serves various businesses that need to manage their payment processing. It was founded in 2020 and is based in Limassol, Cyprus.

Moneris Solutions specializes in payment processing and point-of-sale systems for various industries. Its offerings include POS systems, online payment gateways, and e-commerce solutions to facilitate transactions for businesses. Moneris Solutions provides merchant cash advances, gift card programs, and data analytics services. It was founded in 2000 and is based in Toronto, Canada.

Loading...