Lockheed Martin

Founded Year

1995Stage

IPO | IPOMarket Cap

110.49BStock Price

473.25Revenue

$0000About Lockheed Martin

Lockheed Martin (NYSE: LMT) operates as a global security, defense, and aerospace contractor. The company specializes in the development and production of technology systems, including aircraft, space exploration, and cybersecurity solutions. Lockheed Martin serves the aerospace and defense sectors with a focus on national security. It was founded in 1995 and is based in Bethesda, Maryland.

Loading...

Loading...

Research containing Lockheed Martin

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Lockheed Martin in 10 CB Insights research briefs, most recently on May 21, 2025.

Apr 10, 2025

AI GI Joe: Defense tech goes on the offensive

Feb 13, 2025

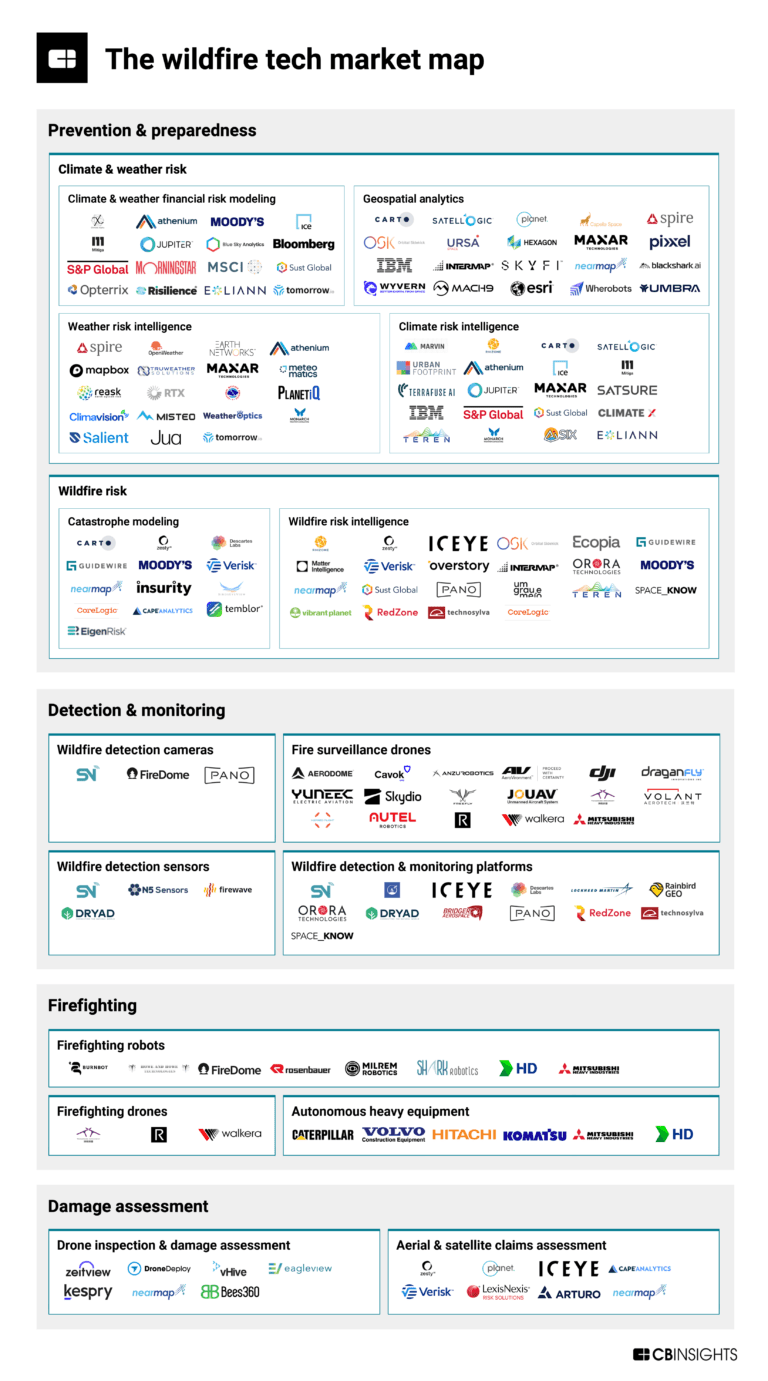

The wildfire tech market map

Aug 14, 2024

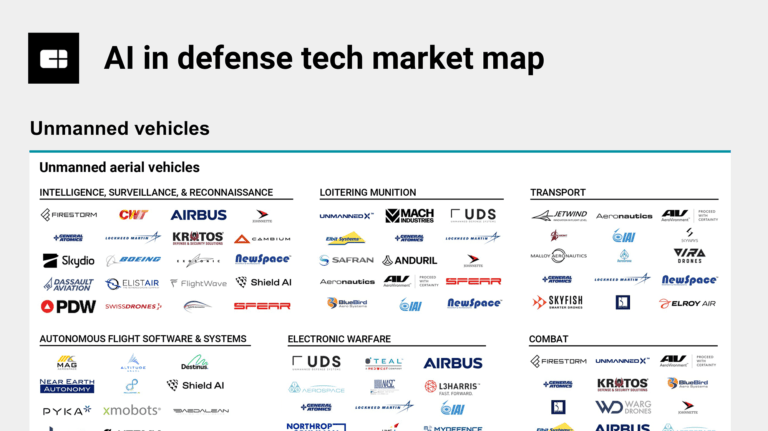

The AI in defense tech market map

Mar 1, 2024

The satellite & geospatial tech market mapExpert Collections containing Lockheed Martin

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Lockheed Martin is included in 4 Expert Collections, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Aerospace & Space Tech

6,954 items

These companies provide a variety of solutions, ranging from industrial drones to electrical vertical takeoff vehicles, space launch systems to satellites, and everything in between

Defense Tech

1,279 items

Defense tech is a broad field that encompasses everything from weapons systems and equipment to geospatial intelligence and robotics. Company categorization is not mutually exclusive.

Artificial Intelligence

10,402 items

Lockheed Martin Patents

Lockheed Martin has filed 3521 patents.

The 3 most popular patent topics include:

- aerodynamics

- military helicopters

- autogyros

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/21/2019 | 4/8/2025 | Fluid dynamics, Sun, Plasma physics, Aerodynamics, Space plasmas | Grant |

Application Date | 8/21/2019 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Fluid dynamics, Sun, Plasma physics, Aerodynamics, Space plasmas |

Status | Grant |

Latest Lockheed Martin News

Sep 16, 2025

Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors ” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, September 16, 2025 / EINPresswire.com / -- What Is The Estimated Industry Size Of Disaster Preparedness Systems Market? The market size for disaster preparedness systems has seen robust growth in the past few years. The market is projected to expand from $201.83 billion in 2024 to $217.35 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 7.7%. The growth witnessed in the historic era is mainly due to the rising occurrence of natural disasters, growing recognition and seriousness of these calamities, an increase in risk perception, heightened instances of crime and terrorism, and an escalation in disaster risks. Anticipated substantial growth in the disaster preparedness systems market is projected in the coming years. The market value is expected to reach $294.9 billion by 2029, with a compound annual growth rate (CAGR) of 7.9%. Factors contributing to this uptick during the forecast period include increasing urbanization, the formulation of many government policies, economic losses mounts, escalating regulatory strategies for public safety, and the rising adoption of advanced technologically disaster preparedness systems. Trends projected to influence this period are the evolution of technology, collaborations with local organizations, an increment in government initiatives, brand recognition, corporate social responsibility, and investment in infrastructure. Download a free sample of the disaster preparedness systems market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=13839&type=smp What Are The Major Factors Driving The Disaster Preparedness Systems Global Market Growth The escalation in the occurrence of natural disasters is anticipated to drive the expansion of the disaster preparedness system market in the future. Natural disasters, such as earthquakes, hurricanes, and floods, can have catastrophic effects on societies and communities. The disaster preparedness system aims to mitigate the impact of natural disasters by offering an array of tools and solutions that enable organizations, individuals, and communities to plan, respond, and recover from disaster situations more efficiently. For example, as reported by the National Oceanic and Atmospheric Administration, a government agency based in the U.S., the country experienced 18 unique weather and climate disasters in 2022, each costing at least $1 billion. In the subsequent year of 2023, the U.S. weathered 28 independent weather and climate disasters, each with similar financial impact. Therefore, the increasing frequency of such natural disasters is fueling the growth of the disaster preparedness system market. Who Are The Leading Companies In The Disaster Preparedness Systems Market? Major players in the Disaster Preparedness Systems include: • Siemens AG • The Lockheed Martin Corporation • Airbus SE • International Business Machines Corporation • Honeywell International Inc. • Johnson Controls International plc • NEC Corporation • Asahi Kasei Corporation • Eaton Corporation • Motorola Solutions Inc. What Are The Future Trends Of The Disaster Preparedness Systems Market? Leading companies in the disaster preparedness system market are concentrating on innovative offerings, such as disaster recovery portfolio solutions, to maintain their market presence. A disaster recovery portfolio solution encompasses a detailed compilation of policies, tools, and techniques utilized to restore or continue critical IT infrastructure, software, and systems after a natural or man-made disaster. As a case in point, Huawei Technologies Co. Ltd., - a tech corporation based in China - unveiled the Storage and Optical Connection Coordination (SOCC) in March 2023. This is a unified disaster recovery portfolio solution designed to address service losses and ensure swift resumption of operations. SOCC represents the industry's inaugural solution that assimilates storage and optical networks to deliver a unified disaster recovery portfolio solution. It primarily aims to minimize data loss and prevent business disruptions during catastrophes such as earthquakes or fires. What Are The Primary Segments Covered In The Global Disaster Preparedness Systems Market Report? The disaster preparedness systemsmarket covered in this report is segmented – 1) By Type: Emergency Or Mass Notification System, Surveillance System, Safety Management System, Earthquake Or Seismic Warning System, Disaster Recovery And Backup Systems, Other Types 2) By Solutions: Geospatial Solutions, Disaster Recovery Solutions, Situational Awareness Solutions 3) By Services: Training And Education Services, Consulting Services, Design And Integration Services, Support And Maintenance Services 4) By Communication Technology: First Responder Tools, Satellite Phones, Emergency Response Radars, Vehicle-Ready Gateways, Other Communication Technologies 5) By End-use: Banking, Financial Services And Insurance (BFSI), Energy And Utilities, Aerospace And Defense, Manufacturing, Information Technology (IT) And Telecom, Public Sector, Transportation And Logistics, Healthcare, Other End-uses Subsegments: 1) By Emergency Or Mass Notification System: Alert And Warning Systems, Public Address Systems, Mobile Alert Systems 2) By Surveillance System: Video Surveillance Systems, Remote Monitoring Systems, Access Control Systems 3) By Safety Management System: Incident Management Systems, Risk Assessment Tools, Safety Audit And Compliance Tools 4) By Earthquake or Seismic Warning System: Ground Motion Sensors, Early Warning Systems, Data Analysis And Visualization Tools 5) By Disaster Recovery and Backup Systems: Data Backup Solutions, Business Continuity Planning Tools, Cloud Disaster Recovery Solutions 6) By Other Types: Training And Simulation Tools, Emergency Response Planning Software, Resource Management Systems View the full disaster preparedness systems market report: https://www.thebusinessresearchcompany.com/report/disaster-preparedness-systems-global-market-report Which Region Is Forecasted To Grow The Fastest In The Disaster Preparedness Systems Industry? In 2024, the disaster preparedness systems market was dominated by North America. Expected to witness the most rapid growth during the forecast period, however, is Asia-Pacific. The market report comprehensively covers all regions including Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global Disaster Preparedness Systems Market 2025, By The Business Research Company Bed Monitoring System And Baby Monitoring System Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/bed-monitoring-system-and-baby-monitoring-system-global-market-report Battlefield Management System Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/battlefield-management-system-global-market-report Automotive Variable Valve Timing Vvt And Start Stop System Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/automotive-variable-valve-timing-vvt-and-start-stop-system-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Lockheed Martin Frequently Asked Questions (FAQ)

When was Lockheed Martin founded?

Lockheed Martin was founded in 1995.

Where is Lockheed Martin's headquarters?

Lockheed Martin's headquarters is located at 6801 Rockledge Drive, Bethesda.

What is Lockheed Martin's latest funding round?

Lockheed Martin's latest funding round is IPO.

Who are Lockheed Martin's competitors?

Competitors of Lockheed Martin include CAES, Adarga, ManTech, Bombardier, Aeronautics and 7 more.

Loading...

Compare Lockheed Martin to Competitors

Dassault Aviation is an aerospace company specializing in the design, manufacture, and support of business jets. The company offers a range of business jets, including large-cabin and ultra-long range models. Dassault Aviation also provides customer services and fleet support. It was founded in 2000 and is based in Saint Cloud, France.

Metrea provides solutions to national security problems by facilitating commercial business models to unleash innovation cycles that anticipate emerging threats. The company offers solutions for air, electromagnetic, space, and simulation. The company was formerly known as Meta Aerospace. The company was founded in 2016 and is based in Washington, DC.

Silicon Valley Defense Group is a nonprofit organization focused on enhancing national security through innovation within the defense industrial base. The company facilitates the development of an ecosystem that connects national security leaders with new technologies from the entrepreneurial sector, supported by a blend of public and private financing. SVDG primarily serves the national security and defense technology sectors. It was founded in 2015 and is based in San Mateo, California.

Cubic focuses on providing technology solutions for the transportation and defense sectors. Its offerings include systems for daily travel and capabilities for defense personnel. It was founded in 1951 and is based in San Diego, California.

AVIC Aerospace System specializes in investing, managing, producing, and selling advanced aviation mechanical and electrical systems and equipment. The company plays a crucial role in the aerospace sector by providing solutions for the aviation industry and supporting domestic and international aviation needs. It was founded in 2010 and is based in Chaoyang District, China.

Knowmadics provides security, public safety, defense and intel, and commercial enterprise solutions within the technology sector. The company offers products aimed at situational awareness, duty of care, and critical event management, personnel logistics, and operations in electronic warfare and cyber domains. Knowmadics serves sectors including defense, law enforcement, and logistics. It was founded in 2013 and is based in Herndon, Virginia.

Loading...