Klarna

Founded Year

2005Stage

IPO | IPOTotal Raised

$5.898BDate of IPO

9/10/2025About Klarna

Klarna provides buy now pay later services and payment options within the ecommerce industry. The company offers products that enable consumers to make purchases online and pay in installments, as well as tools for secure shopping. Klarna's technology is used by various global retailers. Klarna was formerly known as Kreditor. It was founded in 2005 and is based in Stockholm, Sweden.

Loading...

ESPs containing Klarna

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Klarna named as Leader among 15 other companies, including Affirm, Synchrony, and Bread Financial.

Loading...

Research containing Klarna

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Klarna in 12 CB Insights research briefs, most recently on Jul 31, 2025.

Jul 31, 2025 report

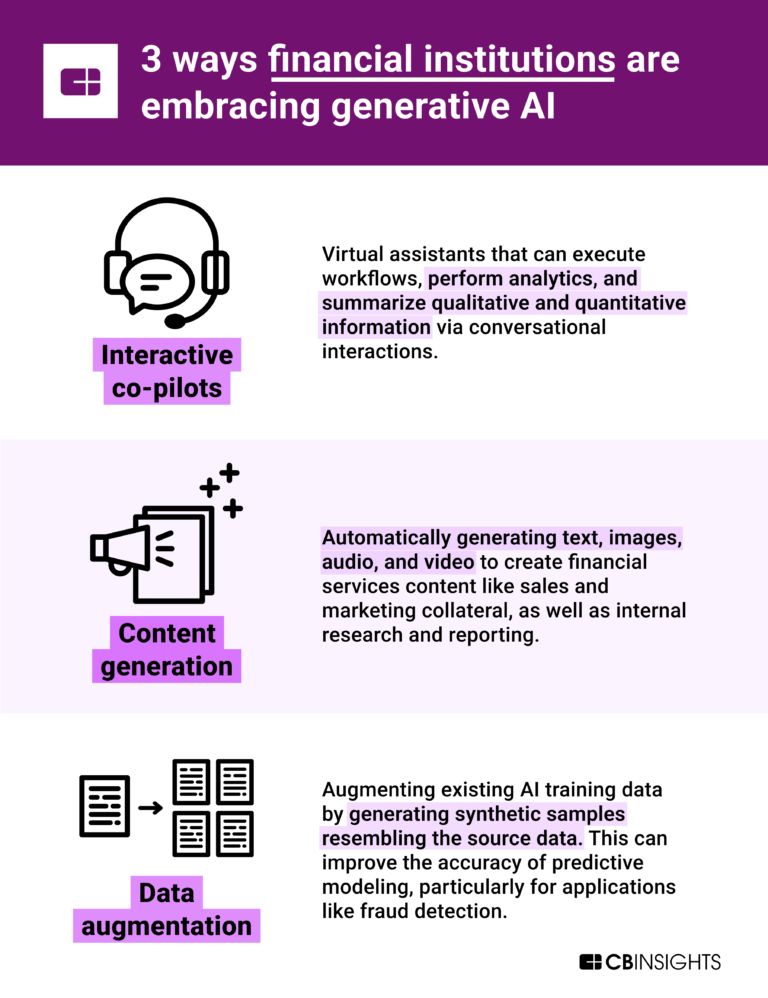

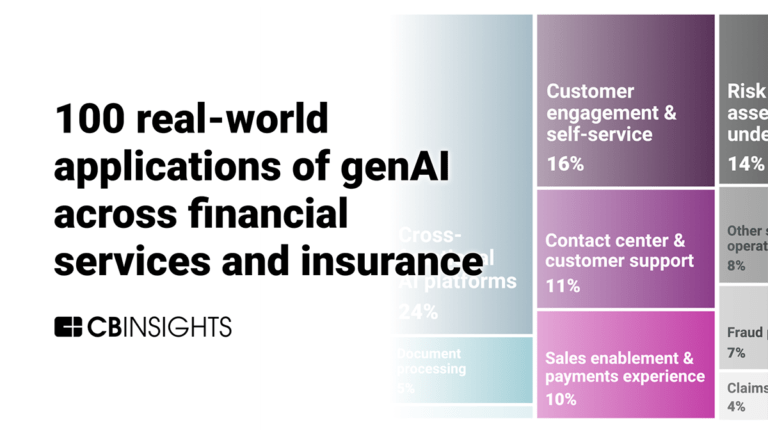

100 real-world applications of genAI across financial services and insurance

Feb 28, 2025

What’s next for AI agents? 4 trends to watch in 2025

May 8, 2024

The embedded banking & payments market map

Expert Collections containing Klarna

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Klarna is included in 11 Expert Collections, including E-Commerce.

E-Commerce

11,342 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Store tech (In-store retail tech)

1,832 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,286 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,661 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Klarna Patents

Klarna has filed 37 patents.

The 3 most popular patent topics include:

- classification algorithms

- machine learning

- artificial neural networks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/7/2022 | 8/20/2024 | Social networking services, Machine learning, Classification algorithms, Artificial neural networks, Computational linguistics | Grant |

Application Date | 4/7/2022 |

|---|---|

Grant Date | 8/20/2024 |

Title | |

Related Topics | Social networking services, Machine learning, Classification algorithms, Artificial neural networks, Computational linguistics |

Status | Grant |

Latest Klarna News

Sep 10, 2025

Reports from Bloomberg, Reuters, and the Financial Times showed Klarna raised about $1.4 billion in its IPO, which was roughly 26 times oversubscribed. Klarna's share pricing was also above the $35 to $37 marketing range outlined by the firm. The company's shares will begin trading on Wednesday. Klarna had delayed its IPO earlier in the year amid heightened market volatility sparked by the announcement of U.S. President Donald Trump's trade tariffs. The Swedish fintech firm pioneered the buy now, pay later model of microfinancing small consumer loans for discretionary purchases. Its valuation had surged as high as $46 billion in 2021, following a Softbank-led investment round– before slumping to $6.7 billion in 2022 amid rising global interest rates. Klarna's listing comes amid a recovery in the U.S. IPO market in recent months, with design software developer Figma Inc (NYSE:FIG) and cryptocurrency exchange Bullish Inc (NYSE:BLSH) both raising over $1 billion in their respective offerings this year. Crypto exchange Gemini, which is run by the Winklevoss twins, will also debut later this week. 3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads Should you invest $2,000 in FIG right now? ProPicks AI evaluates FIG alongside thousands of other companies every month using 100+ financial metrics Using powerful AI to generate exciting stock ideas, it looks beyond popularity to assess fundamentals, momentum, and valuation. The AI has no bias—it simply identifies which stocks offer the best risk-reward based on current data with notable past winners that include Super Micro Computer (+185%) and AppLovin (+157%). Want to know if FIG is currently featured in any ProPicks AI strategies, or if there are better opportunities in the same space? Ask WarrenAI, then decide

Klarna Frequently Asked Questions (FAQ)

When was Klarna founded?

Klarna was founded in 2005.

Where is Klarna's headquarters?

Klarna's headquarters is located at Sveavagen 46, Stockholm.

What is Klarna's latest funding round?

Klarna's latest funding round is IPO.

How much did Klarna raise?

Klarna raised a total of $5.898B.

Who are the investors of Klarna?

Investors of Klarna include Santander, Chrysalis Investments, Leading European Tech Scaleups, Sequoia Capital, Commonwealth Bank of Australia and 99 more.

Who are Klarna's competitors?

Competitors of Klarna include Waytobill, Bumper, Jifiti, ToneTag, FlexM and 7 more.

Loading...

Compare Klarna to Competitors

PayNearMe is a technology company that operates within the financial services industry, providing a payment processing platform. The platform is designed to accept payments and manage exceptions. PayNearMe serves sectors such as auto and consumer lending, tolling, iGaming, Buy Here Pay Here, banks and credit unions, and mortgage servicing. It was founded in 2009 and is based in Santa Clara, California.

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

PingPong provides cross-border payment solutions for e-commerce businesses. The company offers services including multi-currency receiving accounts, international supplier payments, and tools for marketplace payouts and foreign exchange cost reduction. PingPong serves the e-commerce industry, offering financial solutions to aid in payment processes. It was founded in 2015 and is based in San Mateo, California.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in financial transaction analytics and AI-driven insights within the fintech industry. The company offers a platform that connects, matches, and monitors data to provide insights for businesses. Previse's solutions cater to enterprises, financial institutions, and fintechs, focusing on automating payment processes, managing credit risk, and improving decision-making. It was founded in 2016 and is based in London, England.

Loading...